ITC Vs Dabur: India's leading homegrown fast-moving consumer products (FMCG) giants ITC Ltd and Dabur India reported a steady performance despite headwinds during the July-Sept quarter for fiscal 2025-26 (Q2FY26). The FMCG majors have received fresh reviews and stock calls from domestic brokerages after the conclusion of the second quarter results.

While ITC reported a sustained growth in its core business verticals, Dabur India maintained a resilient performance across its geographical segments. On an average, the FMCG stocks have achieved 'hold' or 'accumulate' ratings from brokerages albeit slight trims on their respective target prices.

India's FMCG sector's performance in the quarter ended September 2025 was shaped by various trends across segments. The two most prominent ones being the nationwide goods and services tax (GST) rate cuts and the consumer-led demand growth during the festive season. The Nifty FMCG index is flat-to-negative on a year-to-date (YTD) basis. However, it gained over 3% in three months during the quarter-under-review.

Nifty FMCG index

Two major reasons are causing pain for the FMCG index due to which it has not gained on a YTD basis. Firstly, Q2 results are subdued due to the GST rate rationalisation and the impact may spill over in Q3. Secondly, valuations are still on the premium side and volume recovery is doubtful. However, analysts believe the sector is poised for revival in the second half of FY26 and beyond.

ITC Vs Dabur: Which FMCG stock should you bet on?

During the July-Sept. period, shares of ITC were flat-to-positive while Dabur India shares gained 4% in the three-month period. Interestingly, the Nifty FMCG index gained 3.38% in the second quarter, whereas on a YTD basis, it remains flat. However, brokerages remain positive on both FMCG stocks despite external headwinds. Here's a five-point analysis for investors to decide which stock they should bet on after Q2FY26 results:

1. ITC Vs Dabur: Topline, profit, margins

ITC Ltd.'s net profit rose 2% to Rs 5,179.8 crore in the Sept. quarter on a standalone basis, while its topline saw a 3.4% yearly decline to Rs 18,021.25 crore. Earnings before interest, tax, depreciation and amortisation rose 2% YoY to Rs 6,252 crore while margin came in at 34.7%.

Dabur India's bottom line rose 6% YoY to Rs 452.5 crore on a consolidated basis. The Ghaziabad-headquartered FMCG major's revenue rose 5.4% to Rs 3,191.32 crore while Ebitda was 6% YoY to Rs 588.07 crore. Dabur India's margin came in at 18.4% compared to 18.2% in the year-ago period.

2. ITC Vs Dabur: Share price trend

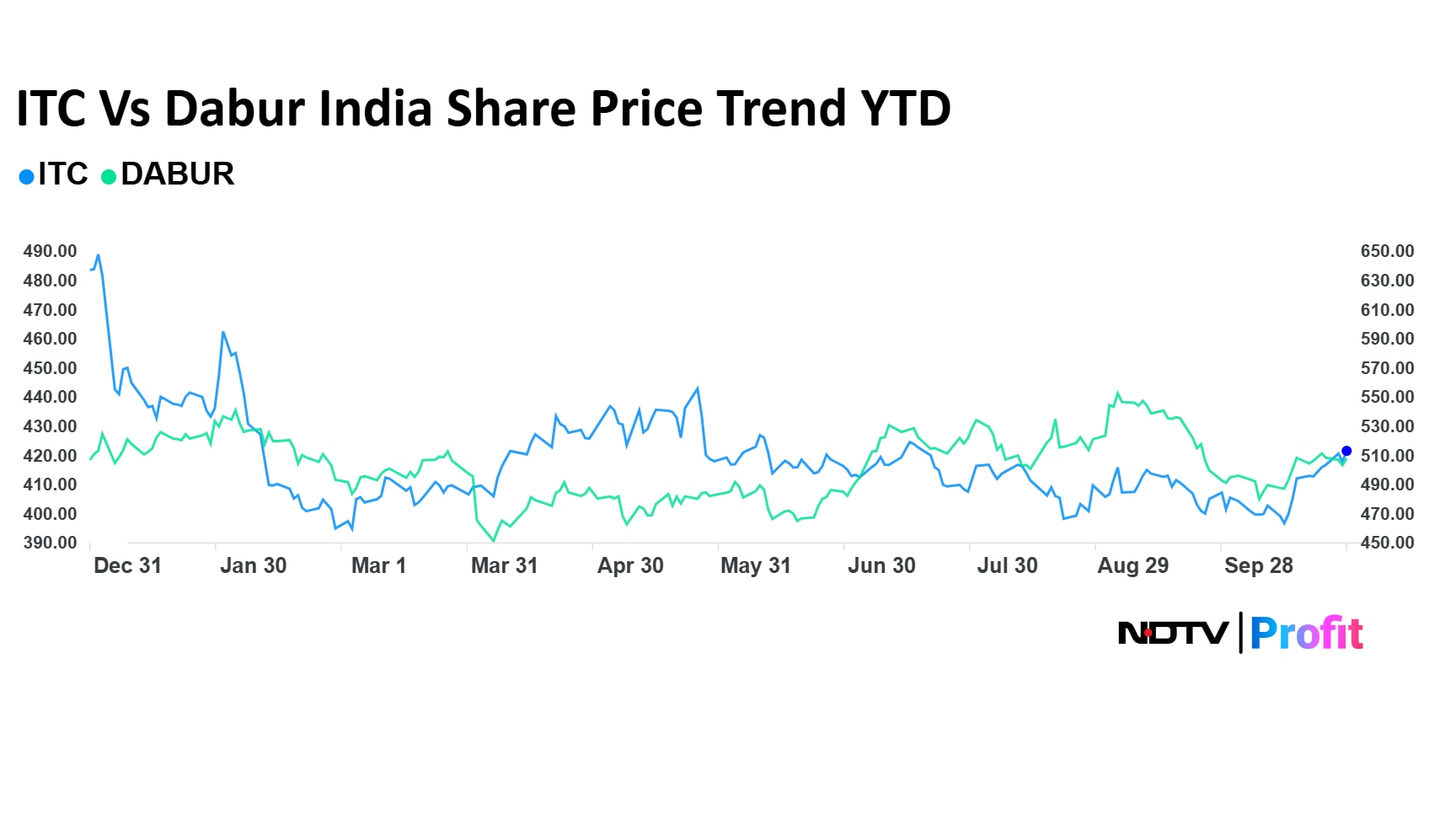

Between ITC and Dabur India, the Kolkata-based cigarette-to-FMCG conglomerate's stock is among the top five losers in the Nifty FMCG index on a YTD basis with a negative return of over 14%. Dabur India is down 1.7% YTD. Shares of ITC have picked an upward trend this month as the stock is up 4.28% as of Oct. 30, whereas Dabur India is up 2.09%.

ITC Vs Dabur India Trend YTD

3. ITC Vs Dabur: Segment growth

Both FMCG majors reported sustained growth across its segments in Q2. ITC Ltd's cigarettes business grew 6.8% YoY and the FMCG segment rose 7% despite operational challenges. The paper business was up 5%. Similarly, Dabur India's consumer care business grew 6%, while food business growth was flat. Toothpaste business reported 14. 3% growth and the 100% fruit juice portfolio under 'Real Activ' brand grew over 45%.

4. ITC Vs Dabur: Outlook

Dabur India is expected to deliver high-single-digit revenue aided by mid-high single-digit volume growth, according to Dolat Capital. Analysts at Systematix Institutional Equities said Dabur India's performance can gradually revive going forward, aided by sustained rural rebound with eventual urban recovery and distribution expansion.

For ITC, Dolat Capital believes that it would gain market share. "Despite a high base, we believe that volume growth would remain in mid-single digits," said Dolat. Similarly, Systematix said ITC's strong positions in atta, biscuits, noodles, snacks should help it leverage a gradual demand recovery manifesting in later quarters and margins should recover QoQ with stabilization in input costs.

#ITC's second quarter net profit at Rs 5,180 crore, up 2% year-on-year. #Q2WithNDTVProfit

October 30, 2025

Read: https://t.co/nTqGbubGBg pic.twitter.com/EVDG5Tm5YM5. ITC Vs Dabur: Target price, stock ratings

For Dabur, Dolat Capital trimmed the target price from Rs 587 to Rs 556 and maintained an 'accumulate' rating with 'buy on dips', indicating a return potential of 10 to 20% in the next 12 months. Systematix has a 'hold' rating on Dabur India with a revised target price of Rs 550 from Rs 565. However, Nuvama Research has a 'buy' rating as La Nina or harsher winters may benefit Dabur's winter portfolio—Chyawanprash, Honey, etc.

For ITC Ltd, Dolat Capital retained its target price of Rs 467 and maintained the 'accumulate' rating, indicating a return potential of 10 to 20% in one year. Systematix has a 'hold' rating on ITC but trimmed the target price to Rs 445 from Rs 460 earlier. Nuvama Research maintained 'buy' on ITC but marginally lowered the target price to Rs 534 from Rs 540.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.