Gold Vs Silver: US Attack On Venezuela Lifts Safe Haven Appeal — Which Precious Metal Should You Bet On?

Gold Vs Silver: Ross Maxwell, Global Strategy Operations Lead, VT Markets predicts that the impact on silver prices in the near-term would be more complex than gold.

Gold Vs Silver: Precious metals began 2026 on a bullish note as gold and silver continue to shine in the first few trading sessions of the new year in the aftermath of US attack on oil-rich Venezuela. The geopolitical risk has lifted the safe haven appeal of the metals in trade after a historic run in 2025.

Venezuela's President Nicole Maduro and his wife were captured by US military forces on Jan. 4, 2026, which fueled global tensions and raised the geopolitical pressure across asset classes, including equities and metals. Maduro pleaded not guilty in a US court on Monday to narcotics charges.

ALSO READ

Venezuela Tops List Of World's Highest Oil Reserves: A Look At Top 15 Nations Rich In 'Black Gold'

Gold Vs Silver After US Attack On Venezuela

US gold futures for February delivery settled 1% higher at $4,496.10. Spot gold was up 0.8% at $4,485.39 per ounce after a 3% gain in the previous session, bringing prices closer to the record high of $4,549.71 hit on Dec. 24, 2025. Non-yielding gold tends to benefit from low-interest-rate environments.

Back home, gold futures, due for a Feb. 5 expiry settled 0.03% lower at Rs 1,39,040 per 10 grams on the multi commodity exchange (MCX). The yellow metal, considered a traditional safe haven among commodities, soared 64.4% last year, logging its best annual performance since 1979.

Spot silver, which hit an all-time high of $83.62 on Dec. 29, gained 5.4% to $80.68 per ounce in international markets. Back home, silver futures, due for March 5, 2026 expiry, settled 0.31% lower at Rs 2,58,000 per one kg on the MCX. The white metal recorded its strongest annual gain in 2025, soaring 147% on rising industrial and investor appetite.

Gold Vs Silver: Which metal should you bet on?

If tensions increase and US escalates through a further military strike on Venezuela, it would create another significant geopolitical shock. Experts believe that would likely create a more protracted conflict and would impact investor behaviour and influence gold and silver well into 2026.

''Such an escalation would heighten global risk aversion, particularly given Venezuela’s strategic role in global energy markets and its alliances with non-Western powers such as China,'' said analysts at VT Markets.

Gold traditionally benefits from geopolitical stress due to its status as a safe-haven asset, and a US-Venezuela conflict could accelerate central bank and institutional demand as investors seek protection against currency volatility, sanctions risk, and potential disruptions to global trade.

Ross Maxwell, Global Strategy Operations Lead, VT Markets predicts that the impact on silver would be more complex. In the short term, rising uncertainty would mean silver moves higher alongside gold, but its position linked to strong industrial demand means that prolonged instability or a slowdown in global growth could weigh on price relative to gold.

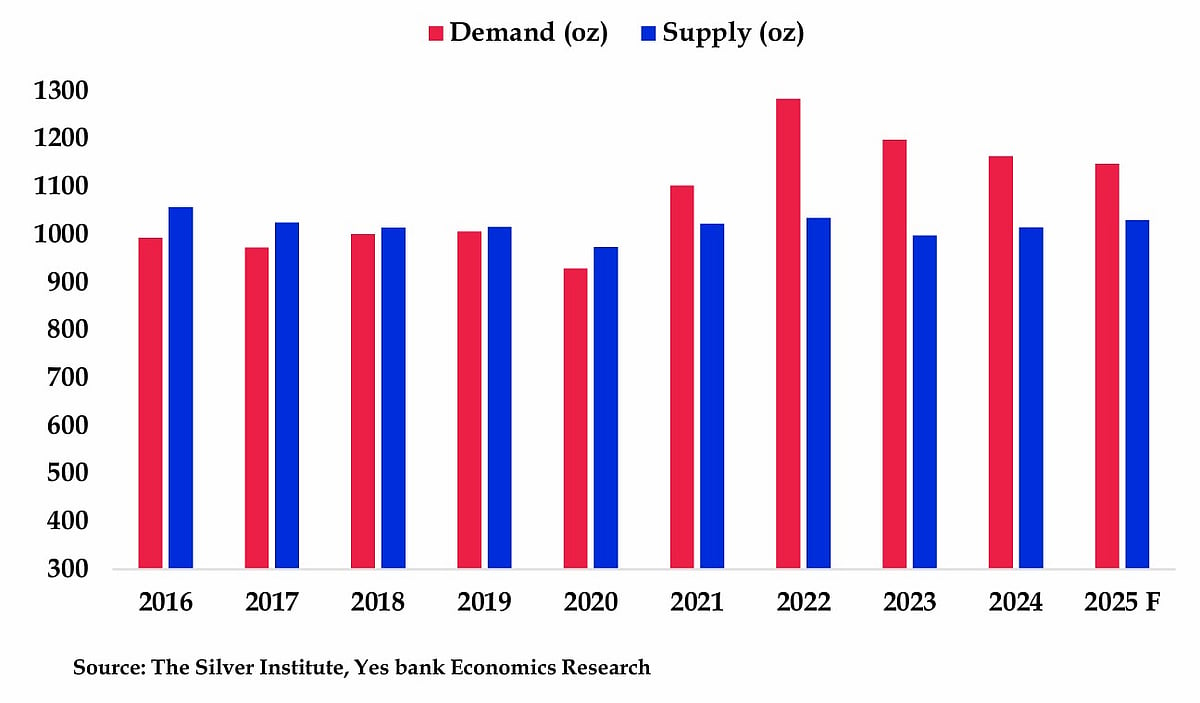

Silver demand-supply is in better balance and the outlook for industrial demand in 2026 is strong. (Image: Yes Bank)

Looking toward 2026, sustained tensions involving the US could reinforce the broader trend of de-dollarisation and diversification of reserves, again supporting higher gold prices. ''Inflationary pressures stemming from energy supply disruptions or expanded defence spending could further enhance gold’s appeal as an inflation hedge,'' said Maxwell.

''US attack on Venezuela would likely be another bullish catalyst for gold through 2026, while silver could experience higher volatility, balancing its safe-haven role against global growth and industrial demand,'' he said.

Back home, Jateen Trivedi, VP Research Analyst - Commodity and Currency, LKP Securities believes that risk sentiment continues to favor higher allocation toward gold amid the renewed global geopolitical tensions.

''Reports of US crossing Venezuela border and heightened alerts of its leadership is adding to global uncertainty. These developments are keeping safe-haven demand firm. Gold is expected to remain volatile but biased upward, with a trading range seen between Rs 1,37,000 and Rs 1,42,000 in the near term,'' said Trivedi.