Foreign portfolio investors (FPI) continue to invest in India's primary market, with total inflows at Rs 7,833 crore recorded so far this month. However, foreign investors have remained net sellers of Indian equities in November with the sell-off reaching Rs 10,753 crore, according to NSDL.

The total outflow, taking into account debt, hybrid, debt-VRR, and equities, stands at Rs 693 crore in Nov. The total amount of FPI sales through exchanges has reached Rs 208,126 crore, while investments in the primary market stand at Rs 62,125 crore. D-Street analysts remain optimistic on the robust IPO frenzy that has gripped the primary action this year.

"The long-term trend of FII buying through the primary market continues with an investment of Rs 7,833 crore so far in November. For 2025, till now, total FII sell figure through exchanges stands at Rs 2,08,126 crore. The total buy figure for the primary market stands at Rs 62,125 crore," said Dr. VK Vijayakumar, Chief Investment Strategist, Geojit Investments Ltd.

India's IPO Frenzy

In November 2025, the primary market has been particularly robust, featuring several notable listings across industries like fintech, clean energy, edtech, and industrial manufacturing. So far, seven mainboard IPOs opened in Nov. which were available for subscription.

Nearly six successful listings have taken place this month. Some of the major IPOs introduced in November 2025 include Pine Labs, Groww, Capillary Technologies, and Fujiyama Power Systems, ed-tech giant PhysicsWallah, among others. Several other IPOs are in the fray.

Why are FPIs selling Indian equities?

The selling by FIIs accelerated on the last few days of the week, and the total FII sell figure up to Nov. 14 stood at Rs 13,925 crore. According to Dr. VK Vijaykumar of Geojit, the underperformance of India vs other markets has accelerated the momentum sell trade in India and buy trade in other markets, particularly those like US, China, Taiwan and South Korea which are widely regarded as the beneficiaries of the ongoing AI trade.

"However, this artificial intelligence trade cannot continue for long since there are concerns of a bubble building up in AI stocks. When the AI trade loses steam, India will attract FII inflows. The timing of this is difficult to predict," he added. He also raised concerns of valuations in the Indian market.

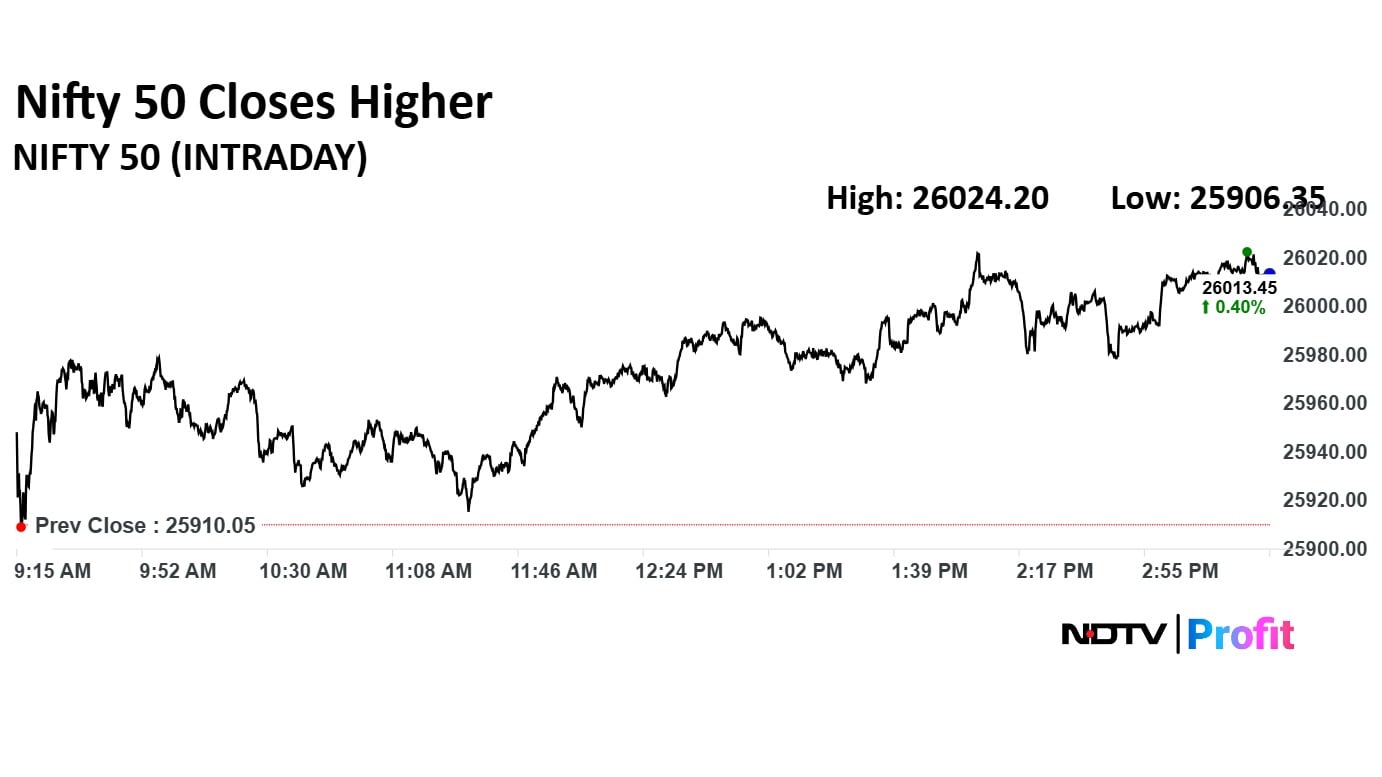

Nifty 50 outlook

D-Street analysts believe that the domestic stock market has maintained its positive momentum, with the Nifty 50 benchmark hovering near the key psychological level of 26,000, as investors anticipate a strong catalyst for an upward movement.

"A potential trade deal remains a crucial trigger that participants are closely monitoring. Currently, the risk-reward ratio is largely favorable, bolstered by stronger-than-expected Q2 earnings from Midcaps, which have reinforced confidence in growth revival and point to potential future earnings upgrades," said Vinod Nair, Head of Research, Geojit Investments Ltd.

A sustained uptrend in the market and new record highs have not been happening since FIIs continued selling on all rallies. According to Dr VK Vijaykumar, a change in FII strategy is necessary for the market to break into new record highs and remain there. This, in turn, requires steady improvement in earnings growth, which is likely from Q3 onwards.

If the global AI trade loses steam, that would be a helpful factor. Analysts noted that Q2 results declared so far indicate an uptrend in earnings growth. Overall, net profits have grown by 10.8%, which is the best in the last six quarters. This is a beat over earlier estimates.

"The present trends in consumption indicate that earnings will further improve in Q3. Discretionary consumption, particularly automobiles, will lead earnings growth in Q3. Whether the present boom in consumption will continue even after the festival season is to be watched," he said.

Technical View

On the technical front, the Nifty 50 index moved up after a few days of consolidation on the daily timeframe. Besides, the index has been sustaining above the 21EMA, which is a critical short-term moving average.

"The RSI is in a bullish crossover on the daily chart. The formation of a higher bottom indicates a rising market. The trend is likely to remain strong in the short term, with the potential to move towards 26,200/26,350. On the lower side, support is placed at 25,800," said Rupak De, Senior Technical Analyst at LKP Securities.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.