- The Nifty 50 index may drop 5-7% if NDA loses Bihar elections, says InCred Equities

- NDA loss could trigger coalition realignment at Centre and increase market volatility

- Political uncertainty may lead to FII outflows, higher bond yields, and rupee pressure

The Indian stock market could face a short-term correction with a 5-7% drop in the benchmark Nifty 50 index if the National Democratic Alliance loses power in Bihar. According to brokerage InCred Equities, if the Bihar election results diverge from the exit polls—that predicts an NDA win, D-Street will price in a 'coalition discount' and brace for a surge in volatility.

NDA's loss in the eastern state could trigger a realignment at the Centre, warned the brokerage. Despite the poll of exit polls forecasting a clear NDA mandate against the Opposition's Mahagathbandhan bloc, the final results may differ as some exit polls have also proven to be inaccurate in the past.

"With the outcome of Bihar polls largely discounted by the market, there are no political triggers that can push indices significantly higher. The reverse might happen if the actual poll results turn out to be different from the exit polls," said Dr. VK Vijayakumar, Chief Investment Strategist, Geojit Investments Ltd.

Bihar Elections 2025: What will happen if NDA loses power?

The electoral battle in the 243-member assembly is seen as a veritable referendum on Bihar's longest-serving Chief Minister Nitish Kumar. As per InCred, if the NDA loses Bihar, the fallout could extend far beyond the state — potentially paving the way for a coalition-led realignment at the Centre.

JD(U) supremo Nitish Kumar, long aspiring for national relevance, may seize the opportunity to accept a prime minister's role within an INDI bloc, possibly under a rotational power-sharing arrangement (2.5 years each) with regional leaders such as Chandrababu Naidu, as per the brokerage.

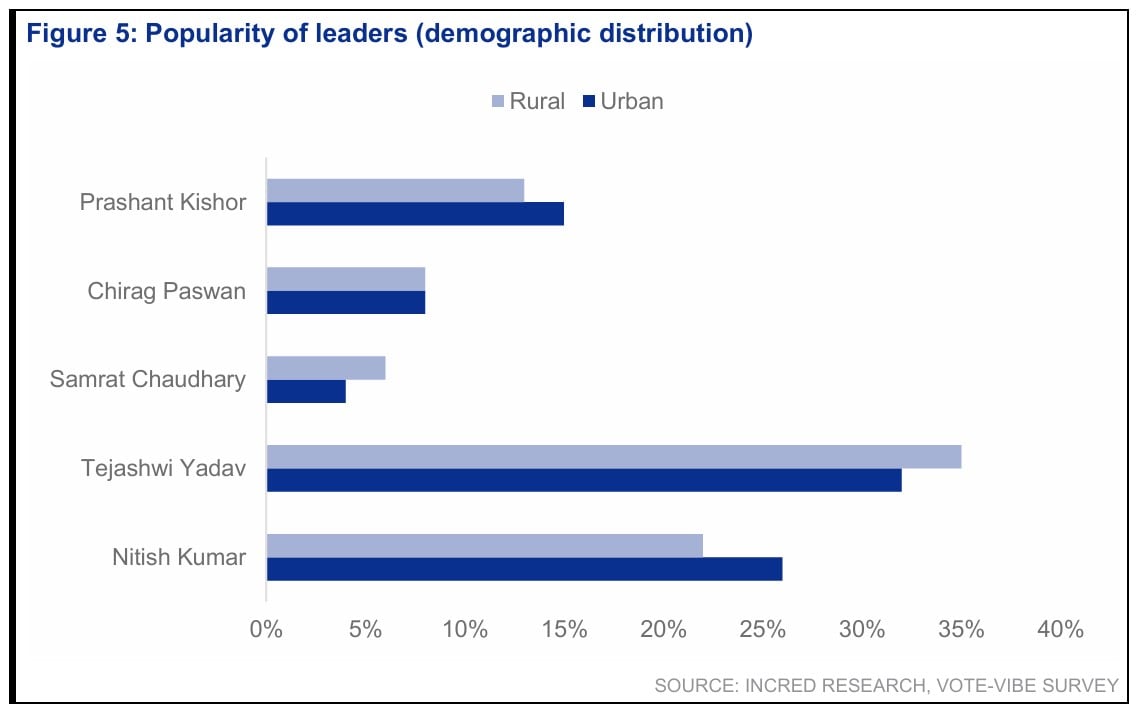

Image: InCred Equities

Bihar Elections 2025: How will NDA's downfall impact D-Street?

If the above happens, the BJP will split JD (U) through loyalists. This will introduce a short-term policy uncertainty and market volatility, as investors reassess fiscal and reform stability in a fragmented coalition set-up. Notably, the trigger point is that stock markets 'dislike' uncertainty.

"The ripple effect extends to the Centre, leading to an INDI coalition government under Kumar or Naidu. Markets may experience a sharp, short-term risk-off phase driven by political uncertainty," said InCred. If a dominant part falls, investors tend to raise questions.

1. Market volatility: "History shows that when dominant-party stability gives way to coalition ambiguity—as in the 2024 post-poll reaction, when the Nifty 50 fell 6% in a single day—investors immediately price in concerns over policy continuity, fiscal prudence, and reform momentum," said the brokerage.

2. FII outflows, high bond yields: A loss of foreign-investor confidence (as seen in June 2024) could trigger capital-flow reversals, impacting domestic equity and bond markets. Bond yields may rise, reflecting a higher fiscal-risk premium, while the rupee could remain under mild pressure until the coalition's policy stance is established.

3. Shift in sector bets: Defence, infrastructure, and PSU themes may lose momentum, while consumption, regional, and SME-linked equities could benefit from a decentralised fiscal orientation. Policy-reform heavy sectors may stay on hold, dragging the valuations of companies highly dependent on them.

Short vs medium vs long-term—What should investors do?

Short-term: According to InCred Equities, market participants and investors should expect near-term volatility across indices, outflows from foreign investors, and a temporary repricing of India's “stability premium.”

Medium-term: The medium-term outcome hinges on credibility rather than composition. If the new coalition sustains infrastructure spending, preserves macro-economic stability, and avoids populism, the medium-term risk may diminish and markets could stabilise with policy clarity.

Long-term: In essence, a post-NDA coalition may unsettle sentiment in the short run—but the long-term trajectory will depend on various factors. It may present a potential investment opportunity, especially if the new coalition delivers on governance, policy, and regional growth.

Markets are forward-looking. If the coalition can articulate a credible Bihar-led growth model, emulate reforms in micro-states, or drive regionally-balanced spending, then the correction could offer a buying opportunity.

It may recoup lost investor confidence and benefit mid-cap and regional growth stocks in particular. "For disciplined investors, the volatility may actually open a cyclical accumulation window, as markets historically rebound once governance visibility returns," said InCred Equities.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.