Silver Intraday Slump: CME Margin Hike To Rally Fatigue — Five Reasons Behind White Metal's Price Crash

Silver Intraday Slump: In global markets, the white metal retreated after touching a record peak above $80 an ounce while gold also slipped from levels close to historic highs.

Silver prices pulled back from record high levels on Monday, Dec. 29, catching the attention of bullish commodity traders during the year-end session. In domestic markets, MCX silver futures, due for a March 2026 expiry, slumped over 10% or Rs 21,000 per kg crashing from an all-time high peak of Rs 254,174 per kg to Rs 233,120 per kg earlier in the session.

In international markets, the white metal retreated after hitting a record peak above $80 per ounce while gold also slipped from levels close to historic highs during the session. Investors booked profits and a market perception of reduced geopolitical risks curbed safe-haven buying.

Spot silver last shed 4.8% at $75.32 per ounce, retreating from an all-time high of $83.62 hit earlier in the session. Spot gold fell 1.4% to $4,470 per ounce after hitting a record-high on Friday. Spot platinum dropped 6% to $2,305.15 per ounce, after rising to an all-time high of $2,478.50 earlier in the day, while palladium plunged 13.2% to $1,669.11 per ounce.

Silver Intraday Slump: Why did the white metal crash from record highs? Five key reasons

Bullion has risen about 72% this year, rallying on factors such as softer US monetary policy, dollar weakness, geopolitical friction, and robust central bank purchases. Outperforming the yellow metal, silver has gained nearly 181% year-to-date, driven by its designation as a US critical mineral, supply-demand imbalance, and rising industrial and investor appetite.

Here are five key reasons behind the devil metal's price crash in today's session:

1. Peace talks amid geopolitical wars hampers safe haven appeal

Analysts believe the tentative optimism from the US administration regarding progress in the Ukraine peace talks represented a mild headwind. US President Donald Trump said on Sunday that he and Ukrainian President Volodymyr Zelenskyy were "getting a lot closer, maybe very close" to an agreement to end the war in Ukraine. Easing geopolitical tensions affected silver's safe haven demand and triggered profit booking.

2. CME Margin Hike

According to reports, the Chicago Mercantile Exchange has raised the initial margin requirement for the March 2026 silver futures contract to approximately $25,000, up from $20,000 earlier this month, with effect from Dec. 29. The move forces commodity traders to offload higher, triggering additional liquidation in the white metal.

3. Precious metal's rally fatigue

The weekly gains recorded by the white metal now signals a rally fatigue as the technical indicators are overheated. Last week's 18% gain marked the largest weekly advance in more than 45 years. The four preceding weeks saw silver's price advancing by 12.95%, 3.26%, 6.42%, and 8.39%, with only three down weeks since mid-August. The precious metal's 14-day relative-strength index is above 70, which means the metal is overbought.

4.Strength in US dollar, yields

Analysts noted that the sudden selling pressure was compounded by a slight uptick in the US dollar and yields, reducing the appeal of non-yielding commodities. The improved risk appetite in broader markets led funds to rotate back into equities, with traders squaring positions ahead of year-end.

“Silver’s rally is being shaped by real metal scarcity rather than speculative positioning. Physical deficits, policy-driven supply restrictions, and concentrated inventories are dictating prices, signaling a durable shift in how the silver market is priced and traded," said brokerage Motilal Oswal Financial Services Ltd.

5. Silver's demand-supply picture

Silver prices surged to record levels during the year, crossing $75 on COMEX and rising above Rs 2.3 lakh in the domestic market, marking multi-year gains. The rally was not driven by short-term speculation, but by the prolonged physical supply deficits, tightening inventories, policy-led supply constraints, and sustained industrial and investment demand.

"The silver market in 2025 moved beyond a conventional bull cycle and entered a structural phase. The disconnect between paper pricing and physical availability highlights deeper stress in global price discovery mechanisms," said Navneet Damani, Head of Research – Commodities at Motilal Oswal Financial Services Ltd.

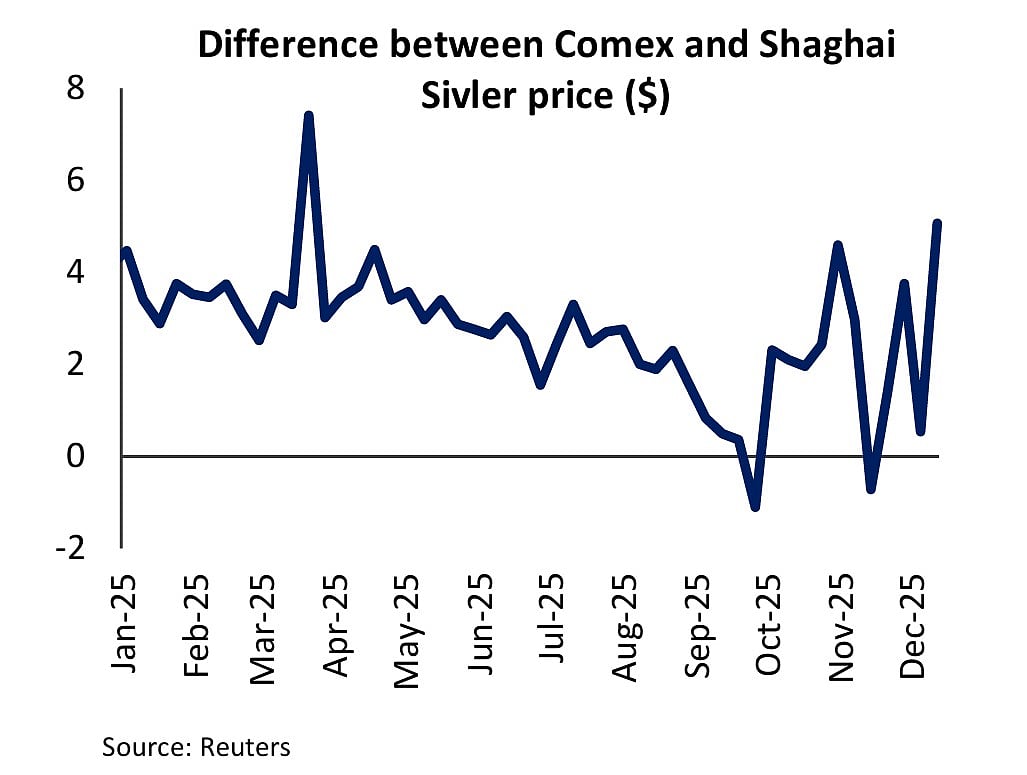

Traditionally, when Shanghai prices trade above COMEX, traders would buy metal where it is cheaper and ship it where it is dearer, locking in a riskless profit and aligning prices globally. According to Motilal Oswal, 2025 marked the fifth consecutive year of physical deficit in the silver market, with mine supply unable to match combined industrial and investment demand.

“Persistent inventory drawdowns across key global hubs, weakening arbitrage between Shanghai and COMEX, and repeated delivery pressures have exposed the limited availability of deliverable silver. The sustained premium in physical markets reflects genuine supply tightness rather than temporary pricing inefficiencies," said Manav Modi, Commodities Analyst – Motilal Oswal.