NCC Share Price: Rekha Jhunjhunwala-backed portfolio stock NCC has declined 22% this year, yet the public sector undertaking (PSU) remains a multibagger-favorite for investors. Despite a weak performance during the June quarter (Q1FY26), brokerages are bullish on the stock and have set target prices higher than the current trading price on the charts.

Based in Hyderabad, NCC is a diversified construction and operates in multiple segments, including roads, buildings, irrigation, water, electrical, metals, mining, and railways. Apart from projects in India, NCC has an international presence through its subsidiaries in Muscat and Dubai.

NCC Q1 Results

During the April-June quarter of FY26, NCC reported a drop of 8.4% in its consolidated net profit (bottomline) to Rs 192.1 crore, compared to Rs 209.9 crore in the year-ago period. The PSU's revenue from operations (topline) declined by 6.3% to Rs 5,178.9 crore compared to Rs 5,527.9 crore in Q1 FY25.

“NCC has reported a turnover of Rs 5,207.93 crore (including other income) on a consolidated basis in the first quarter of financial year 2025-26 as against Rs 5,558.33 crore in the corresponding quarter of the previous year, a decrease of 6% on year-on-year basis,” said NCC in its statement.

The construction firm's earnings before interest, taxes, depreciation and amortisation (EBITDA) also fell by 4.3% to Rs 456.12 crore during the June quarter compared to Rs 477.9 crore in the same quarter of the previous year. EBITDA margin increased marginally to 8.8% in Q1 FY26 from 8.6% in Q1 FY25.

NCC reported a basic and diluted earnings per share (EPS) of Rs 3.03 for the June quarter, compared to Rs 3.20 in the corresponding quarter of the previous fiscal. During the quarter, it secured new orders amounting to Rs 3,658 crore, and NCC's consolidated orderbook at the end of the June quarter stood at Rs 70,087 crore.

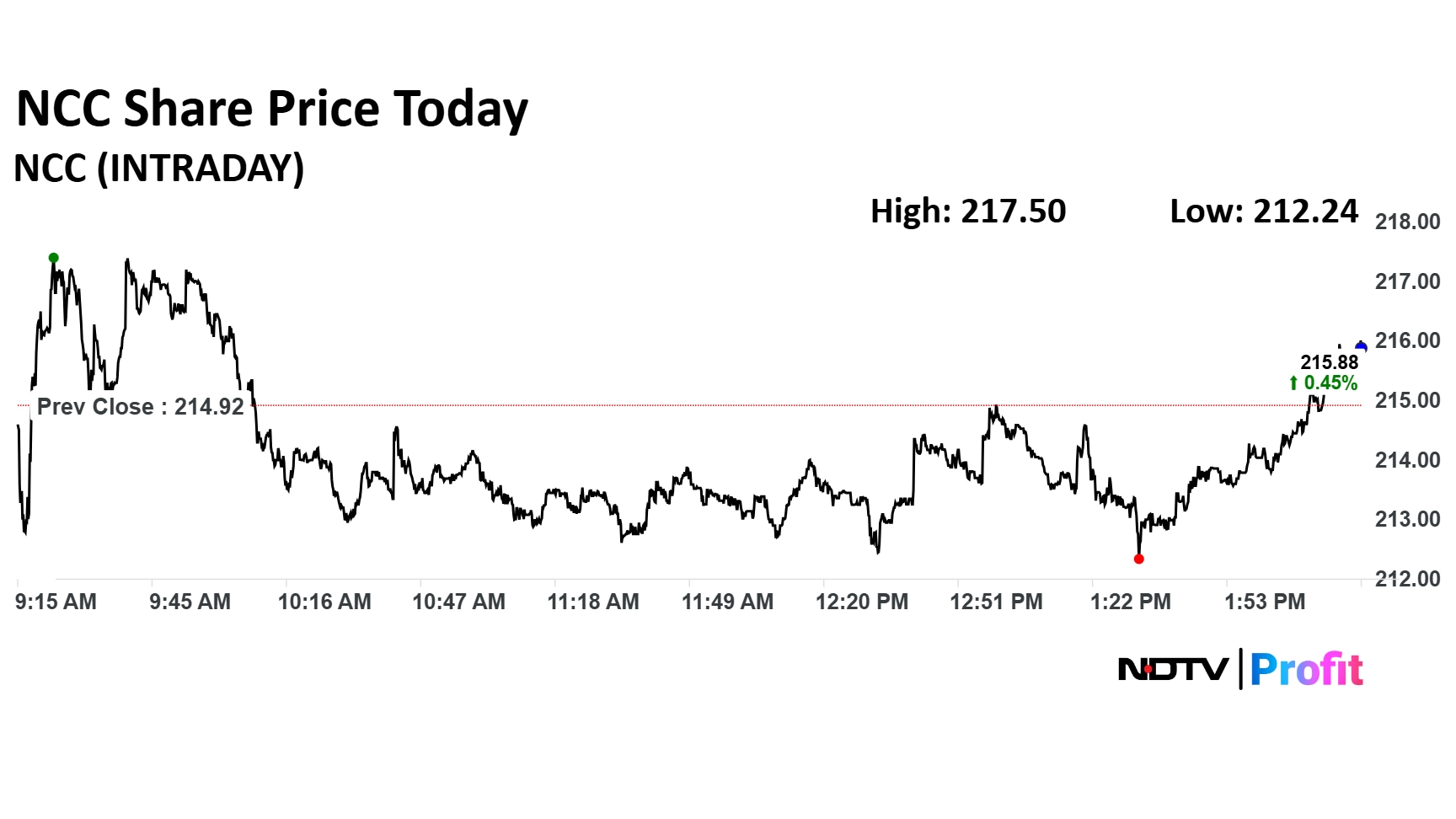

NCC Share Price Today

As of June 2025, Rekha Jhunjhunwala held a 12.5% stake in NCC with 78,333,266 shares worth Rs 1,667.7 crore. The ace investor is the wife of late Rakesh Jhunjhunwala, the Big Bull of the Indian stock market.

Despite a weak set of Q1 numbers, NCC stock snapped a five-day losing streak during yesterday's session. NCC maintained healthy order inflows in the quarter and is confident in making a slow recovery on the back of a strong order book.

On Thursday, the stock opened at Rs 214.60 and has lost 1% intraday so far in the session. At 2:20, the stock traded 0.49% higher at Rs 215.95 apiece on the BSE. The Sensex was last down 0.44% to 80,193.33.

The PSU commands a market cap of Rs 13,570.90 crore. The relative strength index was 53.21. In the last one month, the stock has shed 1.2% but gained 3.6% in six months. In the last 12 months, it has dropped 32%.

However, the Jhunjhunwala-backed multibagger PSU stock has delivered stellar 236% returns in three years and 595% returns in the last five years. NCC hit a 52-week high of Rs 330.8 on September 5, 2024.

NCC Brokerage View: Buy Or Sell?

Out of 15 analysts tracking the company, 10 maintain a 'buy' rating, three recommend a 'hold' and two suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 23.4%.

Nuvama Institutional Equities has set a target price of Rs 280 for NCC Ltd. and provided a 'buy' rating on the PSU stock, indicating a potential upside of 305 from the current market price. The management is confident of execution picking up over coming quarters and has guided for a 10% YoY revenue growth in FY26E with an EBITDA margin on 9%.

"The management expects execution to ramp up going ahead. That said, given payment and labour unavailability issues, we are cutting FY26E/27E EPS by 7%/3%. Maintain ‘BUY' with a TP of INR280 (17x Q1FY28E EPS)," said Nuvama on NCC stock.

Disclaimer: The views and opinions expressed by the investment advisers on NDTV Profit are of their own and not of NDTV Profit. NDTV Profit advises users to consult with their own financial or investment adviser before taking any investment decision.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.