NCC Ltd. share price snapped a five-day losing streak in Wednesday's session despite posting bleak results for April–June. The company has maintained healthy order inflows in the first quarter and is confident in making a slow recovery on the back of a strong order book.

NCC secured new orders worth Rs 3,658 crore in the first quarter, which is around 17% of the fresh order flow expected in the full financial year, the company said in the investors presentation. The full-year expected order inflow is Rs 22,000–25,000 crore.

The healthy order inflow is indicative of the client's confidence, NCC said in the investor presentation. "Approaching the rest of FY26 with a healthy bid pipeline, continued project selectivity, and close alignment to market opportunities—ensuring preparedness for a gradual recovery."

NCC Q1 FY26 Highlights (Consolidated, YoY)

Revenue down 6.3% to Rs 5,178.99 crore versus Rs 5,527.98 crore.

Ebitda down 5% to Rs 456.12 crore versus Rs 477.91 crore.

Margin at 8.8% versus 8.6%.

Net Profit down 8% to Rs 192.14 crore versus Rs 209.92 crore.

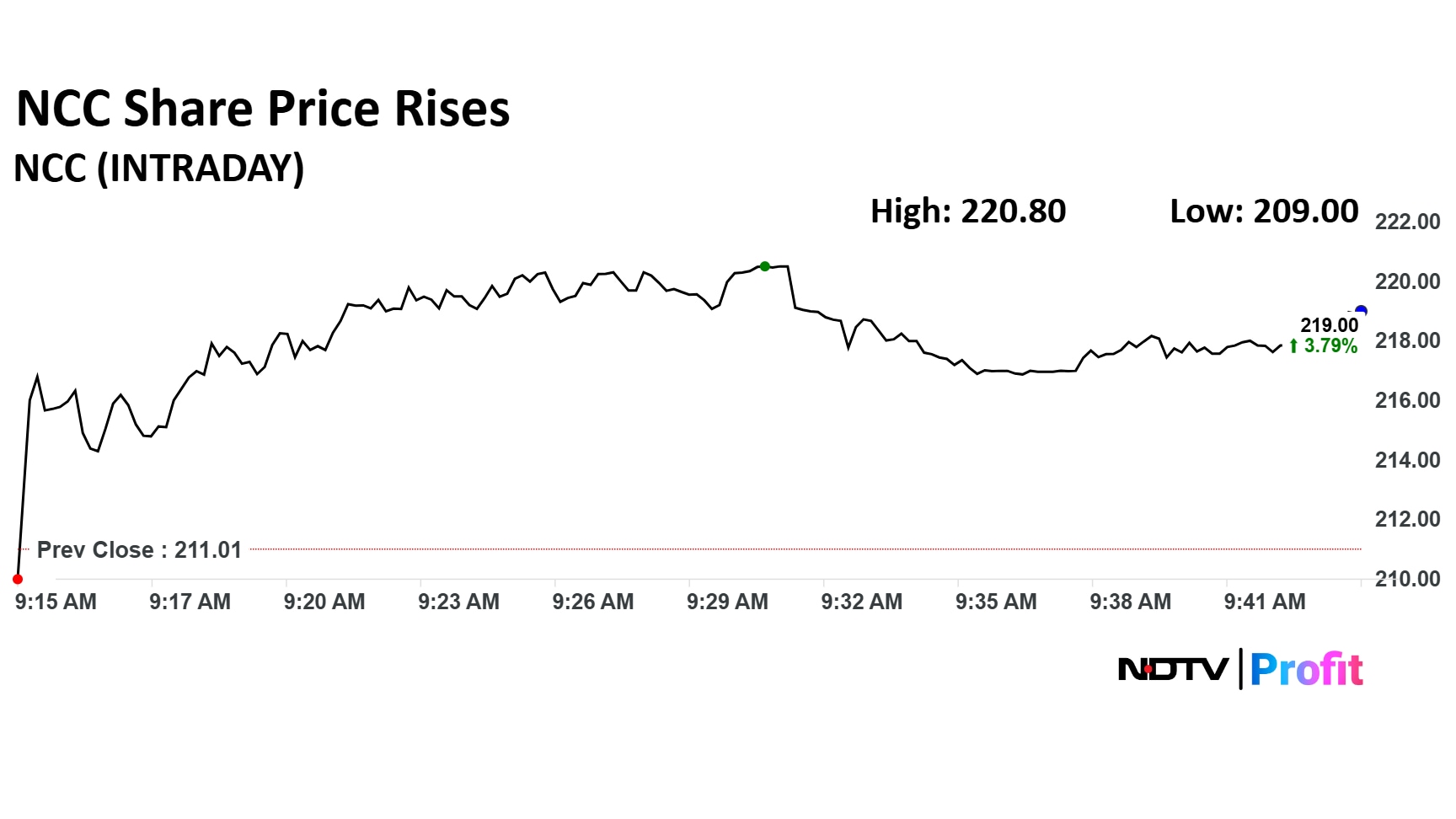

NCC share price advanced 4.64% to Rs 220.8 apiece, the highest level since July 31. It was trading 3.23% higher at Rs 217.66 apiece as of 9:41 a.m., compared to a 0.03% advance in the NSE Nifty 50 index.

The stock declined 29.98% in 12 months and 20.41% on a year-to-date basis. Total traded volume so far in the day stood at 14 times its 30-day average. The relative strength index was at 45.93.

Out of 15 analysts tracking the company, 10 maintain a 'buy' rating, three recommend a 'hold' and two suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 23.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.