.web.webp?downsize=773:435)

Ola Electric Mobility Ltd. received a new 'buy' rating from Citi Research as it initiated coverage on the stock with 22% upside potential citing a wide product portfolio and a strong focus on research and development.

The brokerage has set a target price of Rs 90 per share, implying a 22% upside from Tuesday's close. Significant vertical integration and its large scale of production could also add to the positive triggers, according to the analysts at Citi. "As capacity utilization increases—currently at 40%—we expect profitability to improve."

This comes when the electric manufacturer reels under service-related issues amid reports of laying off 100 employees every week since its service-related woes came to the fore nearly two months ago.

Citi admitted that the "service perception has been negative of late," but expects it to subside over the medium term as the back-end supply chain catches up with volume growth.

The soon-to-be-launched motorcycles and electric three-wheelers could potentially boost volumes, it said. Weak EV penetration, elevated competition, continued negative perception and sustained net losses could to key risks to the brokerages views.

The brokerage prefers Ola Electric over Bajaj Auto Ltd. and TVS Motor Co. However, Eicher Motors Ltd. and Hero MotoCorp remain the top picks for Citi.

It said that while the electric penetration in India may not reach China's levels soon, original equipment manufacturers could remain profitable from optimal cost base and consolidation of the industry.

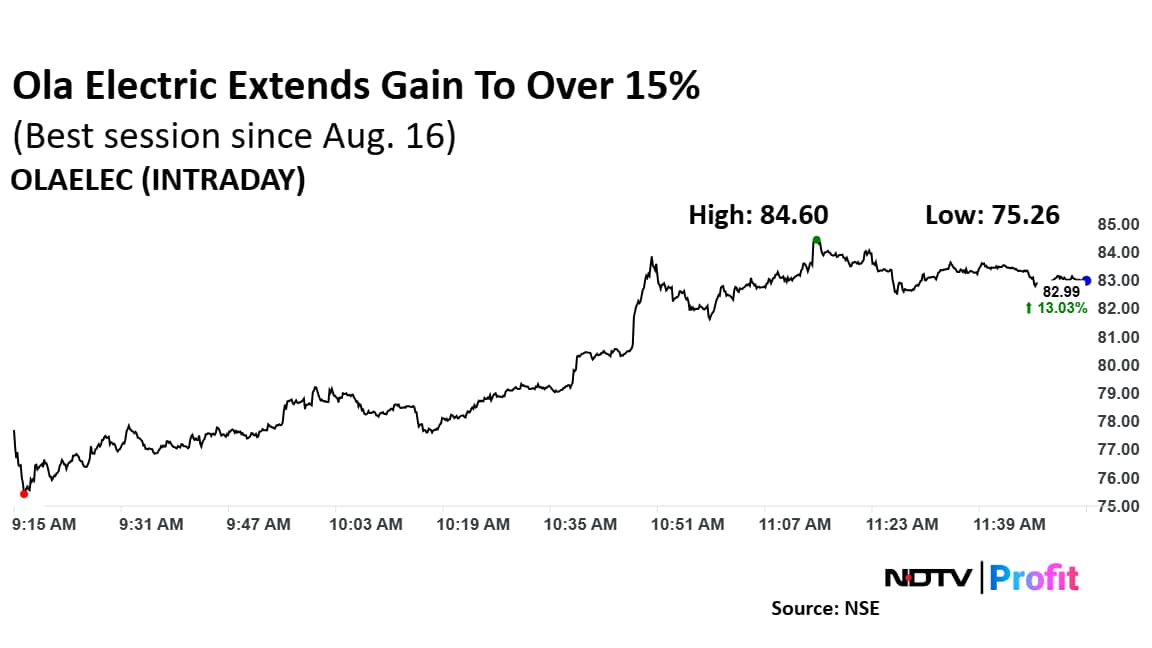

Shares of Ola Electric rose over 15%—its highest intraday gains since Aug. 16—aided by the electric scooter manufacturer's new two-wheeler launch aimed at India's gig workers.

It pared gains and was trading 12.8% higher at Rs 79.1 apiece, compared to a 0.05% decline in the benchmark Nifty 50 as of 11:49 a.m.

It has fallen 9% since its listing on Aug. 9 this year. Total traded volume so far in the day stood at 6.8 times its 30-day average. The relative strength index was at 58.

Five of the seven analysts tracking the company have a 'buy' rating on the stock and two have a 'sell', according to Bloomberg data. The average of the 12-month analysts' price target implies a potential upside of 28%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.