Domestic equity benchmarks Sensex and Nifty 50 snapped a three-week winning streak and logged their worst week in nearly eight months on Sept. 26, 2025. Investor sentiment was rattled by a fresh wave of tariffs targeting the pharmaceuticals, dragging pharma stocks deep into the red.

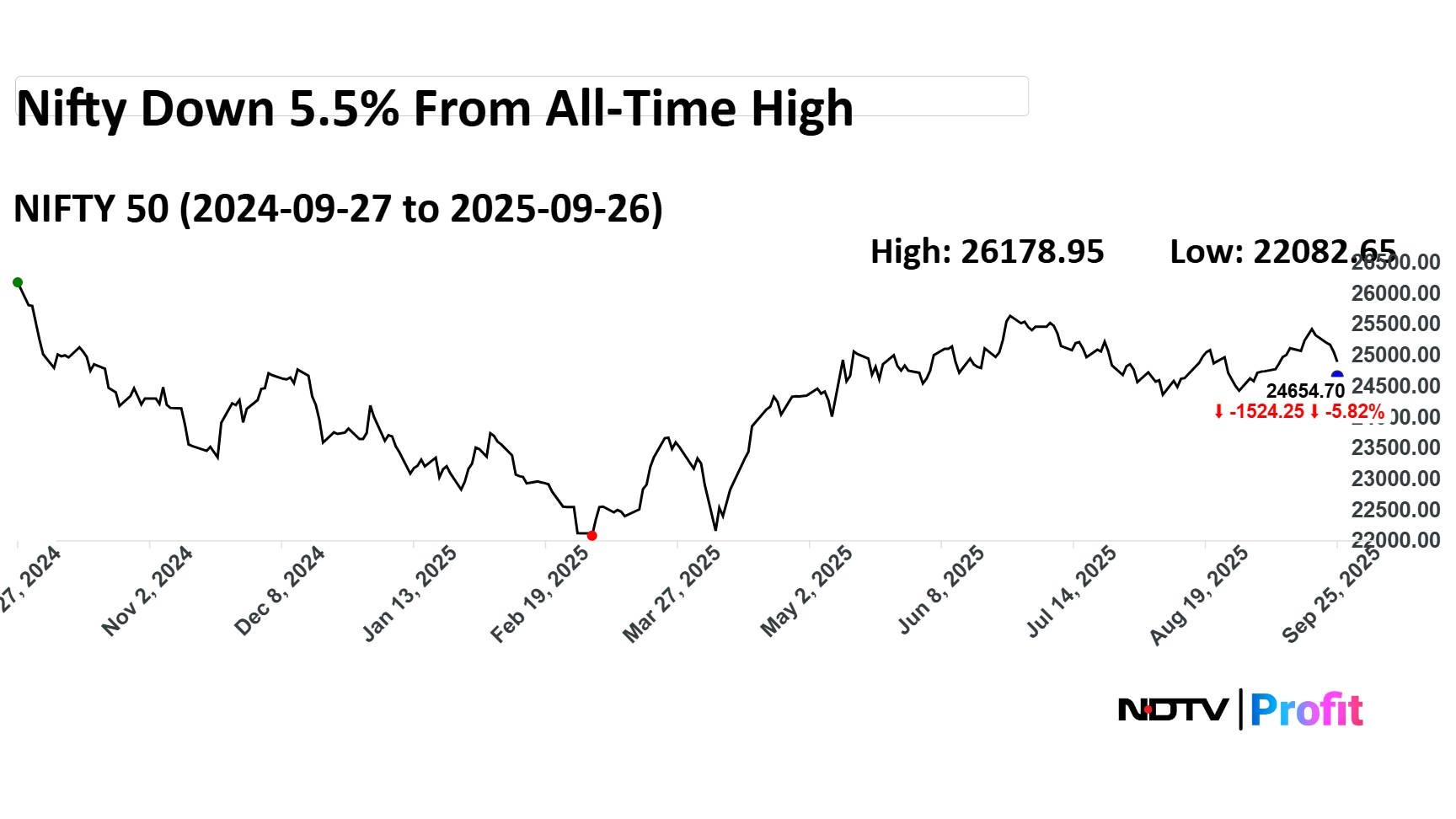

Notably, the NSE Nifty 50 benchmark hit its all-time high exactly one year ago, on Sept. 27, 2025. Since then, the benchmark has slipped 5.5%, giving an impression of relative stability. However, analysts said a deeper look in broader markets revealed a far more painful reality for investors.

According to Apurva Sheth, Head of Market Perspectives and Research, SAMCO Securities, out of the top 750 listed stocks, only 245 have delivered positive returns, while a striking 485 stocks are in the red (20 stocks were listed after Sept. 26, 2024). The median return is -11.56%, and the average return is -6.25%.

Nifty hit lifetime high exactly one year ago: What do trends indicate?

Nifty's one-year returns indicate that losses are more widespread than the benchmark index alone suggests. The pain is more severe in the broader universe. 254 stocks have lost over 20% of their value, while only 103 have managed to gain over 20%. Midcap, smallcap, and microcap indices have underperformed the Nifty in the last one year, with declines in the range of 8%-9%.

This data underscores a key truth. The headline indices often mask the underlying breadth of the market. While the Nifty 50 may look like it's holding ground, the average investor—who typically owns mid and small caps—has faced double-digit losses, according to SAMCO Securities.

Nifty 50 benchmark hit an all-time high of 26,277.35 exactly one year on Sept. 27, 2024. While the benchmark is down over 5% in one year, it has gained 4.27% on a year-to-date basis. On Sept. 26, 2025, the benchmark slipped below the 24,700-mark and pared a two-week gain over global headwinds, rupee's weakness against US dollar, and foreign fund outflows.

Nifty 50 down 5.5% in one year from 52-week high.

What should be your trading strategy?

SAMCO Securities suggests investors to focus on portfolio diversification based on the one-year trend of the Nifty 50. "The lesson is clear. Relying on index-level performance can be misleading. For most investors, the past year has felt far worse than the Nifty's mild decline would suggest," said Sheth.

"Mindless diversification in to more stocks or equity mutual funds doesn't help. Unless you buy non-correlated assets like gold, silver, bonds, your portfolio will bleed and go through these painful periods," warned Sheth.

Looking ahead, market experts believe that investor attention will move to US economic indicators, particularly inflation and employment data. On the domestic front, the RBI's policy decision and macroeconomic figures will play a pivotal role in guiding sentiment.

"Sectoral fundamentals across banking, FMCG, and automobiles remain constructive, supported by domestic policy tailwinds and macroeconomic stability. The sustainability of current market valuations hinges on a visible recovery in corporate earnings and resolution of India-US trade frictions," said Vinod Nair, Head of Research, Geojit Investments Ltd.

Analysts said Indian equities are expected to remain in a sideways phase in the near term as growth visibility remains limited. Meaningful earnings momentum is unlikely to return before FY27, keeping the benchmarks in what is described as a “time correction” phase — where valuations pause and wait for earnings to catch up.

Sideways markets are often misunderstood as negative for investors. N ArunaGiri, Founder & CEO at TrustLine Holdings highlighted a silver lining. "In reality, a range-bound market with a mild positive bias tends to be the best setup for bottom-up stock picking, especially in the broader small- and mid-cap space."

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.