And it's a wrap on NDTV Profit's live market coverage for Sept 26. Thank you for joining us today!

Benchmarks snaps 3-week gaining streak.

Benchmarks underperforms Broader Market Indices for the week

Tech Mahindra and TCS fell the most in Nifty

Tech Mahindra fell over 9% for the week, TCS fell over 8% for the week

Nifty Midcap 150 fell over 4% for the week, Coforge and Mphasis fell the most in Nifty Midcap 150

Nifty SMallcap 250 fell over 4% for the week, Caplin Point and Avanti Feeds fell the most.

Caplin Point, Avanti Feeds, Redington, Sumitomo Chemical and Balrampur Chini Mills fell over 10% for the week

Nifty IT fell over 7% for the week; Coforge and Mphasis fell the most

Nifty Realty, Pharma and IT fell over 5% for the week.

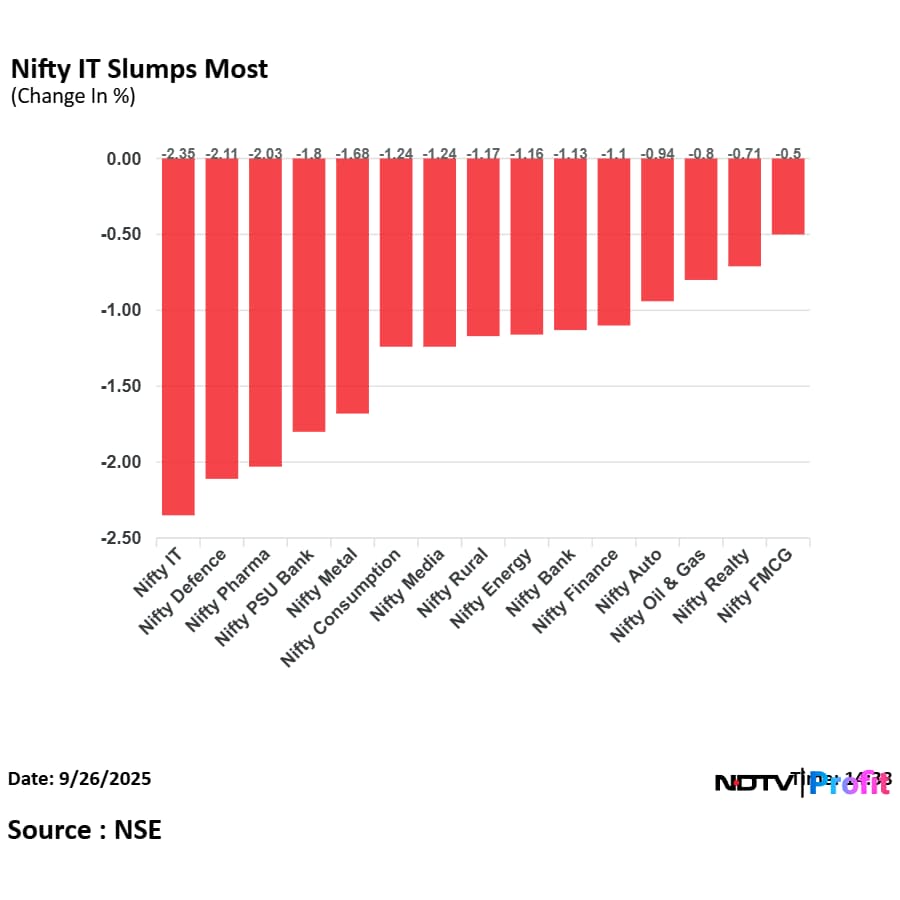

All sectoral Indices fell over 1% for the week

Nifty PSU Banks snaps 3-week gaining streak

Nifty Oil and Gas and Pharma fell for the 5th week in a row.

Benchmarks snaps 3-week gaining streak.

Benchmarks underperforms Broader Market Indices for the week

Tech Mahindra and TCS fell the most in Nifty

Tech Mahindra fell over 9% for the week, TCS fell over 8% for the week

Nifty Midcap 150 fell over 4% for the week, Coforge and Mphasis fell the most in Nifty Midcap 150

Nifty SMallcap 250 fell over 4% for the week, Caplin Point and Avanti Feeds fell the most.

Caplin Point, Avanti Feeds, Redington, Sumitomo Chemical and Balrampur Chini Mills fell over 10% for the week

Nifty IT fell over 7% for the week; Coforge and Mphasis fell the most

Nifty Realty, Pharma and IT fell over 5% for the week.

All sectoral Indices fell over 1% for the week

Nifty PSU Banks snaps 3-week gaining streak

Nifty Oil and Gas and Pharma fell for the 5th week in a row.

Rupee closed 5 paise weaker at 88.72 against the greenback

It closed at 88.67 a dollar on Thursday

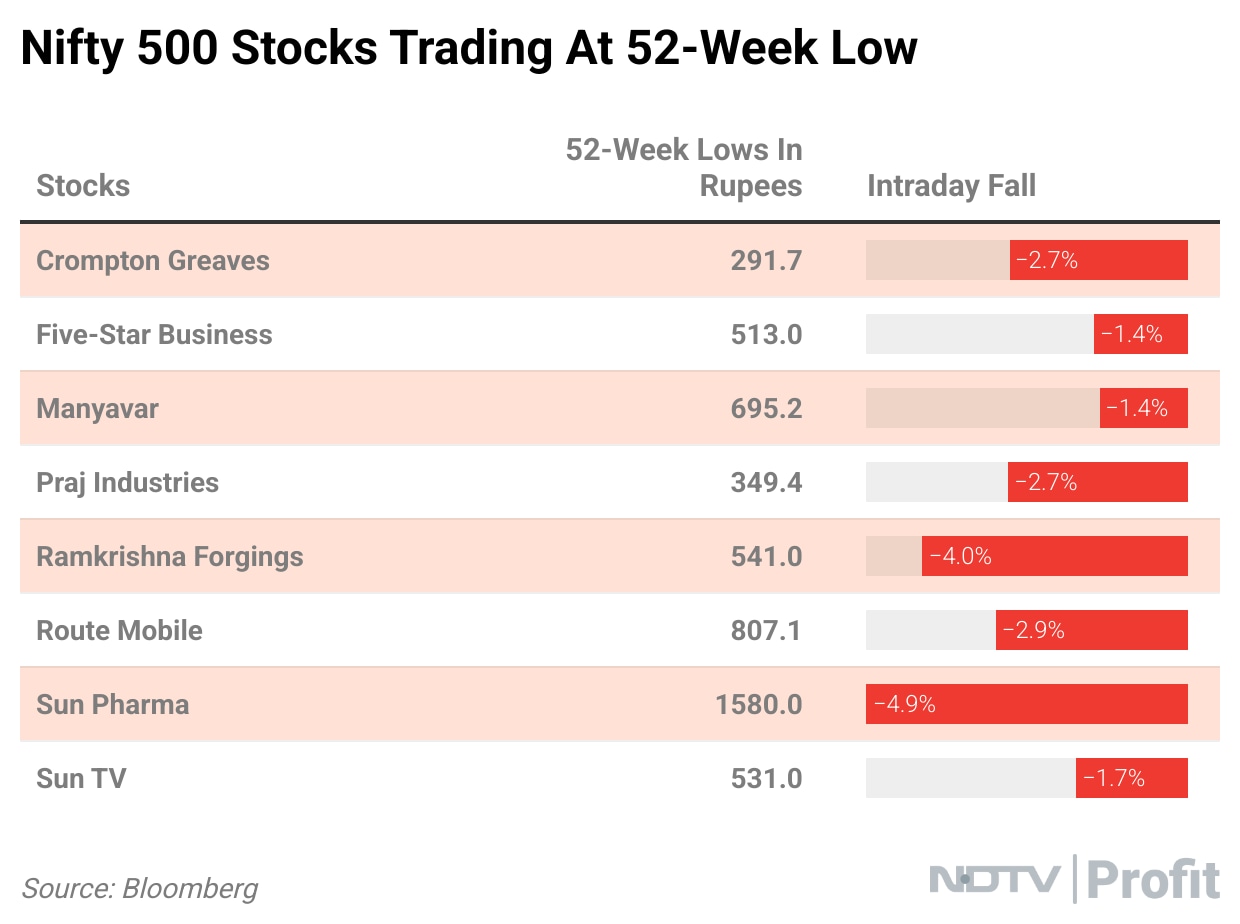

Source: Bloomberg

The Nifty IT index has entered a bear market, dropping more than 20% from the peak it touched on Dec. 13, 2024. Yet despite the selloff, most of the companies in the basket continue to command valuations above the sector’s own multiple.

Names such as Infosys, HCL Technologies and Wipro have logged declines between 20% and 25%.

Welspun Corp received additional orders cumulatively valued at Rs 1,600 crore for India line pipe facility. Current consolidated global order book stands at Rs 18,000 crore.

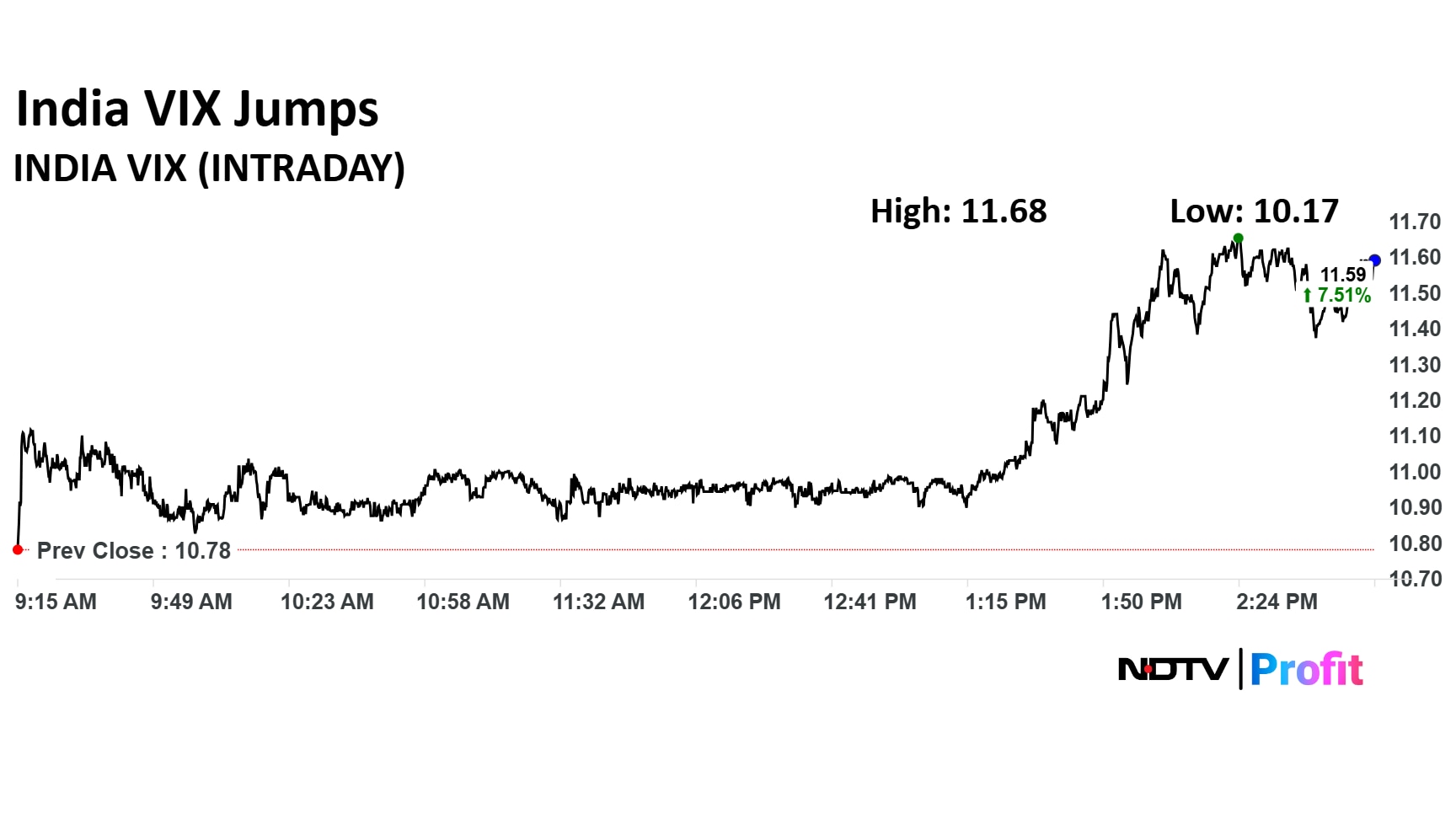

The NSE India Volatility Index jumped 8.30% to 11.68. It was trading 7.79% higher at 11.62 as of 3:00 p.m.

The NSE India Volatility Index jumped 8.30% to 11.68. It was trading 7.79% higher at 11.62 as of 3:00 p.m.

Cupid will commission Palava Plant in Maharashtra to be commissioned in second hald, boosting diagnostics and FMCG manufacturing. New UAE arm to spearhead acquisitions and strengthen MENA presence, the company said in the exchange filing.

Jindal Steel Ltd. commissions 5 million ton per annum blast furnace at Angul, hot metal capacity rises to 9 MTPA from 4 MTPA.

On National Stock Exchange, all 15 sectoral indices ended lower with the NSE Nifty declining the most.

On National Stock Exchange, all 15 sectoral indices ended lower with the NSE Nifty declining the most.

Ircon International received order worth Rs 224 crore from North East Frontier Railways, the company said in the exchange filing.

The NSE Nifty 50 and BSE Sensex extended losses to trade near day's low. The indices were trading 0.93% and 0.98% down, respectively as of 2:15 p.m.

The NSE Nifty 50 and BSE Sensex extended losses to trade near day's low. The indices were trading 0.93% and 0.98% down, respectively as of 2:15 p.m.

The pan-European stock gauge Euro Stoxx rebounded from a two-day slump as market participants digest the latest tariff announcement from the US. President Donald Trump said that the country will impose 100% tariff on branded patented drug imports. He also announced tariffs on furniture, home and kitchen appliances imports.

The index was trading 0.56% higher as of 2:06 p.m.

The Nifty September Future was trading 0.98% at 24,724.2, with a premium of 32 points.

The Nifty Sept 30 Expiry: Most Call Open Interests were concentrated on 25,000 strike. The next strike with most Call OIs is 24,800. Most Put OIs were at 24,700.

South Korea's KOSPI declined for third consecutive session on tariff concerns. The index appearing to be on a consolidation mode after record-rally early September.

The KOSPI ended 2.45% at 3,386.05.

Japan's Nikkei 225 ended 0.87% down at 45,354.99. The Hang Seng and CSI 300 ended 1.36% and 0.95%, down respectively.

Waaree Energies Ltd. on Friday said it will continue to cooperate in ongoing investigations in the US after a report said authorities are probing whether the company evaded anti-dumping and countervailing duties on solar cells from China and other Southeast Asian nations.

"Waaree has in the past cooperated with the US investigations and will continue to cooperate in ongoing investigations. We are a responsible corporate citizen in every country we operate in and we abide by all applicable local laws and regulations," the company said in a statement.

The rupee was trading near day's low against US dollar at 88.71. The unit fell to the day's low of 88.73 a dollar.

It closed at 88.67 a dollar on Thursday.

Tata Power Renewable is in pact with Bank of Baroda for clean energy adoption amonf MSMEs and commercial customers. Bank of Baroda to financia borrowers buying solar equipments having up to 10 gigawat capacity via TPREL.

Jinkushal Industries IPO subscription at 3.6 times on day two

Retail investors led with 5.3 times on second day

NIIs subscribed 4.5 times, QIBs subscription at 3%

The Nifty Bank September future fell 0.89% with a premium of 125.15 points.

The Nifty Bank Sept 30 Expiry: Most Call Open Interests concentrated on 55,000, while most Put OIs concentrated on 54,000

Eternal Ltd.'s traded volume was at 5.22 times 30-day average volume on NSE as of 12:40 p.m.

Tata Steel Ltd.'s total traded volume was at 2.09 times 30-day average volume on NSE.

HDFC Bank's total traded volume was at 2.06 times 30-day average volume on NSE.

Lloyds Metals and Energy Ltd. incorporated Lloyds Global Resources as wholly-owned subsidiary, the company said in the exchange filing.

Shoppers Stop completed investment in third tranche issue of up to Rs 10 crore in Global SS Beauty. Overall investment in preference share capital of GSSBL at Rs 95 crore.

Granules India Ltd.'s trading volume was 3.38 times 30-day avergae volume as of 11:47 a.m. on NSE

Biocon Ltd.'s trading volume was 1.42 times 30-day average volume as of 11:47 a.m. on NSE

Aurobindo Pharma's trading volume was 1 times 30-day average volume as of 11:47 a.m. on NSE

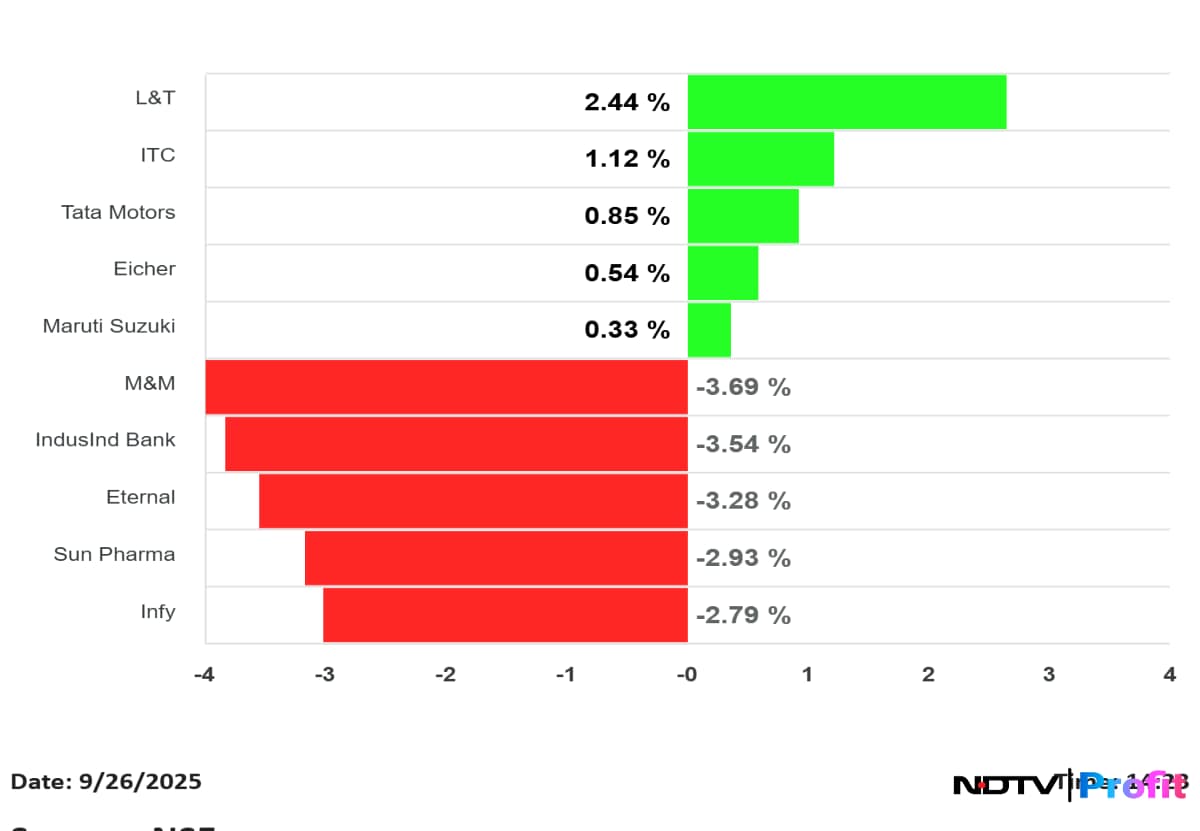

ICICI Bank Ltd., Infosys Ltd., HDFC Bank Ltd., and Mahindra & Mahindra were top detractors in the NSE Nifty 50 index.

Larsen & Toubro Ltd., Reliance Industries Ltd., and Tata Motors were top contributors to the Nifty 50 index.

ICICI Bank Ltd., Infosys Ltd., HDFC Bank Ltd., and Mahindra & Mahindra were top detractors in the NSE Nifty 50 index.

Larsen & Toubro Ltd., Reliance Industries Ltd., and Tata Motors were top contributors to the Nifty 50 index.

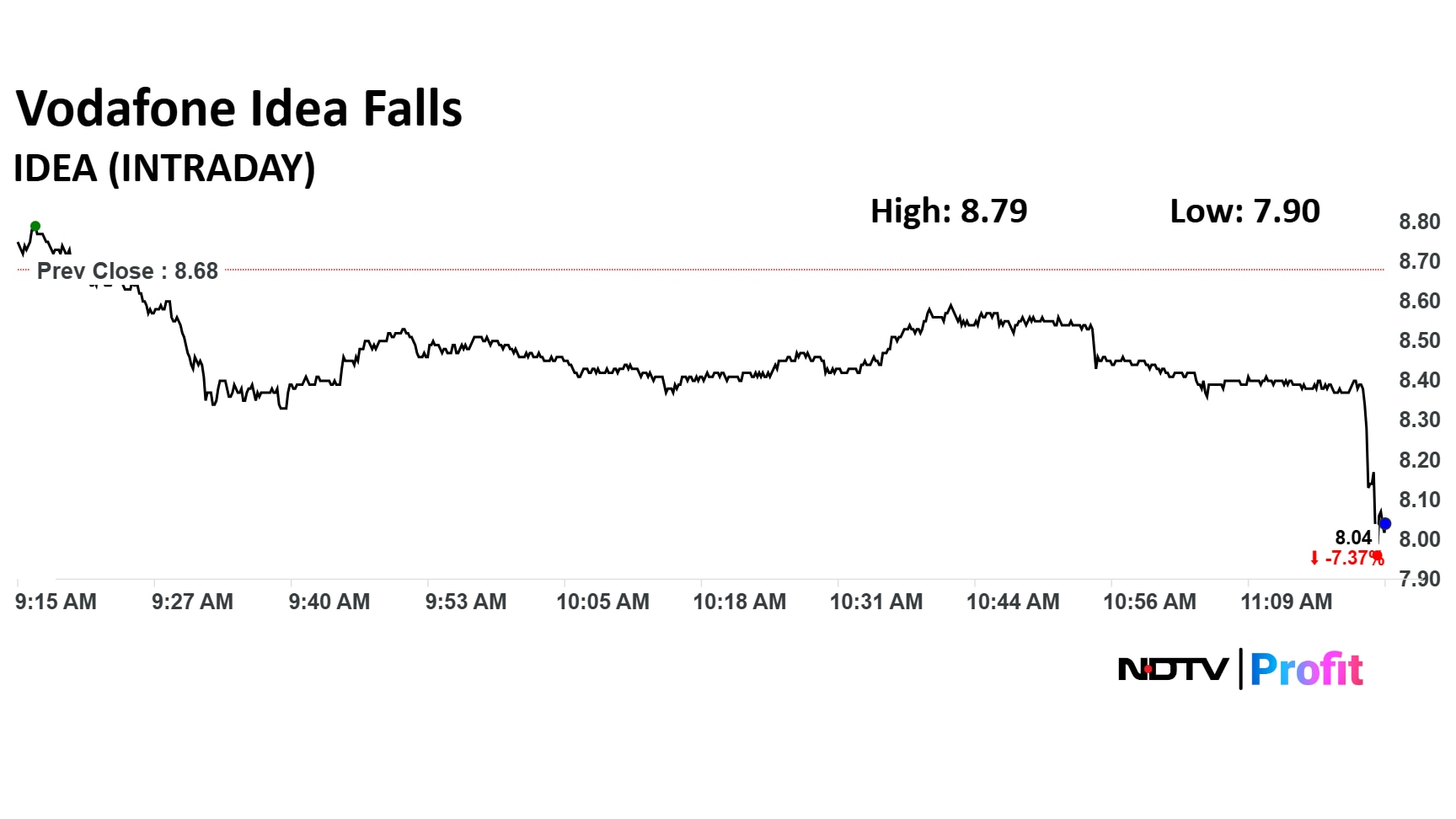

Vodafone Idea share price started to extend losses after the Supreme Court defferred the hearing to Oct 6. The stock was trading 7.37% down at Rs 8.04 apiece as of 11:24 a.m.

Vodafone Idea share price started to extend losses after the Supreme Court defferred the hearing to Oct 6. The stock was trading 7.37% down at Rs 8.04 apiece as of 11:24 a.m.

Tata Consultancy Services Ltd. share price declined 1.30% to Rs 2,919 apiece. The stock has slumped 35% from its 52-week high.

India's benchmark 10-year bond yield retreated from the day's high. The yiled was trading 6.506% compared to intraday high of 6.511%t.

Demand was firm at the weekly auction of Rs 32,000-crore gilt auction, as Informist reported.

Traders await the Oct-March borrowing calendar, scheduled for release post market hours.

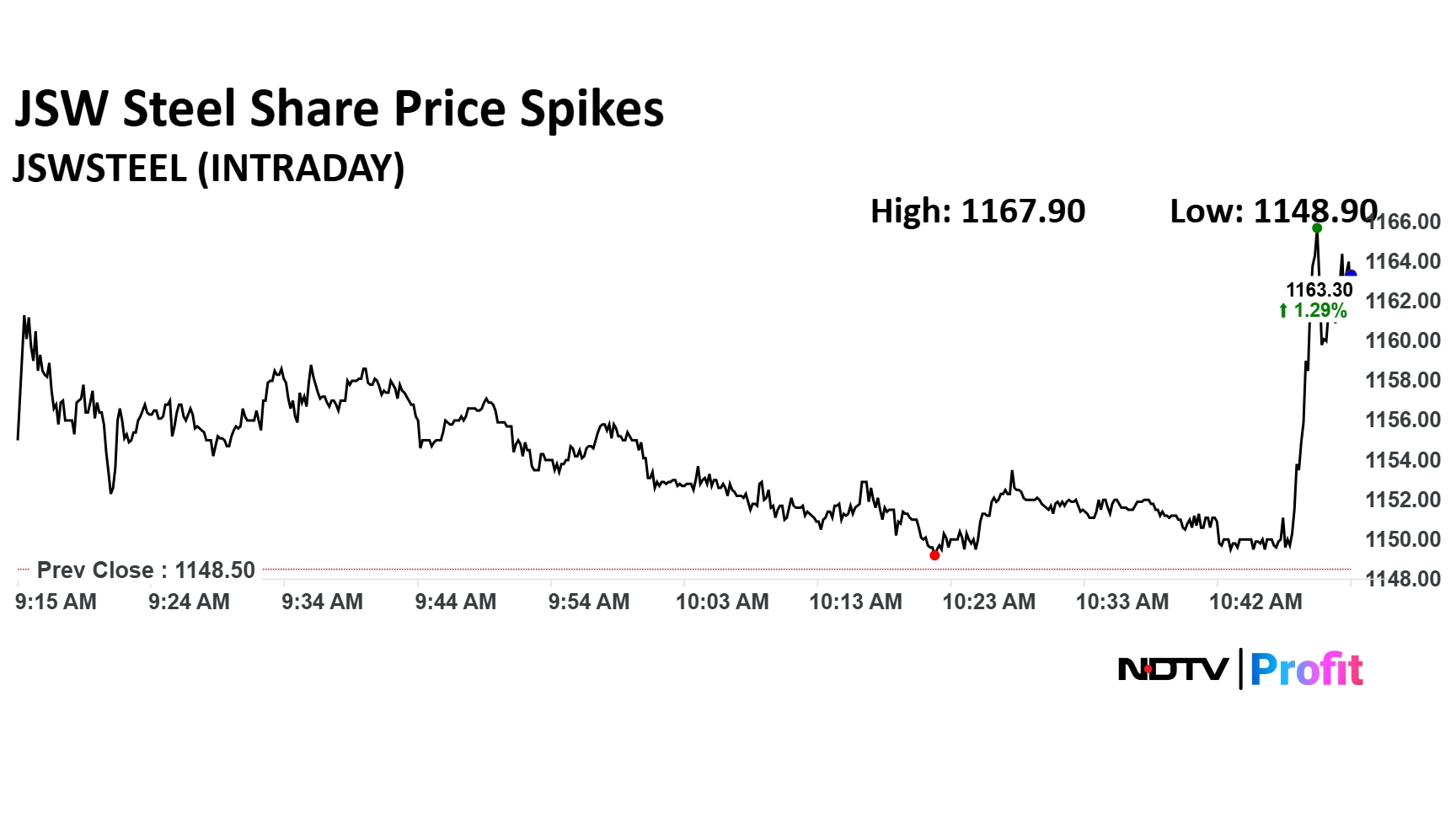

JSW Steel share price recovered sharply after the Supreme Court discarded the previous order which cancelled the acquisition of Bhushan Power & Steel's.

JSW Steel share price recovered sharply after the Supreme Court discarded the previous order which cancelled the acquisition of Bhushan Power & Steel's.

The Nifty September Future declined 0.48% with a premium of 48 points as of 10:49 a.m.

The Nifty Sept 30 Expiry: Most Call Open Interest concentrated on 25,000 strike, while most Put OIs concentrated on 24,800.

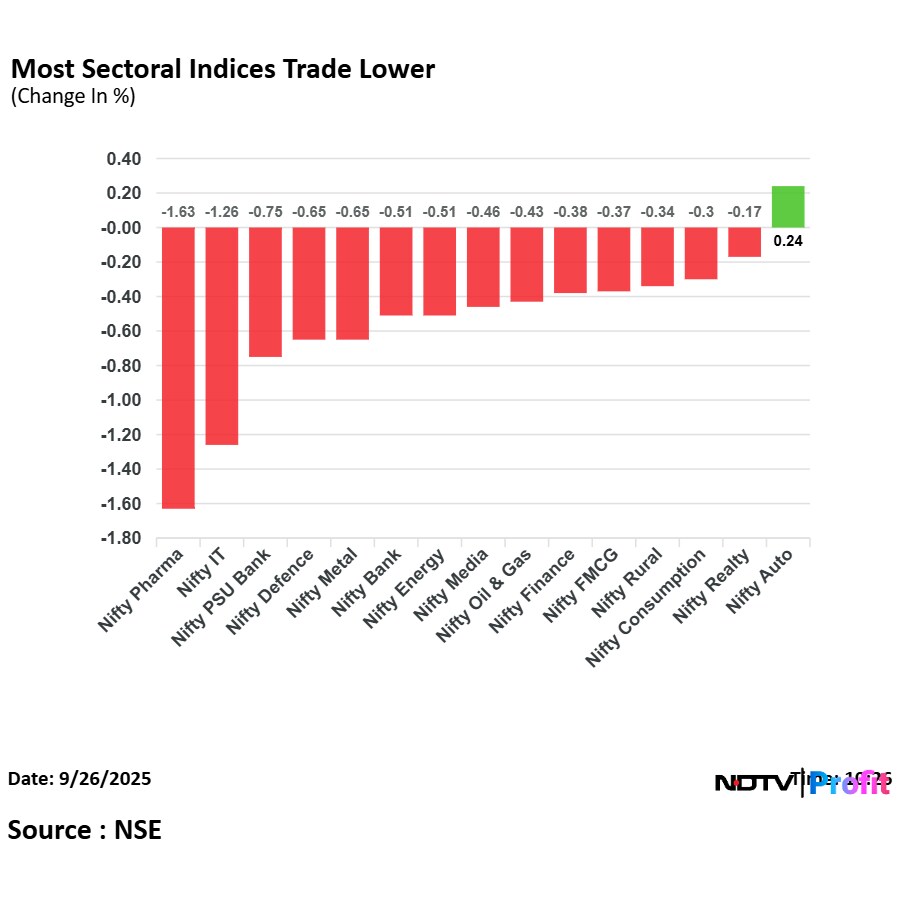

On National Stock Exchange, 14 sectoral indices out of 15 were trading in losses.

On National Stock Exchange, 14 sectoral indices out of 15 were trading in losses.

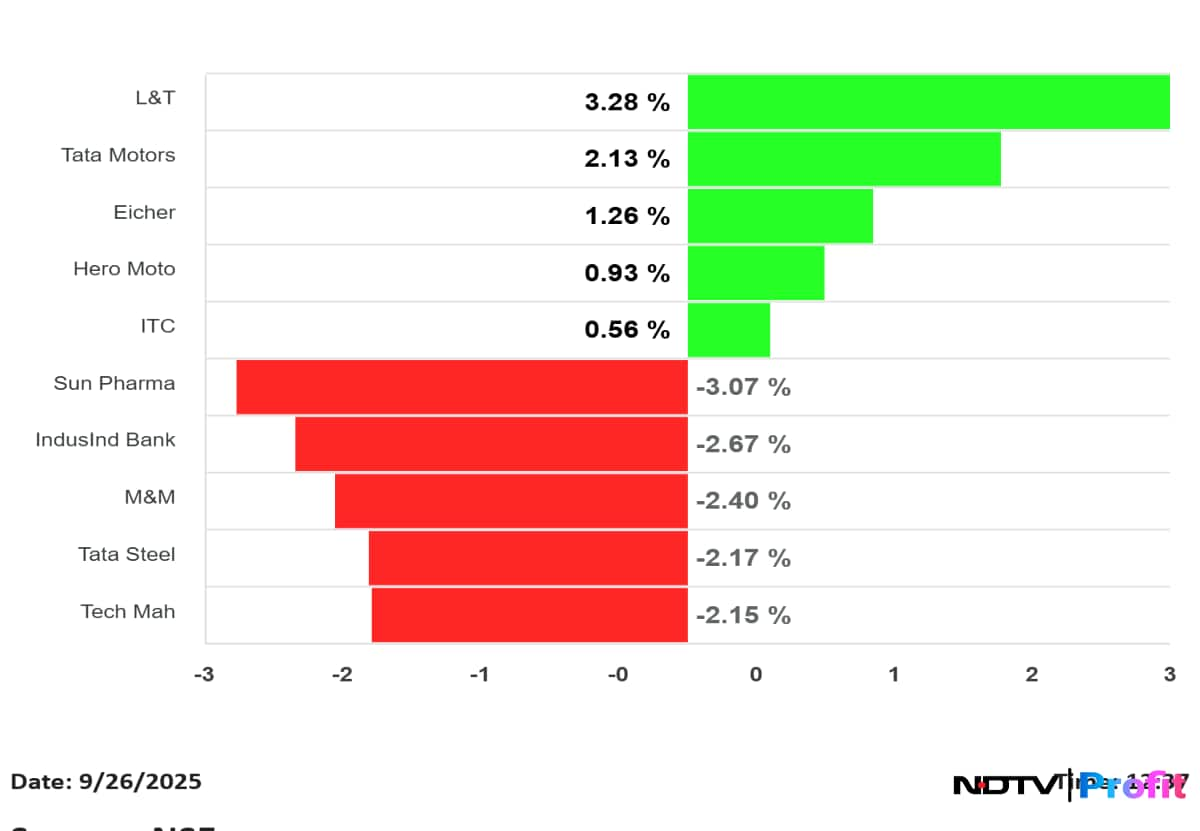

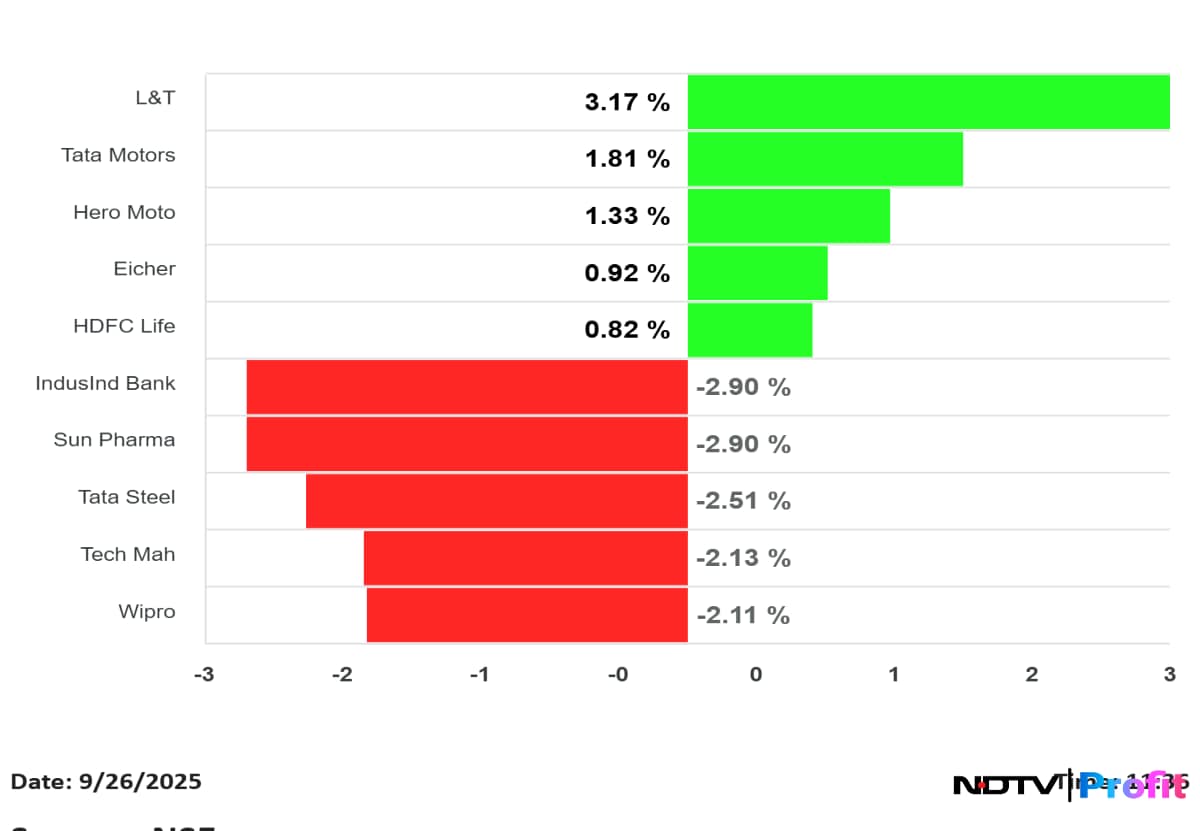

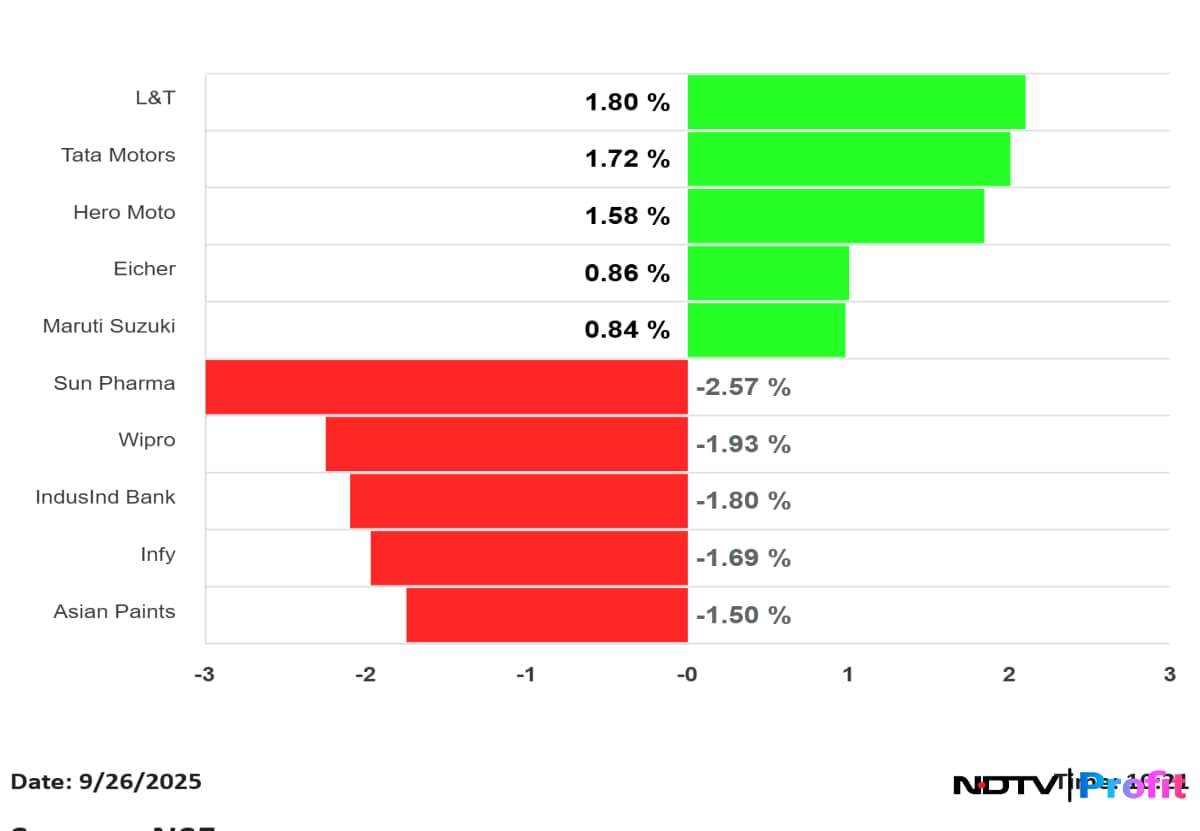

Sun Pharmaceutical Industries Ltd., Wipro India Ltd., IndusInd Bank Ltd., Infosys Ltd., and Asian Paints Ltd. weighed on the Nifty 50 index.

Larsen & Toubro Ltd., Tata Motors Ltd., Hero MotoCorp Ltd., Eicher Motors Ltd., Maruti Suzuki India Ltd. added to the Nifty 50 index.

Sun Pharmaceutical Industries Ltd., Wipro India Ltd., IndusInd Bank Ltd., Infosys Ltd., and Asian Paints Ltd. weighed on the Nifty 50 index.

Larsen & Toubro Ltd., Tata Motors Ltd., Hero MotoCorp Ltd., Eicher Motors Ltd., Maruti Suzuki India Ltd. added to the Nifty 50 index.

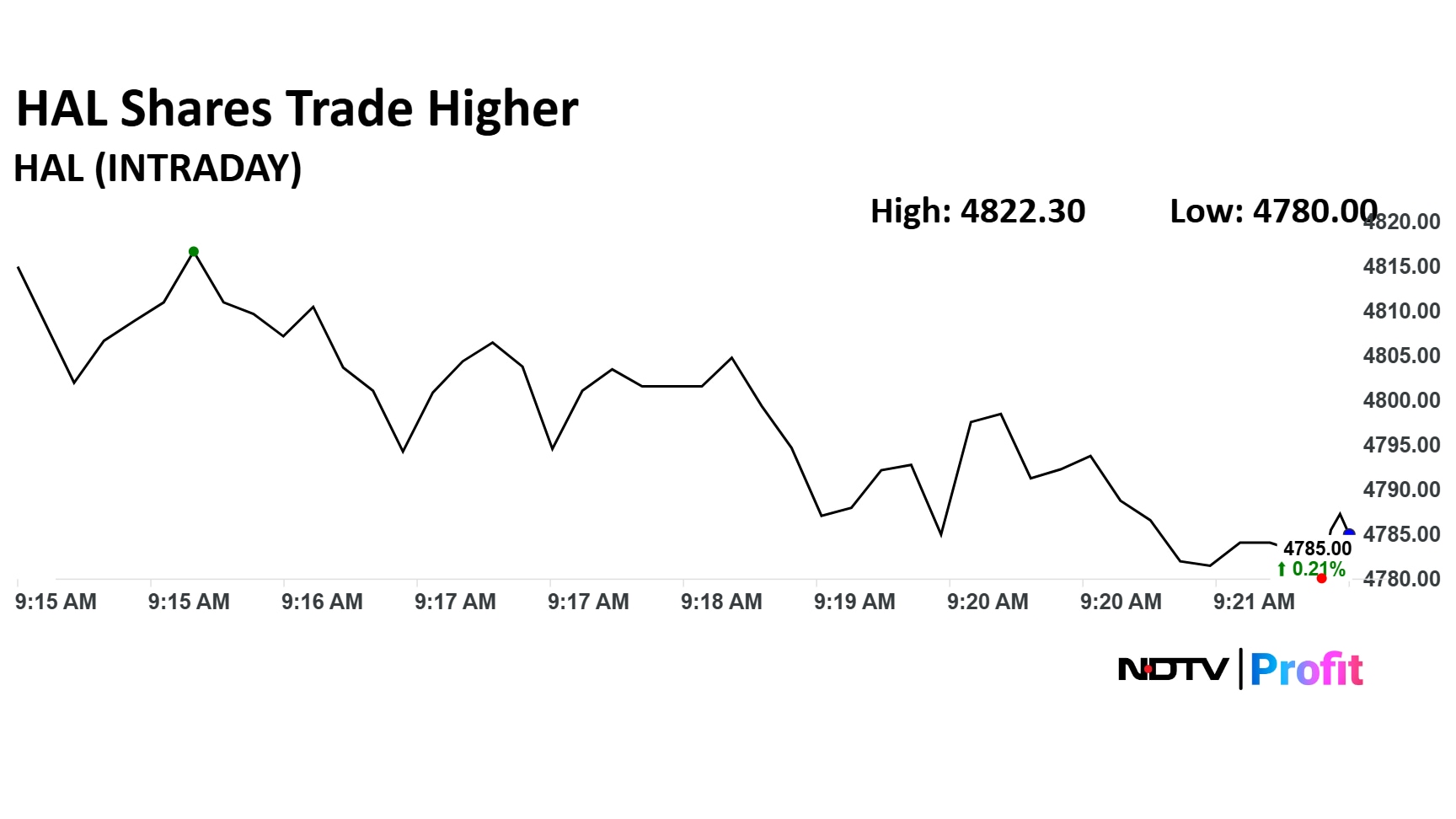

The share price of Hindustan Aeronautics Ltd., rose nearly 1% during early trade after the Ministry of Defence on Thursday signed a Rs 62,370-crore contract with the company. This deal is for the procurement of 97 LCA Mk1A aircraft for the Indian Air Force.

The deal includes 68 fighters and 29 twin seaters, along with associated equipment, for the Air Force, the Ministry of Defence said on Thursday. The delivery of these aircraft would commence during fiscal 2027-28 and be completed over a period of six years.

The share price of Hindustan Aeronautics Ltd., rose nearly 1% during early trade after the Ministry of Defence on Thursday signed a Rs 62,370-crore contract with the company. This deal is for the procurement of 97 LCA Mk1A aircraft for the Indian Air Force.

The deal includes 68 fighters and 29 twin seaters, along with associated equipment, for the Air Force, the Ministry of Defence said on Thursday. The delivery of these aircraft would commence during fiscal 2027-28 and be completed over a period of six years.

Railtel Corp Ltd. received letter of award worth Rs 970 crore from Bihar Education Project Council for labs in the government schools, the company said in the exchange filing.

SpiceJet Ltd. has finalised a lease agreement to induct a wide-body Airbus A340 aircraft. The aircraft will arrive in India by the end of the month and is expected to enter operations in the first week of October.

Shares of GK Energy Ltd. listed at a premium of 12% over IPO price on Friday. The scrip opened at Rs 171 on the NSE and Rs 165 on the BSE, compared to the issue price of Rs 153 per share.

The latest grey market premium for the GK Energy IPO was Rs 18 per share, indicating a listing price of Rs 171 apiece and a premium of 12%, as per Investorgain.

Shares of Rites Ltd. have surged over 6% on Friday's trade, reaching an intraday high of Rs 270. This comes on the back of the company's key international order win in South Africa.

Rites is currently trading at Rs 266, which amounts to gains of more than 5.5%. This surge would go a long way in aiding the stock's momentum, especially after a correction of more than 24% in the last year.

Shares of Rites Ltd. have surged over 6% on Friday's trade, reaching an intraday high of Rs 270. This comes on the back of the company's key international order win in South Africa.

Rites is currently trading at Rs 266, which amounts to gains of more than 5.5%. This surge would go a long way in aiding the stock's momentum, especially after a correction of more than 24% in the last year.

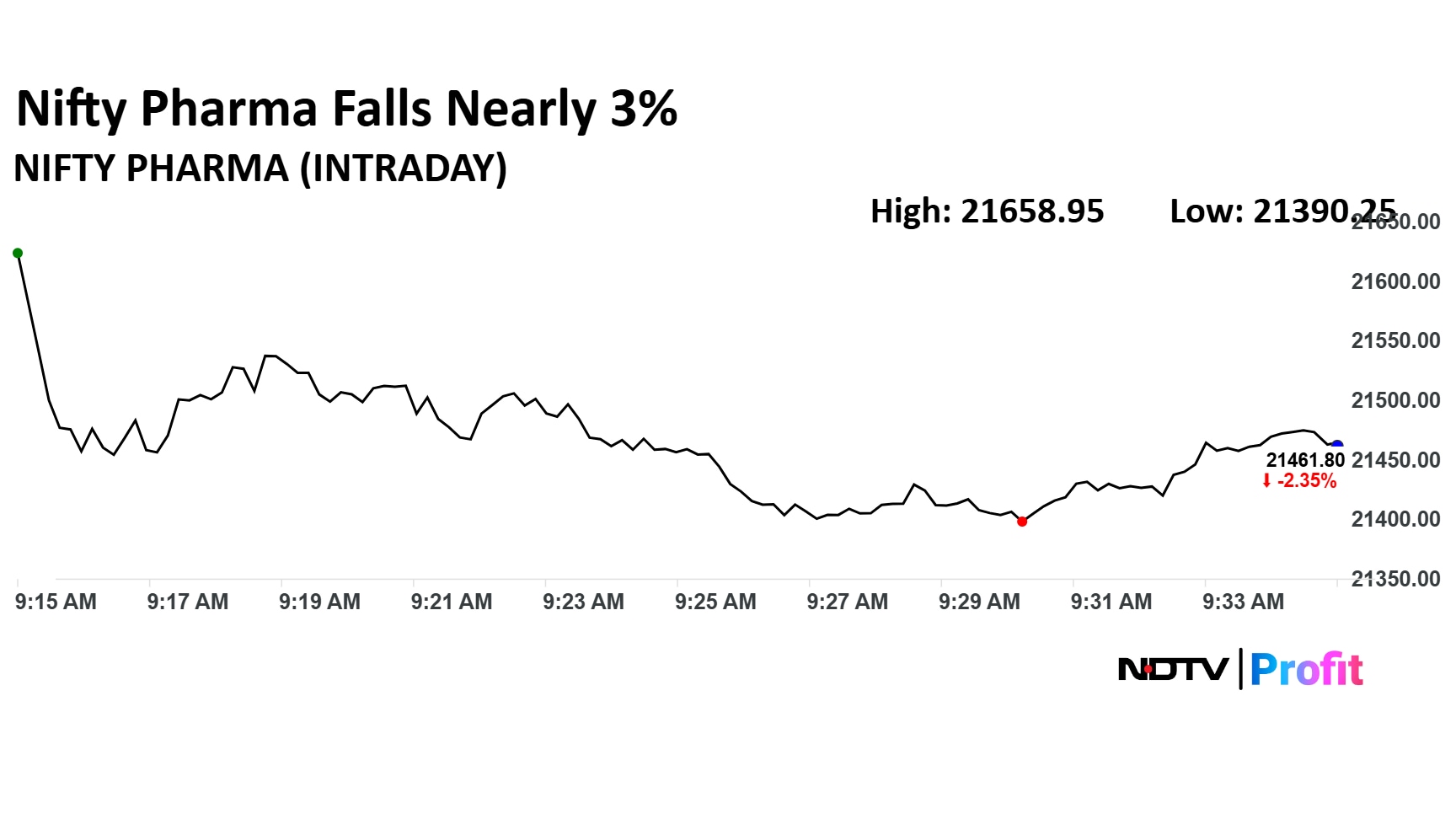

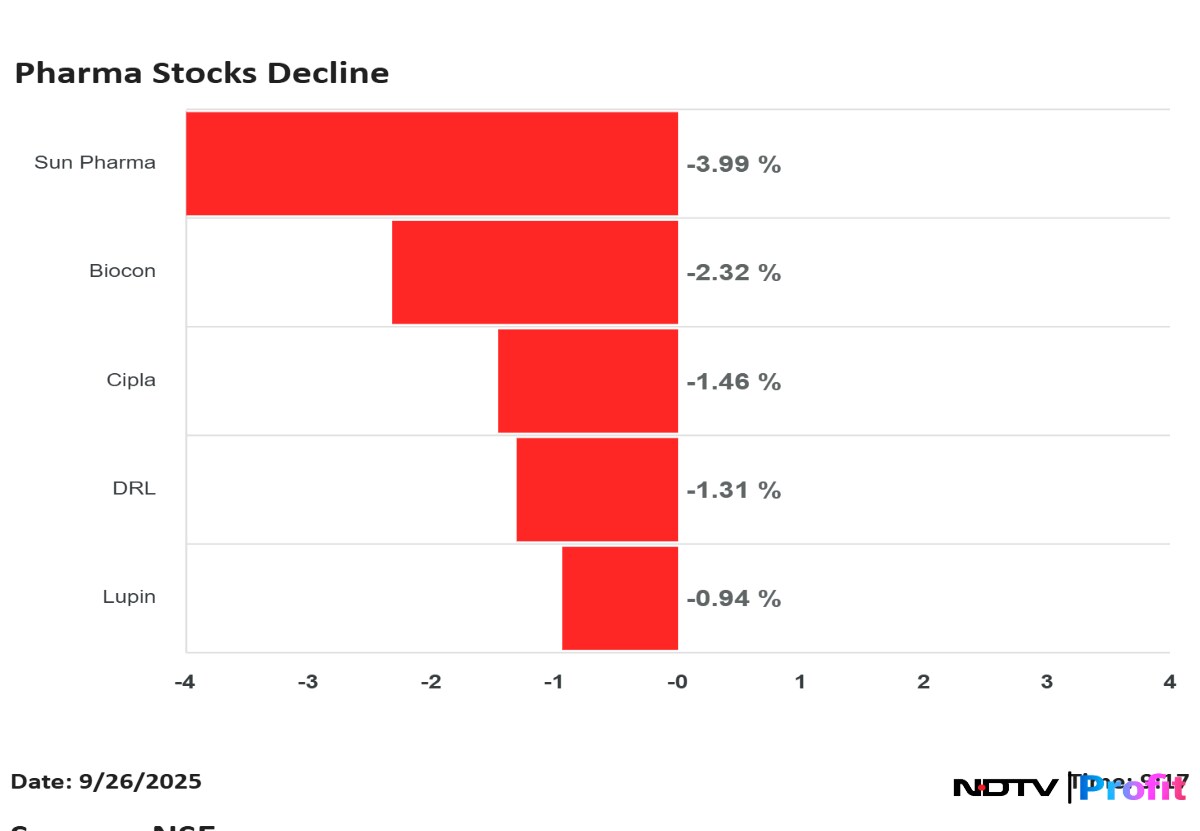

The NSE Nifty Pharma index slumped 2.67% in Friday's session as Sun Pharmaceutical Industries Ltd. and Divi's Laboratories Ltd. share prices weighed.

Market-cap of pharma stocks declined Rs 44,600 crore to Rs 16.57 lakh crore as of 9:38 a.m.

The NSE Nifty Pharma index slumped 2.67% in Friday's session as Sun Pharmaceutical Industries Ltd. and Divi's Laboratories Ltd. share prices weighed.

Market-cap of pharma stocks declined Rs 44,600 crore to Rs 16.57 lakh crore as of 9:38 a.m.

Sun Pharmaceutical Industries Ltd. declined nearly 5% on Friday as Trump announced 100% tariff on the Pharmaceutical sector unless the company has manufacturing capacity in the United States.

Other Pharmaceutical stocks seeing decline are Cipla Ltd., Dr Reddys Laboratories Ltd., Lupin Ltd. and Biocon Ltd., however the impact on these companuies is largely contained since the US tariffs mainly targe branded and patented drugs, where multinational companies like Pfizer Inc. and Novo Nordisk Inc. dominate.

Sun Pharmaceutical Industries Ltd. declined nearly 5% on Friday as Trump announced 100% tariff on the Pharmaceutical sector unless the company has manufacturing capacity in the United States.

Other Pharmaceutical stocks seeing decline are Cipla Ltd., Dr Reddys Laboratories Ltd., Lupin Ltd. and Biocon Ltd., however the impact on these companuies is largely contained since the US tariffs mainly targe branded and patented drugs, where multinational companies like Pfizer Inc. and Novo Nordisk Inc. dominate.

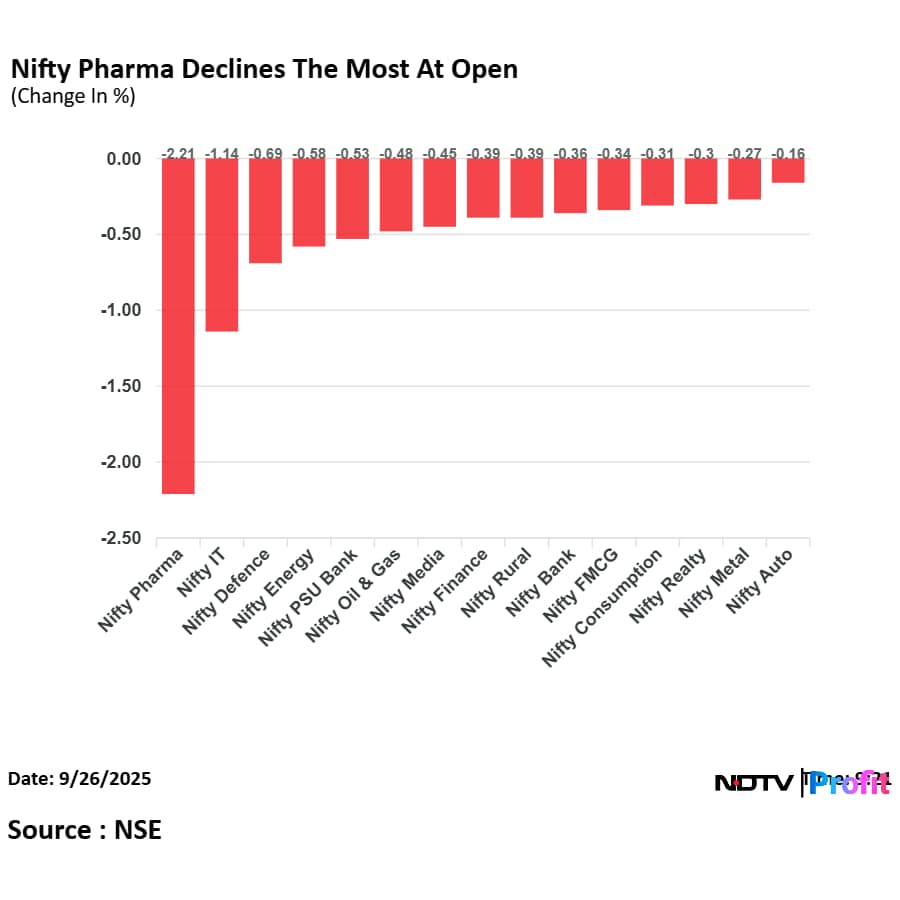

On National Stock Exchange, all 15 sectoral indices declined the most with the NSE Nifty Pharma falling the most.

On National Stock Exchange, all 15 sectoral indices declined the most with the NSE Nifty Pharma falling the most.

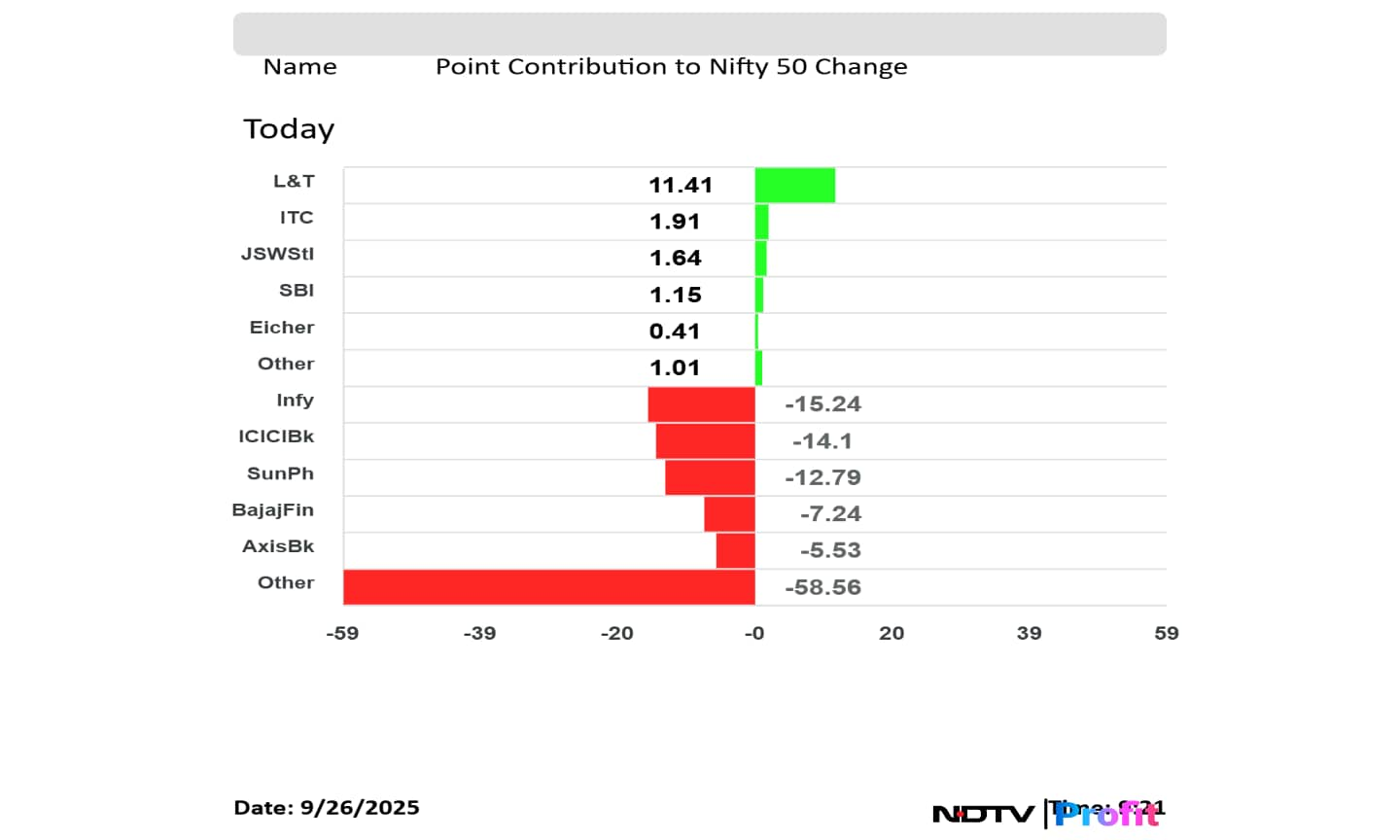

Infosys Ltd., ICICI Bank Ltd., Sun Pharmaceutical Industries Ltd., Bajaj Finance Ltd., and Axis Bank Ltd. weighed on the Nifty 50 index.

Larsen & Toubro Ltd., ITC Ltd., JSW Steel Ltd., State Bank of India, Eicher Motors Ltd. added to the Nifty 50 index.

Infosys Ltd., ICICI Bank Ltd., Sun Pharmaceutical Industries Ltd., Bajaj Finance Ltd., and Axis Bank Ltd. weighed on the Nifty 50 index.

Larsen & Toubro Ltd., ITC Ltd., JSW Steel Ltd., State Bank of India, Eicher Motors Ltd. added to the Nifty 50 index.

The Nifty 50 and Sensex declined sharply as US President Donald Trump announced a slew of sectoral tariffs for pharma sector and furniture imports. The indices were trading 0.31% and 0.21% down, respectively as of 9:26 a.m.

Global equities halted their record-rally which also weighed on the domestic markets.

The Nifty 50 and Sensex declined sharply as US President Donald Trump announced a slew of sectoral tariffs for pharma sector and furniture imports. The indices were trading 0.31% and 0.21% down, respectively as of 9:26 a.m.

Global equities halted their record-rally which also weighed on the domestic markets.

Waaree Energies Ltd. share price fell nearly 4% during early trade on Friday after a report said the US is investigating whether India’s largest solar panel maker evaded anti-dumping and countervailing duties on solar cells from China and other Southeast Asian nations.

US Customs and Border Protection has started a formal investigation of Waaree and Waaree Solar Americas Inc. and imposed interim measures, Bloomberg News reported. The authorities suspect Waaree evaded duties when bringing merchandise into the US.

The yield on the 10-year bond opened flat at 6.51%

Source: Bloomberg

Rupee opened 2 paise weaker at 88.69 against the greenback

It closed at 88.67 a dollar on Thursday

Source: Bloomberg

L&T Technology Services expanded pact with Siemens to advance machine and line smulation technology. The company will utilise digital technology portfolio of Siemens to deliver simulation-driven automation for sectors, the company said in the exchange filing.

Sowlio Investment Fund Manager And Co-Founder not much negative on Indian IT companies. Accenture's numbers tells a fact that it is an ex-growth sector. There will be a similar commentary from Indian IT companies.

Large-cap Indian IT companies are replacing some of the FMCG companies. Traders are buying these companies because they are delivering similar growth, margins at half the multiples, he said.

As the Indian market gears up for another earnings season, HSBC believes the time is right for foreign investors to return after an extended period of weakness and macro turmoil that has stifled growth.

In its latest India Strategy report, HSBC analyst Prerna Garg pointed out that a combination of low valuation, a slow recovery in earnings and a low foreign fund positioning makes it an ideal staging ground for foreign investors to return to India.

The initial public offering (IPO) of Solarworld Energy Solutions, which opened on Tuesday, September 23, concluded its subscription process on September 25.

The IPO was booked 65.01 times on Thursday. Overall, investors bid for 52,60,95,906 shares against the 80,93,092 shares on offer.

Sections of Jaguar Land Rover Automotive Plc's IT systems are back up and running, a company statement from the Tata Motors subsidiary announced on Thursday. The statement comes after the company was attacked by cybercriminals nearly a month ago.

"As part of the controlled, phased restart of our operations, today we have informed colleagues, suppliers and retail partners that sections of our digital estate are now up and running. The foundational work of our recovery programme is firmly underway," the company said.

"Indian government bonds are trading narrowly. Market participants are awaiting debt supply details. The borrowing calendar for the fiscal second half is expected soon. RBI’s monetary policy decision is due on October 1. Traders are also awaiting states' quarterly borrowing calendar. All eyes are on interest rate cues."Kunal Sodhani, Head, Treasury, Global Trading Centre, Shinhan Bank

"The Indian Rupee is set to open weaker at 88.78 amidst rise in dollar index and fall in Asian currencies with dollar strength ruling on all fronts. The rupee which remained in a range of 88.60 to 88.70 yesterday as RBI may have prevented it to fall is still vulnerable to reaching a level of 89.00."Anil Kumar Bhansali, Head, Treasury, Finrex Treasury Advisors

The GIFT Nifty was trading 0.11% or 29 points higher at 24,956, indicating a slight higher start from the NSE Nifty 50 index.

The Trump administration will impose a 100% import tariff starting Oct. 1 on branded or patented drugs unless a company has or is building a manufacturing plant in the US. This presents a fresh challenge to Indian pharmaceutical companies.

The US is the largest market for Indian drugmakers. India exported $3.7 billion worth of pharma products to the US in the first half of 2025.

"The index reflects a neutral-to-bearish bias, raising the risk of a retest at 24,600, and potentially 24,150 near the 200-DMA, if weakness persists. While DIIs managed to offset FII outflows in the cash segment, derivative positions remained skewed towards the bearish side, amplifying downside pressure."Hariprasad K, Research Analyst and Founder, Livelong Wealth

"Markets remain under pressure as global uncertainty, FII selling, and weakness in heavyweights continue to weigh on sentiment. The Nifty’s break below 24,900 signals a fragile near-term trend, with 24,800 now acting as the immediate support. Unless the index reclaims 25,200 decisively, volatility may persist with a downward bias"Gaurav Garg, Research Analyst, Lemonn Markets Desk

Pharma stocks like Dr. Reddy's Laboratories Ltd., Sun Pharmaceutical Industries Ltd., Lupin Ltd., Glenmark Pharmaceuticals Ltd. share prices may react to latest tariff concern.

US President Donald Trump has proposed to impose 100% tariff on branded and patented drug imported, unless the company has manufacturing facility in the country. The tariff will come in effect from Oct 1.

Accenture reported financial results for the fourth quarter and full fiscal year ended Aug. 31, 2025, with revenue rising 7% year-on-year to $17.6 billion, above the Wall Street estimates of $17.38 billion, driven by resilient demand from enterprise clients for its AI-driven consulting and services. Shares of the Dublin-based tech giant were up 3.7% in volatile premarket trading.

Markets in Japan, South Korea, Mainland China, Australia, and Hong Kong were trading in losses, as the record-rally halted on valuation and tariff concern.

US Federal Reserve officials gave mixed signals on rate cut outlook. Meanwhile, President Donald Trump proposed to impose 100% tariff on branded patented drug imports.

South Korea's KOSPI and Hong Kong's Hang Seng were trading 2.00% and 0.85% down, respectively as of 7:21 a.m.

Japan's Nikkei 225 and Mainland China's CSI 300 were trading 0.13% and 0.20% down, respectively as of 7:22 a.m.

The S&P 500 index declined for third consecutive session to post the longest losing streak in a month, Bloomberg reported. Valuation concern weighed on US stocks after tech-rally took a breather.

The S&P 500 and Dow Jones Industrial Average ended 0.50% and 0.38% down, respectively, on Thursday.

The GIFT Nifty was trading 0.15% or 38.50 points higher at 25,127 as of 6:30 a.m., which indicated a positive opening for the NSE Nifty 50.

Traders will keep an eye on Bharat Heavy Electricals Ltd., NTPC Ltd., Power Finance Corp Ltd., JSW Energy Ltd., and Avenue Supermarts Ltd. shares. Pharma stocks will also be in focus on Donald Trump's decision of 100% tariffs on pharma imports.

Informational technology stocks will also be in focus as they may react to Accenture's upbeat earnings.

The Nifty 50 and Sensex declined for a fifth session in a row Thursday. The indices ended 0.66% and 0.68% lower, respectively.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.