India Tops Global IPO Volumes With Maximum Listings In November: SEBI Bulletin—Five Key Highlights

22 companies were listed last month mobilising nearly Rs 33,507 crore. With 22 listings, India led globally in terms of IPO volumes in November.

India's capital markets regulator Securities and Exchange Board of India (SEBI) has released the monthly bulletin for India's financial landscape and the diverse trends that shaped various market sectors in November 2025.

According to SEBI, initial public offerings (IPO) and secondary market action, foreign capital swings, mutual fund and asset movement, along with policy developments in securities market were the noteworthy trends.

SEBI's Monthly Bulletin: Five Key Highlights

1. IPO Action

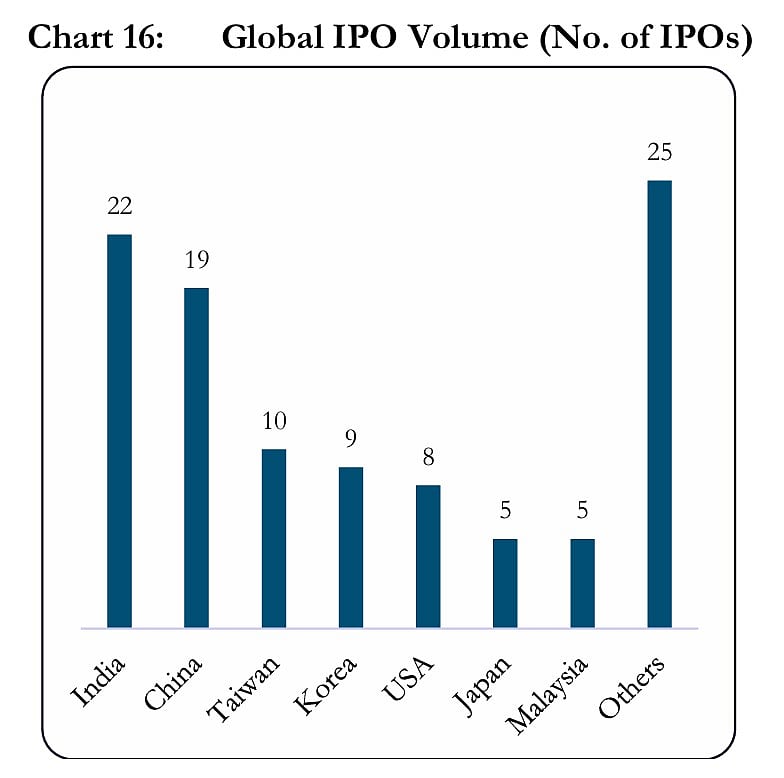

Following a record month of IPO fundraising in October, November remained robust despite a moderation of 18%. 22 companies were listed across NSE, BSE, mobilising Rs 33,507 crore, marking the second-highest monthly resource gathered in FY25. With 22 listings, India led globally in terms of the number of IPOs or IPO volumes.

Offer-for-sale emerged as the dominant component of mainboard listings last month. Of the 22 companies listed, 12 were on mainboard, collectively raising Rs 33,014 crore. Of this amount, 36% was mobilised through fresh issuances, while the remaining 64% was through OFS.

Chart: SEBI

Eight out of 12 mainboard issues were listed at premium, with average listing-day gain of 10%. In the SME segment, six out of 10 issues listed at premium, recording a peak listing-day gain of 90.5% and an average gain of 14%.

Financial services accounted for a third of the total amount raised via mainboard IPOs in FY26 (upto November), followed by consumer durables, consumer services and capital goods. The top four sectors raised Rs 96,068 crore, accounting for 69% of the total amount raised by mainboard IPOs.

2. Secondary Market

Indian equity markets continued to advance for the third consecutive month in November. The benchmark indices Nifty and Sensex posted 1.9% and 2.1% returns respectively. The rally was relatively narrow, with the broader midcaps edging higher while the small caps declined.

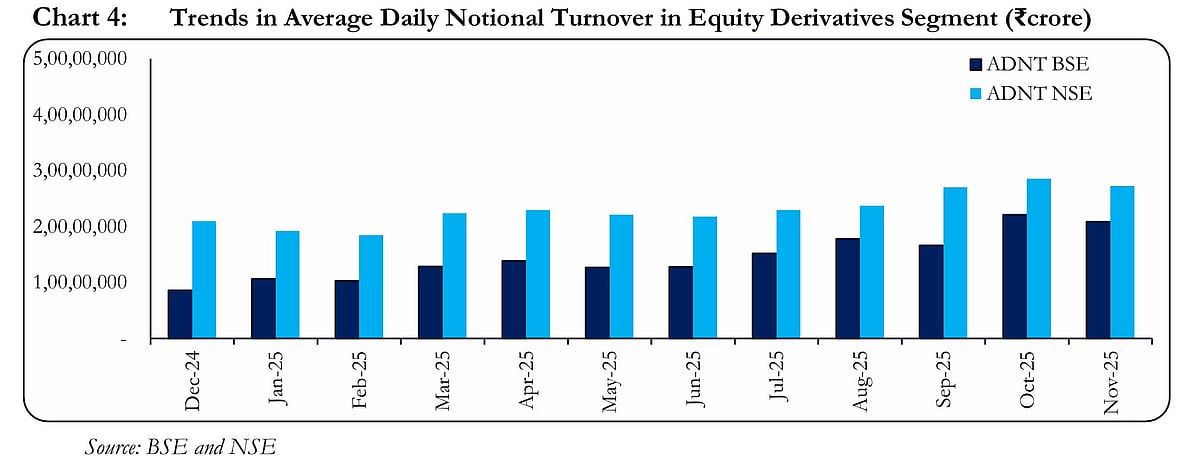

Nifty IT (at 4.7%) was the top performer, with IT heavyweights leading the gains amid stable export demand and deal wins. The market turnover in equity cash segment fell 4.2% at NSE and 2% at BSE.

Chart: SEBI

Combined average daily turnover at BSE, NSE for November was Rs 1.13 lakh crore, up 5.3% YoY. The equity derivatives market witnessed a downward momentum, with a 4% fall monthly, in the options premium average daily turnover across NSE and BSE.

MCX iCOMDEX Composite index rose 3.1%, contributing to 20.8% gain for the Apr-Oct 2025 period. Among its component indices, bullion and metal index posted positive returns of 3.6% and 4.8% respectively.

3. FPI Outflows

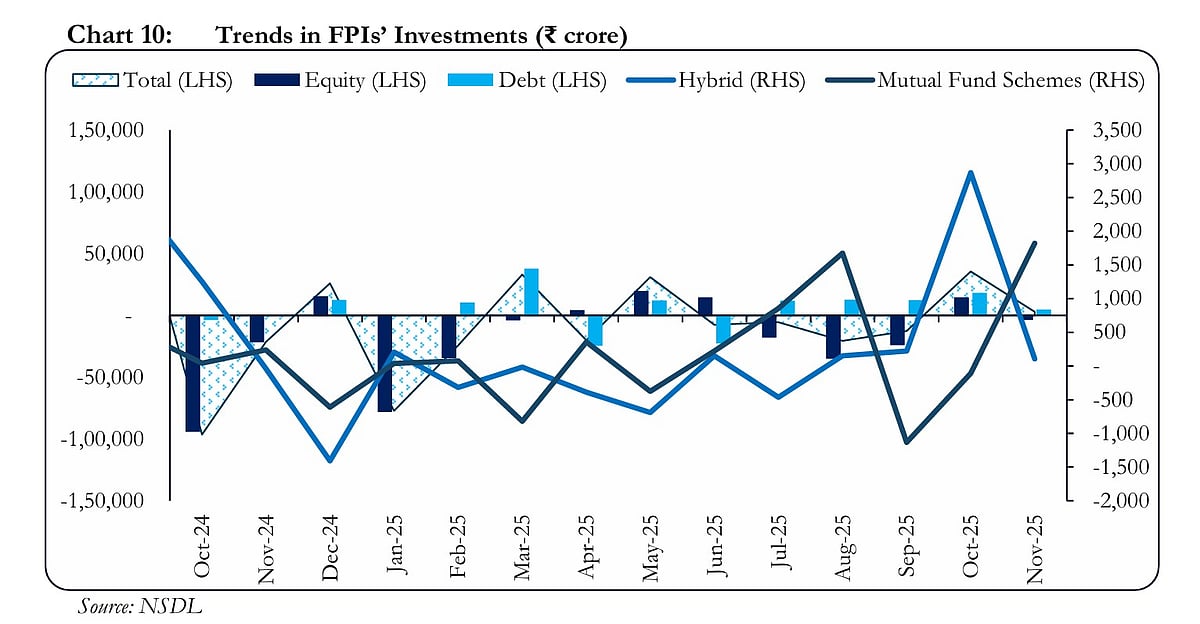

The net investment by FPIs across all segments stood at Rs 2,836 crore, compared to net inflows of Rs 35,598 crore registered in October. FPIs turned net sellers of Rs 3,765 crore in Indian equities last month, reversing the buying of Rs 14,610 crore, seen in October after three straight months of outflows.

On the other hand, the debt segment continued to attract continuous FPI inflows (Rs 4,674 crore) for the fifth consecutive month since July 2025 although this was lower than Rs 18,224 crore inflows witnessed in October 2025.

Chart: SEBI

4. Mutual Funds

Assets under management of mutual fund industry rose to Rs 80.8 lakh crore by November, an increase of 23% since end of March 2025. During FY26 (upto November), gross funds mobilized by MFs was Rs 99.82 lakh crore against the redemption of Rs 91.90 lakh crore, resulting in a net inflow of Rs 7.92 lakh crore.

The net inflows was highest for growth/equity oriented scheme (Rs 29,894 crore) last month, followed by other schemes (Rs 15,385 crore, which include index funds, ETFs, FoFs), hybrid schemes (Rs 13,299 crore), and solution oriented schemes (Rs 320 crore).

5. Policy development in securities market

Reclassification of Real Estate Investment Trusts (REITs) as equity related instruments for facilitating enhanced participation by mutual funds and Specialized Investment Funds (SIFs): With effect from January 1, 2026, any investment made by mutual funds and SIFs in REITs will be considered as investment in equity related instruments.

However, for the same purpose InvITs shall continue to be classified as hybrid instruments. Existing investment in REITs held by debt schemes of MFs and investment strategies of SIFs as on December 31, 2025, shall be grandfathered.

AMCs don’t require to immediately restructure their schemes and have to gradually divest based on market conditions, liquidity and interest of investors. Accordingly, AMFI shall include REITs in its list of market cap based scrip classification system after a period of six months i.e., July 1, 2026.