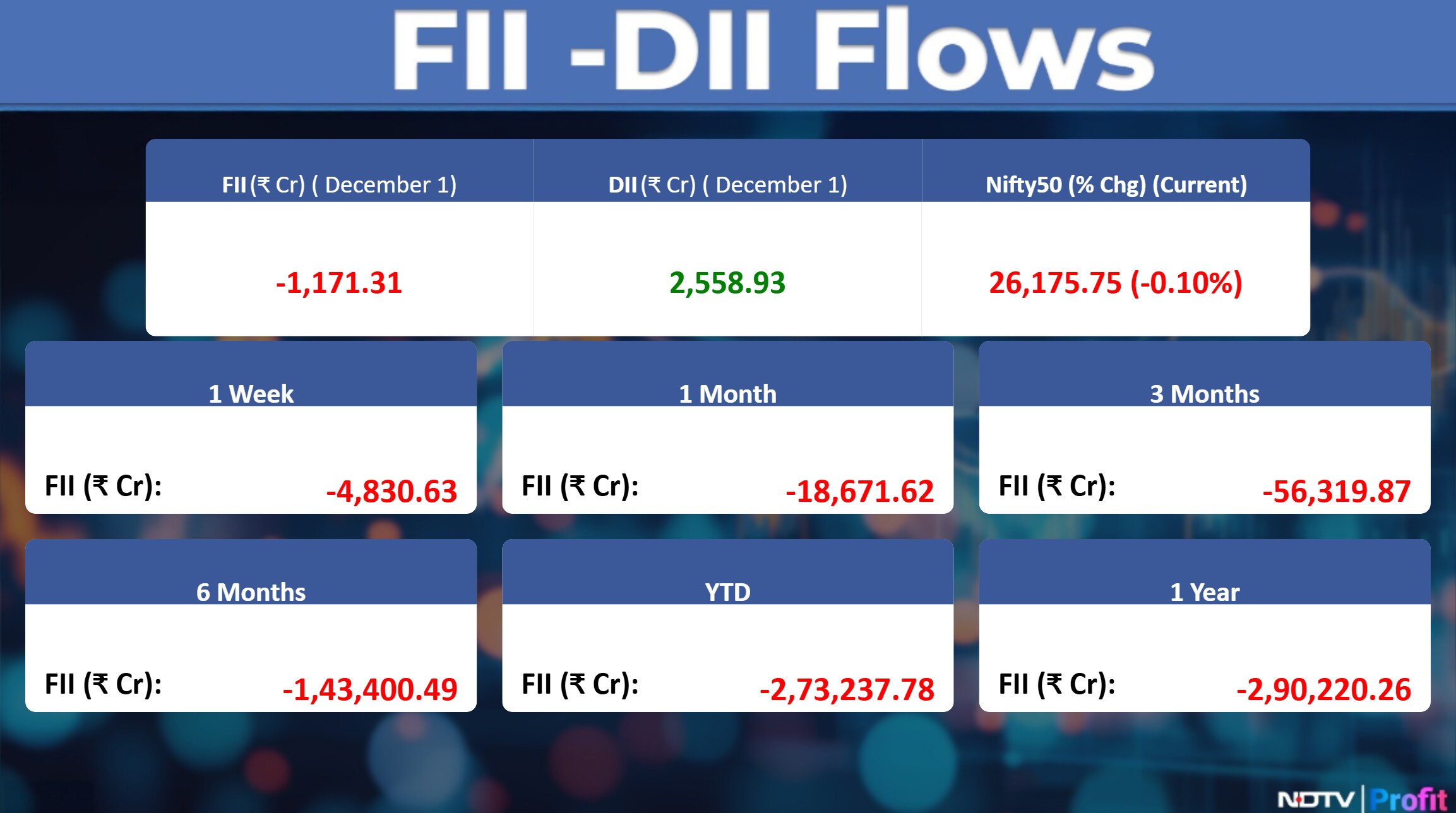

- Foreign investors sold Indian stocks for the third straight session in early December

- FPIs net sold Rs 1,171 crore on Monday and Rs 3,765 crore in November overall

- Domestic investors bought Rs 2,559 crore on Monday, continuing a 27-day buying streak

Overseas investors started December on a subdued note, selling Indian equities for a third consecutive session even as the Nifty 50 hit record high after the second-quarter GDP boost.

Foreign portfolio investors net sold stocks worth Rs 1,171 crore on Monday, according to provisional data from the National Stock Exchange.

FPIs pulled out Rs 3,765 crore in November, bringing their year-to-date outflow to Rs 1.47 lakh crore, as per data from the National Securities Depository Ltd.

Domestic institutions mopped up shares worth Rs 2,559 crore, extending its buying streak for the 27th straight session. Last month, DII inflow stood at Rs 78,000 crore.

India's benchmark equity indices slipped off record highs during the session as profit-booking wiped out early gains. The Nifty closed 0.1% lower, slightly below the 26,200 mark. The BSE Sensex ended flat at 85,641.

During the day, the Nifty climbed 0.46% to hit a lifetime high of 26,325.8, while the Sensex jumped 0.52% to hit a record intraday high of 86,159.02.

On the sectoral front, Nifty Auto, Metal, IT, and PSU Bank indices displayed noticeable strength. In contrast, Nifty Realty, Healthcare, and Pharma remained the key laggards, while other sectors traded with a mixed bias, indicating a lack of broad-based momentum.

The broader market also mirrored the cautious sentiment. Nifty Midcap 100 ended flat, showing little directional movement, whereas the Nifty Small cap 100 gained a marginal 0.25%, supported by selective buying interest.

The world's fourth-largest economy expanded at the fastest pace in six quarters in the three months ended September at 8.2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.