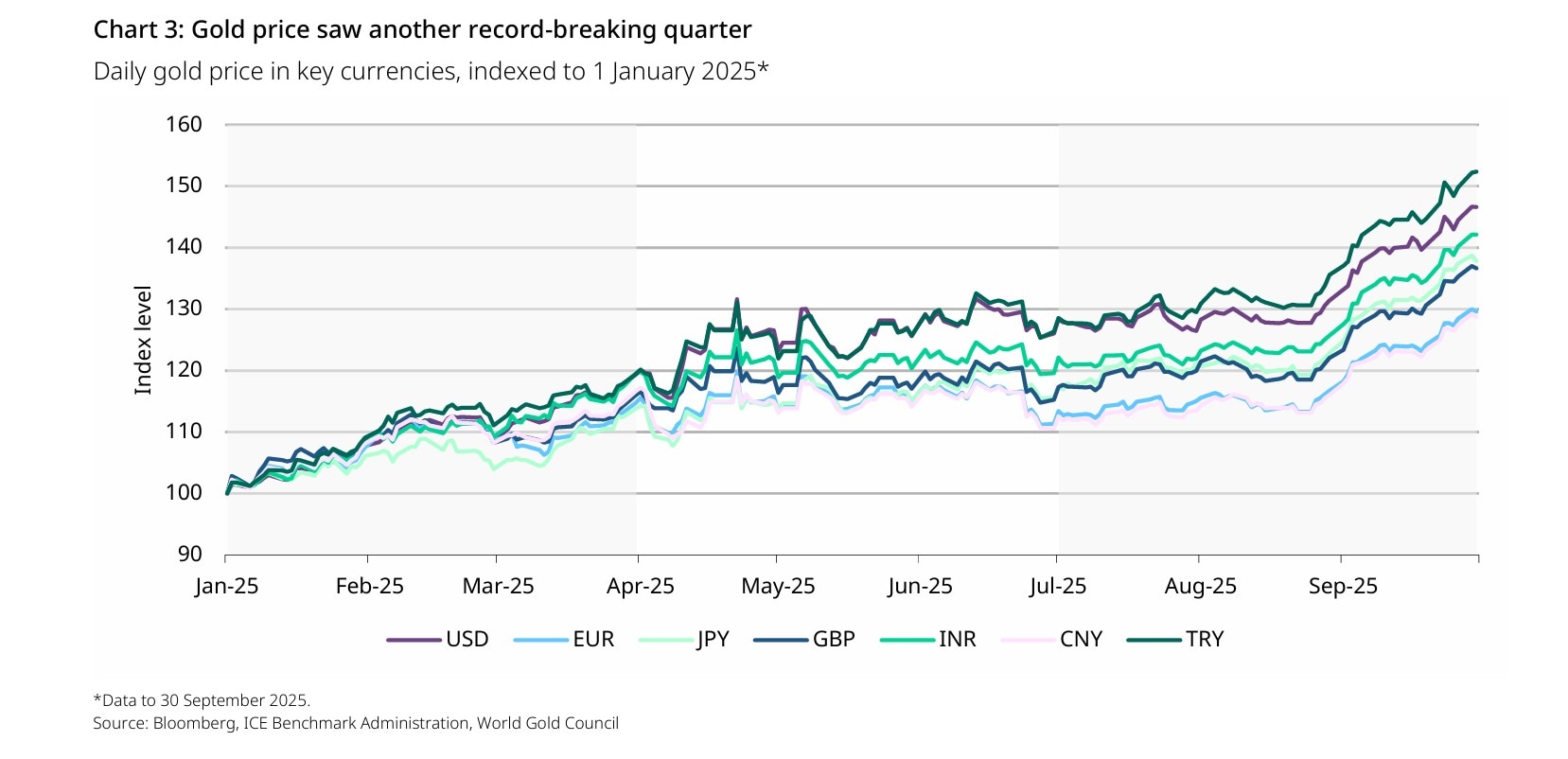

Gold Price Today: Gold prices rose on Thursday, Nov. 6, hovering just near $4,000-per ounce mark, buoyed by a weaker US dollar and a resurgence of safe-haven demand on concerns over a prolonged US government shutdown and uncertainty over the legality of tariff rates among nations.

The US dollar fell 0.3% on Thursday after hitting a four-month high in the previous session, making the yellow metal cheaper for other currency holders. Benchmark US 10-year Treasury yields were also last down 1.3%.

Gold Price Today

Spot gold was last up 0.4% at $3,998.65 per ounce. US gold futures for a December delivery gained 0.3% to $4,005.40 per ounce. Elsewhere, spot silver last rose 0.4% to $48.24 per ounce, platinum was down 0.2% at $1,568.26, and palladium last fell 1.3% to $1,401.14. Gold futures for a Dec. 5 delivery, last traded flat at Rs 1,20,505 per 10 grams after an intraday high of Rs 1,21,550.00 on the multi commodity exchange (MCX).

Gold Price Outlook: How will global trade deals impact yellow metal?

According to Ross Maxwell, Global Strategy Lead at VT Markets, investors are closely watching whether renewed trade negotiations between the US and India, and ongoing US–China discussions, can shift the yellow metal's momentum again. The outlook will depend on the impact from geopolitical uncertainty, central bank policy, and currency movements.

Any extended trade tensions or inconclusive deals could boost gold as investors seek safety amid the uncertainty, as per Maxwell. However, a decisive breakthrough in trade talks, especially if the US comes to credible agreements with China and India, could ease risk aversion, which in turn strengthens the USD, and would reduce the gold's safe appeal.

"With the US Fed maintaining a cautious stance and the possibility of further rate cuts if economic data weakens, the opportunity cost of holding gold falls, while a softer USD would support higher prices. If investors feel that any trade agreements fail to resolve underlying issues, then this could increase demand for gold as a hedge against instability," said Maxwell.

Analysts warn that gold may be overbought in the short term, suggesting limited upside without fresh catalysts. "If negotiations falter or global uncertainty deepens, gold could break higher. But if progress on trade and policy stability continues, it may remain range-bound below the resistance level," he added.

Gold Price Outlook: Short-term Vs long-term

Short-term: Gold traded positive with gains of Rs 660 at Rs 1,21,200 per 10 grams, supported by a weaker dollar index below 99.80. Comex gold also logged renewed buying momentum near $4,010, up by around $30.

"However, optimism around the US–China trade deal could limit further upside. Gold is expected to remain volatile within a range of Rs 1,19,500–Rs 1,22,500 in the next few sessions," said Jateen Trivedi, VP Research Analyst - Commodity and Currency, LKP Securities.

Long-term: Commodity experts believe the meeting between US President Trump and President Xi Jinping has increased chances of a successful US–China trade deal and further the potential India–UK trade pact which is expected by the end of the year could inject a dose of optimism into global markets, tilting global investors focus towards equities.

"Such a shift may trigger short-term volatility and a near term correction in gold after the prolonged rally. However, the longer-term outlook for the metal remains constructive," said Puneet Singhania, Director at Master Trust Group.

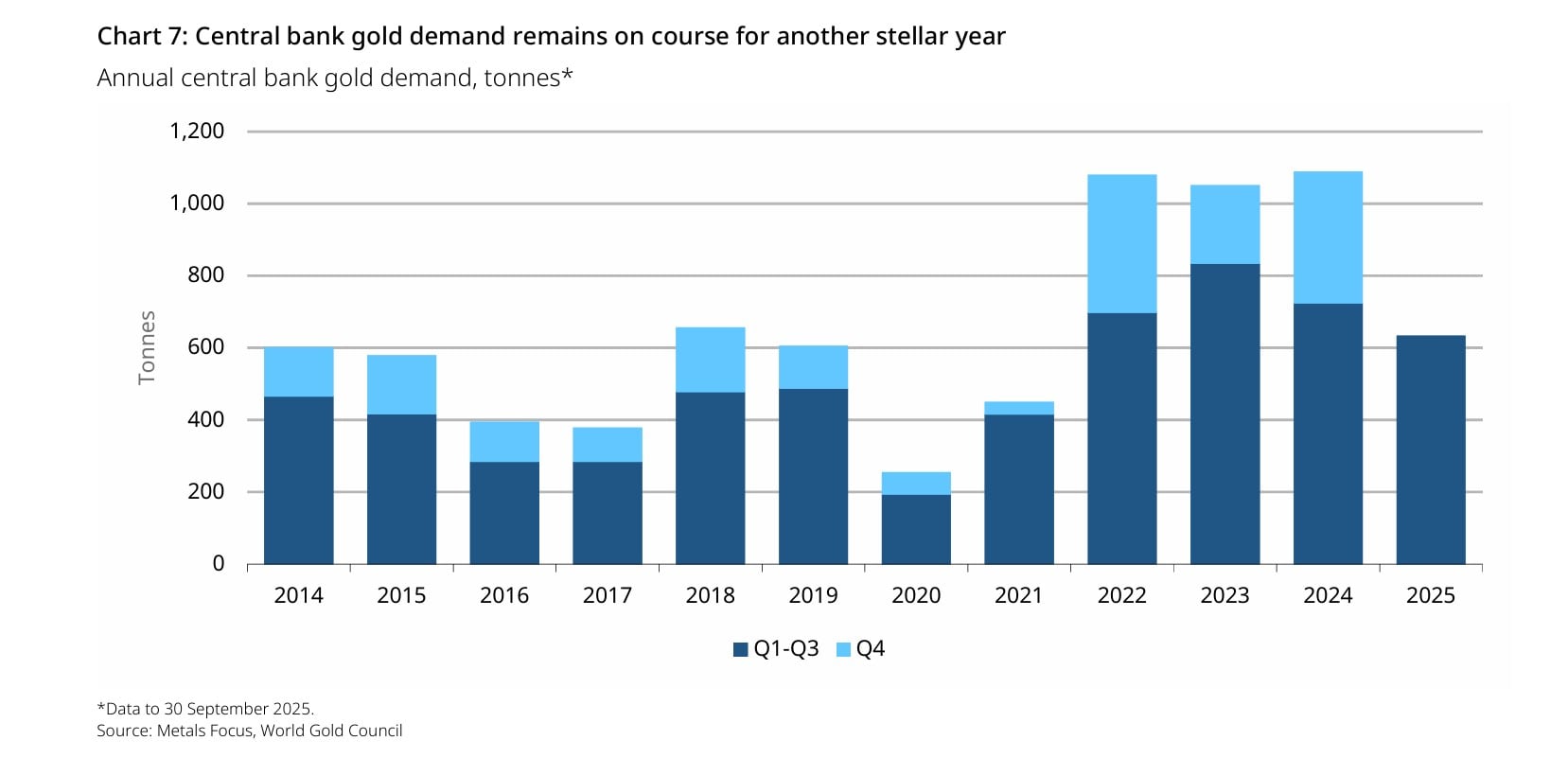

Global central banks which have turned to be the largest source of demand, continue to accumulate gold as part of their reserve diversification amid gradual move away from heavy reliance on the US dollar.

"This sustained buying outlays a structural shift in global asset allocation trends, maintaining gold's relevance as a store of value as well as positive outlook for price appreciation in a longer horizon," added Singhania.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.