Before you go, here's a readlist on today's RBI MPC Meeting.

Repo Rate Retained But 'Space There For Cuts'; Inflation Outlook Lowered

RBI MPC Proposes Risk-Based Deposit Insurance Premium For Banks

RBI Opens Door For Banks To Finance Acquisitions, Expands Lending Scope

RBI Monetary Policy Gives Three-Shot Boost To NRIs — Here's How

More Benefits For Zero Balance Account Holders? Three Consumer-Friendly Measures Announced By RBI

RBI Monetary Policy: Bankers, Industry Leaders Welcome Focus On Ease Of Doing Business

Relief For HDFC Bank, HDB Financial As RBI Removes Restrictions On Business Overlaps

This blog has ended. Thanks For Joining!

"Circumstances change, nothing should be frozen in time," #RBI Governor Sanjay Malhotra on MPC easing some regulations for banks. @Vishwanath4389 @RBI @GovSMalhotra

— NDTV Profit (@NDTVProfitIndia) October 1, 2025

Read #RBIPolicy live updates: https://t.co/WqndU8dFNZ

Watch more: https://t.co/qelRF74L4P pic.twitter.com/tENbnMfQfN

Governor Sanjay Malhotra said the RBI is developing an AI-trained system to alert account holders about potential risky transactions to curb fraud. "It is in an experimental stage. We are making the software," he said.

RBI's under-development Digital Payments Intelligence System will be run by an entity, which will collect data from various sources to trace mule accounts and flag risks to both customers and banks, a senior RBI official explained.

There is no proposal to levy a fee on UPI payments, Governor Sanjay Malhotra said.

He also said the RBI is still holding consultations on a plan to allow lenders to freeze mobile phones when EMI payments are not made.

"We want to ensure protection of interests of consumers and lenders," he said.

The RBI is looking is at the Indonesian Rupiah (IDR), United Arab Emirates Dirham (AED), among others to establish transparent reference rates for currencies of India’s major trading partners to facilitate rupee-based transactions, T Rabi Shankar, part time Member of Sixteenth Finance Commission and RBI Deputy Governor, said.

"The objective is to reduce crossing currencies to get rates. We have to work out ways to set a benchmark reference rate," he said.

Cross currency means a currency pair or transaction that does not involve the US dollar.

The RBI has proposed to withdraw the framework introduced in 2016 that disincentivised lending by banks to specified borrowers (with credit limit from banking system of Rs 10,000 crore and above).

Governor Sanjay Malhotra said the share of corporates in the total banking credit pool has reduced in the last 10 years and so the risks are limited.

Two MPC members suggested switching from 'neutral' to 'accomodative' stance, RBI Governor Sanjay Malhotra said, adding that they gave "forward guidance" that had nothing to do with liquidity. These members were Nagesh Kumar and Ram Singh.

"Inflation has reduced considerably since August. It has opened some space. Growth gave an upside surpise. Growth is estimates to be lower in the coming quarters to account for US tariffs. Therefore, the MPC felt we should pause."

RBI Governor Sanjay Malhotra will address a press conference at noon to discuss the MPC decision and regulatory proposals.

Besides a steady course on monetary policy, Malhotra announced a slew of measures to promote ease of doing business like lowering risk standards for insfrastructure financing.

The Reserve Bank of India's Monetary Policy Committee (MPC), at its September-October meeting, decided to keep the repo rate unchanged at 5.5%. The decision has significant implications for the economy, with its impact expected to be felt across sectors— particularly the home loan market.

When looking to buy a home or invest in property, people are often concerned about how much they will need to borrow and what it will cost them. Most pay attention to the interest rates offered by banks, but an important factor behind these figures is the repo rate, which is set by the RBI.

Whenever this rate changes, the impact on home loans is immediate—they either become more expensive or more affordable. The RBI regulates the repo rate depending on the situation of the Indian economy.

Read more at the link below:

Dinesh Khara, former CEO of SBI, said the RBI commentary has been "pro-industry", as he cited the increasing of IPO financing from to Rs 25 lakh per person and cutting risk weight to infrastructure financing.

"Making infrastructure financing cheaper, supporting Indian exporters and internationalisation of rupee will go a long way to support the Indian economy," he said.

He also said the RBI seems to be frustrated by the slow transmission of monetary policy. "We have to be mindful of banks, the cost of deposit are a challenge as banks are competing with other market instruments. They are doing cost optimisation to maintain their NIMs and pay more to depositors. Banks are looking for the right opportunities for lending."

Keki Mistry, former VC and CEO of HDFC Bank, said the RBI decisions today has been "very good".

RBI has withdrawn the circular on blocking banks and NBFCs they own doing the same business. This is a big positive for HDFC Bank and HDB Financial Services.

"The segregation of role of NBFCs and banks that always weighed on people's minds seems to have been now withdrawn. The board of bank can now decide the allocation of assets between subsidiaries," Mistry told NDTV Profit.

The RBI announced that Expected Credit Loss (ECL) framework will be effective from April 2027. Banks and other lenders will get five year glide path for implementation.

ECL is a forward-looking accounting and risk management framework that requires banks to estimate and provision for potential future losses on financial assets like loans.

"Standardisation of ECL across all entities is important to have," Mistry said.

The RBI has kept the repo rate unchanged at 5.5% for the second consecutive time, in what was a unanimous decision from the MPC.

RBI has also retained 'neutral' stance, with most of the commentary from the governor Sanjay Malhotra alluding to lower inflation.

The Reserve Bank of India lowered its inflation project for FY26 at 2.6% vs 3.1% earlier, with Sanjay Malhotra stating, "There has been a singificant moderation in inflation."

The inflation project of Q2FY26 and Q3FY26 stands at 1.8% while Q4FY26 stands at 4%.

The RBI governor further stated that the recent GST cuts will lead to reduction in prices in the CPI basket.

Real GDP growth for FY26 has been revised upward to 6.8% from the earlier estimate of 6.5%, which indicates stronger-than-expected economic performance.

This comes on the back of a strong Q1FY26 GDP growth number, which stood at an impressive 7.8%.

At a time when rupee has continued to face downward pressure, RBI has vowed to keep a close eye on the local currency.

"The rupee has witnessed depreciation. We will be Keeping a close on the volatility of rupee," Malhotra said in his MPC address.

RBI has proposed a series of measures to improve credit flow, ease costs and expanding lending flexibility.

A risk-based deposit insurance premium framework will be introduced, lowering costs for higher-rated banks.

In an attempt to enhance lending flexibility, the central bank has also proposed to remove he regulatory ceiling on lending against listed debt securities.

Limits for lending against shares raised from Rs 20 lakh to Rs 1 crore per person, and IPO financing caps enhanced from Rs 10 lakh to Rs 25 lakh per person.

The introduction of risk-based deposit insurance premiums to lower costs for higher-rated banks. The expansion of acquisition finance to broaden lending scope.

Regulatory changes in lending against securities:

Removal of the ceiling on lending against listed debt securities

Increase in limits for lending against shares from Rs 20 lakh to Rs 1 crore per person

Enhancement of IPO financing limits from Rs 10 lakh to Rs 25 lakh per person

To make rupee more prominent in international trade, RBI Governor Sanjay Malhotra proposed three measures:

Permit banks to lend in Indian rupees to non-residents in Nepal, Bhutan and Sri Lanka for cross-border trade transactions.

To establish transparent reference rate for currencies of India's major trading partners to facilitate rupee-based transactions.

Permit wider use of special rupee vostro account (SRVA) balances by making them eligible for investments in corporate bonds and commercial papers.

The RBI Governor said the central bank will issue a discussion paper on licensing new urban co-operative banks.

ECL Framework For Banks To Be Effective April 1, 2027

ECL Framework For Banks To Have Glide Path Of Nearly 5 Years

Basel-III Capital Adequacy Norms To Be Effective From April, 2027

Draft For Standardised Credit Risk Approach To Be Announced

Market-related Risk Norms Under Basel-III Still Under Consultation

New Norms To Cut Banks' Capital Need For MSME, Home Loans

Propose To Bring In Risk-Based Insurance Premium

To Remove Ceiling On Lending Against Listed Debt Securities

Moot Removing Regulatory Ceiling On Lending Against Listed Debt

RBI Governor Sanjay Malhotra said Liquidity Adjustment Facility daily surplus averaged at Rs 2.1 lakh crore since August MPC meeting.

"We will anchor short-term rates through 2-way liquidity operations. The drawing down of goverment cash balance and CRR cut will aid liquidity. The transmission of policy has been broadbased so far. Credit growth remains healthy and supportive of real economy. System-level parameters on NBFCs' financial stability healthy."

"The rupee has witnessed depreciation. The RBI is keeping a close watch on the volatility of rupee. Money market trading remain stable."

The yield on the 10-year government bond remained flat at 6.56% after RBI repo rate decision.

Source: Bloomberg

Rupee at 88.76 after RBI MPC maintained the repo rate and neutral stance.

Rupee opened 2 paise stronger at 88.77 against the US Dollar.

It closed at 88.79 on Wednesday.

Source: Bloomberg

Policy Repo Rate: 5.50%

Standing Deposit Facility Rate: 5.25%

Marginal Standing Facility Rate: 5.75%

Bank Rate: 5.75%

FY26 CPI Inflation Estimated At 2.6% Vs 3.1% Earlier

Q2 CPI Inflation Estimated At 1.8% Vs 2.1% Earlier

Q3 CPI Inflation Estimated At 1.8% Vs 3.1% Earlier

Q4 CPI Inflation Estimated At 4%

Q1FY27 CPI Inflation Estimated At 4.5%

Governor Sanjay Malhotra said India's GDP is projected to grow at 6.8%, higher than the previous forecast of 6.5%.

FY26 GDP Growth Projected At 6.8% Vs 6.5% Earlier

Q2 FY26 GDP Growth Projected At 7%

Q3 FY26 GDP Growth Projected At 6.4%

Q4 FY26 GDP Growth Projected At 6.2%

FY27 GDP Growth Projected At 6.4% Vs 6.6% Earlier

Q1 FY27 GDP Growth Projected At 6.4%

Governor Sanjay Malhotra said the RBI MPC's decision to keep repo rate unchanged was unanimous.

RBI Governor Sanjay Malhotra said the central bank has lowered its FY26 retail inflation forecast to 2.6% from 3.1% earlier.

The core inflation this year as well as in FY27 is expected to remain contained.

Governor Sanjay Malhotra announced the RBI MPC has decided to keep the repo rate unchanged at 5.5%. The MPC also decided to continue with the neutral stance.

"Bouyed by a good monsoon, the Indian economy has been doing well. GST cuts will help growth. Global economy has been more resilient than expected. Outlool remains clouded amid policy uncertainity"

RBI Governor has started speaking. Follow live updates.

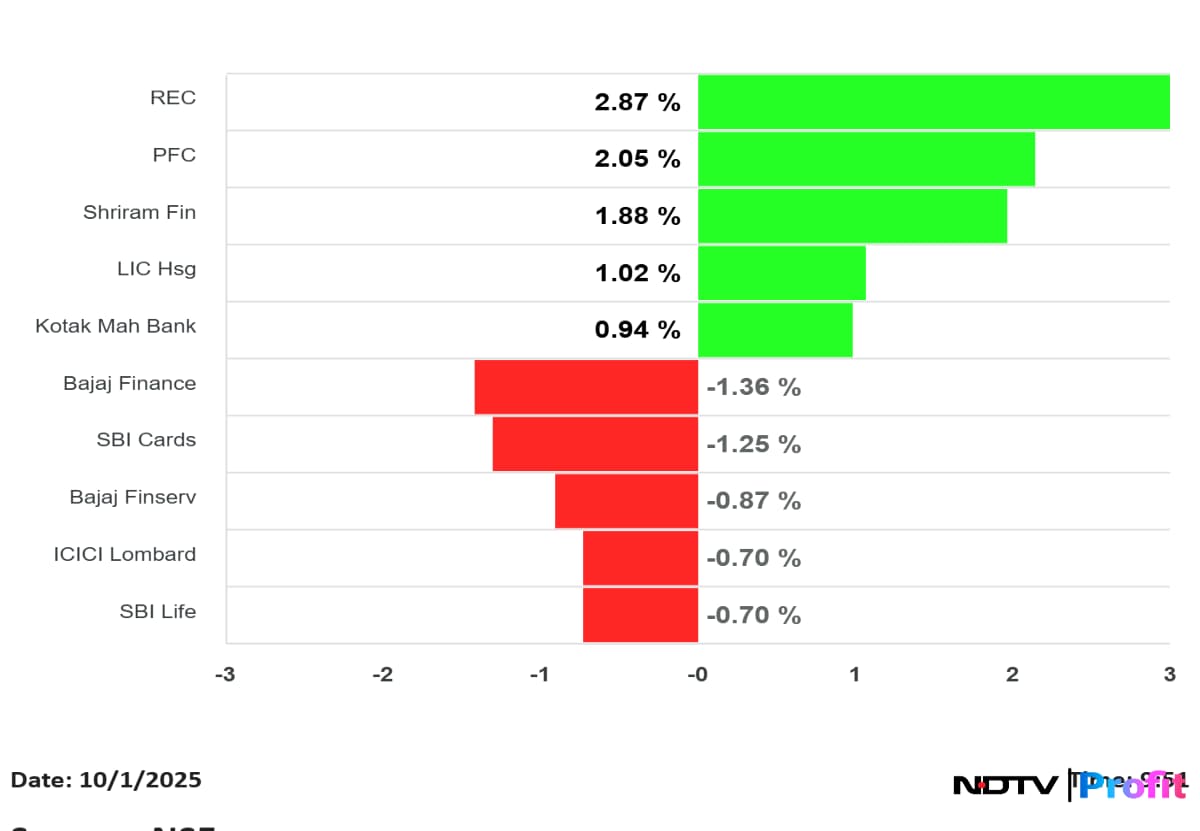

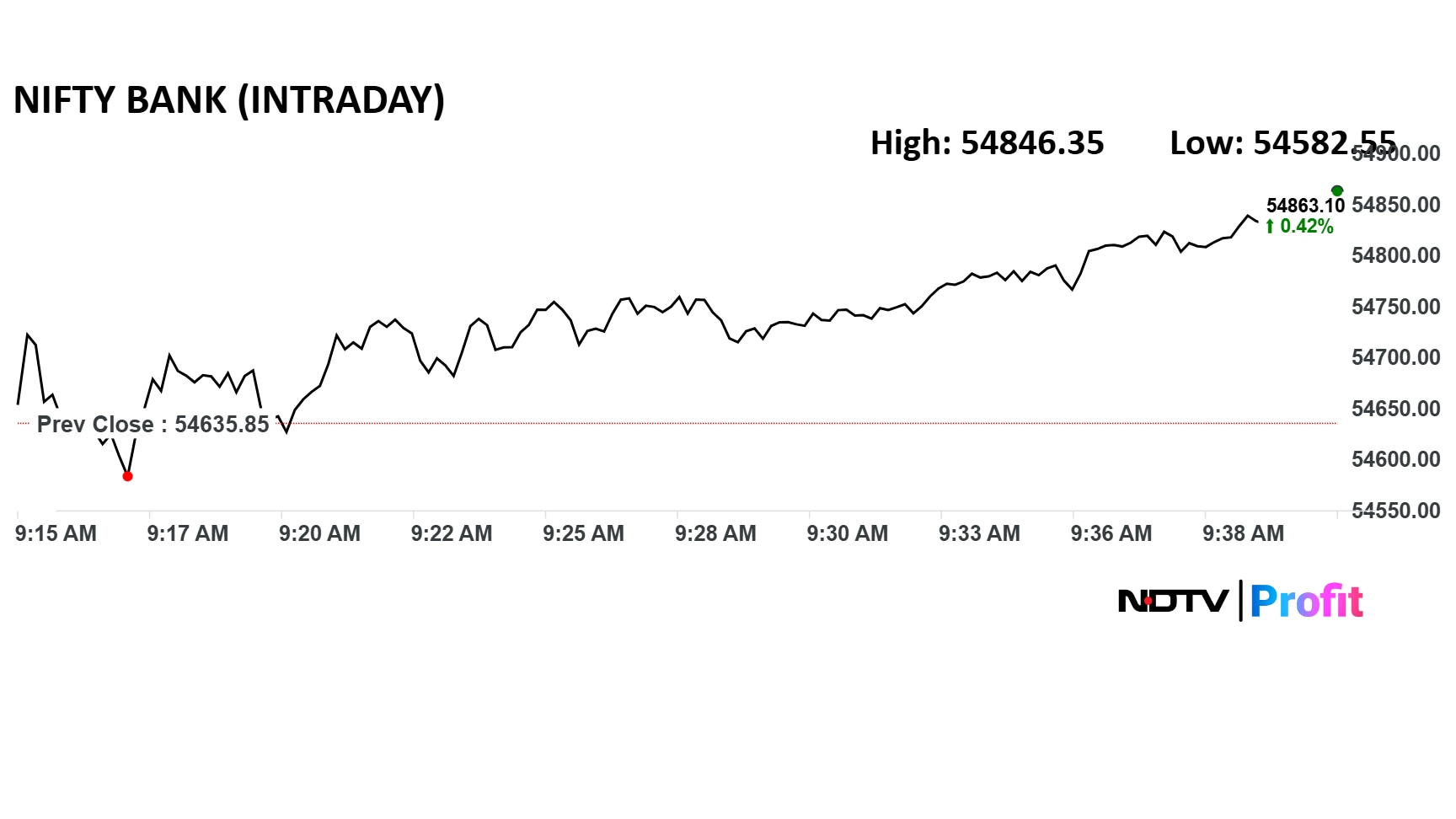

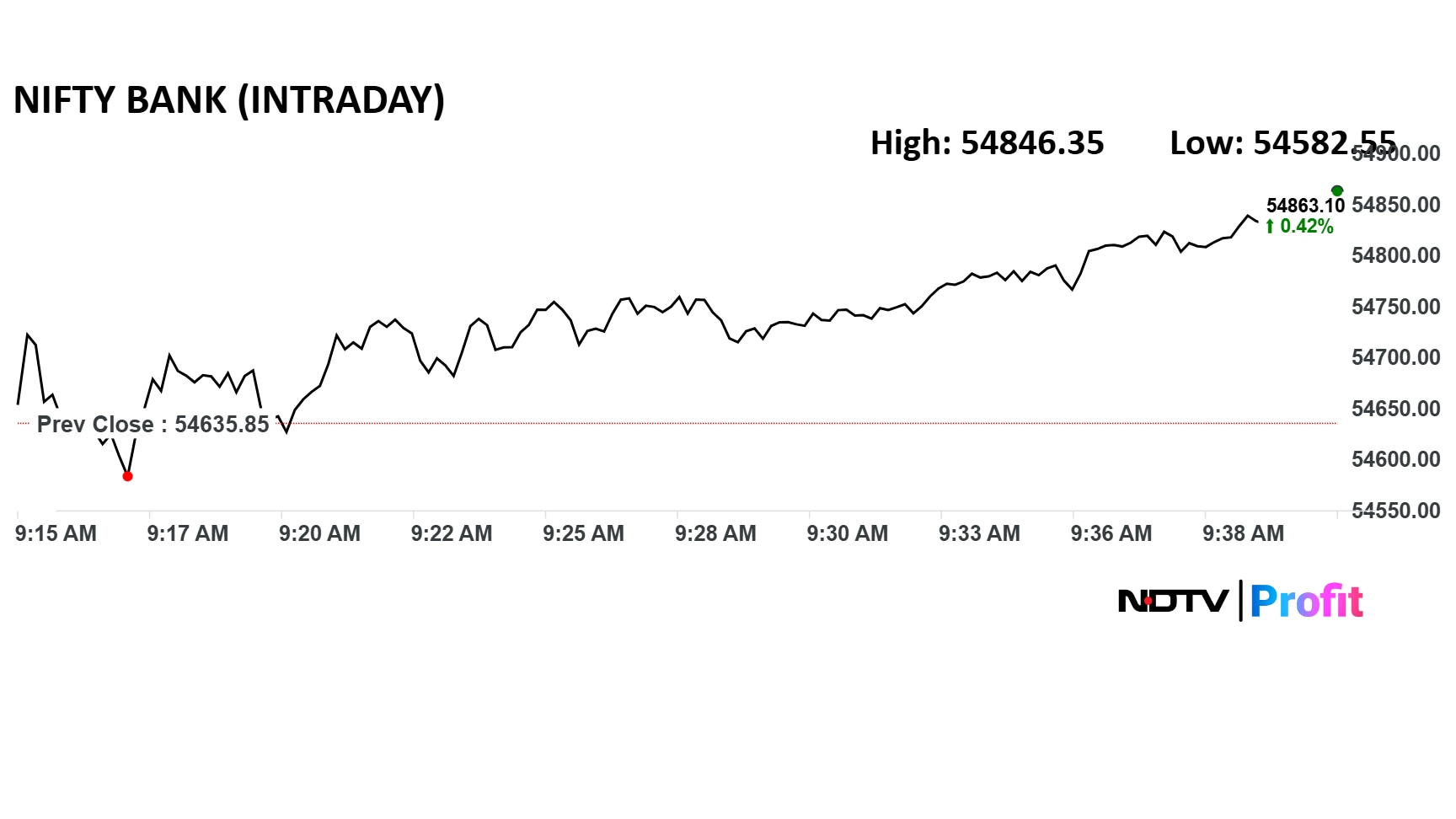

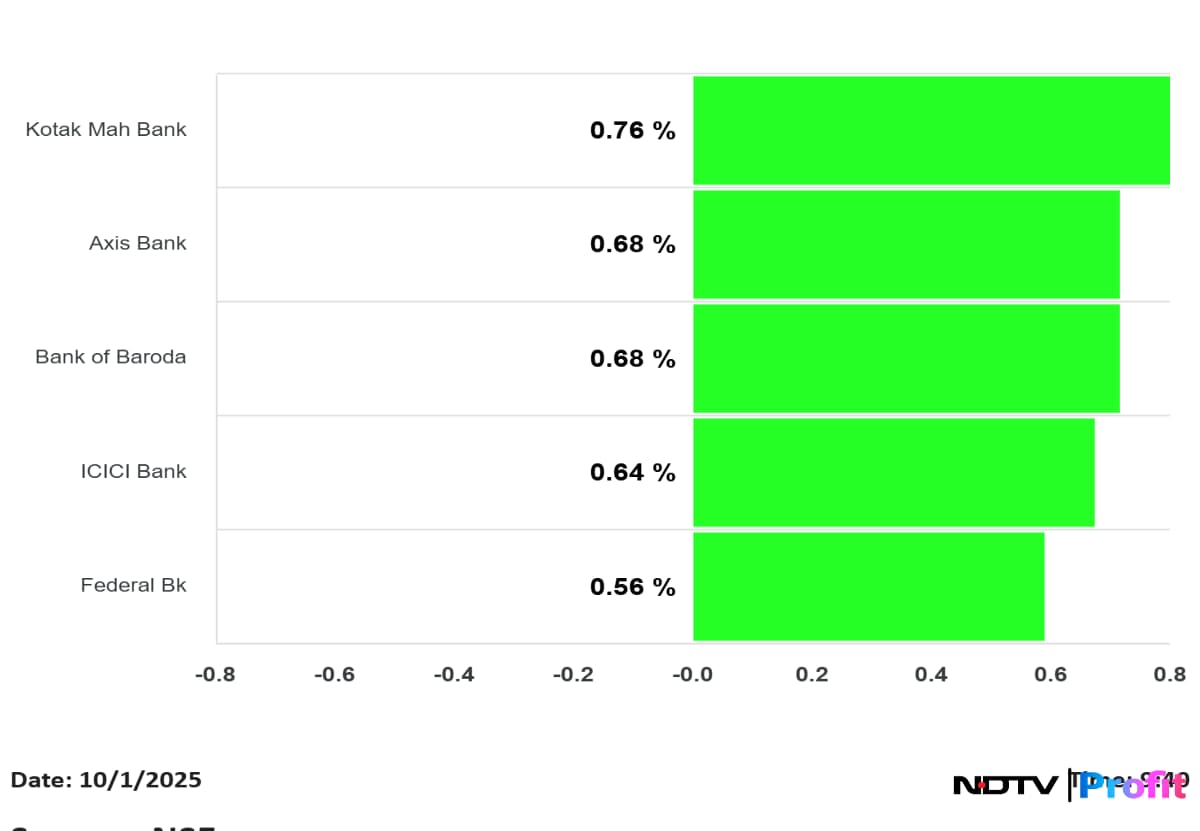

Bank stocks were trading higher ahead of the RBI MPC repo rate decision. The Nifty Bank was up 0.4%.

Bank stocks were trading higher ahead of the RBI MPC repo rate decision. The Nifty Bank was up 0.4%.

Bank stocks were trading higher ahead of the RBI MPC repo rate decision. The Nifty Bank was up 0.4%.

Bank stocks were trading higher ahead of the RBI MPC repo rate decision. The Nifty Bank was up 0.4%.

Catch all the live markets here for real-time updates.

NDTV Profit's Banking Editor Vishwanath Nair explains what people should expect from the RBI MPC meeting.

Watch below:

#RBIPolicy: Status quo to be maintained?

— NDTV Profit (@NDTVProfitIndia) October 1, 2025

Here's @Vishwanath4389 with a breakdown of what to expect.

Also read: https://t.co/cpxd0n6yCl pic.twitter.com/H5kdxYdEdQ

Catch all the live markets here for real-time updates.

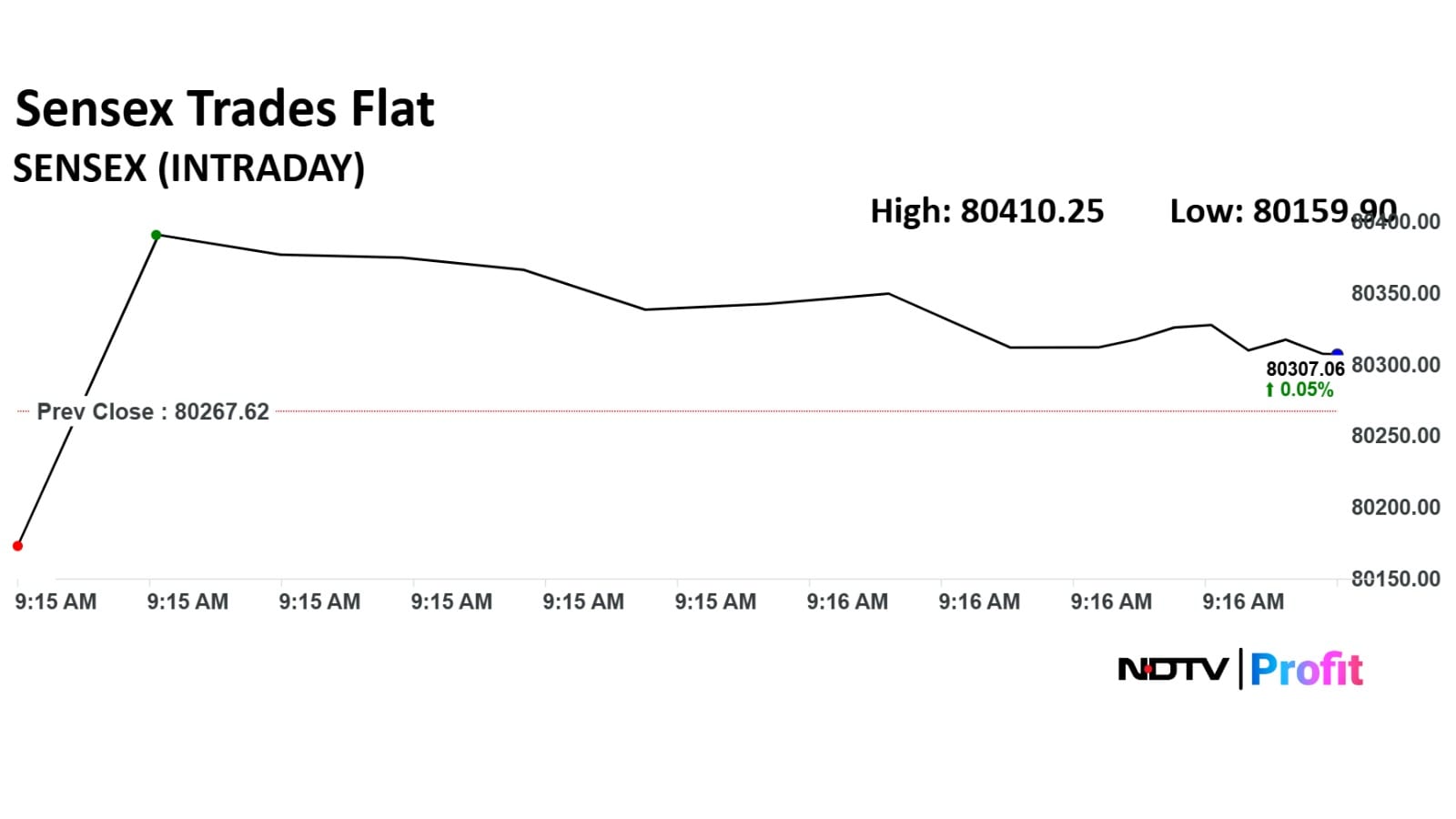

India's stock market opened mixed on Wednesday. The benchmark Nifty started 0.04% higher while BSE Sensex went down 0.1%.

India's stock market opened mixed on Wednesday. The benchmark Nifty started 0.04% higher while BSE Sensex went down 0.1%.

Catch all the live markets here for real-time updates.

The livestream of the RBI’s policy announcement will be available on the RBI’s social media accounts across YouTube, X, and Facebook. RBI Governor Sanjay Malhotra's press conference following the policy announcement is scheduled for 10 a.m. and will also be livestreamed.

You can also follow the RBI Governor's speech and all the live updates on NDTV Profit’s YouTube channel and website.

The yield on the benchmark 10-year government bond opened flat at 6.57%.

Catch all the live markets here for real-time updates.

The rupee was steady ahead of the RBI MPC decision announcement. The local currency opened 2 paise stronger at 88.77 against the US dollar.

Catch all the live markets here for real-time updates.

In August, the RBI pointed to factors such as robust rainfall, moderating inflation, improved industrial output, and supportive financial conditions as contributors to economic momentum.

Further, the central bank noted that ongoing government initiatives spanning monetary, regulatory, and fiscal domains, coupled with continued investment in public infrastructure, are spurring growth.

The real GDP growth projection for 2025-'26 remains unchanged at 6.5%, with the RBI emphasising India's ability to withstand global volatility.

On the daily chart, the Nifty 50 has formed a bearish-bodied candle with a lower high and a lower low, signalling continued weakness. The index’s daily range narrowed to about 144 points, below its 10-day average, as trading turned listless during the mid- to later part of the session. This contraction in range, coupled with muted intraday activity, suggests that downside momentum is losing steam, with market participants avoiding aggressive bets ahead of the central bank’s policy decision.

From a technical perspective, the index remains under pressure, trading below its 20, 50, and 100-day moving averages, and is currently hovering around the falling trendline formed by connecting the Aug. 21 and Sept. 4 swing highs. Going forward, immediate support lies in the 24,580–24,600 zone; failure to hold above this could drag the index towards the 24,340–24,440 band. On the upside, any positive surprise from the RBI meeting or commentary by the governor could spark a short-term relief rally, though the 24,750–24,850 zone is expected to act as a stiff resistance. Until this resistance is convincingly breached, the bias is likely to remain negative, with rallies offering selling opportunities.

Click to read the full story here.

As the Reserve Bank of India’s Monetary Policy Committee (MPC) concludes its meeting today, and the broad expectation is that the central bank will keep the repo rate unchanged for the second consecutive time.

RBI Governor Sanjay Malhotra will announce the committe'd decision at 10 am.

In its August 2025 review, the MPC maintained the repo rate at 5.50% while keeping a neutral outlook. The move was announced ahead of the new round of US tariffs, which doubled levies to 50% from August 27.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.