Wall Street trading was muted before the highly anticipated results from Nvidia Corp. — the last of the “Magnificent Seven” megacaps to report. The dollar rose. Longer-dated bonds fell.

Just hours ahead of results from the world's most valuable company, stocks eked out gains as the chipmaker edged lower. In addition to a take on artificial-intelligence spending, Nvidia's numbers could have implications for the broader market due to its massive influence on major indexes.

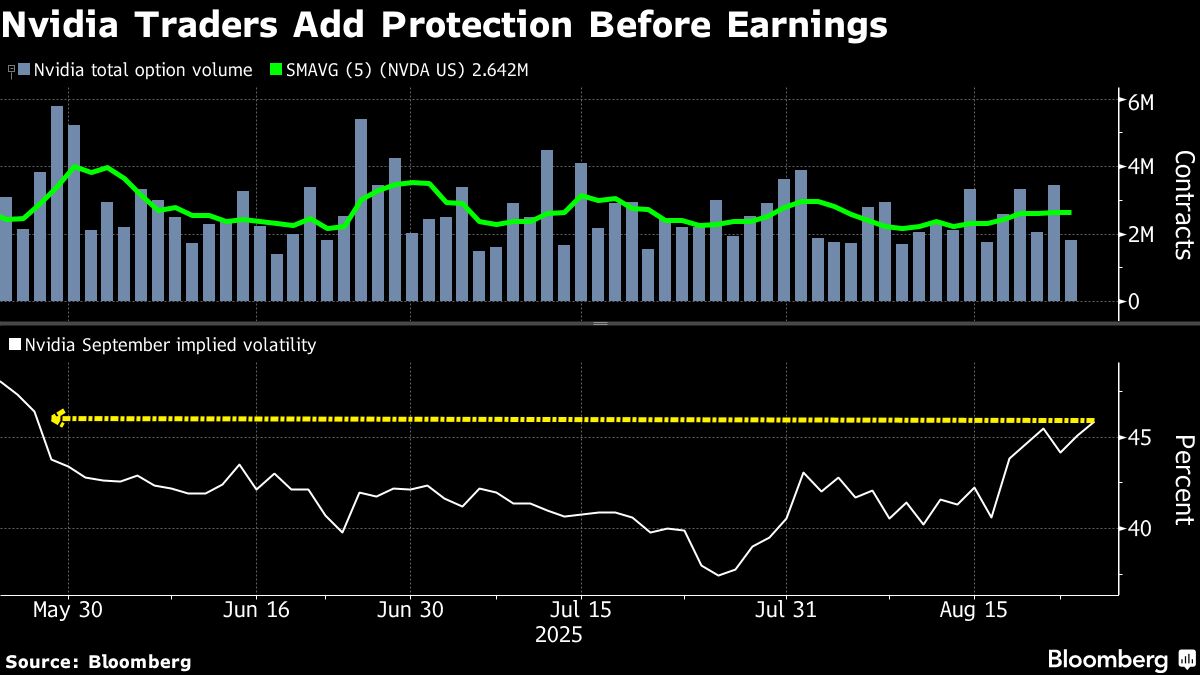

With a $4.4 trillion market capitalization, it has an 8.1% weighting in the S&P 500, meaning the stock has the power to swing the entire market. Options traders are pricing in a move of about 6% in either direction for Nvidia shares the day after results, according to data compiled by Bloomberg.

“Nvidia is the ultimate bellwether for the AI story and investors look to this company every quarter for reassurance that the AI story is still intact,” said Clark Bellin at Bellwether Wealth. “Nvidia shares are trading near all-time highs and the market has been pricing in expectations of strong earnings from Nvidia for some time, so valuations are elevated heading into earnings.”

Bellin also noted that Nvidia is the next hurdle for markets to climb now that Wall Street has been all but assured of a September Federal Reserve rate cut.

Short-dated Treasury yields fell amid bets on policy easing, with investors gearing up for a $70 billion US sale of five-year notes. The 30-year yield edged up again, following the recent announcement by President Donald Trump that he was firing Fed Governor Lisa Cook amid allegations of mortgage fraud.

His top economic adviser Kevin Hassett said Cook should go on leave while her status on the board is being litigated.

“We retain our constructive long-term view on AI and the broader technology sector,” said Ulrike Hoffmann-Burchardi at UBS Global Wealth Management. “However, we like seeking a more balanced exposure across the AI value chain, with a preference now for laggards that offer a more attractive risk-reward trade-off.”

Structured investments, such as capital preservation and put-writing strategies, may help investors take advantage of near-term volatility, she said.

To Thomas Lee at Fundstrat Global Advisors, Nvidia stock has been flat for the past four weeks, reflecting investor apprehension into results.

“Thus, we think odds favor a rally post-quarterly results,” he noted.

Lee says investors have been holding muted expectations for multiple reasons including OpenAI chief Sam Altman's recent comments about a potential AI bubble as well as general concerns that investors simply do not know where we are in the cycle.

“But keep in mind, NVDA remains the most important company in AI — and AI remains one of the most important structural themes for the next decade,” Lee said. “NVDA is a stock that has shown every dip has proven to be profitable. So we would recommend buying any dip.”

Meanwhile, Trump said he was prepared for a legal fight while the Fed, weighing in for the first time this week, said it would abide by any court decision in Cook's legal challenge of her dismissal.

The Fed's perceived independence from government whims is a bedrock assumption of US markets, and any change to that perception could weigh on US credit ratings.

“Trump's push to fire Cook has exacerbated concerns about the Fed's independence,” said Ian Lyngen at BMO Capital Markets. “While the price action in US rates has been largely contained to the recent range, many of the go-to hedges against an erosion of Fed independence outperformed on the news of Cook's firing.”

Traders are loading up on September puts and calls tied to Nvidia by the most in three months.

Over the next month, only the highly anticipated Sept. 17 Fed policy meeting is expected to have a bigger trading impact than Nvidia on Thursday, and only barely, going by swings implied on derivatives markets, according to Piper Sandler & Co.

Analysts and investors are eagerly awaiting Chief Executive Officer Jensen Huang's remarks on China, now that Beijing is reportedly urging local companies to avoid using Nvidia's less-advanced H20 processors.

“Outside of the ongoing H20 drama, NVDA has a strong track record of beating expectations,” said Adam Turnquist at LPL Financial. “Over the last five years, NVDA has only missed on earnings in one quarter.”

Some of the main moves in markets:

Stocks

The S&P 500 rose 0.2% as of 10:38 a.m. New York time

The Nasdaq 100 was little changed

The Dow Jones Industrial Average rose 0.2%

The Stoxx Europe 600 fell 0.1%

The MSCI World Index was little changed

Bloomberg Magnificent 7 Total Return Index rose 0.2%

The Russell 2000 Index rose 0.3%

Nvidia fell 0.3%

Currencies

The Bloomberg Dollar Spot Index rose 0.3%

The euro fell 0.5% to $1.1583

The British pound fell 0.3% to $1.3446

The Japanese yen fell 0.4% to 147.96 per dollar

Cryptocurrencies

Bitcoin rose 0.9% to $112,387.51

Ether rose 1.2% to $4,643.98

Bonds

The yield on 10-year Treasuries advanced two basis points to 4.28%

Germany's 10-year yield declined one basis point to 2.71%

Britain's 10-year yield was little changed at 4.73%

The yield on 2-year Treasuries declined three basis points to 3.65%

The yield on 30-year Treasuries advanced three basis points to 4.95%

Commodities

West Texas Intermediate crude rose 1.1% to $63.92 a barrel

Spot gold fell 0.3% to $3,382.66 an ounce