Oil held a steep drop as investors counted down to the imposition of higher US tariffs on India over imports of Russian crude, with no signs of a major shift in local refiners' purchasing patterns.

Brent was near $67 a barrel after falling more than 2% in the previous session, while West Texas Intermediate traded above $63. The US is set to double levies on some Indian goods to 50% to punish the country for taking Moscow's oil. Even with the higher rate due to take effect at 12:01 a.m. Washington time, local processors plan to maintain the bulk of their purchases.

“I don't see much supply concern,” said Vandana Hari, founder of market analysis firm Vanda Insights. “There is no directive from the Indian government to halt Russian crude purchases, and there's little point in Indian refiners making individual decisions to pare back as there is no clear indication that it would help New Delhi negotiate.”

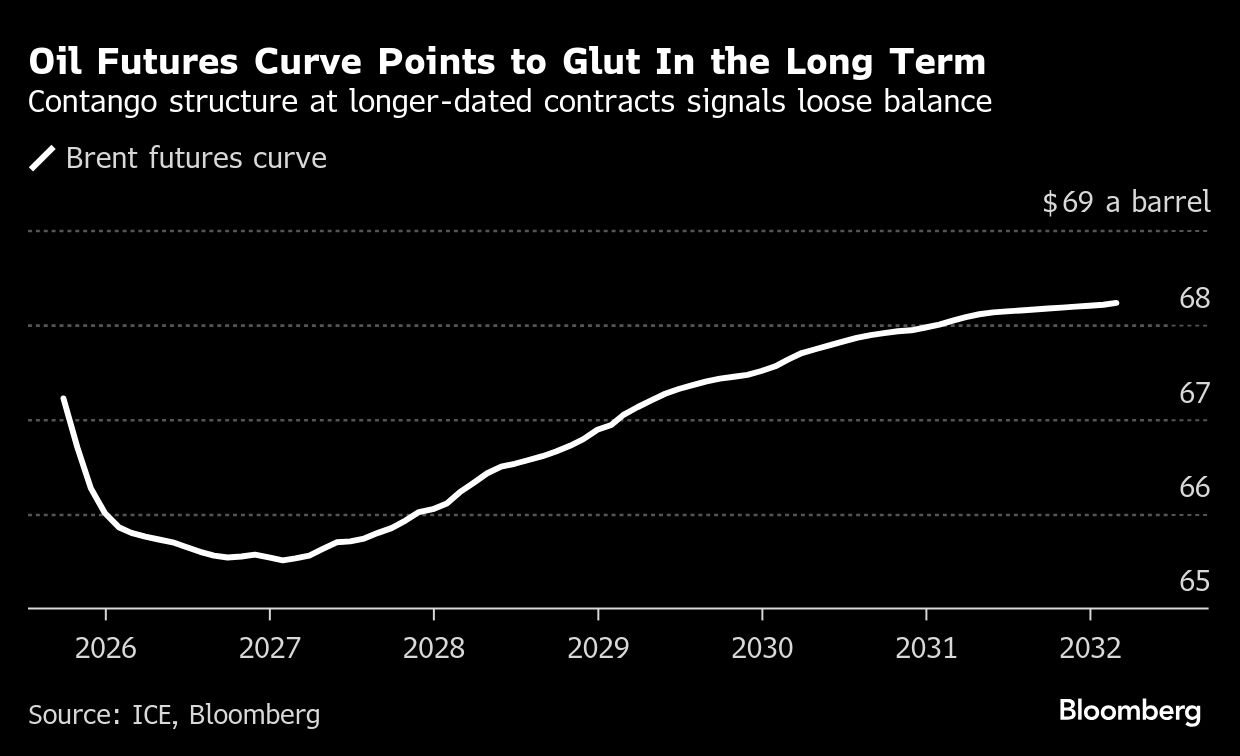

Brent oil has shed about 10% this year as the US-led trade war fanned worries about demand, and OPEC+ unwound supply curbs. That's spurred concerns a glut will form, including an outlook from the International Energy Agency for a record surplus next year. On Tuesday, Trump praised prices close to $60 a barrel, adding that crude would move lower “pretty soon”.

The move against India by the US — which has refrained from similar action against China, another major buyer of Moscow's crude — is part of a broader push to try to broker an end to the war in Ukraine. On Tuesday, President Donald Trump warned of “an economic war” if he could not get Russia's Vladimir Putin and Ukraine's Volodymyr Zelenskiy to end the conflict.

India became a major taker of Moscow's oil following the outbreak of Ukraine war in 2022. At present, state-run and private processors are expected to buy 1.4 million to 1.6 million barrels a day for October loading and beyond, according to people with knowledge of the matter. That compares with an average of 1.8 million barrels a day in the first half.

In the US, an industry report showed nationwide crude stockpiles fell by a modest 1 million barrels last week, along with drawdowns in gasoline and distillates. Official figures are due later Wednesday.

Some metrics point to near-term tightness, with the spread between the two closest Brent contracts holding in a bullish structure known as backwardation. Longer-dated contracts, however, are in contango, the opposite pattern.

Prices:

Brent for October settlement added 0.2% to $67.32 a barrel at 11:33 a.m. in Singapore.

WTI for October delivery was little changed at $63.30 a barrel

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.