Nvidia Corp.'s China sales have taken on new levels of complexity, and investors will be hoping for a clearer read when the chipmaker reports earnings Wednesday afternoon.

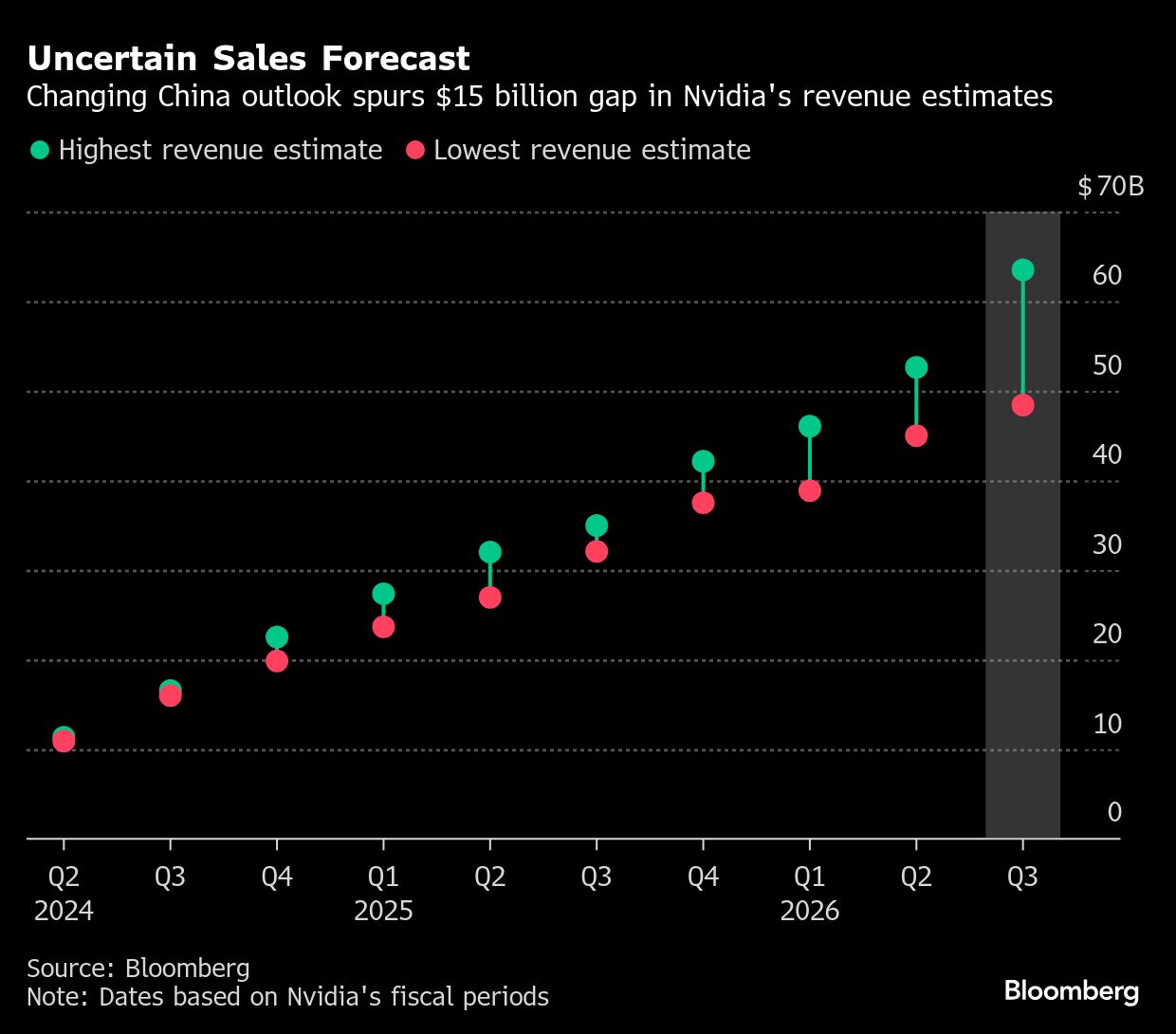

The firm's on-again, off-again sales in the word's largest market for semiconductors have been a source of confusion for Wall Street. Third-quarter revenue projections for the company are roughly $15 billion apart, twice the difference between the highest and lowest estimates in the second quarter and the widest in percentage terms in at least a decade, according to data compiled by Bloomberg.

Nvidia's revenue in China has been an issue since the Biden administration restricted the sale of advanced artificial intelligence chips in the country in 2022. But the business has been further complicated under President Donald Trump, who stopped chip sales to China in April, then reversed the order earlier this month on the condition that the US government gets 15% of the proceeds.

And now Beijing is reportedly urging local companies to avoid using Nvidia's less-advanced H20 processors. Nvidia shares were little changed at 11:25 a.m. ET in New York, paring an early drop of as much as 1.5%.

“It does complicate the setup,” heading into results, said Matt Stucky, chief portfolio manager of equities at Northwestern Mutual Wealth Management. “The uncertainty to me is going to be centered around if they're able to guide to some inclusion of China-based revenues or not, and whether or not that matches up with consensus estimates.”

The back and forth over Nvidia's China sales is causing headaches for Wall Street analysts. For example, Susquehanna analyst Christopher Rolland is resisting from putting sales of Nvidia's H20 chips, which were designed for China, back into his model. UBS's Timothy Arcuri says the inclusion of China sales could lift Nvidia's forecast by as much as $3 billion.

Investors are already skittish about chipmakers' exposure to China — in fiscal 2025, it accounted for 13% of Nvidia's revenue. Several weeks ago, Advanced Micro Devices Inc. shares tumbled more than 6% after the company failed to deliver a clear outlook for its Chinese sales, overshadowing generally solid guidance for the business.

AI Spending Clues

As the biggest beneficiary of the AI craze, Nvidia's earnings will also be closely watched for a read into spending on the technology.

“Investors expect both the results and the guidance to be a couple billion better than consensus,” said Brian Colello, equity strategist at Morningstar Investment Services. “There's so much fast money in the market, if there's just a headline number that doesn't live up that will likely cause a volatile reaction one way or the other.”

In addition, the report could have major implications for the broader market, given Nvidia's stature as the world's most valuable company. With a $4.4 trillion market capitalization, it has an 8.1% weighting in the S&P 500 Index, meaning the stock has the power to swing the entire market. Options traders are pricing in a move of about 6% in either direction for Nvidia shares the day after results, according to data compiled by Bloomberg.

Wall Street expects Nvidia to report $46.2 billion in revenue for the second quarter and adjusted earnings per share of $1.01, both up roughly 50% from the same period a year ago. For the third quarter, consensus estimates project revenue of about $53.5 billion and adjusted earnings per share of $1.21.

Analysts and investors are eagerly awaiting Chief Executive Officer Jensen Huang's remarks on China, including the development of the B30 chip, which could replace the H20 chip. Of course, Chinese sales aren't the biggest story for Nvidia, as demand for its Blackwell chips in other markets appears to be so strong that the company could beat estimates without any contribution from the country.

That said, with the chipmaker's stock price about 1% from a record high and up nearly 35% since its first quarter earnings report in May, a strong China outlook could be key to keeping the rally going.

“The overall story in Nvidia can still play out with everything else going on,” said David Wagner, portfolio manager at Aptus Capital Advisors LLC, adding that any inclusion of revenue from China is “just icing on a cake.”