Tata Consultancy Services Ltd. share price target received hikes from several brokerages after its second-quarter financial results.

Analysts had a split view on India's largest IT player, with some maintaining a cautious or neutral stance, and others more optimistic, focusing on strong deal momentum and bottoming-out trends.

TCS's new Data Center business plans are a major point of discussion, viewed as either an ambitious growth driver or an unrelated distraction. The commentary also highlights the risk to artificial intelligence-led productivity in existing businesses.

Out of the 51 analysts tracking TCS, 33 have a 'buy' rating on the stock, 13 recommend a 'hold', and five suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price targets is Rs 3,517, which implies a potential upside of 15% over the previous close.

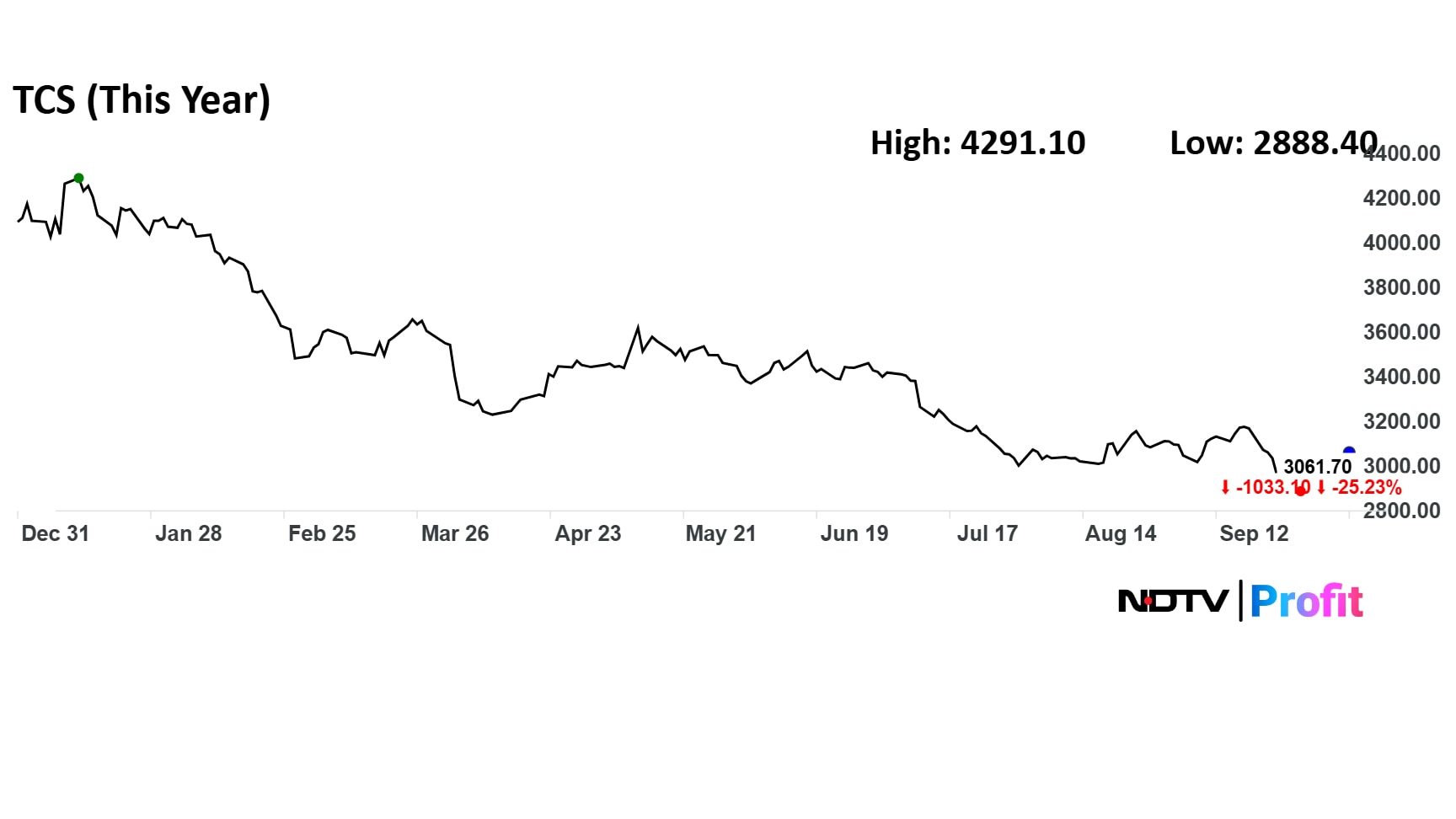

The TCS share price has declined 25% so far this year and 33% from its all-time high in August 2024.

TCS share price down 25% so far in 2025.

Read TCS Q2 Results — Five Key Highlights

Analyst Commentary

Citi

Maintain 'Sell' but raise TCS price target to Rs 2,800 from Rs 2,790.

Inline Q2; Asset intensity to increase medium term.

Headcount reduction of 3% QoQ highlights weak outlook.

See the risk to AI-led productivity in existing business.

Maintain a cautious view.

Jefferies

Maintain 'Hold' and reduce TCS price target to Rs 3,100 from Rs 3,230.

Weak Q2 growth; Data center to add limited upside.

Growth in key markets is yet to recover and 3% QoQ decline in headcount does not bode well.

While TCS' intent to invest in growth is promising, its data center foray has limited synergies.

Cut earnings estimates by up to 1% and expect 4% EPS growth over FY26.

Avendus Spark

Upgrade to 'Buy' from 'Add' and raise TCS price target to Rs 3,700 from Rs 3,690.

Better-than-expected Q2, thereby reversing a string of poor performances in the last few quarters.

Deal win momentum remains strong and provides visibility on recovery in revenue through the second half of the current year and FY27.

This would lead to a reversal in the decline in headcount trend in the coming quarters.

Deal extension from BSNL would augment revenue in the near term.

Upgrade in the rating is also driven by near-term underperformance, which makes the risk-reward attractive and restricts downside.

Nomura

Maintain 'Neutral' with TCS price target at Rs 3,300.

Forays into the data center (DC) business; capex of $6-6.5 billion over six years.

Management continues to expect FY26 to be better than FY25 for major markets.

Significant margin improvement in FY26 is unlikely.

UBS

Maintain 'Neutral' raise price target to Rs 3,435 from Rs 3,400.

Margin beat and AI investments announced.

Management highlighted that clients remain cautious, leading to tight discretionary budgets and project delays.

Albeit deferrals are lower than the previous quarter.

CLSA

Maintain 'Outperform' and raise TCS price target to Rs 3,559 from Rs 3,545.

Beat on all fronts.

Ambitious data centre investment plans.

Becoming more acquisitive to gain speed.

Big, bold and ambitious data centre plans to participate in India AI story.

JPMorgan

Maintain 'Overweight' and raise TCS price target to Rs 4,050 from Rs 3,900.

Underlying trends are bottoming out.

The AI colocation business appears to be an unrelated distraction.

Margin improvement was heartening.

Underlying cost control has been achieved post-restructuring.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.