Bajaj Auto Q1 Results: Bajaj Auto announced its April-June quarter results for fiscal 2025-26 (Q1FY26) on Wednesday, Aug. 6, reporting a rise of 5.4% in standalone net profit to Rs 2,096 crore, compared to Rs 1,988 crore in the corresponding period last year. The Bajaj Group company broadly met Bloomberg estimates in terms of financials in the quarter-under-review.

The leading domestic two-and-three-wheeler manufacturer's topline or revenue from operations during the first quarter of current fiscal rose 5.5% to Rs 12,584 crore compared to Rs 11,928 crore in the year-ago period.

Bajaj Auto Q1 FY26 Highlights (Standalone, YoY)

Revenue rises 5.5% to Rs 12,584 crore Vs Rs 11,928 crore (Bloomberg estimate: Rs 12,283.5 crore)

Net profit rises 5.4% to Rs 2,096 crore Vs Rs 1,988 crore (Bloomberg estimate: Rs 2,012.3 crore)

EBITDA rises 2.7% to Rs 2,481 crore Vs Rs 2,415 crore (Bloomberg estimate: Rs 2,429.4 crore)

Margin at 19.7 Vs 20.3% (Bloomberg estimate: 19.78%).

On the operational front, Bajaj Auto's earnings before interest, tax, depreciation and amortisation (EBITDA) for the quarter stood at Rs 2,481 crore, which is 2.7% higher on a year-on-year basis. Margins narrowed by 60 basis points to 19.7% from 20.3% last year's June quarter. For the June quarter, Bajaj Auto's volumes increased by 1% from last year.

Bajaj Auto highlighted that it has seen an increase in its market share in the 125cc+ segment, and that the KTM+ Triumph has billed over 25,000 bikes in the domestic market, a growth of 20% from last year.

Electric vehicles (EVs) contribute over 20% of Bajaj Auto's overall portfolio. Bajaj Auto's Africa, Latin America and Asia business has seen broad-based double-digit volume growth, according to a statement. Middle East and North Africa though remained muted due to the geopolitical challenges.

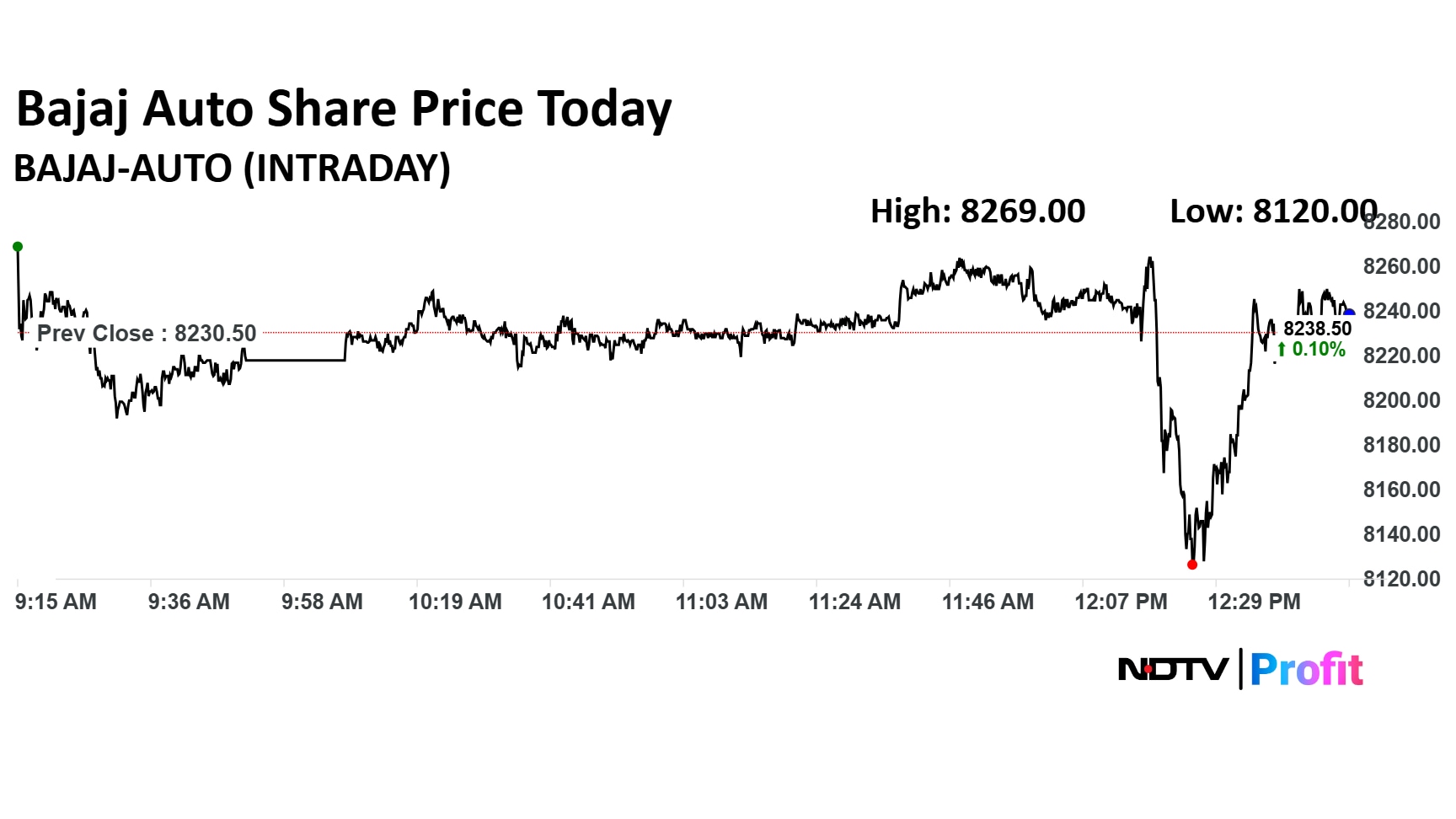

Bajaj Auto Share Price Trend

On Wednesday, shares of Bajaj Auto opened at Rs 8,269 and gained 0.09% intraday so far to hit a session's high of Rs 8,269. At 12:53 pm, the stock traded 0.02% lower at Rs 8,228.65 apiece on the BSE. The NSE Nifty 50 was 0.22% lower to 22,594.22.

Shares of Bajaj Auto have fallen 6.38% on a year-to-date basis (YTD) and down 12.70% in the last 12 months. The relative strength index was 32.76, indicating that the stock is neither oversold nor overbought. The auto major commands a market cap of Rs 2,29,791.31 crore.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.