In a recent Twitter post, the Income Tax department has requested taxpayers who hold foreign bank accounts or assets or receive income from abroad to to fill the Foreign Asset Schedule in their Income Tax Return (ITR) for Assessment Year 2023-24 and ensuring to disclose all Foreign Assets (FA) and Foreign Sources of Income (FSI) if they possess foreign bank accounts, or assets, or receive income from abroad.

Kind Attention: Holders of foreign bank accounts, assets & income!

July 18, 2023

Please fill the Foreign Asset Schedule in the Income Tax Return (ITR) for A.Y. 2023-24 and disclose all Foreign Assets (FA)/ Foreign Source of Income (FSI) if you have foreign bank accounts, assets or income.… pic.twitter.com/LwntoNj8jjThis is the second time in last four days where the department has urged holders of foreign bank accounts, assets, and income to fill the Foreign Asset Schedule in thier Income Tax Return (ITR) for Assessment Year 2023-24.

Last Date to File Income tax Returns

The finance ministry has stated that it will not extend the deadline for filing Income Tax Returns (ITR) beyond July 31 and has urged taxpayers to file their returns at the earliest. So the last day to file your Income tax retuns is July 31, 2023.

Who needs to fill the Foreign Asset Schedule in the Income Tax Return?

As stated by the Income Tax Department,

If you are a tax resident of India in the previous year, and own foreign assets or bank accounts, or have earned foreign income during the previous year then you have to fill out the FA schedule.

A resident of India must fill foreign asset schedule for the foreign assets held as on 31st December 2022, even if:

You do not have any taxable income or your income falls within the basic exemption limit.

Same information is captured in any other schedule like schedule AL.

The foreign asset is created/acquired from disclosed sources of foreign or domestic income.

One also needs to fill FA schedule if you have a foreign custodial account, foreign cash value insurance contract or annuity contract, account signing authority, a name as a trustee, beneficiary or settlor in trusts, outside India.

What does the Foreign Assests (FA) include?

The Foreign Assets includes,

Foreign Bank Accounts

Foreign Equity and Debt

Financial Interest in any entity/business

Immovable property

Any other capital asset

Any other financial assets prescribed in Schedule FA

What is the penalty for failure to disclose foreign assets/income?

The department has mentioned that in case the taxpayer misses this deadline they are entitled to pay Rs 10 Lakh as penalty under the Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015.

How to fill Foreign Asset Schedule in your Income Tax Return?

As per the online User Manual available on the official website of Income Tax Department, tax payers who possess foreign bank accounts, or assets, or receive income from abroad need to follow these steps to fill the 'Foreign Asset Schedule'.

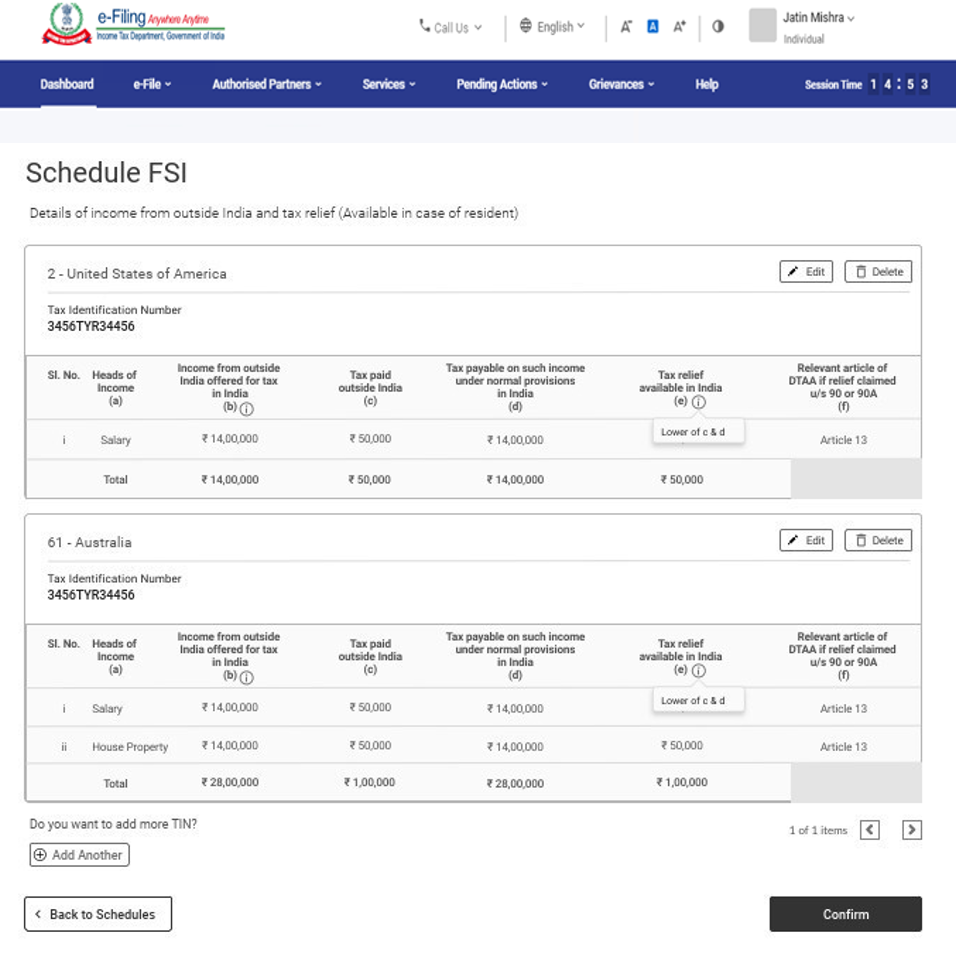

Under FSI (Foreign Source Income) taxpayers need to enter the details of any income generated or arising from abroad.

Source: https://www.incometax.gov.in/

How To Schedule Tax Relief?

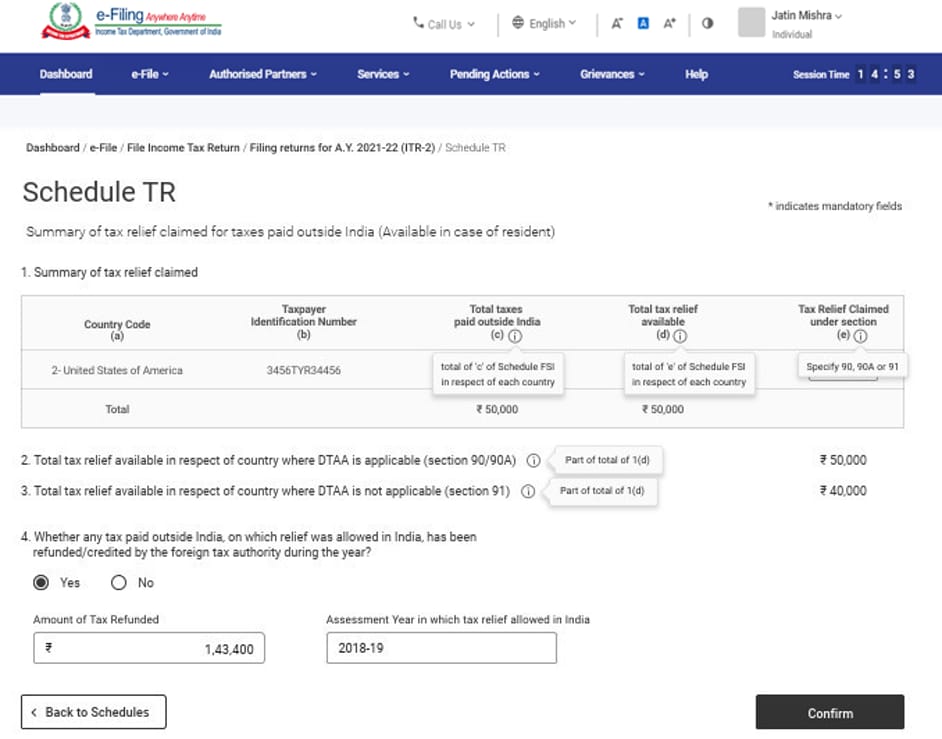

Taxpayers have to share a summary of tax relief that is being claimed in India for taxes paid abroad in respect of each country.

Source: https://www.incometax.gov.in/

How To Schedule Foreign Asset?

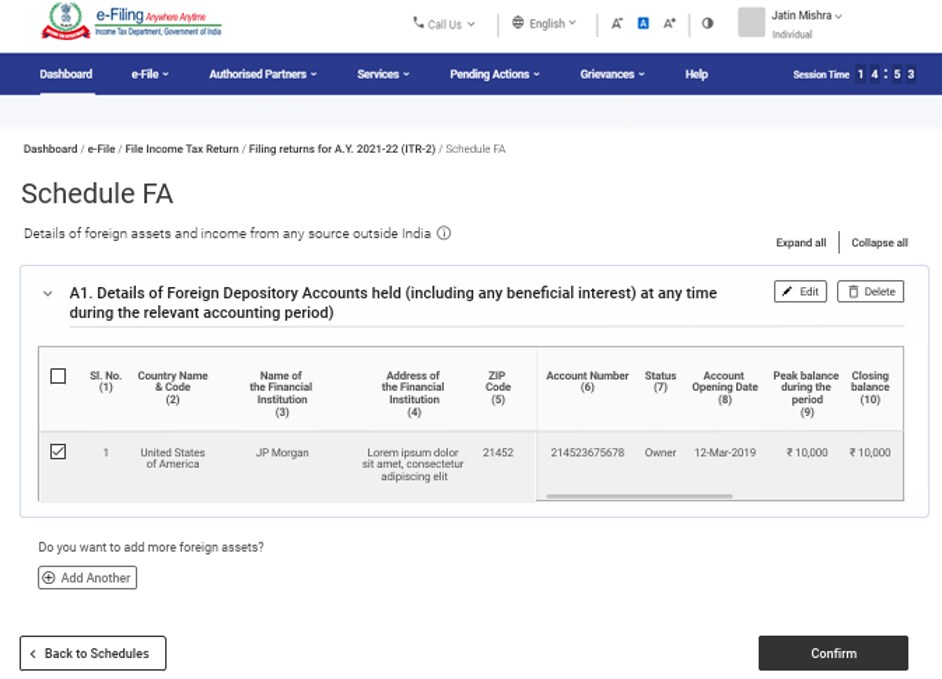

Individuals have to enter details of foreign assets or income from any source outside India. This schedule need not be filled up if you are a Non-Resident or Not Ordinarily Resident.

Source: https://www.incometax.gov.in/

As mentioned by the Income Tax Department the last day for filing Income Tax Return (ITR) for Assessment Year 2023-24 is 31st July 2023.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.