The Income Tax Department of India has started sending timely reminders to tax payers on the last date of filing Income Tax Returns for the financial year 2022-23. The last date to file your IT returns is July 31, 2023.

The Income Tax filing Official portal from the Ministry of Finance, Government of India is designed under the National E-Governance Plan as a Mission Mode Project.

With this portal, the government aims for a single-stream chain for all tax-related services for taxpayers and related stakeholders.

5 Reasons Why You Should File Income Tax Returns

Makes visa processing easier.

Makes loan processing easier.

Acts as a legal document for showing identify and income proof.

Avoid penalties and punishments.

Losses can be Carried Forward

Here's how you can beging thr process of filing your income tax return.

How To Add Details For Income Tax Return Filing?

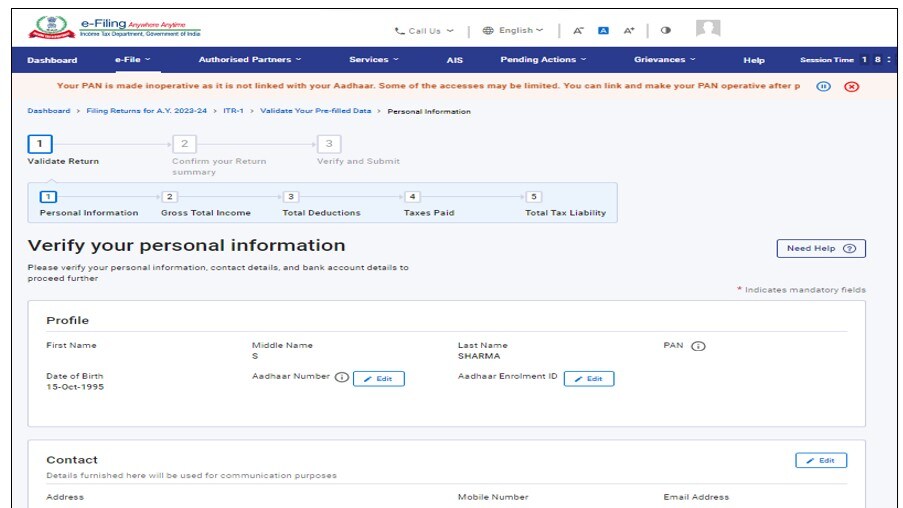

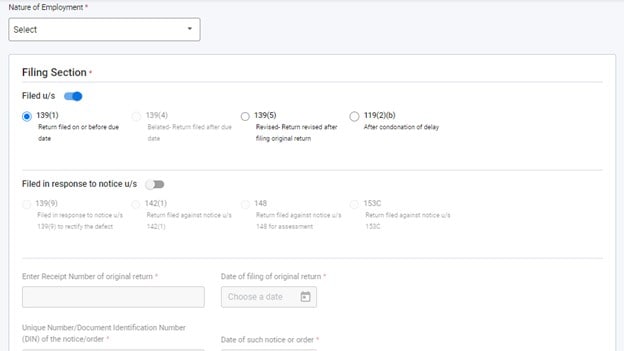

Step 1: Enter all the required Personal Information

(In case of auto-filled data make sure that you validate it)

Source:https://www.incometax.gov.in/

Source:https://www.incometax.gov.in/

Source:https://www.incometax.gov.in/

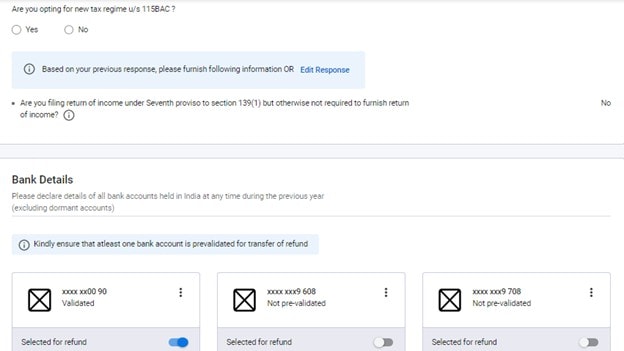

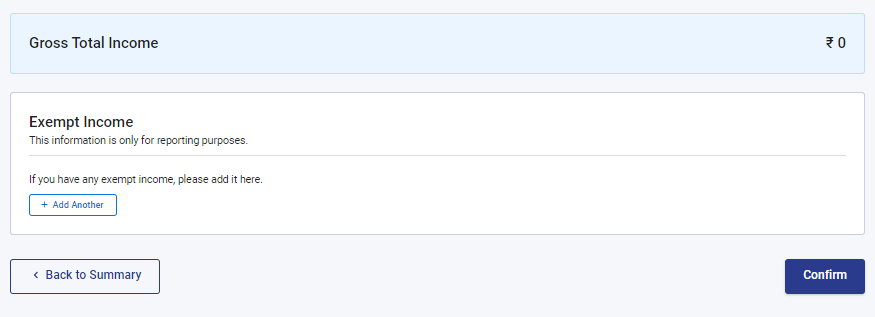

Step 2: Fill in details of your Total Gross Income, confirm pre-filled data, and edit income details as per income source information.

Do not forget to add exempt income details.

Source:https://www.incometax.gov.in/

Source:https://www.incometax.gov.in/

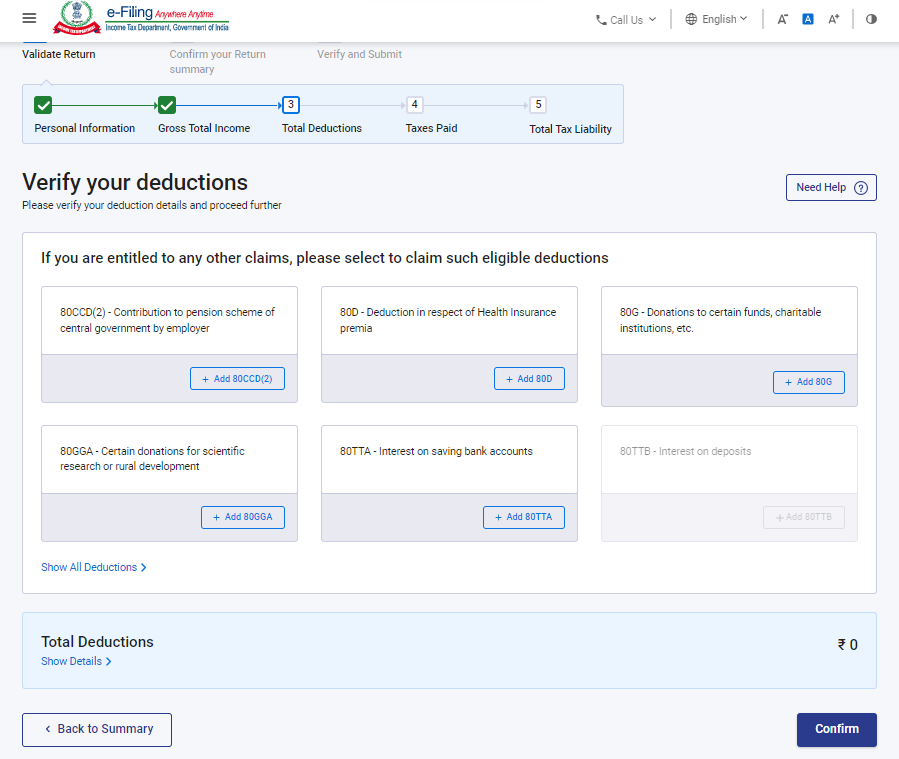

Step 3: In the Total Deductions section, delete, add, and verify deductions applicable for your re-claim under Chapter VI-A under the IT Act.

Source:https://www.incometax.gov.in/

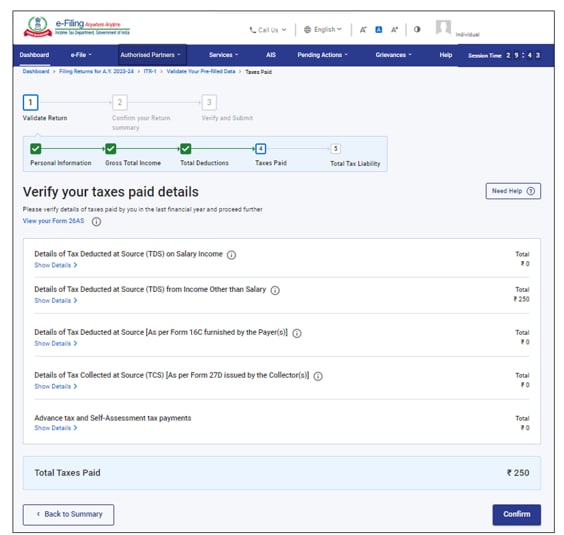

Step 4: In the Tax Paid section, verify and confirm taxes paid in the previous year such as TDS, taxes on other salary sources, advance tax, and self-assessment tax.

Source:https://www.incometax.gov.in/

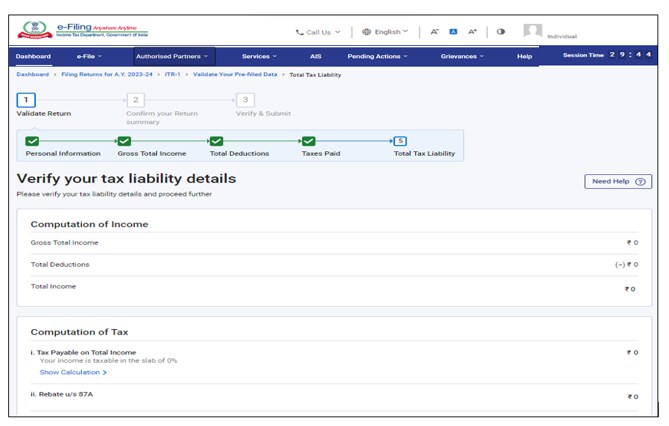

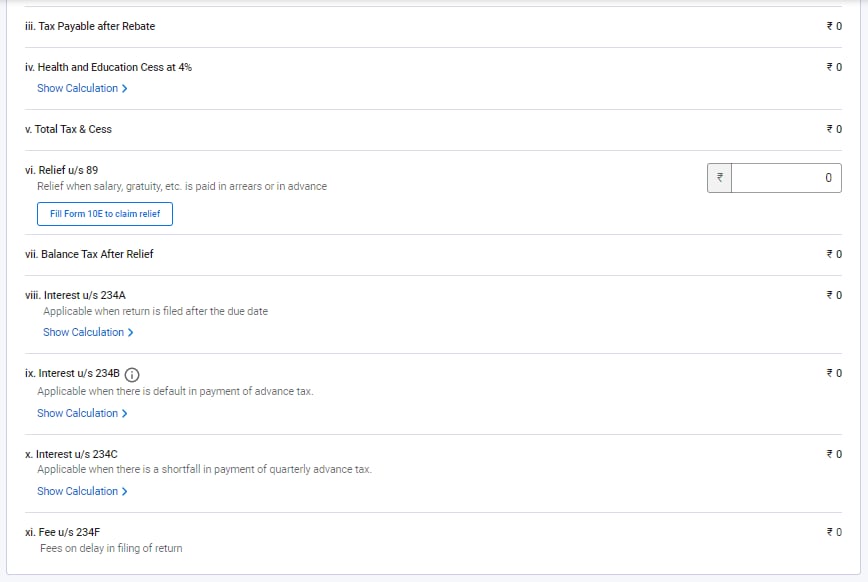

Step 5: In the Total Tax Liability section, review tax liability computed based on the verified sections.

Source:https://www.incometax.gov.in/

Source: Website

https://www.incometax.gov.in/iec/foportal/help/how-to-file-itr1-form-sahaj

Source:https://www.incometax.gov.in/

How To File Income Tax Return?

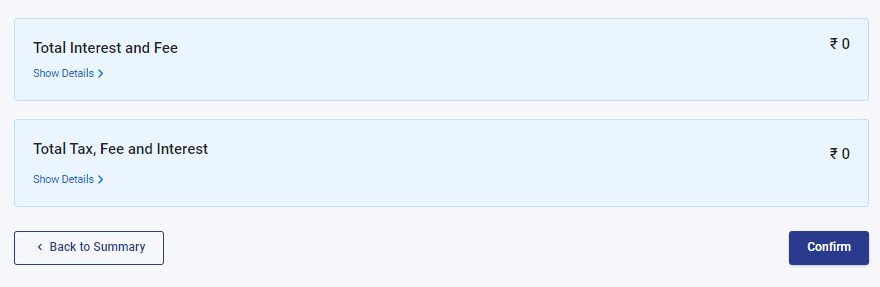

Step 1: Visit the official ITR portal -- https://www.incometax.gov.in/iec/foportal/ and login into it.

Source:https://www.incometax.gov.in/

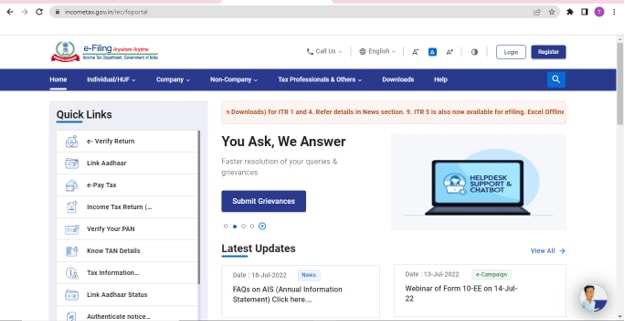

Step 2: Check Dashboard, select e-File, then Income Tax Returns, and then File Income Tax Return.

(Link your PAN-Aadhaar if you have not done so far)

Source:https://www.incometax.gov.in/

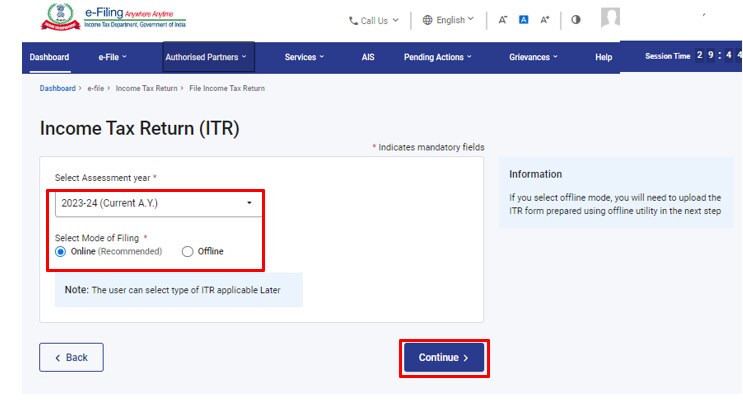

Step 3: Select the Assessment year as 2023-24 and Online filing mode and click on Continue.

Source:https://www.incometax.gov.in/

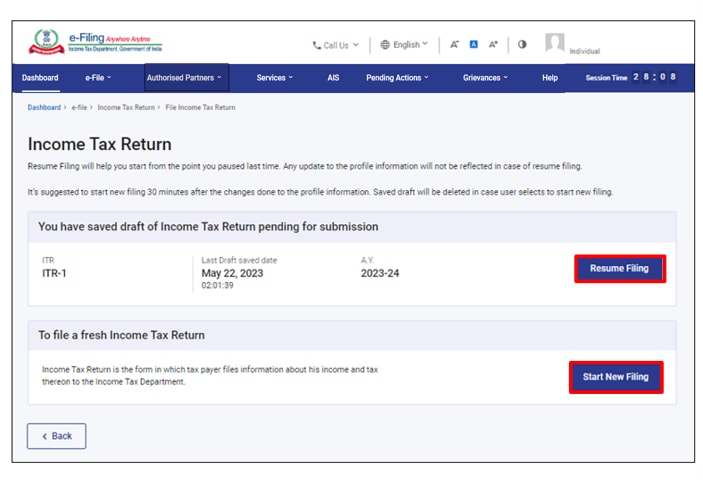

Step 4: Click on Start New Filing if you have not entered any data previously, if you have previously filled data, then click on Resume Filing.

Source:https://www.incometax.gov.in/

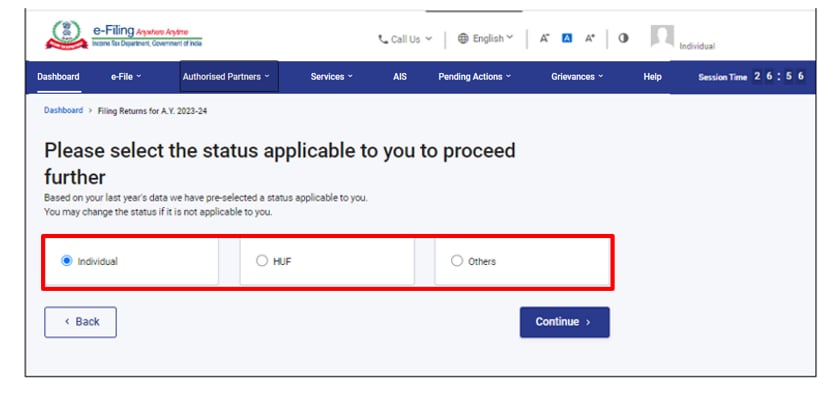

Step 5: Select Status and tap Continue for further process.

Source:https://www.incometax.gov.in/

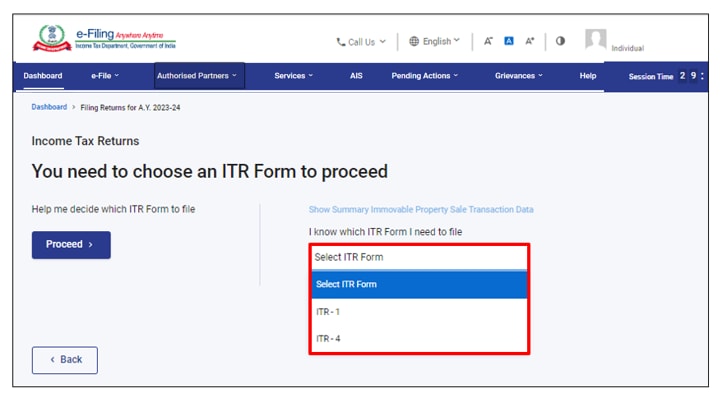

Step 6: If you know which ITR to file, then select the type and proceed.

If you are unclear, then click on Help me decide which ITR Form to file and click on Proceed.

Source:https://www.incometax.gov.in/

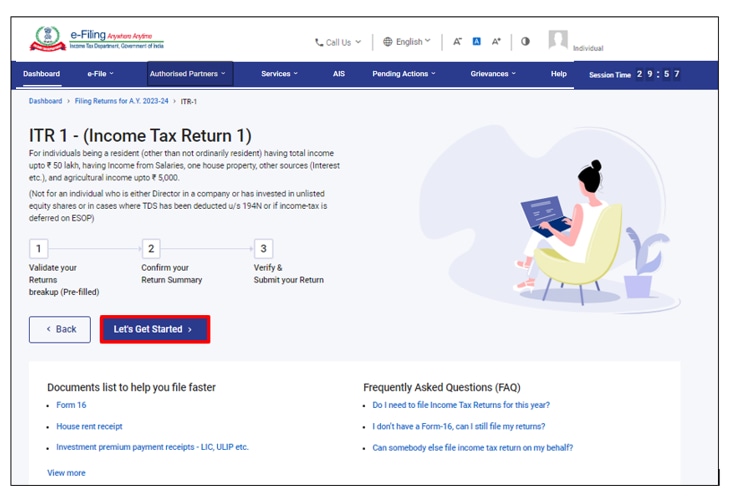

Step 7: Note the list of required documents and click on Let's Get Started.

Source:https://www.incometax.gov.in/

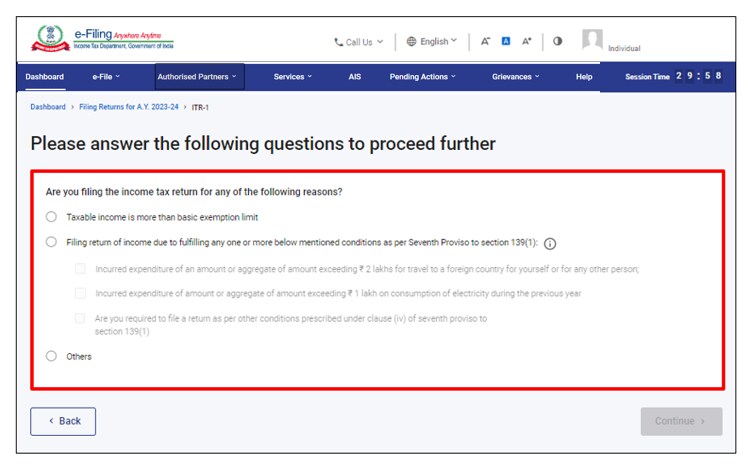

Step 8: Tick the checkbox applicable as per your ITR reasoning and click on Continue.

Source:https://www.incometax.gov.in/

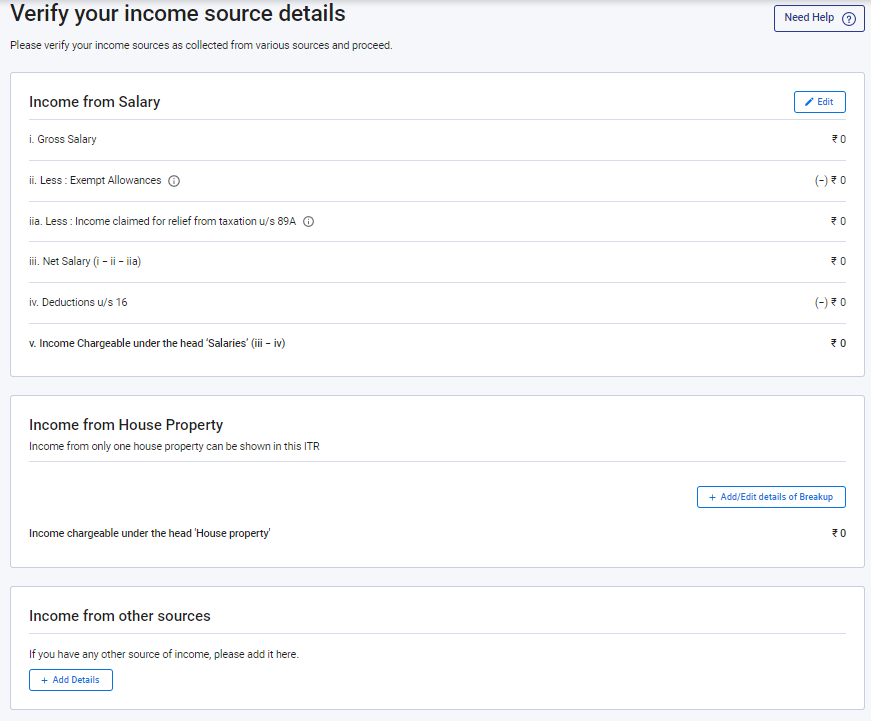

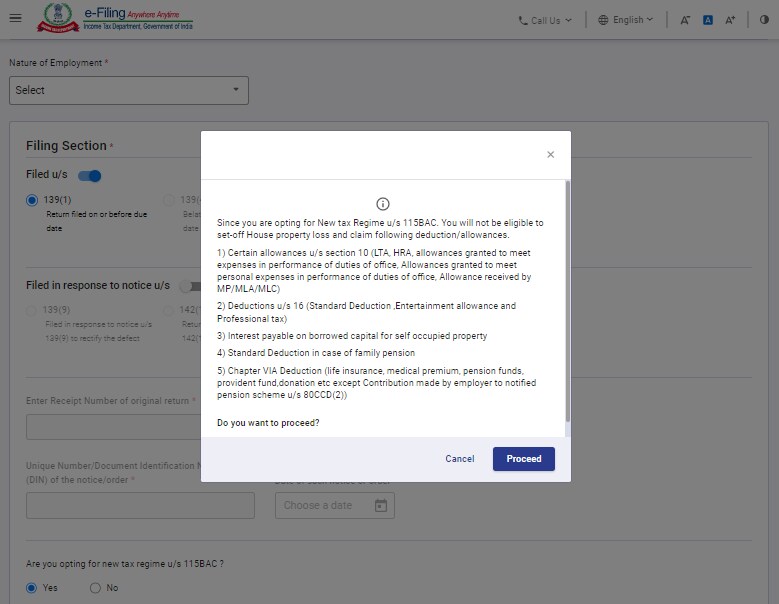

Step 9: In case you go for the New Regime, click on Yes in the Personal Information section and enter the required details

(Note the pop-up information with exemptions and deductions may not be available for the next regime.)

Source:https://www.incometax.gov.in/

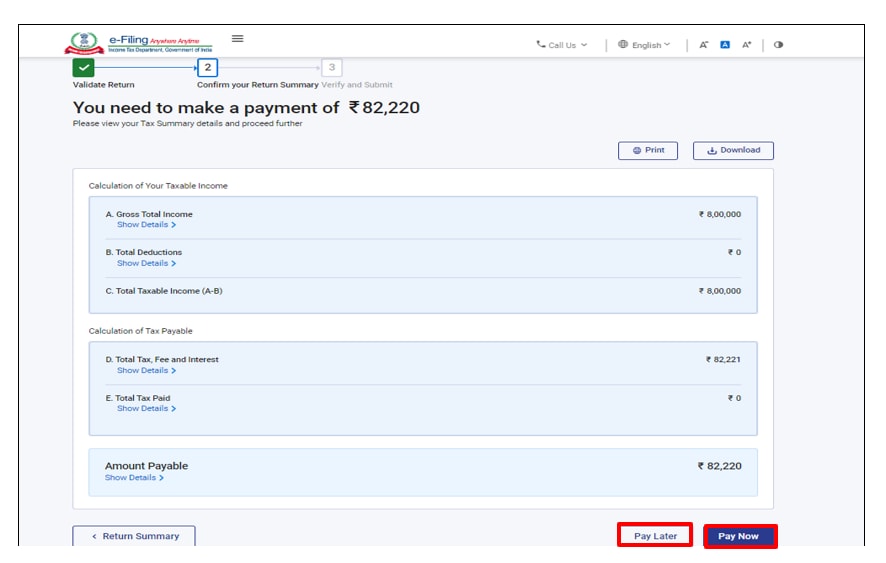

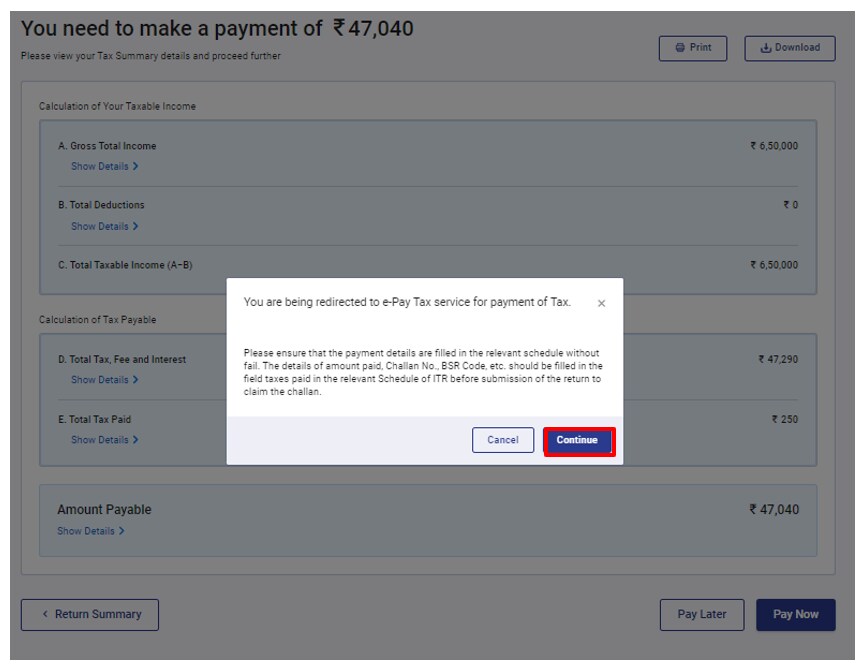

Step 10: Fill in all the details, click on Pay Now, and then on Continue.

Once the payment is done, you will get a message notifying the successful payment and click on the Preview Return button.

Source:https://www.incometax.gov.in/

Step 11: Preview and submit the Return and click on Proceed to Validation.

Step 12: Once validated, next click on Proceed to Verification, and click on Continue

Source:https://www.incometax.gov.in/

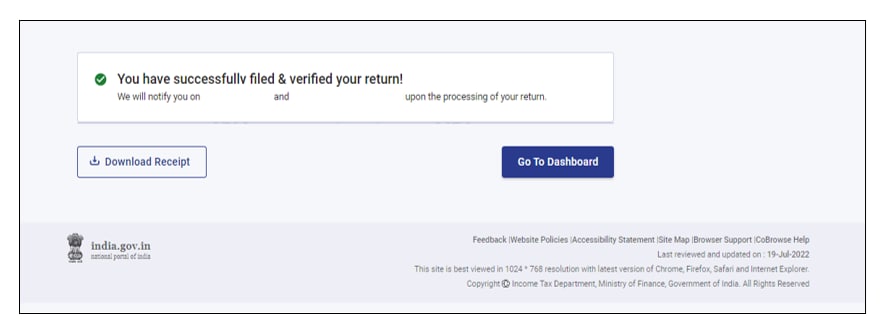

Step 13: Click on the e-Verify Now option to complete the process.

Once this is done, you can download the receipt.

Source:https://www.incometax.gov.in/

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.