- Wipro and LTIMindtree shares fell ahead of June quarter results release after market close

- LTIMindtree expected Q1 net profit of Rs 1,194.1 crore and revenue of Rs 9,855.4 crore

- Wipro estimated Q1 net profit of Rs 3,249.3 crore and total income of Rs 22,078.3 crore

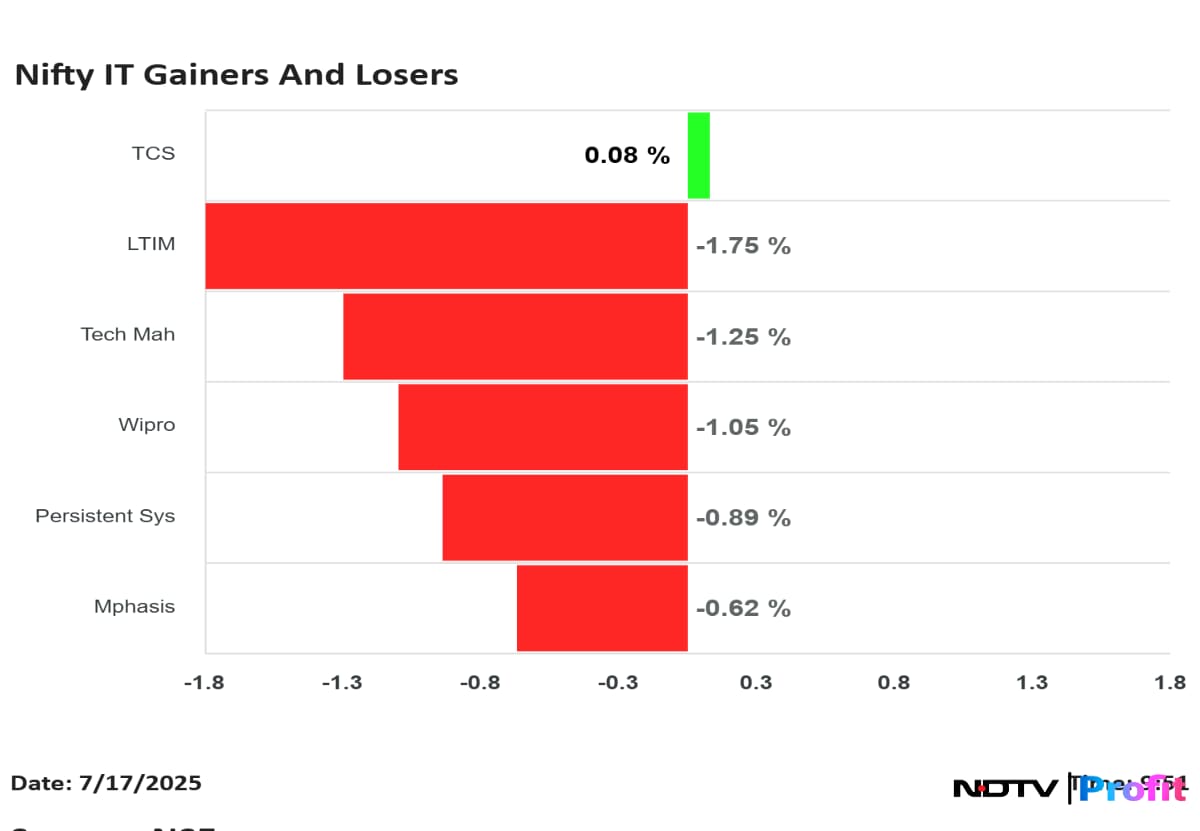

Shares of Wipro Ltd. and LTIMindtree Ltd. traded lower during early trade on Thursday, ahead of their June quarter results.

Both information technology companies are expected to release their first quarter financials after market close in the evening. The benchmark Nifty 50 was down 0.1% while the Nifty IT was down 0.3%.

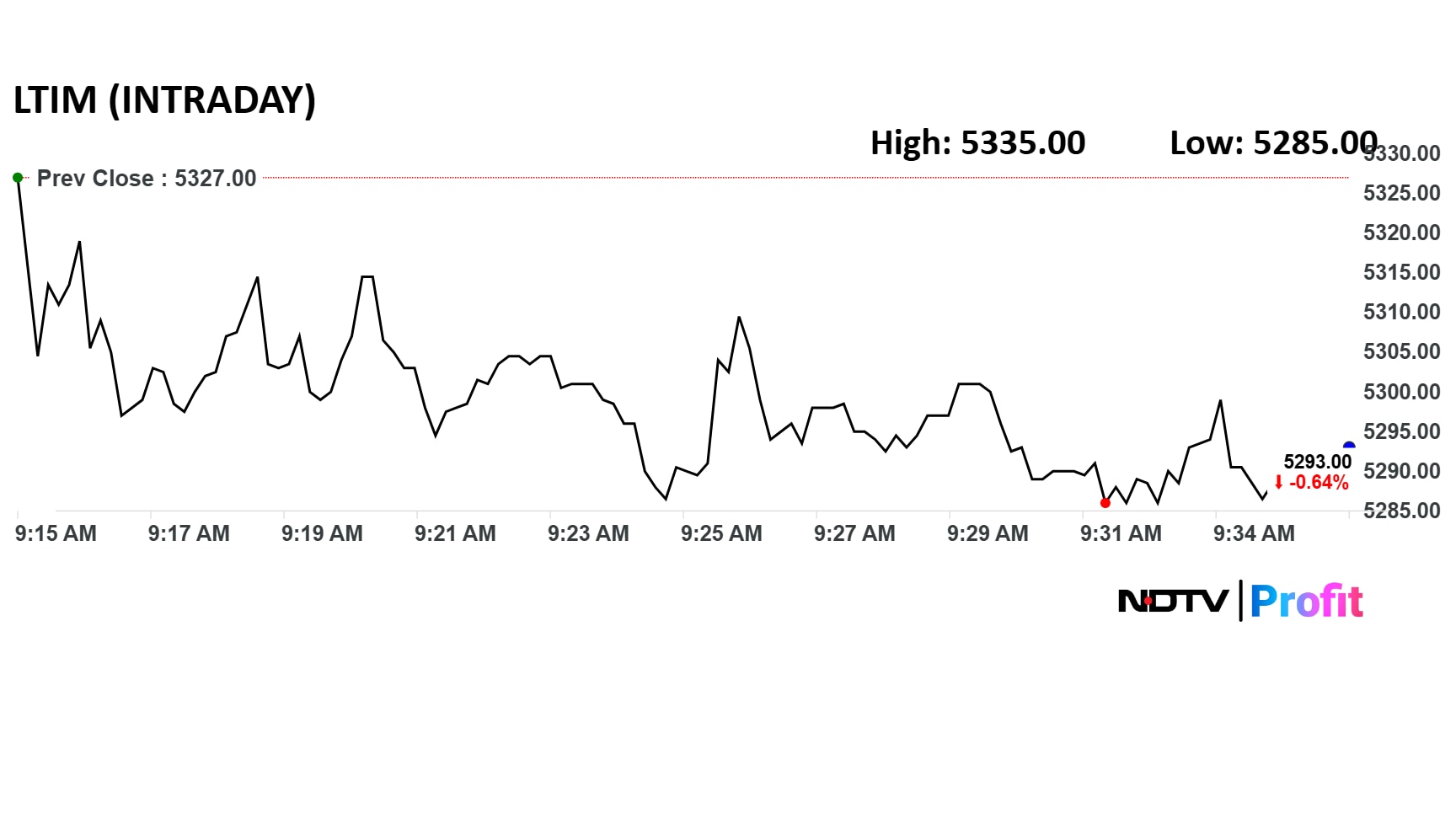

LTIMindtree stock fell as much as 0.8% to Rs 5,285 apiece on the NSE. The relative strength index was 50. The total traded volume had a turnover of Rs 17.58 crore, as per NSE data.

The company is likely to report a net profit of Rs 1,194.1 crore and revenue of Rs 9,855.4 crore for the first quarter, according to estimates. Its EBIT is expected at Rs 1,416 crore, while margin will be at 3%.

LTIMindtree stock fell as much as 0.8% to Rs 5,285 apiece on the NSE.

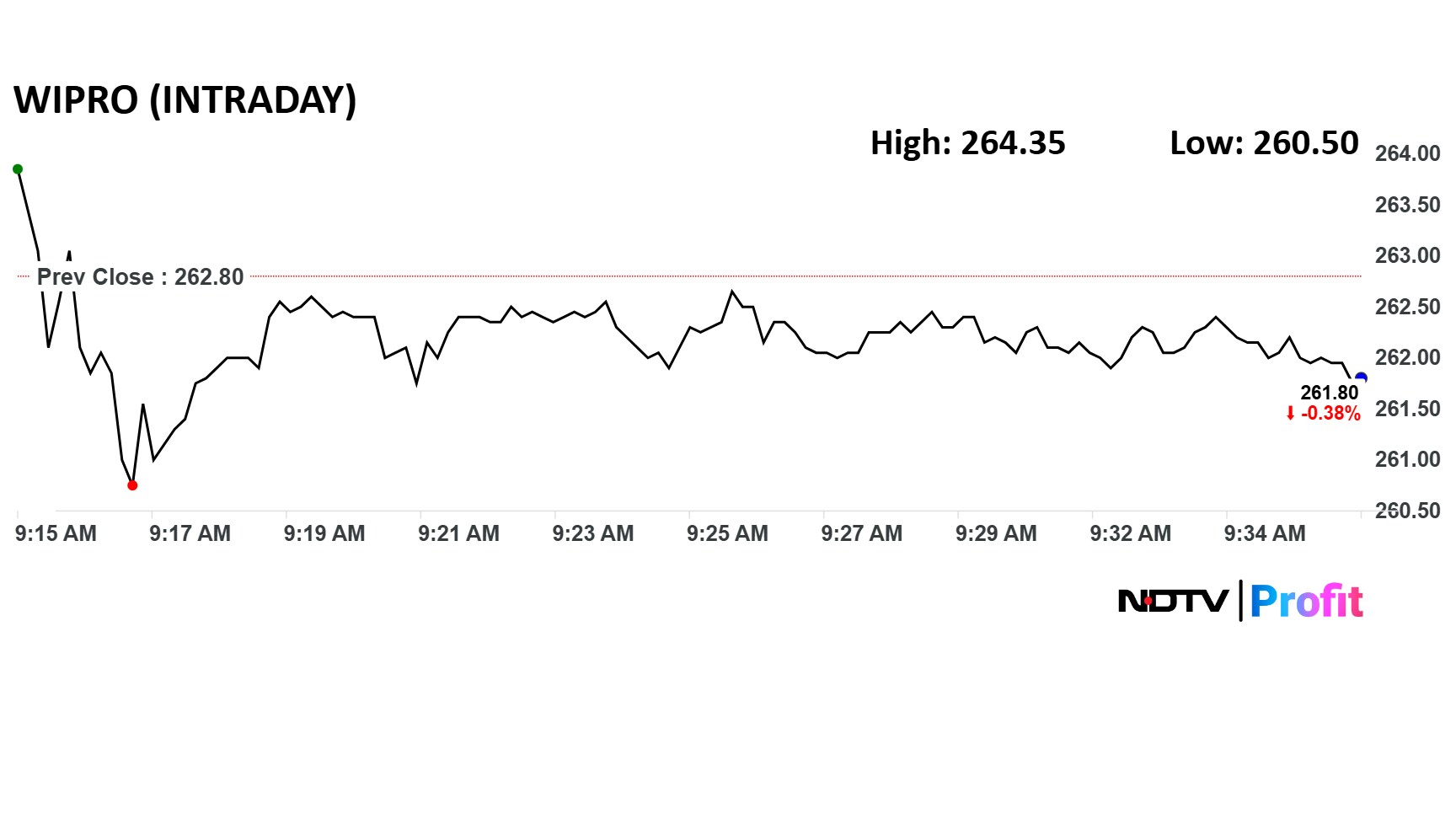

Wipro stock declined as much as 0.9% to Rs 260.5 apiece on the NSE. The relative strength index was 49. The total traded volume had a turnover of Rs 39.51 crore, as per NSE data.

The company is likely to clock a net profit of Rs 3,249.3 crore and total income of Rs 22,078.3 crore for the quarter ended June, according to a survey of analysts' estimates done by Bloomberg. The company is expected to post an EBIT of Rs 3,783 crore, with margin likely to be at 4%.

Wipro stock fell as much as 0.9% to Rs 260.5 apiece on the NSE.

Analysts anticipate a soft quarter for Wipro, driven by persistent weakness in European markets and limited demand recovery. Price sensitivity from clients, headwinds from vendor consolidation, and ongoing project ramp-downs are also expected to weigh on topline growth.

Guidance for the second quarter will be closely watched, with most firms expecting a narrow range of -1.5% to +0.5% sequential revenue growth. Analysts also see potential downside risks to margins due to lower utilisation and limited pricing power in the current environment.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.