The NSE Nifty 50 gave it highest-ever close and formed a bullish candle on the daily frame. Now, it has to continue to hold above the 22,550 to witness an upmove towards 22,750 and 22,900, while on the downside, support exists at 22,500 and 22,400, according to Chandan Taparia, head of technical and derivatives research at Motilal Oswal Financial Services Ltd.

"Volatility has slightly risen after the cool off from the last week but is supporting the buy-on-decline stance in the market," Taparia said.

Bank Nifty has to continue to hold above the 48,250 to extend the momentum for a new life-time high of 49,250 and higher zones, while on the downside, support is seen at 48,250 and 48,000, Taparia said.

Option data suggests a broader trading range in between 22,000 and 23,000 for Nifty 50, according to Taparia. The immediate trading range is between 22,500 and 22,800, he said.

Strong moves were seen in the automobile sector, but Reliance Industries Ltd. was the real star on Monday. Realty, metals and pharma stocks have been gaining consistently for the last few days. Recent underperformance and possible benefits from the Indian Premier League make quick-service restaurants an interesting pocket to research.

The GIFT Nifty was trading 5 points or 0.02% lower at 22,833.00 as of 06:33 a.m.

FII And DII Activity

Overseas investors turned net sellers of Indian equities on Monday after a session of buying.

Foreign portfolio investors offloaded stocks worth Rs 684.7 crore and domestic institutional investors turned net buyers and mopped up equities worth Rs 3,470.5 crore, according to provisional data from the National Stock Exchange.

Markets On Monday

The benchmark indices kicked off the week by surging to a fresh record closing highs on Monday, led by gains in automobile stocks. The market cap of BSE-listed firms crossed the Rs 400 lakh crore mark and the Bank Nifty also recorded the highest closing level of 48,581.7.

The NSE Nifty 50 ended 147.25 points, or 0.65%, higher at 22,660.95, and the S&P BSE Sensex rose 494.28 points, or 0.67%, to close at 74,742.5. Intraday, the Nifty hit an all-time high of 22,697.30, and the Sensex touched a new life-high of 74,869.30.

Shares of Larsen and Toubro Ltd., Mahindra and Mahindra Ltd., Maruti Suzuki India Ltd., NTPC Ltd. and Reliance Industries Ltd. positively contributed to changes in the Nifty.

Adani Ports and Special Economic Zone Ltd., HDFC Bank Ltd., Infosys Ltd., Nestle India Ltd., and Tata Consultancy Services Ltd. weighed the index.

Three of the 20 sectors compiled by BSE Ltd. declined, while 17 advanced.

Major Stocks In News

Axis Bank Ltd.: Bain Capital is looking to sell its entire stake in Axis Bank through a block deal.

Yes Bank Ltd.: The company received Rs 244 crore from a single trust in the Security Receipts Portfolio after the sale of NPA Portfolio to JC Flower ARC in December 2022.

Gland Pharma Ltd: Shareholder Nicomac Machinery and RP Advisory Services plan to sell up to 4.9% stake in the company at a floor price of Rs 1,725 apiece, which represents a discount of 7.34% from current market price.

Top Brokerage Calls

Morgan Stanley On Reliance Industries

Morgan Stanley retains 'overweight' rating on Reliance Industries Ltd. with a target price Rs 3,046 apiece, implying a potential upside of 2.5% from the previous close.

Multiple areas of multiple re-rating will take centre stage.

Investments slow, global fuel demand picks up, long-term concerns unwind.

Potential for re-rating across verticals — new energy, refining, chemicals and telecom.

Net debt and slower capital-expenditure intensity to be supportive of valuations in the current financial year.

New energy investments should be monetised from end the of 2024.

Telecom seen relative underperformance in revenue growth vs Bharti Airtel Ltd.

Estimate O2C Ebitda to reach peak level, chemical Ebitda/ton to rise 3-4% QoQ.

Estimate 11% YoY Ebitda growth in telecom vertical, 11.5million subscriber adds.

Citi on Indian Chemical Sector

Expects most agrochemical producers to report year-on-year revenue decline in Q4, led by global destocking.

Revenue to improve quarter-on-quarter, in part aided by seasonality.

Expect UPL Ltd.'s Q4 revenues to be down about 27% year-on-year.

Ebitda margin for UPL expected to improve to 9% vs nil in Q3 FY24.

Expects SRF Ltd. revenues to be down 8% due to lower refrigerant gas pricing.

Management guidance in PI Industries Ltd. for high teens growth in FY25 could be a positive trigger.

Nuvama Research on Transformers and Rectifiers

Nuvama retains 'buy' with a target price of Rs 575 per share.

Reported 3.5 times profit after tax growth with 18% sales growth 640-basis-point margin expansion.

Order backlog at Rs 2,580 crore and order pipeline at Rs 17,000 crore.

Management guides for revenue of over Rs 2,000 crore and margins of 12.5–13%.

Expects 25% new orders CAGR FY24–27.

Valuations based on 25 times FY27 earnings per share, discounted to FY26.

Global Cues

Markets in the Asia-Pacific region rose despite a rise in US Treasury yields as market participants wait for the CPI print to get fresh cues about the Federal Reserve's rate outlook.

The Nikkei 225 was trading 250.09 points or 0.64% higher at 39,597.13, and the S&P ASX 200 was trading 36.70 points or 0.47% higher at 7,825.80 as of 06:26 a.m.

The world's biggest bond market kicked off the week on the backfoot as geopolitical pressures abated and traders positioned for this week's key inflation data, Bloomberg said.

The S&P 500 index fell 0.04% and Nasdaq Composite rose 0.18% as on Monday. The Dow Jones Industrial Average fell 0.03%.

Brent crude was trading 0.51% higher at $90.84 a barrel. Gold rose 0.07% to $2,340.77 an ounce.

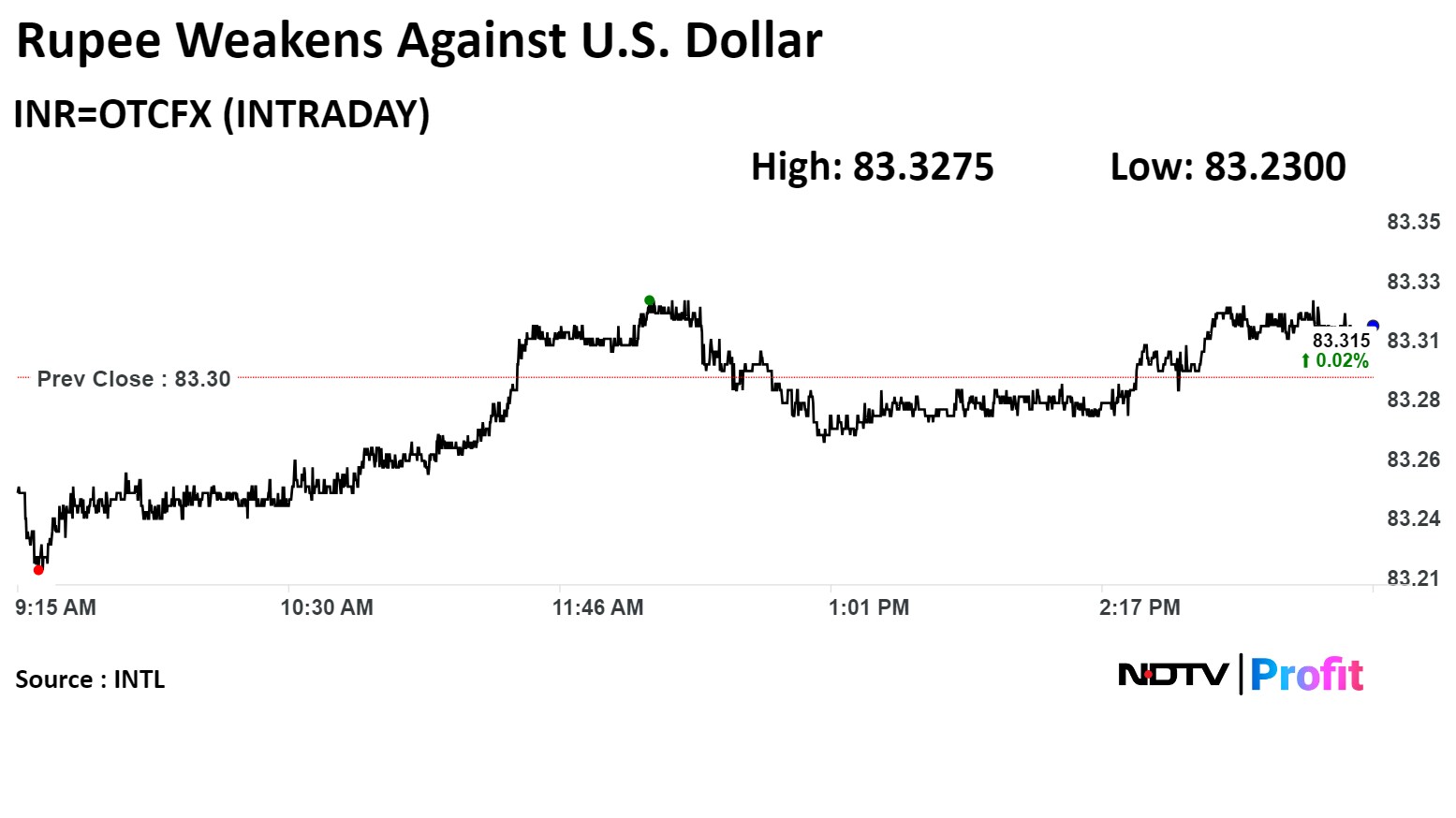

Rupee Update

The Indian rupee closed weaker against the US dollar on Monday, days after the Reserve Bank of India kept its benchmark repo rate unchanged for the seventh time in a row.

The local currency depreciated three paise to close at Rs 83.32 against the greenback. It had closed at Rs 83.29 against the dollar on Friday, according to Bloomberg data.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.