Oil steadied after capping a monthly drop, with traders focused on concerns over a potential glut and geopolitical tensions.

Brent traded near $67 a barrel, while West Texas Intermediate was below $64.Good morning!

The GIFT Nifty was up 0.13% or 32 points at 24,585 as of 6:25 a.m., indicating a positive start for the benchmark Nifty 50.

US and European futures were trading higher. A US federal appeals court rued that President Donald Trump's sweeping trade tariffs were illegal. US markets are closed for the Labor Day holiday.

S&P 500 futures up 0.3%

Euro Stoxx 50 futures up 0.3%

Key Events/Data To Watch

Prime Minister Narendra Modi is in Tianjin, China will attend the SCO Summit, at the invitation of President Xi Jinping. Modi met Xi Jinping on Sunday and is likely to meet Russian President Vladimir Putin and other leaders on the sidelines of the Summit.

S&P Global and HSBC India to release manufacturing PMI for August at 10:30 a.m.

Automobile companies will release the August sales data.

Markets At Home

The benchmark equity indices closed in the red for the third straight session on Friday, dragged down by shares of Reliance Industries Ltd.

The NSE Nifty 50 ended 74.05 points or 0.3% lower at 24,426.85 and the BSE Sensex closed 270.92 points or 0.34% down at 79,809.6. The Nifty fell over 0.39% during the day to 24,404.7, while the Sensex slipped 0.42% to 79,741.76.

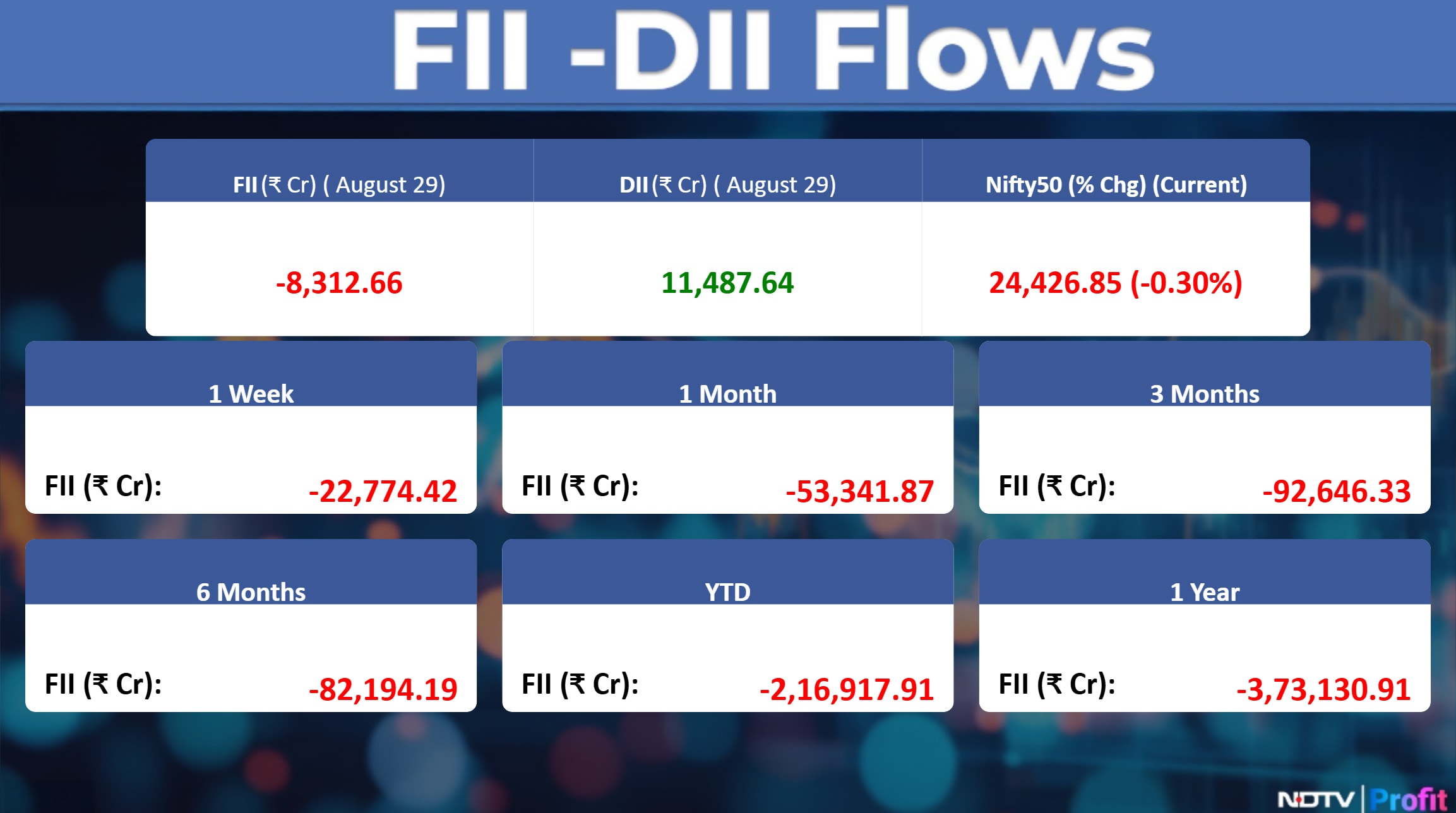

The FPIs sold stocks worth approximately Rs 8,092.9 crore, according to provisional data from the National Stock Exchange. The domestic institutional investors stayed net buyers for the fourth session and bought stake worth Rs 10,925.34 crore.

Wall Street Recap

US stocks retreated from records Friday, spurred by declines in technology companies as investors took profits after the Federal Reserve's preferred measure of underlying inflation remained stubbornly high last month.

The S&P 500 shed 0.6%, falling below the key 6,500 level. The Nasdaq 100 Index lost 1.2%. The Dow Jones Industrial Average fell 0.2%.

Asia Market Update

Asian equities opened lower after a selloff in technology stocks hit Wall Street on Friday, with chip shares among the losers. Indexes in Japan and South Korea opened lower along with Australian stocks.

Chinese stock markets will be in focus after Alibaba Group Holding Ltd. reported a surge in revenue from China's AI boom. However, the country's factory activity remained stuck in contraction in August, Bloonberg reported.

Nikkei down 0.9%

Kospi down 0.45%

S&P/ASX 200 down 0.2%

Hang Seng futures up 0.9%

Commodities Check

Oil steadied after capping a monthly drop, with traders focused on concerns over a potential glut and geopolitical tensions. Brent traded near $67 a barrel, while West Texas Intermediate was below $64.

Gold held just below a record as traders weighed the future of the Federal Reserve and uncertainty around Trump's tariffs ahead of key US jobs data due later this week. Bullion was near $3,445 an ounce in early Asian trading.

Stocks In News

Intellect Design: Debal Dutt resigns as chief marketing officer effective Aug. 31. The company appointed Rajesh Makhija as chief marketing officer effective Sept. 1.

Mangalore Chemicals: The company executed a business transfer agreement with Zuari Agro Chemicals for the purchase of the fertiliser business in Maharashtra.

Kirloskar Industries: Anandh Baheti resigned as the chief financial officer.

Brigade Enterprises: UNIQLO opens its first store in Bengaluru.

Role Rings: The board is to meet on Sept. 3 to consider stock splits & bonus issues.

HG Infra: The company allotted non-convertible debentures worth Rs 400 crore on private placement basis.

Muthoot Microfin: The board is to meet on Sept. 3 to consider raising funds via NCDs.

Fiem Industries: The company resumed production on undamaged floors of a building in Alwar. A fire occurred on Aug. 23 at the company's unit-8 in Alwar.

RBL Bank: The bank approved raising funds worth up to Rs 3,500 crore via qualified institutional placement and Rs 3000 crore via debt securities.

Federal Bank: The bank re-appointed Harsh Dugar as executive director and appointed Venkatraman Venkateswaran as an executive director.

Bandhan Bank: RBI imposes monetary penalty of Rs 44.7 lakh on the bank.

Epack Durable: The company made an investment of Rs 10 crore in arm EPACK manufacturing technologies.

Easy Trip: The company appointed Vikas Bansal as a whole-time director for five years.

Rites: The company received a letter of award worth Rs 25.3 crore for Biennial MGR mega contract from NTPC Ltd..

BLS International: Arm BLS International FZE subscribes to 100% stake of BLS consular services.

Hindustan Copper: The board is to meet on Sept. 25 to consider raising up to Rs 500 crore via NCDs.

Ceinsys Tech: Samir Sabharwal resigned as CFO effective Sept. 15.

GOCL CORP: The company to acquire Hinduja National Power's thermal power operations near Visakhapatnam.

Emami: The company re-appointed Mohan Goenka as a vice-chairman and whole-time director and Sushil Kumar Goenka as whole-time director.

Emcure Pharma: The company re-appointed Mukund Gurjar as Whole-Time Director.

Panorama Studios: Arm in an agreement with the Tweak India Ink to exploit airborne rights of the program ‘Tweak India -The Icons With Twinkle Khanna'.

Sterlite Tech: US arm faces $96.5 million jury verdict in Prysmian Litigation.

Enviro Infra: The company appointed Sanjay Jain as chairman and whole-time director.

NHPC: The company revised borrowing plan for raising up to Rs 10,000 crore via NCDs on private placement basis.

Zydus Wellness: The company's arm acquired UK-based firm Comfort Click for GBP 239 million.

RVNL: Chairman and managing director Pradeep Gaur to Superannuate from the Services on Aug. 31.

Bajaj Finserv: The company incorporated Wholly Owned arm Bajaj alternate investment management.

PNB Housing Finance: The board is to meet on Sept. 5 to consider raising funds worth up to Rs 5,000 crore via NCDs.

Popular Vehicles And Services: The company received in-principle approval from Maruti Suzuki India Ltd. to acquire an existing authorized dealership in the state of Telangana.

Aditya Birla Capital: Made an investment of Rs. 250 crore in the equity of Aditya Birla Housing Finance on a rights basis.

Salasar Techno : The audit committee appointed Alok Kumar as whole-time director for five years commencing Sept. 1. Alok Kumar was also elected as chairman of the board.

Tech Mahindra: The firm voluntarily liquidated its wholly owned subsidiary, Tech Mahindra Technology Services.

MTNL : NSE and BSE imposed fines amounting to Rs. 6,73,780 (inclusive of Rs. 5,71,000 basic fines and Rs. 1,02,780 GST).

Adani Power : Received supply order for a new 800 MW thermal project in Anuppur, Madhya Pradesh. To invest Rs. 10,500 crore in the project; emerged as successful bidder with final tariff of Rs. 5.838/kWh.

Indoco Remedies : Entered a pact to sell some properties worth Rs. 24.7 crore.

Mishra Dhatu: BSE and NSE imposed fines of Rs. 6,78,500 each (inclusive of goods and services tax) for first quarter fiscal 2026 non-compliance.

PG Electroplast: Company arm Next Generation Manufacturers signed a memorandum of understanding with Maharashtra to invest Rs. 1,000 crore in a greenfield project at Ahilyanagar.

Apollo Tyres: Tax Tribunal rules in favour of the company for a sum involving Rs. 302 crore.

Shipping Corporation of India: Received penalty of Rs. 10.9 lakh each from BSE and NSE for non-compliance during first quarter fiscal 2026.

HEG : Its arm TACC signed a technical collaboration agreement with Ceylon Graphene Technologies and an agreement to accelerate commercialisation and large-scale adoption of graphene and its derivatives.

Nitin Spinners : The firm acquired 1.7 crore shares, or a 7% stake, in CGE II Hybrid Energy Private.

Torrent Power : Received Letter of Award for development of 1,600 MW coal-based power plant in Madhya Pradesh from MPPMCL. Project cost stands at nearly Rs. 22,000 crore.

Electronics Mart : Commenced commercial operations of a new multi-brand store under the brand name Electronics Mart in Gurugram.

Gujarat Industries Power : Gujarat government approved proposal to establish 700–750 MW lignite-based power plant at Valia; GUVNL's Board approved procurement of power from the proposed 700 MW plant for 25 years.

Oriental Rail Infrastructure : Received orders worth Rs. 3.4 crore from Integral Coach Factory, Chennai, for supply and installation of 38 sets of one coach set of seats and berth complete.

Neuland Labs : Commenced commercial production of additional capacity under expansion plan at Unit 3 in Telangana.

Balmer Lawrie : BSE imposed total fine of Rs. 11.9 lakh for non-compliance of regulations in first quarter fiscal 2026.

BEML : Received order worth Rs. 80 crore for supply of utility track vehicles from Indian Railways.

The Indian Hume Pipe Company : Income Tax Commissioner passed an order in favour of the company; tax and interest demand of Rs. 93.4 crore for assessment year 2023 reduced to nil.

SBI : Surender Rana, DMD - Retail-Agri And SME, superannuated from services effective Aug. 31; Rajesh Kumar entrusted with responsibility as DMD - Retail-Agri and SME effective Sept. 1.

Precision Camshafts : Firm approves initiation of insolvency proceedings of arm MFT Motoren und Fahrzeugtechnik GmbH, Germany.

Hindustan Copper: BSE and NSE imposed fines of Rs. 9.8 lakh each due to non-compliance of regulation.

DOMS Industries: To acquire additional 13% stake in Pioneer Stationery for Rs 5.5 crore.

Ola Electric:To hold multiple investor meets over Sept.3 to Sept.12.

Welspun Speciality: Received clearance from Gujarat Pollution Control Board to continue its operations in plant located in Bharuch, Gujarat.

AB Capital: To invest Rs 250 crore in Aditya Birla Housing Finance to fund its growth and improve its leverage ratio.

Hubtown: To issue shares worth Rs 500.6 crore at Rs 341/share from 101 investors. List of allottees includes few renowned institutions like Abakkus Diversified Alpha Fund, Swyom India Alpha Fund, Aryabhata Global Assets Funds ICAV- Aryabhata India, Sharad Mittal and others.

Laxmi India Finance: To expand its branch network by opening 28 branches across the states where it currently has an operational presence.

Time Technoplast: To hold multiple investor meets over Sept. 3 to Sept. 4.

Allied Blenders: Considering to challenge the Order dated July 16, 2025 passed by The Division Bench of the Bombay High Court, which says that Allied Blenders shall continue the current status of non-introduction of its products in India under the impugned marks “MANSION HOUSE” and “SAVOY CLUB” till decision of the said suit.

Thomas Cook: Thomas Cook India & SOTC Travel ink long-term strategic MOU with Queensland Tourism

NCC: Received two orders during the month of August 2025, totaling Rs. 788 crore pertaining to the Water Division of the company.

Neogen Chemical: To form a joint venture with Morita Chemicals Industries. Joint venture to utilise the technological and manufacturing capabilities of both organisations and to utilise these synergies to participate in the rapidly growing LithiumIon Battery business.

Dharan Infra EPC: Received work contracts of an aggregate value of approximately Rs 1171.21 crore from Skymax Infra Power Ltd. A significant portion of the contract scope—approximately 80% of the total value—relates to international procurement of plant and machinery, which will be undertaken through the company's subsidiary entities.

GHCL: Securities And Exchange Board of India passed an order restraining Anurag Dalmia, non-executive chairman of GHCL and GHCL Textiles Ltd., from accessing or dealing in securities markets for a period of 18 months and imposing a monetary penalty of Rs 20 lakh.

EPACK Durable: Search proceedings by Uttarakhand tax authority at Dehradun concluded yesterday. No allegation has been proved during the search. Tax authority seized two units of goods, tree units of registers for general reference purpose

Nazara Tech: Terminates pact to acquire Moonshine Tech for Rs 15.9 crore due to online gaming bill.

IPO Offering

Anlon Healthcare: Anlon Healthcare is a chemical manufacturing company engaged in manufacturing Pharma Intermediates and active pharmaceutical ingredients. The public issue was subscribed to 7.13 times on day 3. The bids were led by Qualified institutional investors (1.07 times), non-institutional investors (10.61 times), retail investors (47.3 times)

Vikran Engineering: Vikran Engineering is an engineering, procurement, and construction company. The company's projects include underground water distribution and surface water extraction, overhead tanks, and distribution networks. The public issue was subscribed to 2.59 times on day 3. The bids were led by Qualified institutional investors (19.45 times), non-institutional investors (58.58 times), retail investors (10.97 times).

Amanta Healthcare: The company will offer shares for bidding on Monday. Amanta Healthcare is a pharmaceutical company that specializes in the development, manufacturing, and marketing of a diverse array of sterile liquid products. The company is also a manufacturer of medical devices. The price band is set from Rs 120 to Rs 126 per share. The Rs 126-crore IPO is entirely a fresh issue.

Bulk Deals

Advanced Enzyme Tech: Polunin Emerging Markets Small Cap Fund LLC bought 12.5 lakh shares (1.11%) at Rs 353.5 apiece.

Insider Trade

MTAR Technologies: Promoter Akepati Manogna sold 1,118 shares on Aug. 25.

Paushak: Promoter Chirayu Ramanbhai Amin HUF bought 4,509 shares on Aug. 26.

Paisalo Digital: Promoter Equilibrated Venture Cflow bought 6.56 lakh shares Aug. 29.

Trading Tweaks

Ex-Dividend: Triveni Turbine, Triveni Engineering and Industries, Alivus Life Sciences.

Shares to exit anchor Lock-In: Premier Energies (41%)

List of securities to be excluded from ASM Framework: Signpost India.

List of securities shortlisted in Long-Term ASM Framework Stage – I: Elgi Rubber Company.

List of securities to be excluded from ASM Framework: Garden Reach Shipbuilders & Engineers, Lotus Eye Hospital and Institute.

Price Band change from 10% to 20%: Jeena Sikho Lifecare, Stallion India Fluorochemicals.

Price Band change from 20% to 10%: Elgi Rubber Company, Lotus Eye Hospital and Institute.

F&O Cues

Nifty September Futures down by 0.3% to 24,577 at a premium of 151 points.

Nifty September futures open interest up by 3.64%.

Nifty Options 2 September Expiry: Maximum Call open interest at 25000 and Maximum Put open interest at 23,500.

Securities in Ban Period: Nil

Currency/Bond Update

The rupee ended 58 paise to record closing low of 88.21 against US dollar. It fell as much as 68 paise to a record low of 88.31. The yield on the 10-year bond, went up four basis points to close at 6.57%.

Disclaimer: NDTV is a subsidiary of AMG Media Networks Limited, an Adani Group Company.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.