Indian bonds slumped on Friday after stronger-than-expected economic data dampened hopes of near-term interest rate cuts by the Reserve Bank of India.

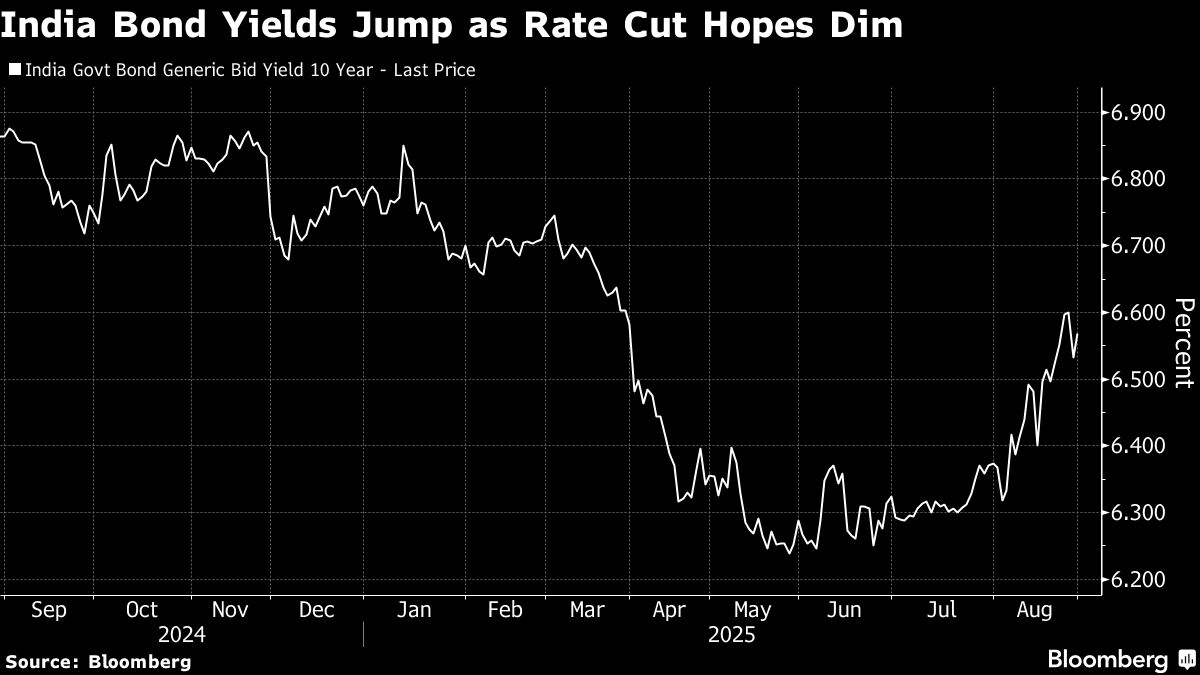

The benchmark 10-year bond yield jumped as much as 11 basis points to 6.64% before trimming gains. Sentiment also soured after the RBI accepted bids at higher-than-expected yields at a bond sale, signaling weaker demand from investors.

The sharp selloff underscores growing concern among traders that faster economic growth could reduce the urgency for the central bank to ease monetary policy further. Higher yields also risk pushing up borrowing costs for Indian businesses, and may dilute the impact of the 100 basis points of rate cuts delivered between February and June.

“The data certainly seems extremely strong and that pushes back rate cut expectations by at least a quarter,” said Rajeev Pawar, head of treasury at Ujjivan Small Finance Bank.

The 10-year yield could “definitely revisit” the 6.60-6.65% level in the near term, he added.

Bond yields had already been drifting higher ahead of the GDP data release, with traders disappointed by an apparent lack of action by the central bank in cooling the recent spike. The 10-year yield has climbed as much as 26 basis points since Aug. 14.

Traders were expecting the RBI to either cancel Friday's auction or ask bond underwriters to step in and buy some of the securities at the sale, Puneet Pal, head of fixed income at PGIM India Asset Management. Such a move would typically indicate the central bank's discomfort with higher yields demanded by investors.

The “market got a bit disappointed on lack of any yield signal from the RBI,” he said.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.