- Brent crude traded near $68, remaining in the $65-$70 range for a month

- India defended its Russian crude imports against US pressure

- Ukraine increased attacks on Russian oil refineries over the weekend

Oil climbed within its recent narrow band as traders focused on geopolitical risks ahead of a glut that's expected to form in the coming months.

Brent traded near $68, staying in the $65-to-$70 range it's been in for the last month. Monday's trading is likely to be thin due to the Labor Day holiday in the US.

India rebutted mounting US pressure to end crude imports from Russia, with the country's oil minister saying the purchases helped shield the global economy from price spikes. Ukraine struck more Russian refineries over the weekend as it ramps up its attacks on the country's infrastructure.

The global oil benchmark has shed about 10% this year, hurt by a deluge of additional supply from OPEC+, as well as concerns that the US-led trade war will crimp energy demand. In the nearer-term, US inventories declined last week, while the OPEC+ producer group is scheduled to hold a virtual meeting on Sept. 7 to discuss its next supply move.

“As we exit summer and demand drops, the market surplus should swell in 4Q25 and 1Q26,” HSBC analysts including Kim Fustier said. “But the key question is where stockbuilds will turn up. If China continues to absorb excess oil volumes via its strategic reserves, as it did in 2Q, stockbuilds in the OECD could be muted.”

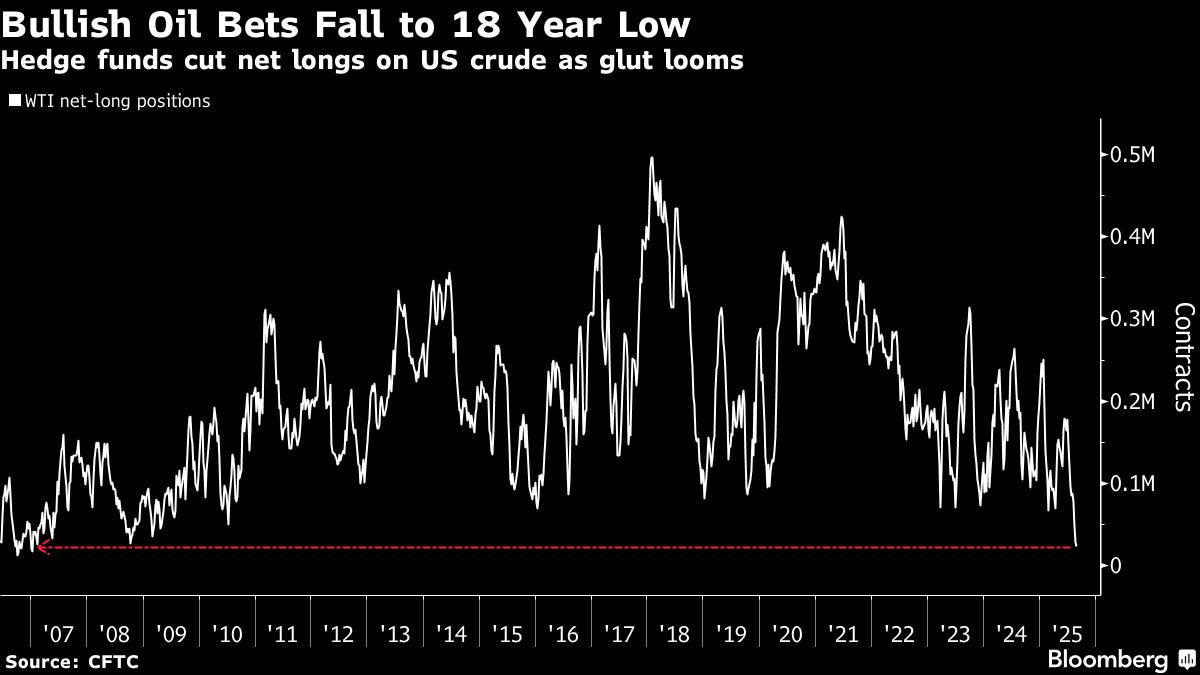

In the US, hedge funds winnowed their bullish position on US crude to the lowest in about 18 years as uncertainty over economic policy compounded growing concerns about oversupply. In contrast, outright wagers on higher Brent prices rose by the most since early July last week, after the difference in value between the two benchmarks widened recently.

Prices:

Brent for November settlement was up 1.2% to $68.29 a barrel at 8:57 a.m. in New York.

Most-active Brent prices dropped more than 6% last month.

WTI for October delivery added 1.2% to $64.80 a barrel.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.