Good morning!

The GIFT Nifty was down 0.01% at 24,862as of 07:00 a.m., signaling a muted start to Indian markets today.

Following Wall Street's biggest rally in over two weeks, Asian shares opened higher, spurred by a rebound in US consumer confidence and a global bond surge.

Tuesday's rebound interrupted a "Sell America" trend in the markets, particularly affecting the dollar after President Trump's tariff war and tax cuts raised concerns about the US fiscal deficit.

In Japan, investors are closely watching Wednesday's key bond sale. The Ministry of Finance's debt sale occurs amid rising long-term borrowing costs in major economies, including the US Japan's yields, especially in the super-long sector, have been increasing as the Bank of Japan reduces its bond purchases.

Watch NDTV Profit Live

Markets On The Home Turf

The benchmark equity indices closed lower on Tuesday, reversing its two-day gains amid volatility in domestic markets.

The NSE Nifty 50 closed 174.95 points or 0.70% lower at 24,826.20 and the BSE Sensex ended 624.82 points or 0.76% down at 81,551.63. During the day, the Nifty fell 1.19% to 24,704.10, while the Sensex dropped 1.28% to 81,121.70.

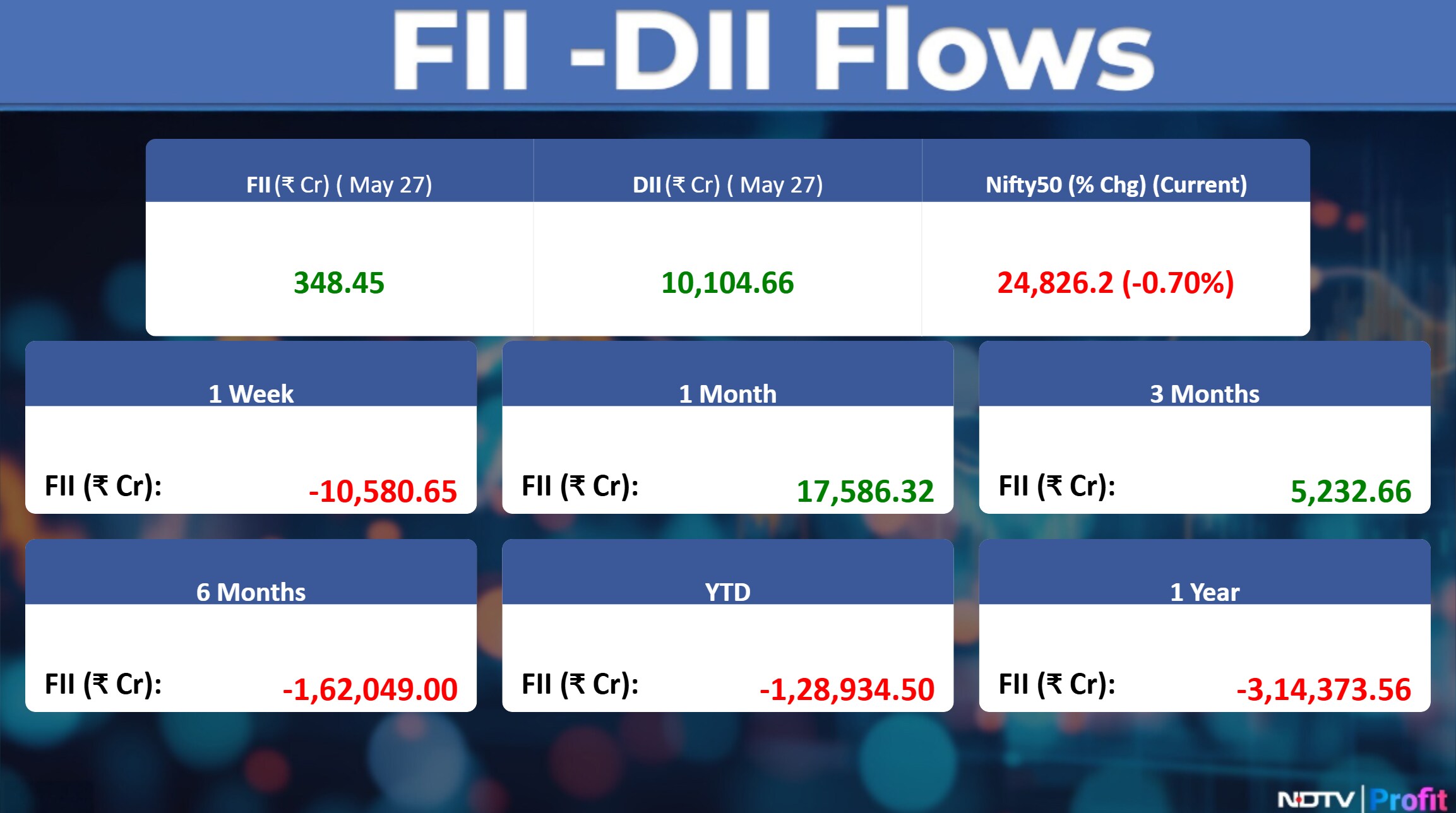

Foreign portfolio investors mopped up stocks worth Rs 348.45 crore, according to the provisional data from the National Stock Exchange.

Domestic institutional investors stayed net buyers for the sixth straight day as they bought equities worth Rs 10,104.66 crore, the data showed.

The FPIs had bought shares worth Rs 136 crore on Monday.

Here's everything that could influence Indian equities today:

Asian Markets Update

S&P 500 futures rose marginally.

Hang Seng index futures were up 0.51%.

Futures for the Nikkei 225 on the Osaka Exchange fell 0.79%.

Japan's Topix index advanced 0.44%.

Australia's S&P/ASX 200 index rose 0.37%.

Euro Stoxx 50 futures were marginally down.

Commodity Check

West Texas Intermediate crude advanced 0.74% to trade at $61.34 per barrel.

Spot gold advanced by 0.11% to $3,304.50 per ounce.

London Metal Exchange

Copper fell 0.14%, erasing gains.

Nickel was down 1.19%, reversing upward trend.

Aluminium was up 0.97%, extending gains.

Zinc was up 0.15%, extending three-day gains.

Lead fell 0.28%, reversing advances.

US Market Updates

Wall Street saw a rally fueled by rebounding consumer confidence and accelerated trade discussions between the Ux and the European Union. The S&P 500 increased by 2%, halting a four-day decline in equities.

President Trump expressed optimism regarding the EU's expedited trade negotiations, following his previous statement about potentially imposing 50% tariffs if a deal with the US was not reached. After a discussion with European Commission President Ursula von der Leyen, Trump extended the deadline for these tariffs to July 9.

The dollar strengthened against all developed-market currencies, while the Nasdaq 100 rose by 2.4%, and the Dow Jones Industrial Average increased by 1.8%.

Key Events And Data To Watch

The government is set to release industrial production data for the month of April. A Bloomberg survey projects the Index Of Industrial Production to rise by 0.9% compared to 3% growth in March.

Earnings To Watch

3M India

Avanti Feeds

Bata India

Birlasoft

Cummins India

Deepak Nitrite

Elgi Equipments

EMS

FDC

Finolex Cables

Granules India

HeidelbergCement India

Hinduja Global Solutions

Hindustan Oil Exploration Company

IFB Industries

Insecticides (India)

Ion Exchange India

Indian Railway Catering And Tourism Corp.

Jindal Worldwide

JSW Holdings

Juniper Hotels

Mishra Dhatu Nigam

Mahanagar Telephone Nigam

Natco Pharma

National Fertilizers

Nuvama Wealth Management

Polyplex Corporation

Som Distilleries & Breweries

Steel Authority of India

Suprajit Engineering

Tarsons Products

TVS Supply Chain Solutions

Welspun Corp.

Earnings Post Market Hours

LIC Q4 Highlights (Consolidated, YoY)

Net premium income down 3.2% to Rs 1.48 lakh crore versus Rs 1.53 lakh crore.

Net profit up 38% to Rs 19,038.7 crore versus Rs 13,781.6 crore. (Bloomberg estimate: Rs 12,395 crore).

Solvency ratio at 2.11% versus 1.98%.

Annual premium equivalent down 11% to Rs 18,853 crore versus Rs 21,180 crore.

JK Lakshmi Cement Q4 Highlights (Consolidated, YoY)

Revenue up 6.6% to Rs 1,897.62 crore versus Rs 1,780.85 crore.

Ebitda up 4% to Rs 351.20 crore versus Rs 336.52 crore.

Margin at 18.5% versus 18.9%.

Net Profit up 17% to Rs 183.54 crore versus Rs 157.01 crore.

Precision Camshafts Q4 Highlights (Consolidated, YoY)

Revenue down 25.7% to Rs 190 crore versus Rs 256 crore.

Ebitda up 18.3% to Rs 25.6 crore versus Rs 21.7 crore.

Margin at 13.5% versus 8.5%.

Net Profit to Rs 40.44 crore versus Rs 3.34 crore.

Goodyear India Ltd Q4 Highlights (YoY)

Revenue up 9.5% to Rs 602.70 crore versus Rs 550.53 crore.

Ebitda up at Rs 17.34 crore versus Rs 5.38 crore.

Margin at 2.9% versus 1.0%.

Net Profit of Rs 4.87 crore versus loss of Rs 4.21 crore.

Bharat Dynamics Q4 Highlights (YoY)

Revenue up 112.2% to Rs 1,800.54 crore versus Rs 848.56 crore.

Ebitda up 4% to Rs 322.53 crore versus Rs 310.84 crore.

Margin at 17.9% versus 36.6%.

Net Profit down 6% to Rs 272.77 crore versus Rs 288.77 crore.

EID Parry Q4 Highlights (Consolidated, YoY)

Revenue up 22.56% at Rs 6811 crore versus Rs 5557 crore.

Ebitda up 12.79% at Rs 529 crore versus Rs 469 crore.

Ebitda margin down 67 bps at 7.76% versus 8.43%.

Net profit up 30% at Rs 286 crore versus Rs 220 crore.

Exceptional Loss of Rs 346 crore.

Ebitda Uptick due to fall in Cost of Materials by 11%.

Segment Revenue

Nutrient and Allied Business revenue up 28.18% at Rs 4320 crore versus Rs 3370 crore.

Crop protection revenue up 23.75% at Rs 698 crore versus Rs 564 crore.

Sugar revenue up 6.77% at Rs 1372 crore versus Rs 1285 crore.

Distillery revenue up 20.17% at Rs 268 crore versus Rs 223 crore.

NMDC Q4 Result Highlights (Consolidated, QoQ)

Revenue: Up 6.6% to Rs 7,004.59 crore versus Rs 6,567.83 crore

Net Profit: Down 21.8% to Rs 1,483.18 crore versus Rs 1,896.66 crore

Ebitda: Down 13.5% to Rs 2,051.11 crore versus Rs 2,372.01 crore

Margin: At 29.3% versus 36.1%

NMDC Steel Q4 Results (QoQ)

Revenue up 34% At Rs 2,838 crore versus Rs 2,120 crore

Ebitda loss at Rs 291 crore versus loss Of Rs 656 crore

Net loss at Rs 473 crore versus loss Of Rs 758 crore

Sansera Engineering Q4 Highlights (Consolidated, YoY)

Revenue up 4.8% to Rs 782 crore versus Rs 746 crore.

Ebitda flat at Rs 127 crore.

Margin at 16.3% versus 17%.

Net Profit up 28.7% to Rs 59 crore versus Rs 46 crore.

DCX Systems Q4 Highlights (Consolidated, YoY)

Revenue down 26.3% to Rs 550 crore versus Rs 746 crore.

Ebitda down 73% to Rs 10.2 crore versus Rs 37.9 crore.

Margin at 1.9% versus 5.1%.

Net Profit down 37.2% to Rs 20.7 crore versus Rs 33 crore.

ITI Q4 Highlights (Consolidated, YoY)

Revenue up 73.9% to Rs 1,046 crore versus Rs 601 crore.

Ebitda Loss at Rs 28.2 crore versus Ebitda Loss of Rs 174 crore.

Net Loss at Rs 4.4 crore versus Loss of Rs 239 crore.

Time Technoplast Q4 Highlights (Consolidated, YoY)

Revenue up 5.3% to Rs 1,469 crore versus Rs 1,394 crore.

Ebitda up 14.8% to Rs 214 crore versus Rs 186 crore.

Margin at 14.5% versus 13.3%.

Net Profit up 18.6% to Rs 109.5 crore versus Rs 92.4 crore.

RCF Q4 Highlights (Consolidated, YoY)

Revenue down 4% to Rs 3,730 crore versus Rs 3,880 crore.

Ebitda down 8.7% to Rs 178 crore versus Rs 195 crore.

Margin at 4.9% versus 5%.

Net Profit down 24% to Rs 72.5 crore versus Rs 95.2 crore.

Sun Flag Q4 Highlights (Consolidated, QoQ)

Revenue down 1% to Rs 883 crore versus Rs 892 crore.

Ebitda down 9.3% to Rs 100 crore versus Rs 111 crore.

Margin at 11.4% versus 12.4%.

Net Profit down 13.7% to Rs 43.3 crore versus Rs 50.1 crore.

Medplus Health Q4FY25 Results Highlights (Consolidated, YoY)

Revenue up 1.3% at Rs 1,510 crore versus Rs 1,490 crore

Ebitda up 29% at ₹136 crore versus Rs 106 crore

Margin at 9% versus 7.1%

Net Profit up 53.7% at Rs 51.3 crore versus Rs 33.4 crore

Bosch Q4 Highlights (Consolidated, YoY)

Revenue up 16% to Rs 4,911 crore versus Rs 4,233 crore.

Ebitda up 16% to Rs 647 crore versus Rs 557 crore.

Margin flat at 13.2%.

Net Profit down 1.9% to Rs 554 crore versus Rs 564 crore.

Entero Heathcare Solutions Q4 Results (Consolidated, YoY)

Revenue: Up 29.5% at Rs 1,339 crore versus Rs 1,034 crore

Ebitda: Up 69.3% at Rs 49 crore versus Rs 29 crore

Margin: At 3.6% versus 2.8%

Net Profit: Up 22.5% at Rs 26 crore versus Rs 21 crore

P&G Hygiene Q4 Highlights (YoY)

Revenue down 1% to Rs 992 crore versus Rs 1,002 crore.

Ebitda down 18.5% to Rs 210 crore versus Rs 257 crore.

Margin at 21.1% versus 25.7%.

Net Profit up 1% to Rs 156 crore versus Rs 154 crore.

Gateway Distriparks Q4 Highlights (Consolidated, YoY)

Revenue up 42.7% to Rs 535 crore versus Rs 375 crore.

Ebitda up 29.4% to Rs 108 crore versus Rs 83.2 crore.

Margin at 20.1% versus 22.2%.

Net Loss at Rs 193 crore versus Profit of Rs 55 crore.

Exceptional Loss of Rs 259 crore in Q4.

Triveni Engineering Q4 Results (Consolidated, YoY)

Revenue: Up 24.4% at Rs 1,629 crore versus Rs 1,302 Crore

Ebitda: Up 25.5% atRs 308 crore versus Rs 246 Crore

Margin: At 19% Versus 18.8%

Net Profit: Up 13.6% at Rs 183 crore versus Rs 161 Crore

Supriya Lifescience Q4 Highlights (YoY)

Revenue up 16.4% to Rs 184 crore versus Rs 158 crore.

Ebitda up 21.7% to Rs 67.6 crore versus Rs 55.5 crore.

Margin at 36.7% versus 35%.

Net Profit up 36.4% to Rs 50.4 crore versus Rs 37 crore.

Stocks In News

ITC: British American Tobacco to sell about 2.3% stake of company to Institutional Investors via block trade on May 28 at Rs 400 apiece, which is at 8% discount to current market price. The size of the deal is Rs 11,600 crore.

Tata Steel: The company filed a petition in Delhi High Court over coal mine to seek relief including compensation of Rs 757 crore along with applicable interest.

Sonata Software: The company partnered with Qualtrics to transform customer experience into global brands.

HBL Engineering: The company received an order worth Rs 102 crore from Ircon International.

Vedanta: Committee to mull issuance of non-convertible debentures on private placement basis on May 30.

Bharat Forge: Delhi High Court sets aside arbitral award of Rs 77 crore, Delhi HC dismisses enforcement petition filed by Tarsem Jain.

Zinka Logistics: The board approved a proposal to change the name of the company to ‘Blackbuck' from “Zinka Logistics Solutions'.

Muthoot Capital: The company to mull fund raise proposal via bonds on May 30.

Ramkrishna Forgings: The company to mull fund raising via shares, bonds on May 30.

Waaree Energies: The firm's arm's pact with Ewaa Renewable Techno Solutions was mutually terminated.

Jupiter Wagons: The company's arm signed a memorandum of understanding with Pickkup to boost electronic vehicle adoption in India.

IPO Offering

Aegis Vopak Terminals: The public issue was subscribed to 0.35 times on day 2. The bids were led by qualified institutional investors (0.43 times), non-institutional investors (0.12 times), and retail investors (0.44 times).

Schloss Bangalore (Leela Hotels IPO): The public issue was subscribed to 0.17 times on day 2. The bids were led by qualified institutional investors (0.11 times), non-institutional investors (0.11 times), and retail investors (0.41 times).

Prostarm Info Systems: The public issue was subscribed to 3.55 times on day 1. The bids were led by qualified institutional investors (0.05 times), non-institutional investors (6.83 times), and retail investors (4.15 times).

Scoda Tubes: The company will offer shares for bidding on Wednesday. The price band is set from Rs 130 to Rs 140 per share. The Rs 220-crore IPO is entirely a fresh Issue.

Listing Day

Belrise Industries: The company's shares will debut on the stock exchange on Wednesday. The Rs 2,150 -crore IPO was subscribed 41.3 times on its third and final day. Bids were led by institutional investors (108 times), retail investors (4.27 times), non-institutional investors (38.33 times).

Media Reports

India eyes partnership with France's Safran to power next-gen Tejas Mk2 jets, reports CNBC.

Tata Sons board is set to review Tata Capital's IPO plans on May 29, as per Business Standard.

Brokerage Radar

Jefferies on Afcons Infrastructure

Maintain 'buy' rating with a target price of Rs 580.

The financial year 2025 order flow miss is more a timing aspect.

Management commentary reflects confidence in capital expenditure prospects in a challenging environment.

The company is the lowest bidder on orders of Rs 10,700 crore, which should convert in the first half of fiscal 2026.

Morgan Stanley On Zinka Logistics

Maintain 'equal-weight' rating with a target price of Rs 490.

The quarter ended March 2025 showed a revenue miss led by the core business.

Average monthly transacting truck operators increased to over 765,000, which is viewed positively.

Gross transaction value of payments rose 8.7% quarter-on-quarter but was 3.5% below estimate; the main drag was a 2% miss in payment volume.

JPMorgan On NMDC

Maintain 'underweight' rating with a target price of Rs 56.

The company showed a sharp earnings miss on elevated costs in the quarter ended March.

Revenue came in 2% higher on better sales in pellets and other minerals.

Overall costs were up 12% year-on-year on a per-ton basis and came in 19% higher versus estimates.

Capital expenditure for the financial year ended March 2025 came in lower than management guidance.

Clarity on the progress of capacity expansion projects will be a key monitorable.

Catch all calls by brokerages on Wednesday here.

Bulk Deals

InterGlobe Aviation: Rakesh Gangwal sold 22.1 lakh shares (0.57%) at Rs 5,231.28 apiece, The Chinkerpoo Family Trust sold 1.98 crore shares (5.15%) at an average price of Rs 5,232 apiece.

PG Electroplast: Government of Singapore bought 38.18 lakh shares (1.35%) at Rs 754.8 apiece, Motilal Oswal Asset Management Company bought 15.89 lakh shares (0.56%) at Rs 754.8 apiece, while Vikas Gupta sold 50 lakh shares (1.77%) at Rs 754.86 apiece, Anurag Gupta sold 50 lakh shares (1.77%) at Rs 754.83 apiece, Vishal Gupta sold 50 lakh shares (1.77%) at Rs 755.73 apiece.

Borana Weaves: Kshitij Portfolio bought 2 lakh shares (0.75%) at Rs 243 apiece, Pine Oak Global Fund bought 1.41 lakh shares (0.53%) at Rs 243 apiece.

Camlin Fine Sciences: Aditya Singhania bought 10.47 lakh shares (0.075%) at Rs 244.58 apiece.

Cosmo First: Ravi Kant Jaipuria bought 2.34 lakh shares (0.89%) at Rs 1090.7 apiece.

Tourism Finance Corp: Aditya Kumar Halwasiya bought 10 lakh shares (1.07%) at Rs 220.76 apiece

Trading Tweaks

Price Band change from 10% to 5%: GE Vernova T&D India, Khaitan (India),

Price Band change from 20% to 10%: Camlin Fine Sciences.

Price Band change from 5% to 20%: Raymond

Ex-Dividend: Sundaram Finance Holdings, Colgate Palmolive (India), ITC.

F&O Cues

Nifty May Futures down by 0.7% to 24,860 at a premium of 34 points.

Nifty May futures open interest down by 18.4%.

Nifty Options May 29 Expiry: Maximum call open interest at 26,000 and maximum put open interest at 24,000.

Securities in ban period: RBL Bank.

Currency Update

The Indian rupee weakened by 25 paise to close at 85.34 against the US dollar on Tuesday, in comparison to its previous close of 85.09 on Monday. This significant depreciation comes amid various global and domestic economic factors influencing the currency markets.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.