Good morning!

The GIFT Nifty was trading 20.5 points higher at 25,677 as of 6:30 a.m., indicating a positive start for the 50-stock benchmark on the NSE later in the morning.

Most Asian indices were down after US President Donald Trump said he wouldn't delay the July 9 deadline for imposing higher levies on trading partners. US index futures were little changed.

Watch NDTV Profit Live

Markets On Home Turf

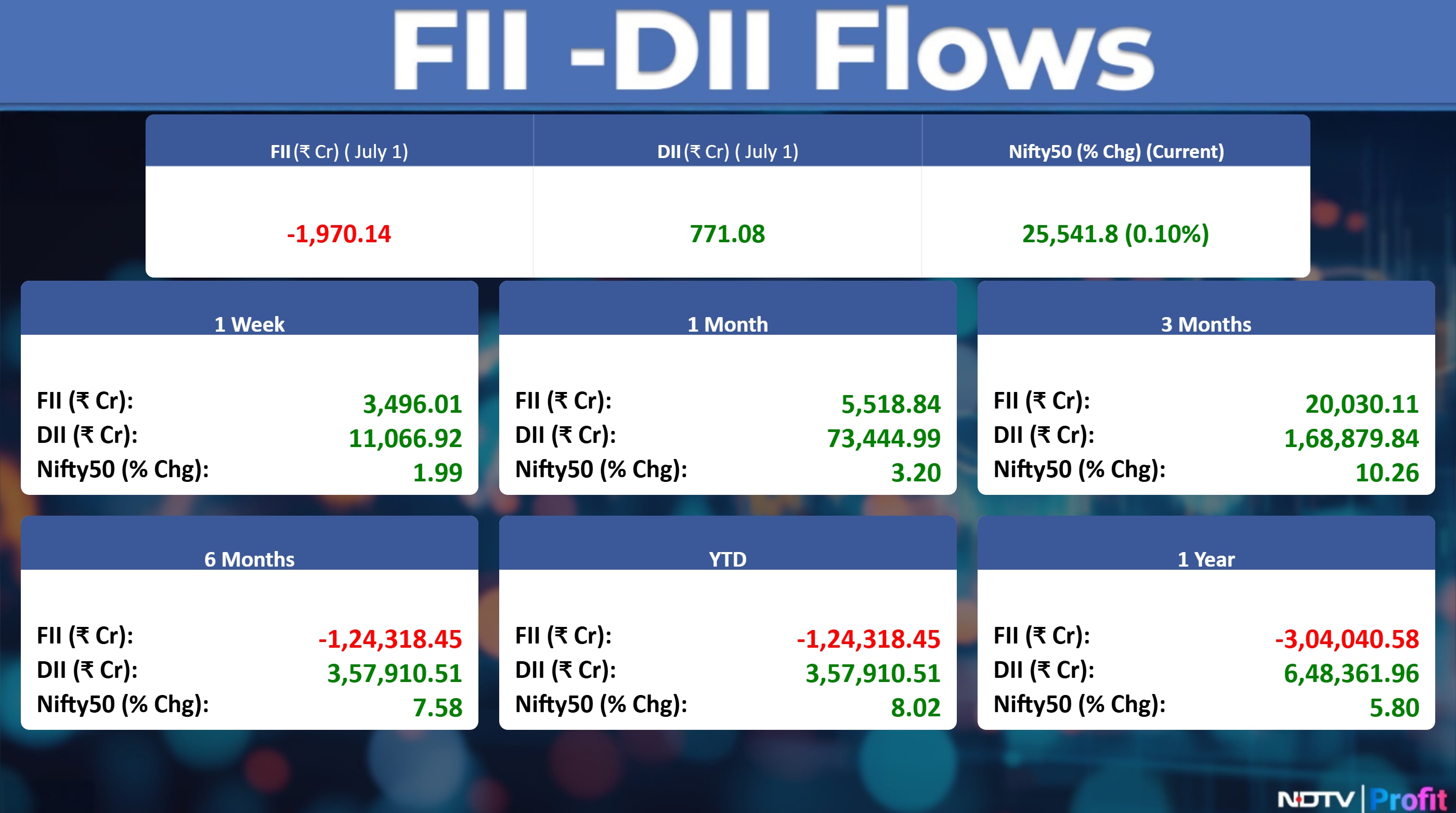

Indian benchmark equity indices closed with gains on Tuesday, led by share prices of Reliance Industries Ltd. and HDFC Bank Ltd. The NSE Nifty 50 ended 24.75 points or 0.1% higher at 25,541.8, while the BSE Sensex closed 90.83 points or 0.11% up at 83,697.29.

Foreign portfolio investors stayed net sellers of Indian equities for the second consecutive day on Tuesday and net sold shares worth Rs 1,970.1 crore, according to the provisional data from the National Stock Exchange. Domestic institutional investors stayed net sellers and offloaded equities worth Rs 771.1 crore.

Asian Market Update

S&P 500 futures up 0.1%.

Euro Stoxx 50 futures up 0.2%.

Futures for Hong Kong's Hang Seng Index flat.

Nikkei 225 down 0.77%.

Japan's Topix index down 0.16%.

Kospi down 1.35%

Australia's S&P/ASX 200 up 0.38%.

US Market Update

The rally on Wall Street took a pause after another record high as investors rotated out of megacap technology stocks and into other corners of the market on the first day of a new quarter.

The S&P 500 fell 0.1%, after earlier declining as much as 0.4%. The Nasdaq Composite lost 0.8%. The blue-chip Dow Jones Industrial Average rose 0.9%.

Commodity Check

Oil steadied after a modest advance, with tensions in the Middle East and US inventories in focus. Brent crude traded near $67 a barrel after rising 0.6% on Tuesday, with West Texas Intermediate above $65.

London Metal Exchange

Copper up 0.66%.

Aluminium up 0.05%.

Nickel down 0.06%.

Zinc down 1.4%.

Lead down 0.3%

Key Events, Economic Data To Watch

2:00 a.m. API Weekly Crude Oil Stock

1:30 p.m. ECB De Guindos' Speech

2:30 p.m. Unemployment Rate

4:00 p.m. ECB Lane's Speech

5:45 p.m. ADP Nonfarm Employment Change

8:00 p.m. Crude Oil Inventories

Stocks In News

Hyundai Motor India: Passenger vehicle sales in June stood at 60,924 units, above the estimate of 59,400 units. Domestic sales were 44,024 units versus 43,861 units in May. Exports rose to 16,900 units from 14,840 units in May.

Maruti Suzuki: Total sales fell 6% year-on-year to 1.68 lakh units, versus an estimate of 1.675 lakh units. Domestic sales declined 12% to 1.3 lakh units, while exports increased 22% to 37,842 units. Domestic passenger vehicle sales dropped 13% to 1.19 lakh units.

CreditAccess Grameen: The company raised total funds of Rs 2,570.1 crore during the June quarter through term loans, ECBs, cash credits and direct assignments.

Adani Enterprises: The company will issue NCDs worth Rs 500 crore, with an additional green-shoe option of Rs 500 crore. The issue opens on July 9 and closes on July 22. Its arm, Adani Defence Systems and Technologies, completed the acquisition of an 85.1% stake in Air Works India for Rs 400 crore on July 1.

Lupin: Received US FDA approval for the ANDA of Loteprednol Etabonate Ophthalmic Gel, a bioequivalent of Lotemax SM, used to treat postoperative inflammation and pain.

Ceigall India: An arm of the company received an order worth Rs 1,199 crore from NHAI for constructing the 4/6-lane Northern Ayodhya Bypass (Part-1) with a length of 35.40 km.

JSW Energy: Subsidiary JSW Renew Energy signed a purchase pact with Rajasthan Vidyut Utpadan Nigam for a 250 MW/500 MWh battery energy storage system.

India Pesticides: Commissioned an expansion of its formulation plant, increasing capacity by 3,500 MTPA from 6,500 MTPA.

NIBE: Received a purchase order worth Rs 22.7 crore for the supply of turret structure assemblies, to be executed in tranches by June 28, 2026.

PDS: An arm entered a share subscription agreement to acquire a 60% equity stake in GSC Link.

Cantabil Retail: Opened three new showrooms in June, taking the total number of showrooms to 607.

Godrej Properties: Sold a 2.5% stake in Vivrut Developers to Godrej Ventures & Investment Advisers for Rs 8.6 crore.

Supriya Lifesciences: Received a demand notice of Rs 60.4 crore including tax and penalty from the Mumbai Commissioner's Office.

Lloyds Metals: In the first quarter of financial year 2026, iron ore production remained flat at 4 million tonnes, while direct reduced iron production rose 3% to 79,033 tonnes.

Shree Renuka Sugars: An arm received a penalty of Rs 4.7 crore from the Income Tax Department for alleged documentation issues related to AY 2012–13.

NMDC: June production was at 3.57 million tonnes compared to 3.37 million tonnes. Sales stood at 3.58 million tonnes versus 3.73 million tonnes.

HEG: Received a show cause notice from Bhopal Tax Authority for GST demand and recovery of IGST refunds for financial year 2018–19, totaling Rs 282.34 crore.

REC: Incorporated SR WR Power Transmission as a wholly owned subsidiary to strengthen inter-regional grid connectivity.

Nazara Technologies: AFK Gaming became a wholly owned subsidiary of Nodwin and a step-down subsidiary of Nazara Technologies.

Dreamfolks: Closed some programmes for Axis Bank and ICICI Bank as of July 1, 2025, which may have a material impact.

D.P. Abhushan: Allotted 1.6 lakh equity shares at Rs 10 each on July 1, 2025, to warrant holders who converted their preferential warrants.

MOIL: Increased prices of most manganese ore grades and all chemical grades by 2% as of July 1, 2025.

Satin Creditcare: Infomerics Ratings assigned an IVR A/Stable rating to its proposed Rs 750 crore NCDs, indicating low credit risk.

Nuvoco Vistas: Received a show cause notice proposing to deny input tax credit of Rs 7.26 crore, interest of Rs 6.5 crore, and penalty of Rs 1.82 crore for financial year 2018–19, despite an appeal being pending.

Greenlam Industries: CARE Ratings reaffirmed its credit ratings while revising the outlook from Stable to Negative for certain long-term facilities.

Rane Madras: Received a show cause notice from Chennai Central Tax and Central Excise for a tax impact of Rs 22.64 crore.

Medplus Health Services: Received a suspension order for a store's drug licence in Karnataka.

Neogen Chemicals: Completed the subscription and allotment of 20 lakh equity shares in its wholly owned subsidiary Neogen Chemicals Japan Corp.

Isgec Heavy Engineering: Due to heavy rainfall on June 30, a material subsidiary experienced water ingress at the Yamuna Nagar factory godowns, damaging some sugar stock.

SRM Contractors: CARE upgraded its long-term rating from CARE BBB+ Stable to CARE A- Stable and bank facilities to CARE A- Stable/CARE A2.

Paras Defence: Will supply up to 30 CHIMERA 200 counter-drone systems to France's CERBAIR in a deal valued at Rs 22 crore.

Hero MotoCorp: Launched the VX2 E-VOOTER electric scooter, available in VX2 Plus and VX2 Go variants, starting at Rs 59,490 (ex-showroom). Additionally, in its June sales updates it said that it has dispatched 5.54 lakh motorcycles and scooters in June 2025, with 3.94 lakh VAHAN registrations.

Asian Paints, Grasim Industries: The CCI ordered an investigation into a complaint by Birla Opus Paints, part of Grasim Industries, alleging Asian Paints abused its dominant position in the decorative paints segment.

Rites: Received a letter of award from South Western Railway for station redevelopment at Tumakuru worth Rs 37.81 crore. Also received a $3.6 million order from African Rail Co for supply of 2 overhauled ALCO locomotives.

Elitecon International: Postponed the decision on a fundraising proposal of up to Rs 75 crore to the next board meeting on July 4.

SBI Cards: Received a penalty of Rs 81 crore from Gurugram tax authorities for disallowance of input tax credit under GST provisions.

Ram Ratna Wires: Completed acquisition of an additional 4% stake in its subsidiary.

Cyient DLM: Appointed Rajendra Velagapudi as Managing Director and CEO.

Trident: Received a GST demand of Rs 51 crore including interest and penalty from the Ludhiana tax body.

Dynamic Cables: Approved an increase in authorised share capital to Rs 50 crore from Rs 25 crore.

Exicom Tele-System: Approved a rights issue in the ratio of 3:20 at Rs 143 per share, aggregating to Rs 259 crore. Approved a rights issue of up to 1.8 crore equity shares at Rs 143 each. The issue opens on July 15, with a record date of July 7.

V-Mart Retail: In the first quarter its total revenue grew 13% year-on-year to Rs 885 crore. Same-store sales growth was 1%. Opened 15 new stores and closed two stores in the quarter ended June.

Rainbow Children's Medicare: Acquired 76% equity and 100% preference shares of Prashanthi Medicare.

Satin Creditcare: Approved the issuance of NCDs worth Rs 44.1 crore.

South Indian Bank: Reported June update: gross advances rose 8% YoY to Rs 89,201 crore, deposits increased 9% to Rs 1.12 lakh crore, and CASA rose 9% to Rs 36,204 crore. CASA ratio remained at 32.06%.

One Point One Solutions: Achieved CMMI V3.0 Maturity Level 3 certification for both development and services.

Royal Orchid Hotels: Promoters acquired 5,183 shares worth Rs 19.98 lakh from the market.

AstraZeneca Pharma: Received approval from the Central Drugs Control Organisation to import durvalumab solution, used in endometrial cancer treatment.

Avenue Supermarts: Received a penalty of Rs 10 lakh from the Commission of Air Quality Management.

Bajaj Hindusthan Sugar: Received Rs 631 crore from Lalitpur Power Generation Company through a buyback.

Zaggle Prepaid Ocean Services: Signed a 5-year agreement with DTDC Express to offer Zaggle Zoyer and Zaggle Save solutions.

Zen Technologies: Acquired a 76% stake in TISA Aerospace Private Limited, making it a subsidiary by purchasing equity shares and converting debentures.

IPO Offering

Crizac: The company will offer shares for bidding on Wednesday. The price band is set from Rs 233-245 per share. The IPO is for a size of Rs 860 crore. Tentative listing date fixed as July 9.

Listing

HDB Financial Services: The company's shares will debut on the stock exchange on Wednesday at an issue price of Rs 740 apiece. The Rs 12,500 crore. IPO was subscribed 2.49 times on its third and final day.

Sambhv Steel Tubes: The company's shares will debut on the stock exchange on Wednesday at an issue price of Rs 82 apiece. The Rs 540 crore IPO was subscribed 6.02 times on its third and final day.

Bulk Deals

Ellenbarrie Indus Gases: Motilal Oswal Mutual Fund bought 20.95 lakh shares at Rs 511.1 apiece.

Kajaria Ceramics: JP Morgan Funds sold 8.85 lakh shares (0.56%) at Rs 1067.88 apiece.

Block Deals

Bharti Airtel: Goldman Sachs (Singapore) Pte. -ODI bought 1.03 lakh shares (0.001%) at Rs 2,009.6 apiece and Kadensa Master Fund sold 1.03 lakh shares (0.001%) at Rs 2,009.6 apiece

Hindustan Aeronautics: Goldman Sachs (Singapore) Pte. -ODI bought 3.06 lakh shares (0.04%) at Rs 4917 apiece and Kadensa Master Fund sold 3.06 lakh shares (0.04%) at Rs 4917 apiece

HDFC Bank: Goldman Sachs (Singapore) Pte. -ODI bought 76,851 shares at Rs 2001.5 apiece and Kadensa Master Fund sold 76,851 shares at Rs 2001.5 apiece

ICICI Bank: Goldman Sachs (Singapore) Pte. -ODI bought 1.26 lakh shares at Rs 1445.8 apiece and Kadensa Master Fund sold 1.26 lakh shares at Rs 1445.8 apiece

Reliance Ind.: Goldman Sachs (Singapore) Pte. -ODI bought 7.48 lakh shares at Rs 1500.6 apiece and Kadensa Master Fund sold 7.48 lakh shares at Rs 1500.6 apiece

Varun Beverages: Goldman Sachs (Singapore) Pte. -ODI bought 15.25 lakh shares at Rs 457.55 apiece and Kadensa Master Fund sold 15.25 lakh shares at Rs 457.55 apiece

Voltas: Goldman Sachs (Singapore) Pte. -ODI bought 3.88 lakh shares at Rs 1314.1 apiece and Kadensa Master Fund sold 3.88 lakh shares at Rs 1314.1 apiece

Kaynes Tech: Goldman Sachs (Singapore) Pte. -ODI 67,690 shares at Rs 6095 apiece and Kadensa Master Fund sold 67,690 shares at Rs 6095 apiece

Trading Tweaks

Moving into short-term ASM framework I: Dolphin Offshore Enterprises (India), Hubtown.

Pledge Shares

SMS Pharmaceuticals: Promoter Potluri Infra Projects LLP pledged 73.46 lakh shares on June 30, Promoter Potluri Laboratories Private Limited pledged 11.2 lakh shares on June 30.

Insider Trades

Paras Defence and Space Technologies: Promoter and Director Sharad Virji Shah sold 1.56 lakh shares on June 30, promoter Kaajal Harsh Bhansali sold 31,250 shares on June 30 and promoter Anish Hemant Mehta sold 31,250 shares on June 30.

Aarti Pharmalabs: Promoter ORCHID FAMILY TRUST Relacion Trusteeship Services Pvt Ltd sold 5.3 lakh shares on June 30.

Fusion Finance: Promoter Devesh Sachdev sold 2.07 lakh shares on June 27, Promoter Mini Sachdev sold 1 lakh shares on June 27.

F&O Cues

Nifty July Futures up by 0.09 % to 25,643 at a premium of 101 points.

Nifty July futures open interest up by 0.91%

Nifty Options July 3 Expiry: Maximum Call open interest at 26000 and Maximum Put open interest at 25500

Securities on ban period: RBL BANK

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.