Minda Corp.'s share price jumped to an eight-month high during early trade on Wednesday after the company guided for 350% growth in revenue by financial year 2030 during an analyst meeting held on Sept. 23.

The company projected revenue of Rs 17,500 crore by FY30. It also expects an expansion of its operating margin to 12.5% from 11.4% in FY25, according to an investor presentation.

It also expects the debt-equity ratio to decline to 0.3 times from 0.6 times in the last fiscal. The return on capital employed, a metric used to analyse the profitability and capital efficiency of a firm, is projected to increase to 25% from 20%.

The management said this growth will be driven by investment in existing businesses, premiumisation of products, a push for exports to 10-15% of topline and new product launches in EV kits and switches.

Minda Corp will undertake Rs 2,000 crore capex for the next five years.

The roadmap aligns well with mobility megatrends, such as electrification, connectivity, software-defined vehicles, and premiumisation, analysts at Emkay Global said. They retained a 'buy' rating on the stock with a price target of Rs 600.

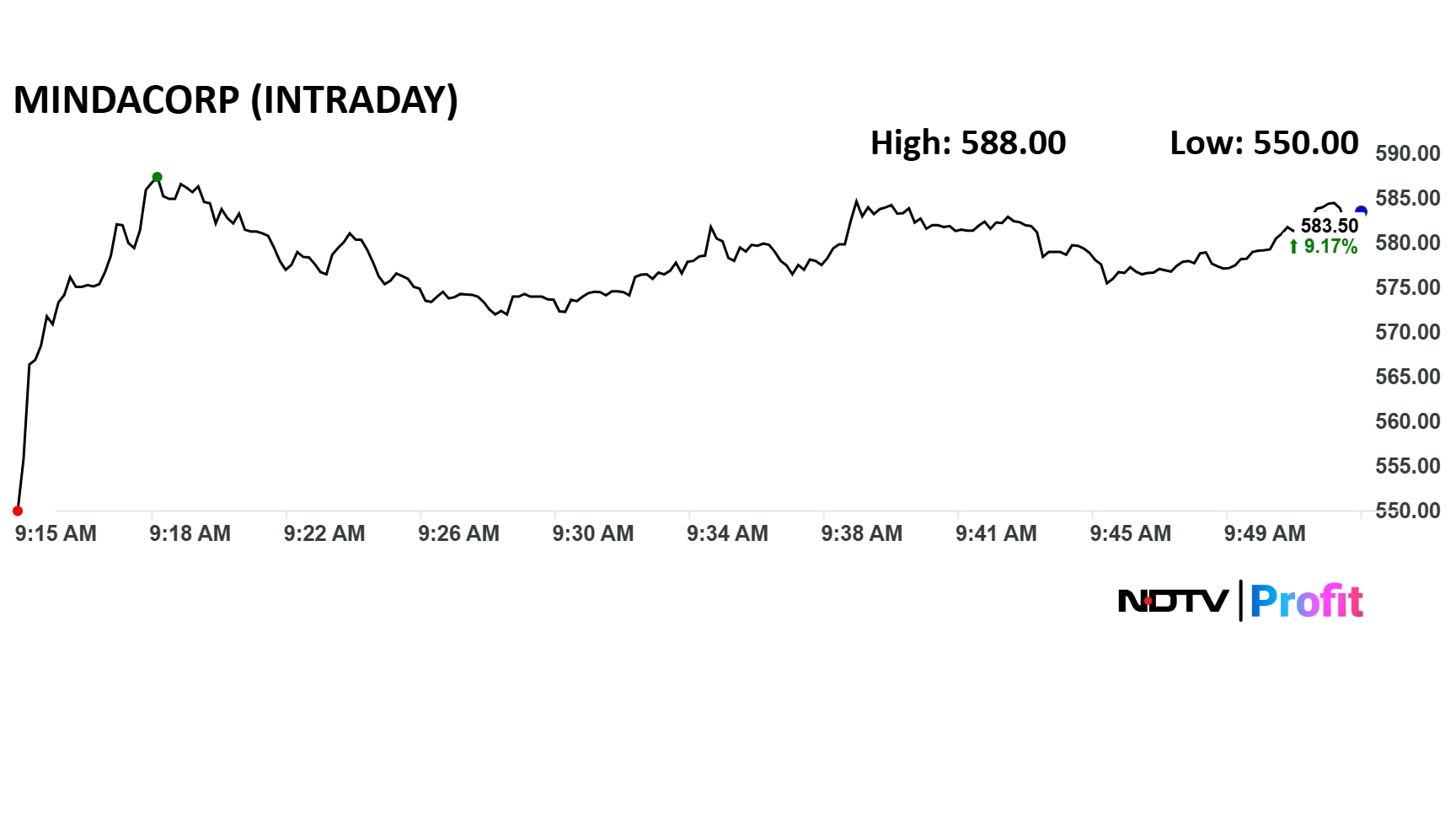

Minda Corp Share Price Movement

Minda Corp share price advanced 10% intraday to Rs 588 apiece, the highest since January. The benchmark NSE Nifty 50 was down 0.35%. The total traded volume so far in the day stood at 14 times its 30-day average with a turnover of Rs 417 crore. The relative strength index was at 64.

The stock has fallen 2% in the last 12 months and risen 20% on a year-to-date basis.

Eight out of the nine analysts tracking Minda Corp have a 'buy' rating on the stock, and one recommends a 'hold', according to Bloomberg data. The average of 12-month analyst price target implies a potential upside of 1%.

Catch all the live markets here for real-time updates, stock movements, and broader market trends throughout the day.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.