Infosys Ltd.'s share price rose 2% in early trade on Thursday, ahead of the release of its July-September quarter results. The IT services major's consolidated net profit may rise 7% sequentially to Rs 6,815 crore in the second quarter, according to a consensus of analysts' estimates tracked by Bloomberg.

Infosys' revenue is projected to increase by 3.5% to Rs 40,707 crore. Additionally, EBIT is expected to grow by 5.2% to Rs 8,726 crore, with the EBIT margin anticipated to expand by 30 basis points, reaching 21.4%.

In terms of guidance, BofA, Morgan Stanley, and Motilal Oswal expect Infosys to upgrade its full-year guidance by 50 basis points, while Ambit Capital expects it to maintain it.

The Bengaluru-based IT behemoth has guided revenue growth of 3–4% for the fiscal. The company has increased its revenue forecast, citing significant deals during the April-June period.

The company secured 34 large deals in the first quarter, its highest ever, with a total contract value of $4.1 billion, 57.6% of which were net new. Ahead of Q2 results, ICICI Securities notes that deal wins have been flat QoQ, slightly on the lower side.

The Infosys results will follow that of larger rival Tata Consultancy Services Ltd., whose second-quarter earnings missed profit and margin estimates as the IT giant grappled with weak demand and high pass-through costs.

Infosys share price advanced 2% intraday to Rs 1,958.35 apiece.

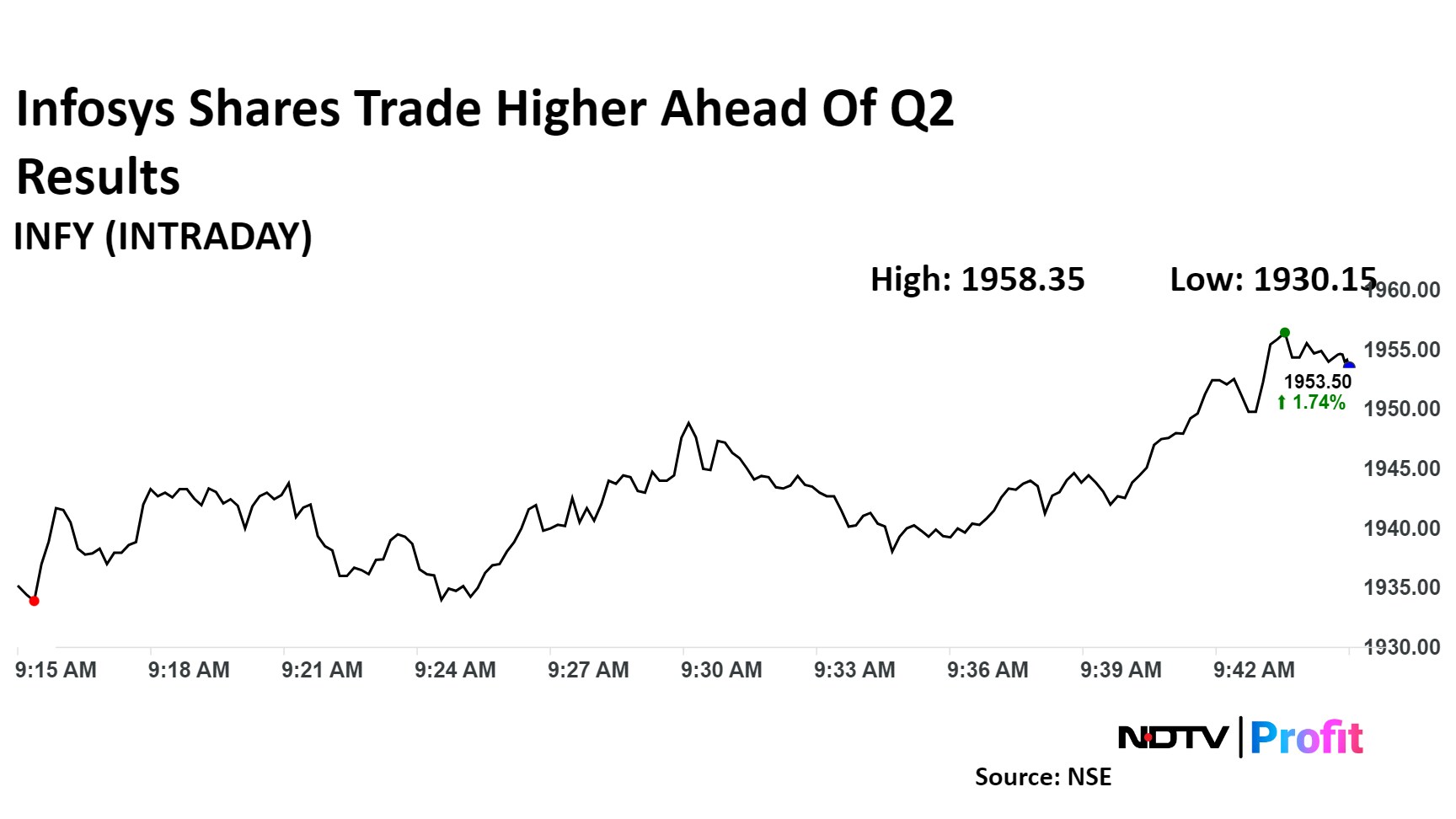

Infosys share price advanced 2% intraday to Rs 1,958.35 apiece. The scrip was trading 1.74% higher at Rs 1,953.5 by 9:45 a.m. The benchmark NSE Nifty 50 was down 0.56%, while the Nifty IT index surged 0.74% with most constituents in the green.

The stock has risen 35% in the last 12 months and 26% on a year-to-date basis. The relative strength index was at 32.

Thirty out of the 45 analysts tracking the stock have a 'buy' rating on the stock, 10 recommend a 'hold' and five suggest a 'sell', according to Bloomberg data. The average 12-month analyst price target of Rs 1,981.8 implies a potential upside of 2.2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.