The Indian rupee strengthened against the dollar for the sixth consecutive session on Thursday to close at the highest level in nearly two months after the US Federal Reserve maintained the interest rates.

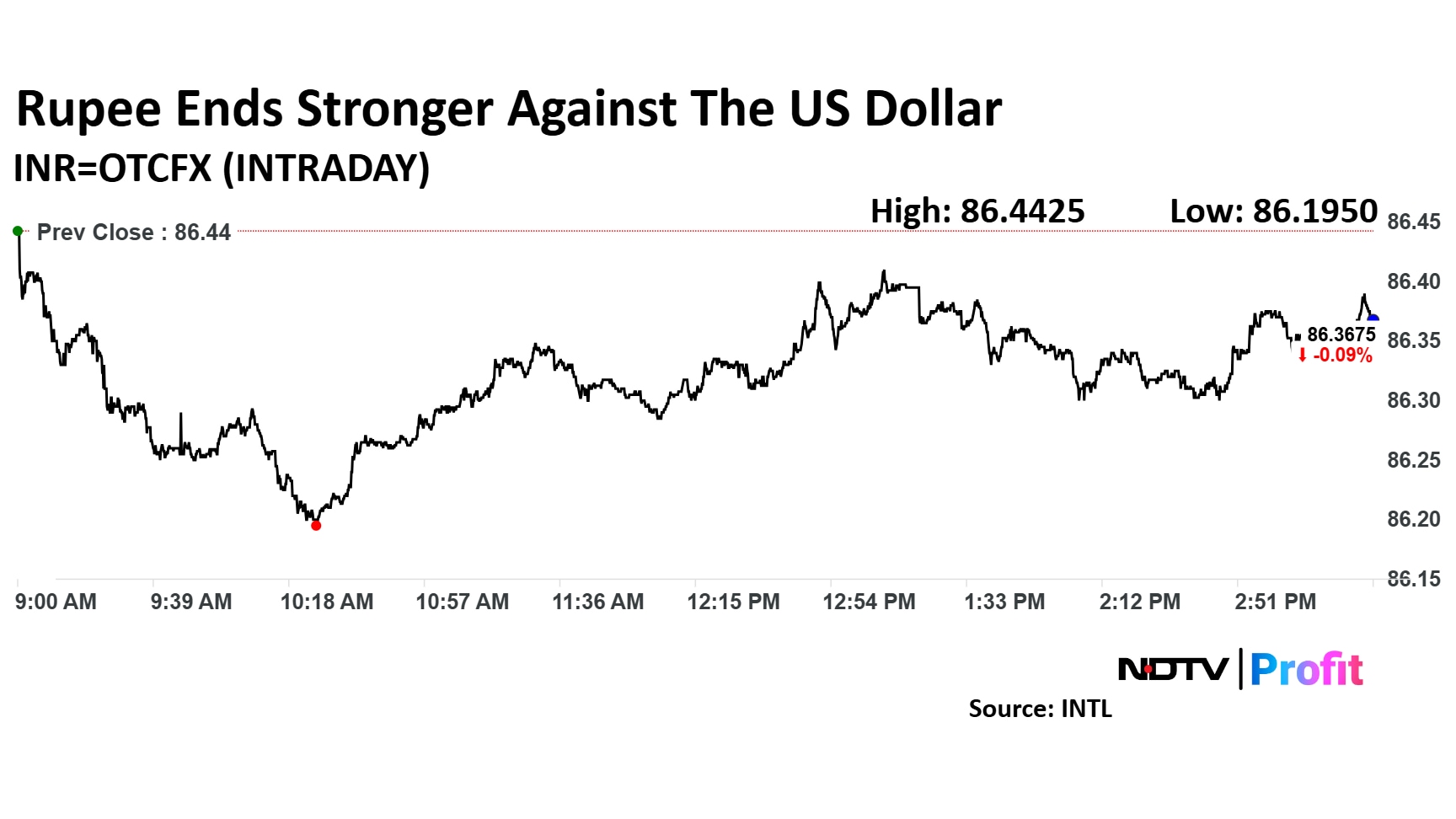

The local currency closed six paise higher at 86.38 — the strongest closing since 86.02 on Jan. 27. It ended at 86.44 against the greenback on Wednesday, according to Bloomberg data.

The domestic unit opened weaker as the US dollar index rebounded. During the onshore session, the DXY extended gains to the day's high of 103.72. As of 3:38 p.m., it was trading 0.35% higher at 103.60.

The Fed kept the rates unchanged as expected and the median dot plot indicated two cuts this year. It revised growth projection for 2025 to 1.7% from 2.1% and inflation projection to 2.7% from 2.5%.

Fed Chair Jerome Powell has downplayed growth concerns and said any inflationary impact from tariffs would likely prove transitory in his base case.

The surge in the rupee has been largely fuelled by a shift in foreign investor activity after months of persistent selling, according to Amit Pabari, managing director of CR Forex Advisors.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.