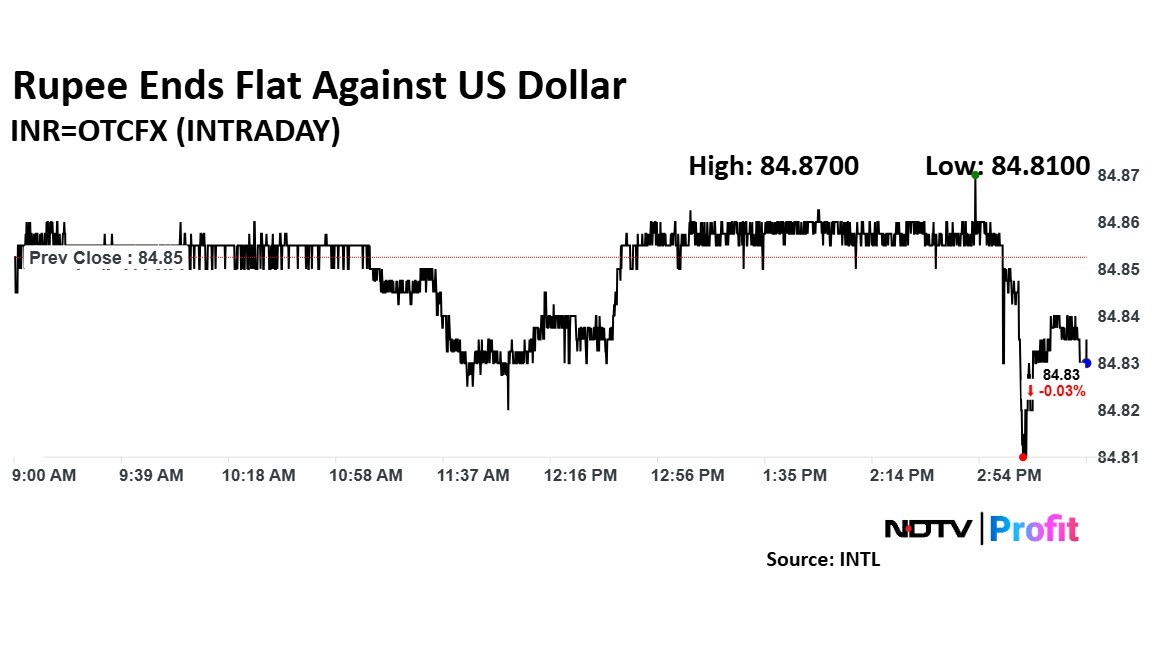

The Indian Rupee closed flat at 84.84 against the US dollar on Wednesday. It also opened flat at 84.85. The currency had weakened by 12 paise to close at a record closing low of 84.85 against the US dollar on Tuesday.

This marks the continuation of a downward trend that began earlier in the week, after the rupee closed at a low of 84.73 against the greenback on Monday.

During trading hours on Tuesday, the rupee had dropped another 13 paise to a fresh all-time low of 84.86, reflecting market concerns. The rupee's struggle against the dollar has been a significant talking point, especially after a period of slight positive momentum last week.

Last week, the currency mirrored some optimism led by the Reserve Bank of India maintaining a steady interest rate and introducing measures aimed at boosting market liquidity. Last Friday, the rupee had strengthened by 3 paise to close at 84.7, offering a brief respite.

Sanjay Malhotra has been appointed as the new RBI governor, following Shaktikanta Das' tenure that ended on Tuesday.

To stabilise the rupee and attract foreign investment, the RBI had taken a series of proactive steps. One of the key measures included raising the interest rate ceiling on one-year Foreign Currency Non-Resident (FCNR) deposits by 200 basis points, bringing it to 400 basis points. The RBI also increased the ceiling for FCNRB deposits with 3-5 year maturities. These changes are intended to boost capital inflows and will remain in effect until March 31, 2025.

Additionally, the RBI made a strategic decision to reduce the Cash Reserve Ratio (CRR) by 50 basis points. This move, which will inject Rs 1.16 lakh crore into the banking system starting December 14, is designed to enhance liquidity in the financial markets.

In a sign of caution, the RBI also revised its real GDP growth forecast for the current fiscal year, lowering it from 7.2% to 6.6%. This adjustment reflects a more tempered outlook for India's economic growth, which has further weighed on the rupee's performance in the forex market.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.