11_07_24 (1).jpg?downsize=773:435)

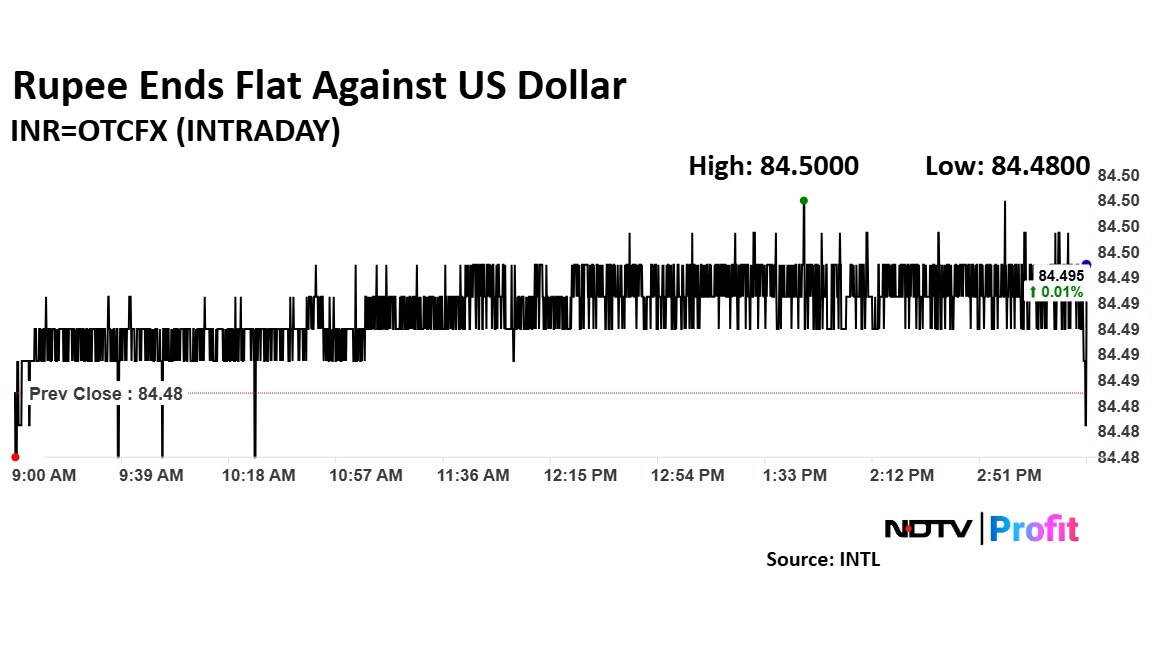

The Indian rupee closed flat against the US dollar on Friday, trading at 84.49. The domestic currency had hit a fresh low of 84.5038 during the day on Thursday, reflecting ongoing volatility in the foreign exchange market.

The rupee had opened weak by 5 paise on Wednesday at 84.39 against the US dollar and remained under pressure, primarily due to persistent dollar demand. On Wednesday, the Reserve Bank of India intervened in the market to help stem the rupee's decline, selling dollars as the rupee approached 84.47, which allowed it to appreciate slightly to 84.39 before closing at 84.4525.

For Friday, the range for the domestic currency was expected to be between 84.40 and 84.55, with an expected opening of 84.47, according to Anil Kumar Bhansali, head of treasury at Finrex Treasury Advisors LLP.

The rupee's ongoing weakness is largely driven by continued dollar demand, which has been putting pressure on the domestic currency. Global uncertainties, including the ongoing Russia-Ukraine conflict, have only added to the volatility, affecting currencies worldwide. Furthermore, global funds offloaded Rs 5,321 crore worth of Indian equities on Thursday, taking the total net outflow over the past 37 sessions to Rs 1.65 lakh crore, further weighing on the rupee.

Despite these challenges, the Reserve Bank of India has been actively stepping in to stabilise the currency. RBI's interventions in the non-deliverable forward market and its efforts to sell dollars have been aimed at supporting the rupee in the face of global volatility. However, analysts remain cautious about the rupee's near-term outlook, with the ongoing dollar demand and global market uncertainties expected to continue influencing the currency.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.