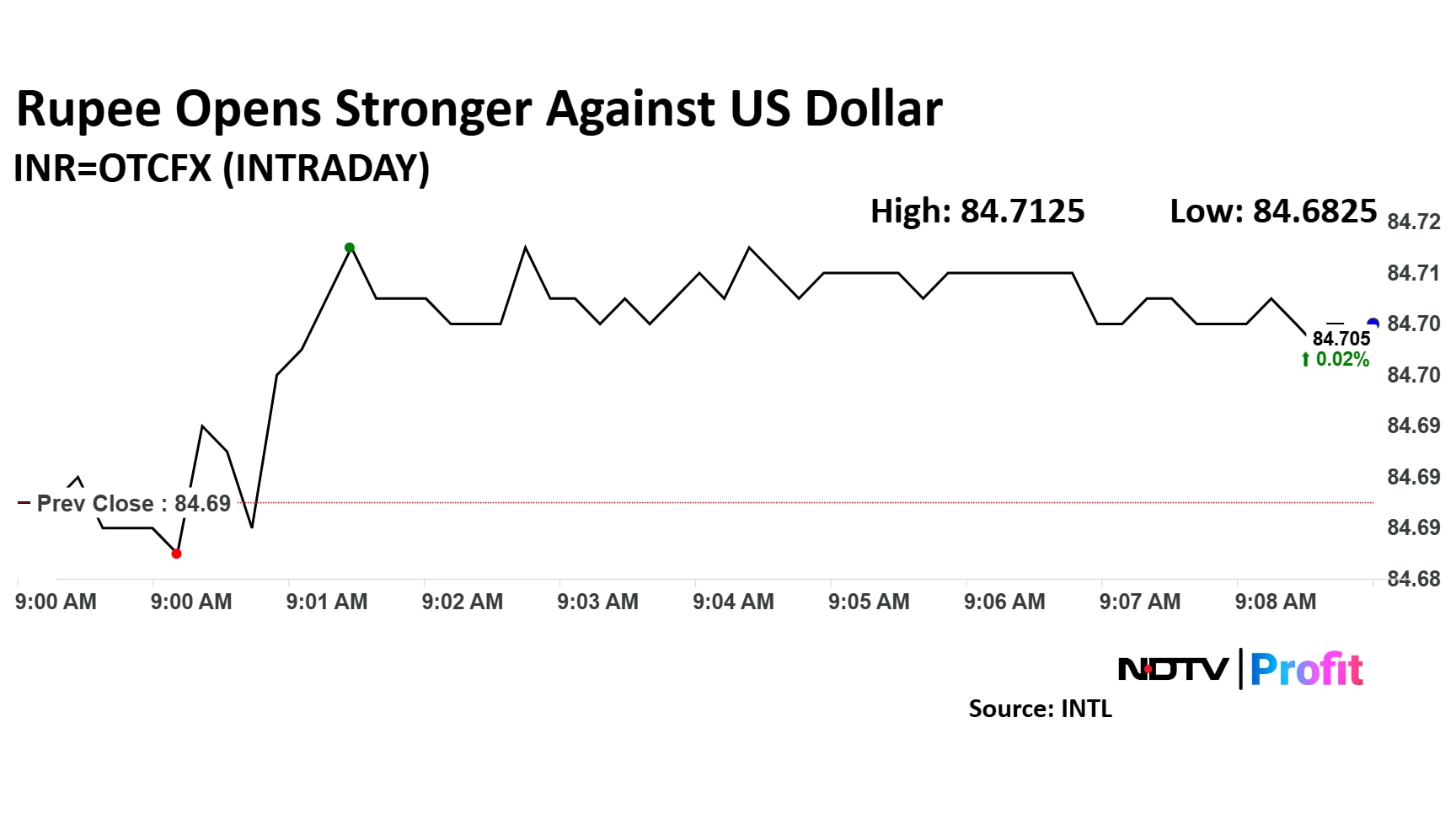

The Indian rupee weakened by three paise to close at 84.73 against the US Dollar on Monday, after opening four paise strong at 84.66 against the greenback in the morning's trade.

The domestic currency had closed last week on a positive note, after the Reserve Bank of India's Monetary Policy Committee maintained the benchmark interest rates and unveiled measures to boost liquidity in the market.

The rupee had strengthened by three paise on Friday, closing at 84.7 against the greenback, according to Bloomberg data.

As the week begins, market participants are watching closely to see how the RBI will act to shield the rupee from further depreciation, especially as the holiday season approaches. The range for Monday was expected to remain between 84.60 and 84.80, as per Anil Kumar Bhansali, head of treasury and executive director at Finrex Treasury Advisors LLP.

“Exporters may continue to wait with a stop loss at 84.50 since the rupee remains in a weakening mode due to dollar demand,” Bhansali said. He added that importers are advised to buy all dips to manage their exposures.

On Friday, the RBI had raised the interest rate ceiling on one-year Foreign Currency Non-Resident deposits by 200 basis points to 400 basis points, in an effort to attract more capital inflows. The central bank also increased the ceiling for FCNRB deposit rates for 3-5 year maturities. The relaxation of FCNRB deposit rates will remain in effect until March 31, 2025.

In another key move, the RBI announced a 50 basis point reduction in the Cash Reserve Ratio to 4%, effective in two stages starting Dec. 14 and continuing on Dec. 28, with a 25 basis point cut in each tranche. This reduction will lead to an infusion of Rs 1.16 lakh crore into the banking system.

Additionally, the RBI revised its real GDP growth forecast for the current fiscal, lowering it from 7.2% to 6.6%, signaling a more cautious outlook for the Indian economy.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.