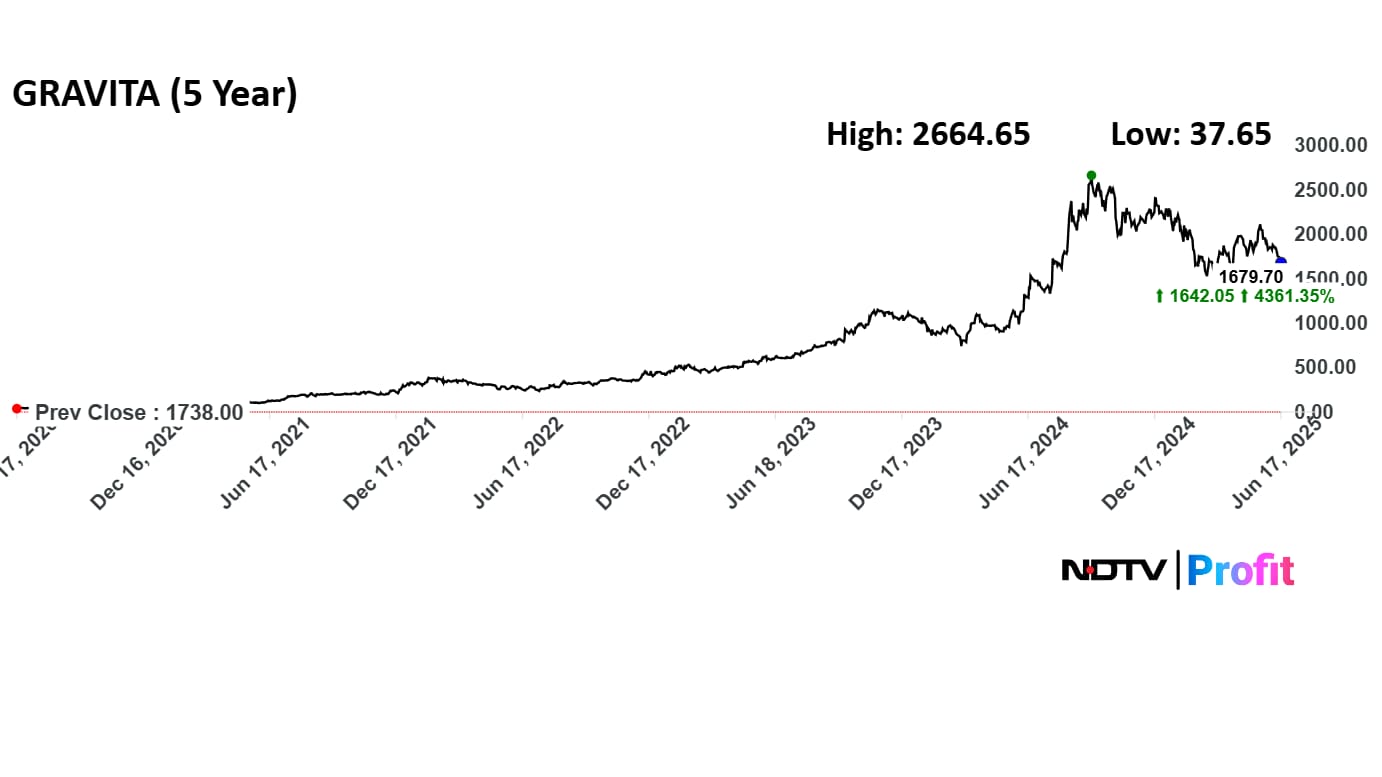

Gravita India Ltd. is a multibagger stock that has rallied nearly 5000% in the last five years. The scrip has seen a dip of 25% gain so far in 2025.

The five-year return of the stock is 4725.13%, while the three-year return stands at 557%. In the year so far, the share price recorded a high of Rs 2,336 on Jan. 3 and then fell to Rs 1,379.65 on April 7.

Gravita India is a global recycling company that specialises in the environmentally friendly recycling of lead, lead products, aluminium, and plastic. The company operates across four main verticals: lead recycling (its flagship business), aluminium recycling, plastic recycling, and turnkey recycling projects.

The company's net profit surged 38% in the March quarter, reaching Rs 95 crore, compared to Rs 69 crore in the previous year. Revenue from operations advanced 20% to Rs 1,037 crore, while on the operating side, earnings before interest, taxes, amortisation and depreciation stood at Rs 92 crore, with margins expanding to 8.9%.

Gravita India Shares In The Last Five Years

Analyst Outlook

The analysts' take on the counter is pretty positive, as all analysts tracking the company maintain a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target of Rs 2,438.67 implies an upside of 45.2%.

Nuvama Institutional Equities is has a 'buy' call on the stock with a target price of Rs 3,067, marking the highest target price on the counter. Other brokerages like Emkay Global, Antique Stock Broking, ICICI Securities and Motilal Oswal Securities have a 'buy' rating on the stock, while Kotak Securities maintains an 'add' rating.

In ICICI Securities' view, over the next three years, the company's capacity is likely to increase 2.06 times through to fiscal 2028 estimates at a capex of Rs 1,500 crore, "providing a pivot for future growth."

The aforementioned capex represents a massive jump over the past years and is likely to provide a solid pick-up to the earnings, believes the brokerage. However, ICICI Securities' lowered their Ebitda margin estimates over the next two years to 10–11%, from 12- 13%, citing slower-than-expected aluminium volume ramp-up and formalisation of recycling space.

Management Outlook

Gravita India is targeting at least 25% CAGR growth in volumes over the next three to four years, said Chirag Somani, deputy general manager of the company to NDTV Profit recently. A lithium-ion recycling plant is coming up at Mundra, and the company is discussing expansion in East India as well.

Gravita India plans to invest Rs 2,500 crore in the business over the next four years. There are huge opportunities for inorganic growth across the globe, said Somani. The company has currently zeroed down all debt in India, he added. Structural overseas debt will be reduced in a phased manner after the capex plan is completed, Somani stated.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.