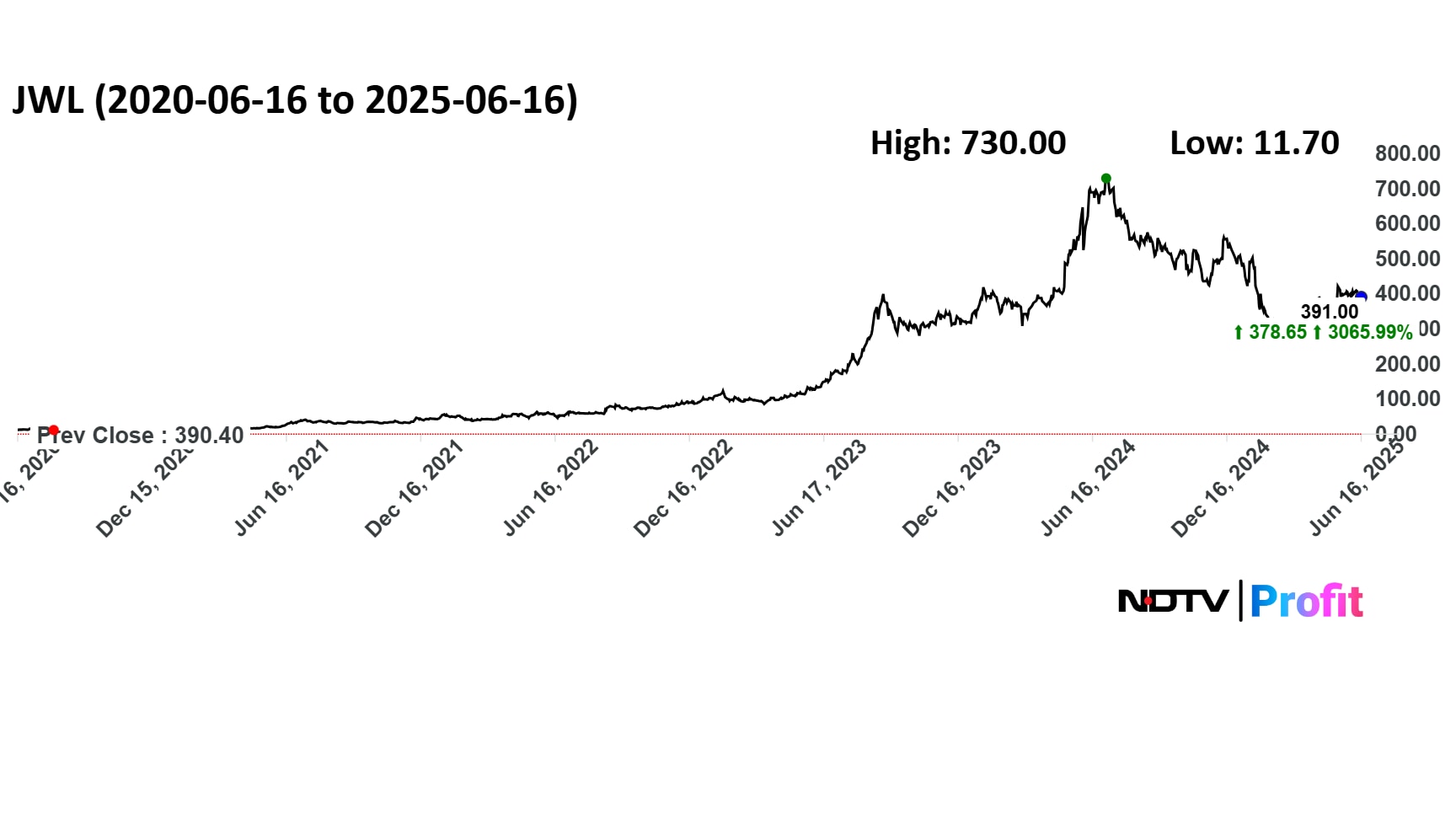

Jupiter Wagons Ltd., a key player in the railway manufacturing sector, is a multibagger stock that has rallied over 3000% over the last five years. The scrip has delivered a negative return of 21.87% on a year-to-date basis in 2025, while the five-year return of the stock stands at 3110.66%.

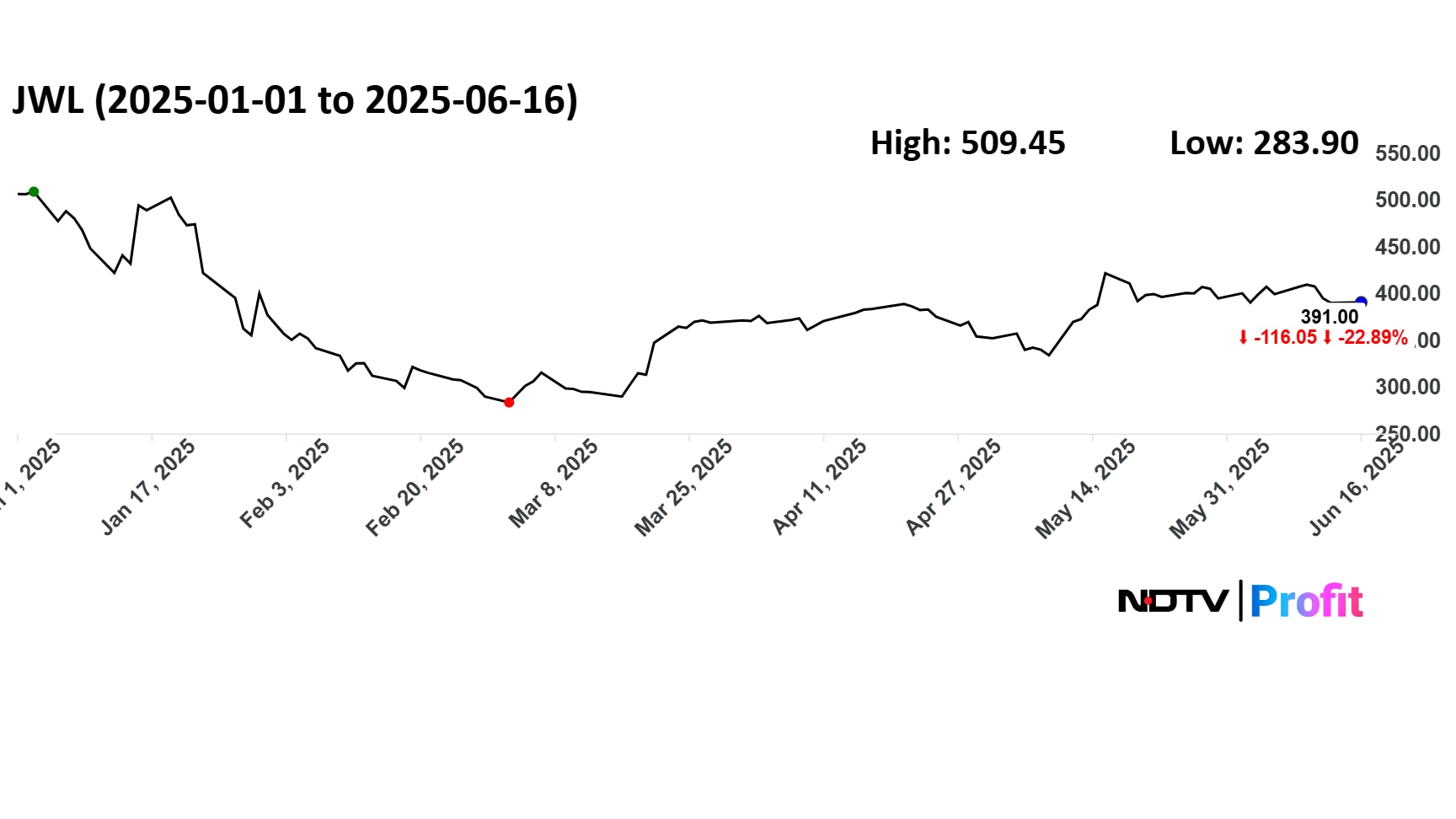

In the year so far, the share price recorded a high of Rs 509.4 on Jan. 3 before falling to the year's low of Rs 283 on Mar. 3. The company is a manufacturer of railway freight waggons, passenger coaches, waggon components, cast manganese steel crossings and castings headquartered in Kolkata, West Bengal. The company manufactures coaches for the Indian Railways and many other private companies.

Jupiter Wagons Share Price In The Year So Far

Jupiter Wagons Ltd. reported a decline in earnings during the fourth quarter of the financial year 2025. Consolidated net profit declined nearly 2% to Rs 103 crore in the January-March quarter, compared to Rs 105 crore in the corresponding period last year, according to financial results released on Monday.

The fall in the bottom line came as a result of a sharper decline in revenue from operations, which sank 6.4% to Rs 1,044 crore, compared to Rs 1,115 crore in the year-ago period. For the full year, net profit surged 15% to Rs 382.2 crore, from Rs 331.5 crore in financial year 2024. Operational profitability improved in the March quarter, with an over one percentage point expansion in margin.

Jupiter Wagons Share Price In The Last Five Years

The analysts' take on the counter is mixed, as three out of the five analysts tracking the company have a 'buy' rating on the stock, according to Bloomberg. Two analysts have a 'hold' rating on the counter.

ULJK Financial Services and Systematix Group give the counter a buy, while Antique Stock Broking and Dalal & Broacha Stock Broking give a hold rating for Jupiter Wagons. The average of the 12-month analysts' price target of Rs 430 implies a potential upside of 10.1%.

Jupiter Wagons: Outlook And Orderbook

Jupiter Wagons aims to achieve a topline of Rs 10,000 crore with an Ebitda margin of 27% by financial year 2027, driven by the company's new facilities and entry into the EV truck segment. Sharing the projection in an earlier interview with NDTV Profit, Jupiter Wagons' Managing Director Vivek Lohia said that the freight business will continue to deliver strong numbers for the company in the coming years.

“By FY27, after all the facilities come online, we are looking at a revenue of about Rs 10,000 crores. That has been our guidance. Going forward, the freight business will continue to remain strong. With all the businesses put together, I think Rs 10,000 crore is what we are looking at, along with EBITDA margins of 15% plus,” Lohia said.

The company has forayed into the electric light commercial vehicle (e-LCV) space with the launch of JEM Tez, a 1-tonne payload truck with a 2.5-tonne GVW. Kolkata-based Jupiter Wagons' order book as of March 2025 stands at Rs 6,303.6 crore, according to an earlier press statement.

This includes a Rs 600 crore order from Ambuja Cement Ltd. and ACC Ltd. for the supply of BCFCM rake waggons, a Rs 255 crore order from Braithwaite & Co for the supply of railway wheelsets, Rs 150 crore for passenger brake systems, and Rs 65 crore for brake discs.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.