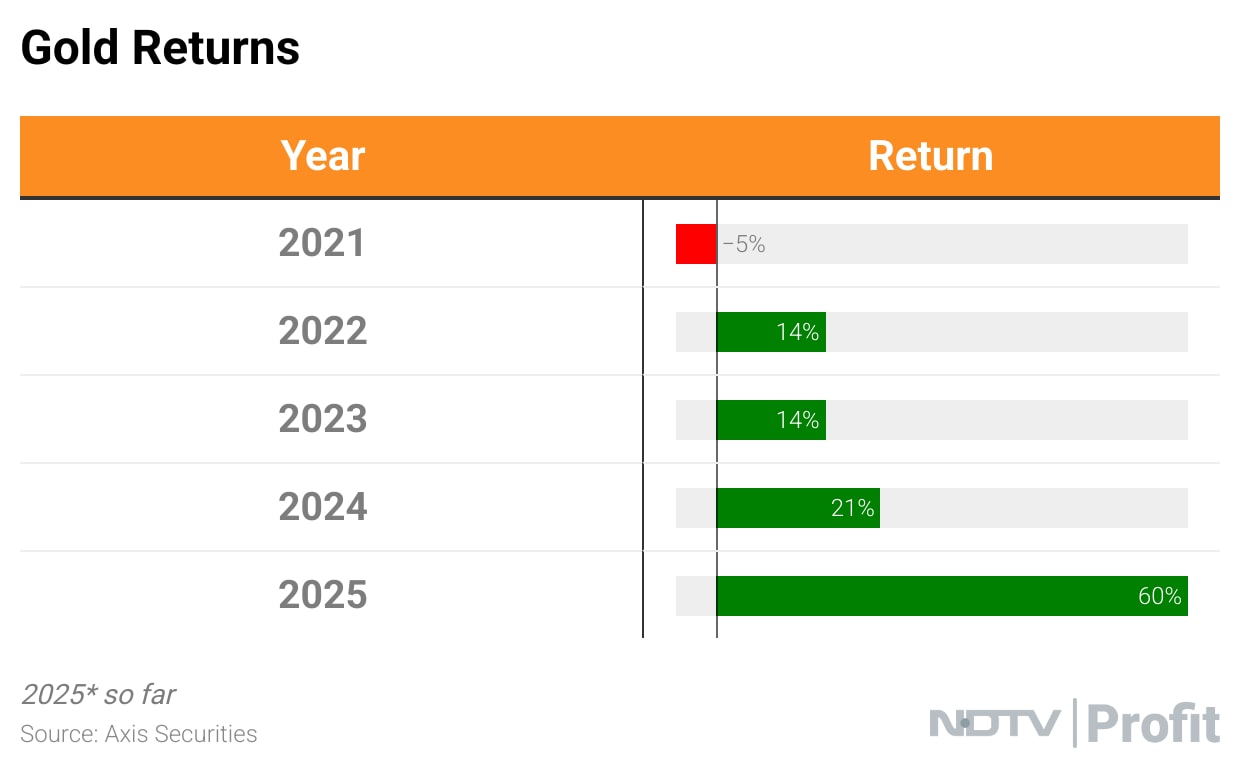

Gold prices have surged 60% so far this year, its best yearly gain since 1979, outpacing return on equities. The yellow metal is set to clock its fourth consecutive year of positive gains.

The precious metal delivered these exceptional returns, supported by strong central bank buying, rising geopolitical tensions, economic uncertainty, and heavy passive inflows.

Now, as investors ponder over profit booking or staying put with their gold investments, the attention is on likely headwinds for the bullion.

Gold returns in the last five years. (Image NDTV Profit)

Indians typically do not sell physical gold due to sentimental affinity. However, retail money have flooded alternative instruments like gold exchange traded funds (ETFs). Total assets under management of gold ETFs in India soared to Rs 1 lakh crore for the first time in October.

In a note, analysts at Axis Securities pointed to six key factors that could potentially derail the gold rally.

Monetary Policy

If inflation proves stickier than expected, major central banks — especially the US Federal Reserve — may pause rate cuts or even signal renewed tightening. Higher real yields raise the opportunity cost of holding gold and can trigger long liquidation.

King Dollar

A rebound in the US dollar driven by better-than-expected economic growth, capital flows into the world's largest economy, or safe-haven demand for the dollar instead of gold could cap upside for bullion.

Central Bank Demand

Central banks, particularly in China and India, have been major buyers of gold since 2022. Any slowdown due to reserve diversification reaching maturity, improved FX stability, or political realignments would remove a structural pillar of support.

Geopolitics

If major flashpoints in the Middle East, Russia–Ukraine war, US–China trade relations stabilise, safe-haven demand could taper. Gold thrives on uncertainty and so calm conditions generally reduce flows.

Other Assets

A powerful rally in equities, tech, crypto, or other higher-yielding asset classes may draw capital away from gold. Risk-on sentiment often suppresses safe-haven inflows like gold that does not give a dividend or interest. A rebound in nominal or real yields, whether due to higher growth, lower recession odds, or increased government borrowing, could pressure bullion, as investors shift toward income-generating instruments.

Retail Demand

Weak physical gold demand from China and India, the world's two largest customers, could also pressure bullion. Factors such as high local premiums, slower income growth, import restrictions, or currency depreciation could dampen physical offtake.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.