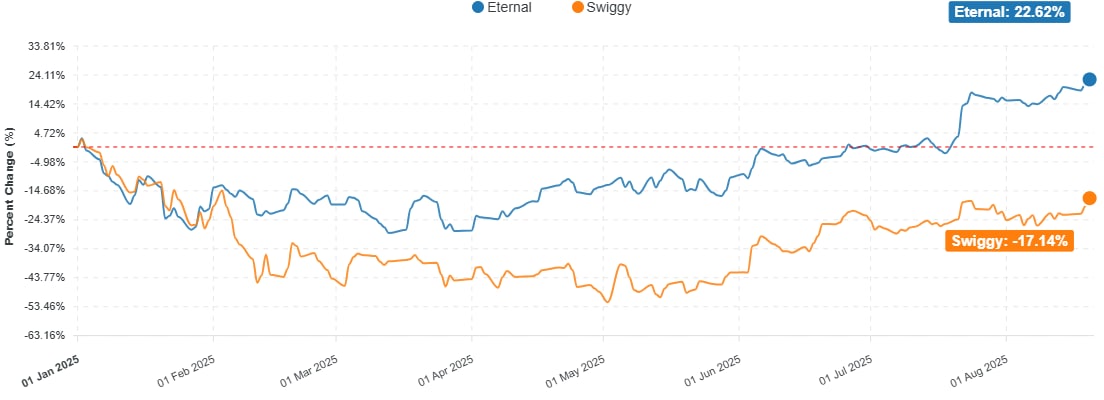

- Eternal and Swiggy received share price target hikes from Macquarie despite lower intrinsic valuations

- Structural challenges and low likelihood of long-term profit success are expected

- Eternal target price raised to Rs 200, Swiggy to Rs 285, both maintain underperform ratings

Eternal Ltd. and Swiggy Ltd. received share price target hikes from the multinational financial firm Macquarie, despite lower intrinsic valuations. Analysts Aditya Suresh and Baiju Joshi said in a note that the market is rewarding rapid quick commerce growth and buying into management's promise of better margins.

The QC segment of both Eternal (Blinkit) and Swiggy (Instamart) did well in the first quarter, even as headline numbers were subdued. However, they see structural challenges and view hopes of profit as "illusory". "We assign a far lower likelihood of long-term success," he said.

Year-To-date Stock Performance

Challenges Ahead

Suresh and Joshi cited heightened competition from Zepto, Tata Group's BigBasket, Flipkart Minutes and Amazon Prime Now. Besides, large offline retailers like Reliance JioMart, that has a wider reach and only variable costs, are starting to respond with faster delivery options.

Zomato's Blinkit is a growth leader with aggressive expansion plans. The recent moderation in losses arose from lower allocated central costs, not from improvement, the analysts said. In contrast to Eternal's guidance, Macquaire sees challenges for the aggregate network to reach 2.5-3.0% adjusted Ebitda margin.

On the other hand, Instamart's Ebitda loss would be nearly Rs 4,000 crore. Incremental levers to improve this position remain highly uncertain and they expect additional fundraises.

Eternal, Swiggy Target Price

Eternal – Maintain 'Underperform' and hike target price to Rs 200 from Rs 150. Last closing at Rs 321.45.

Swiggy – Maintain'Underperform' and hike target price to Rs 285 from Rs 260. Last closing at Rs 409.7.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.