Syngene is a subsidiary of Biocon Ltd..jpg?downsize=773:435)

Biocon Ltd.'s shares saw a sharp rise of more than 7% after HSBC upgraded the company's stock to 'buy' from 'reduce' and raised its target price to Rs 430 from Rs 290 per share. This move comes after the brokerage highlighted multiple catalysts driving Biocon's potential operational turnaround, primarily its strong pipeline of biosimilars and recovery in the generics sector.

HSBC noted that Biocon is well-positioned for growth, citing key developments such as the FDA clearance for its Malaysia insulin plant, which ends a long regulatory overhang and paves the way for the launch of insulin aspart in the US. Biocon is the exclusive biosimilar filer for insulin aspart, a product with a potential total addressable market of around $550 million, positioning the company for significant revenue growth.

The brokerage also emphasised Biocon's improving execution with in-market biosimilars, including the anticipated launches of ustekinumab and aflibercept, and the recovery in its generics segment driven by high-value launches like GLP-1 products. Furthermore, Biocon is expected to benefit from better utilisation of its manufacturing plants and reduced regulatory risks, leading to an improved growth outlook.

With an increased confidence in the company's prospects, HSBC raised its earnings estimates for Biocon, projecting significant growth in its biosimilar sales over the next few years. The brokerage now expects biosimilar sales to reach $1.8 billion by FY27, with a possible upside in its bull-case scenario.

HSBC's improved visibility on Biocon's future growth trajectory has led to the upgrade and an increased target price, which now implies a 19.1% upside potential for the stock.

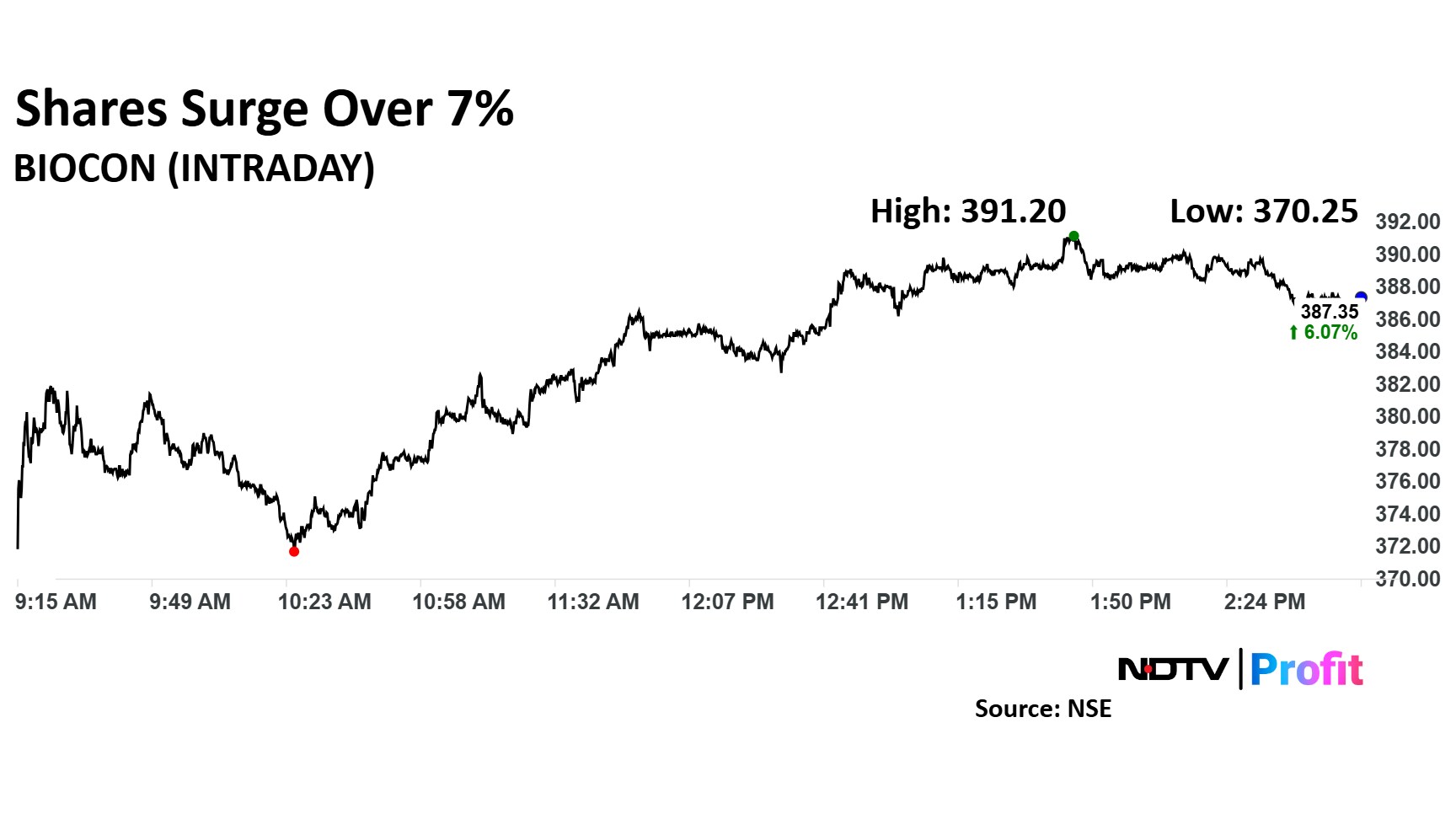

Biocon Share Price Today

Shares of Biocon rose as much as 7.12% to Rs 391.20 apiece. It pared gains to trade 6.04% higher at Rs 387.25 apiece, as of 03:03 p.m. This compares to a 0.31% advance in the NSE Nifty 50.

It has risen 37.76% in the last 12 months. Total traded volume so far in the day stood at 4.8 times its 30-day average. The relative strength index was at 61.

Out of 18 analysts tracking the company, 10 maintain a 'buy' rating, three recommend a 'hold' and five suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies a downside of 5.6%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.