The shares of Biocon Ltd. rose over 4% on Monday after the U.S. Food and Drug Administration cleared its subsidiary's facilities in Malaysia.

The US drug regulator has given a 'Voluntary Action Indicated' classification for the Malaysian insulin manufacturing units of Biocon Biologics, the company said in a statement on Sunday. This means that the company can go ahead and file products from that facility.

The move comes after USFDA had slapped an 'Official Action Indicated' status on the insulin facilities in October 2023. In addition, they had received five observations in last September during an inspection by the regulator.

After the clearance from USFDA, Motilal Oswal has upgraded Biocon to 'buy' with a target price of Rs 430 apiece. According to the brokerage the clearance will improve its business prospects in the US market. The clearance will also pave the way for commercial opportunities for B-Aspart, it added in its report.

"We believe the contractual cycle will pose a limited hurdle, as there is currently no biosimilar competition for this product," it said.

The report also pointed out that the firm has experienced significant earnings decline over the last two years due to lack of potential approvals from the US market.

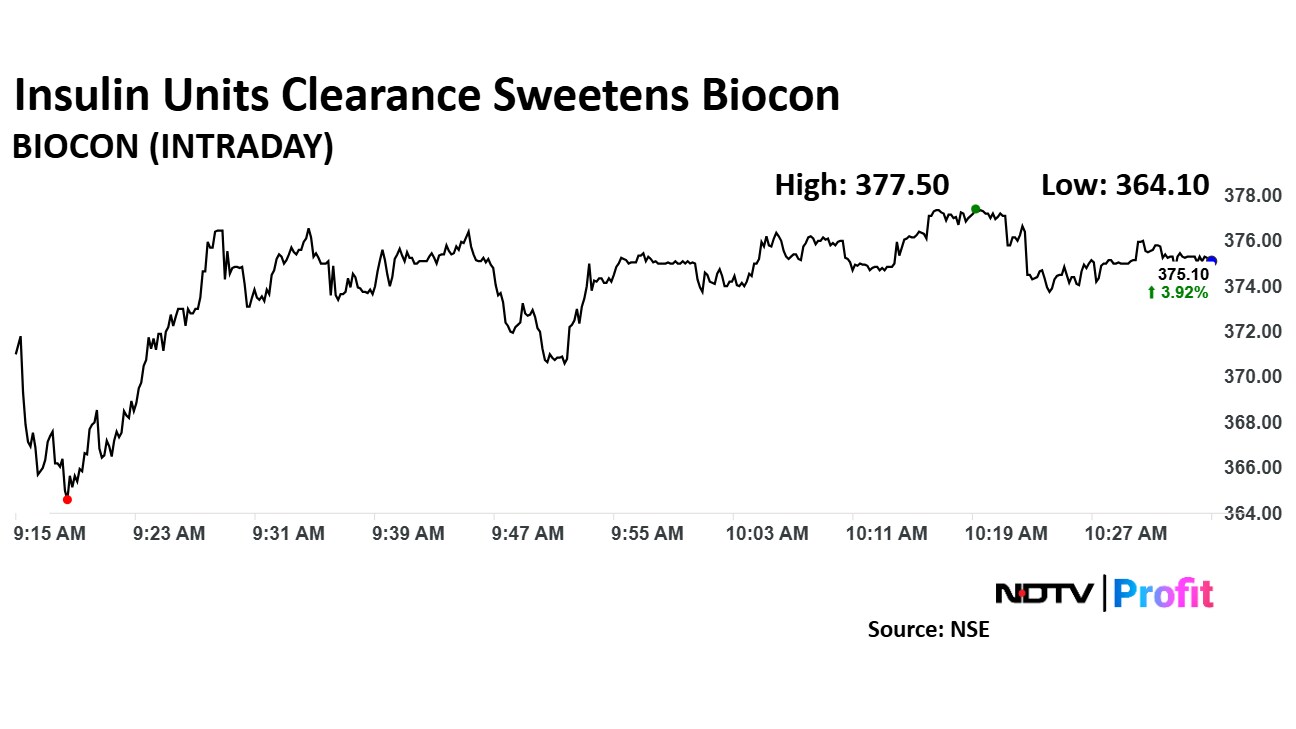

Biocon Shares Rise Over 4%

The scrip rose as much as 4.58% to 377.50 apiece following the development, before paring gains to trade 3.92% higher at Rs 375.10 apiece, as of 10:37 a.m. This compares to a 0.46% decline in the NSE Nifty 50 Index at 23,323.20.

It has risen 33.40% in the last 12 months. Total traded volume so far in the day stood at 10 times its 30-day average. The relative strength index was at 56.

Out of 18 analysts tracking the company, nine maintain a 'buy' rating, three recommend a 'hold,' and six suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies a downside of 4.7%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.