A major overhaul of the goods and services tax (GST) system comes into force from today, Sept. 22. The new GST rate changes, cleared by the GST Council earlier this month, will alter the tax burden across a wide range of items used every day.

Finance Minister Nirmala Sitharaman said the Council decided to move away from the earlier four-slab structure of 5%, 12%, 18% and 28%, opting instead for a simpler two-rate system of 5% and 18%. A higher rate of 40% has been reserved for certain categories such as high-end vehicles, tobacco and sin goods.

The new GST rates and structure is expected to ease costs on several household essentials while raising levies on discretionary and luxury products. Everyday items such as food staples, toiletries and footwear will see a reduction, while services like business-class air travel and products like gaming and caffeinated drinks will attract higher tax.

See which products are getting cheaper and which are becoming more expensive under GST.

Daily Staples And Food

Indian breads, UHT milk and packaged paneer, which earlier carried a 5% levy, are now free of GST. Cereals and ready-to-eat snacks fall sharply, with rates dropping from 12–18% to 5%.

Also Read: Full List Of Scooters, Bikes, Motorcycles That Get Cheaper Under GST 2.0

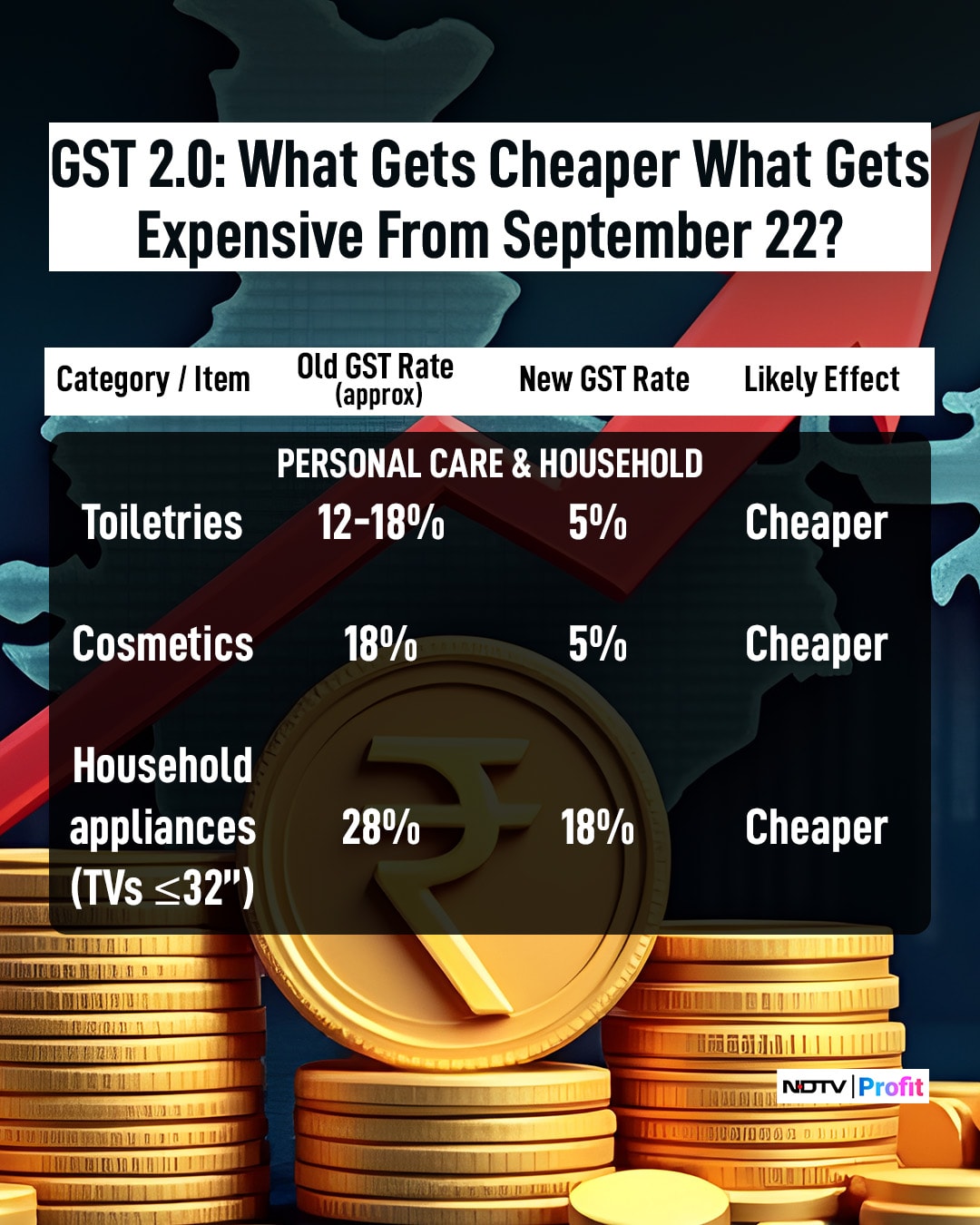

Personal Care And Household

Hair oil, soaps and cosmetics, once taxed at 12–18%, will now be charged only 5%. Televisions under 32 inches shift to 18% from 28%, offering relief for small-screen buyers.

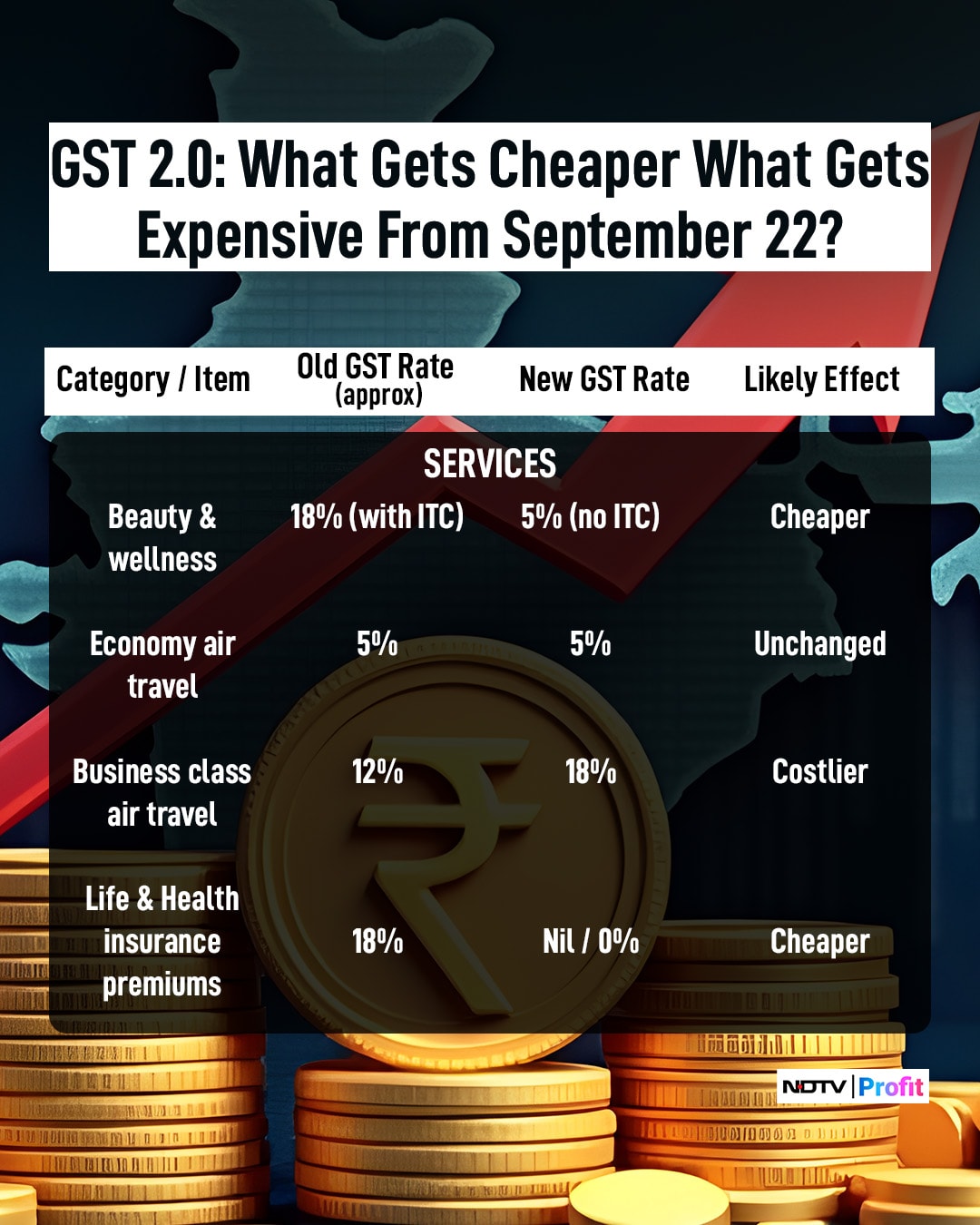

Beauty, Wellness And Travel

Beauty and wellness offerings fall from 18% with input tax credit to 5% without credit. Economy fares stay at 5%, while business class tickets rise from 12% to 18%.

Besides, Individual health and life insurance premiums, earlier taxed at 18%, are now exempt.

Also Read: Full List Of Cars That Get Cheaper Under GST 2.0

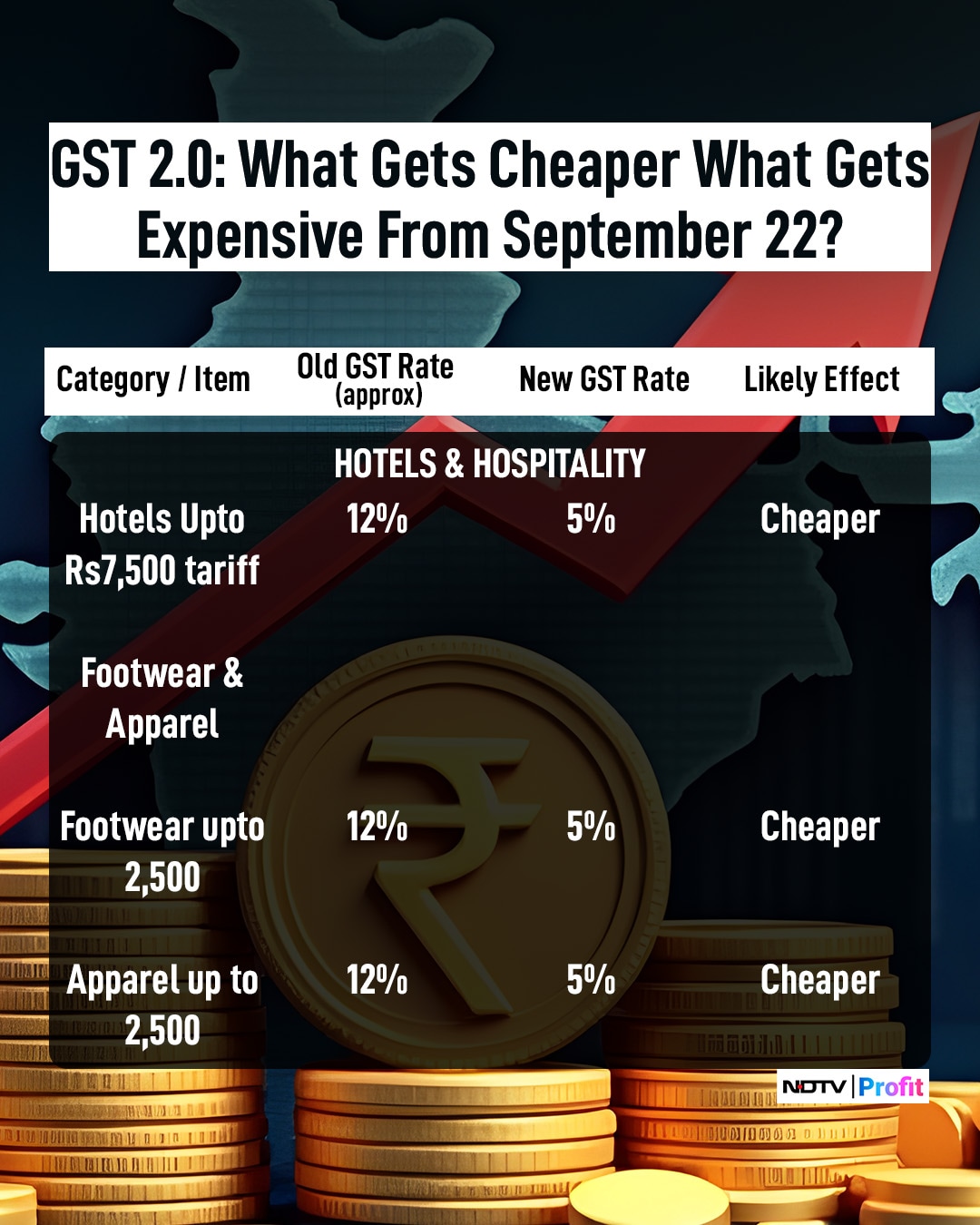

Hotels, Apparel And Footwear

Hotel stays priced up to Rs 7,500 a night drop from 12% GST to 5%. Footwear and clothing up to Rs 2,500, earlier in the 12% bracket, now fall under 5%.

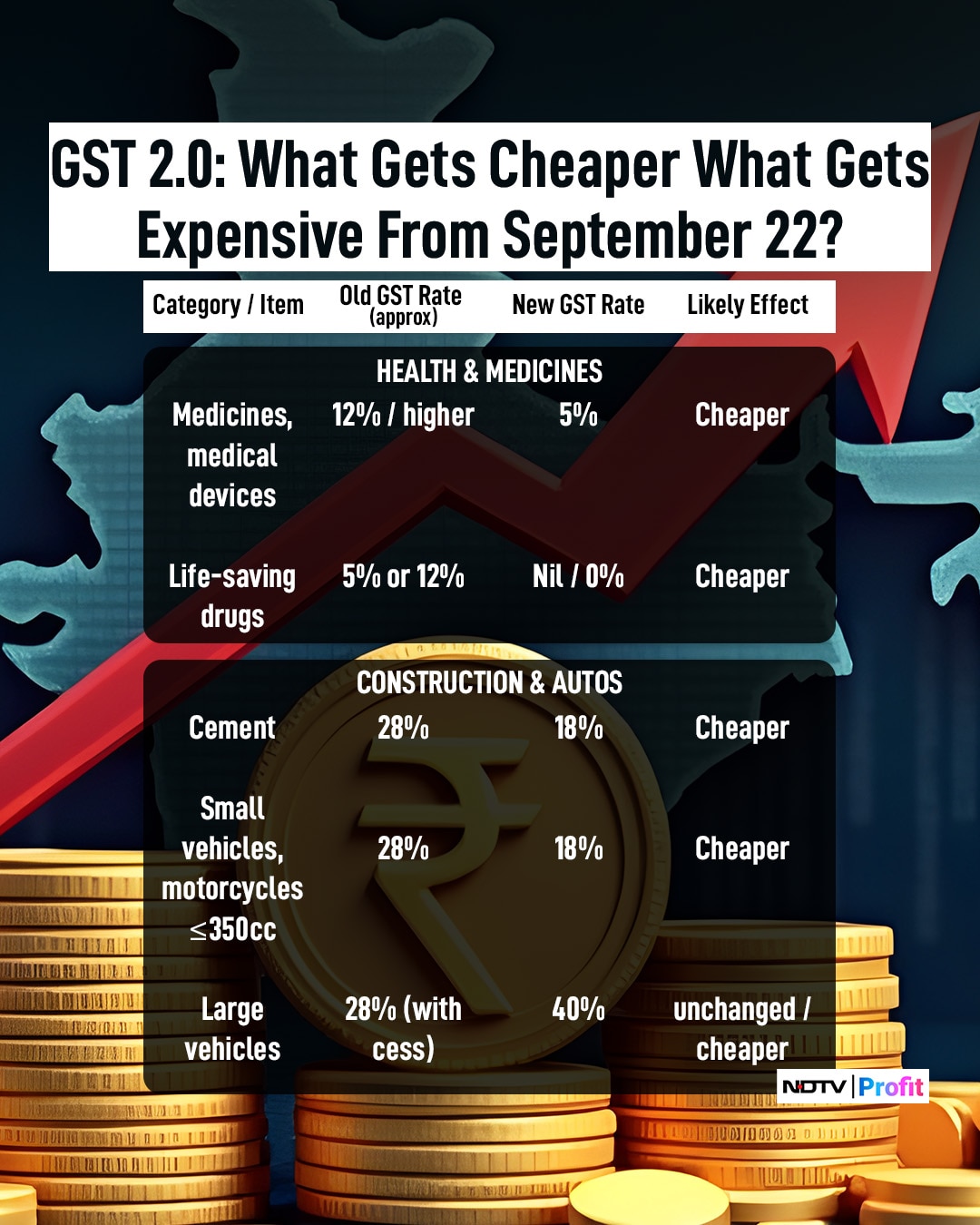

Medicines, Construction And Automobiles

Medical devices fall to 5%, while certain life-saving drugs become tax-free, down from 5–12%, while cement moves from 28% to 18%. Two-wheelers below 350cc drop from 28% to 18%. Larger vehicles remain in the 40% bracket, unchanged.

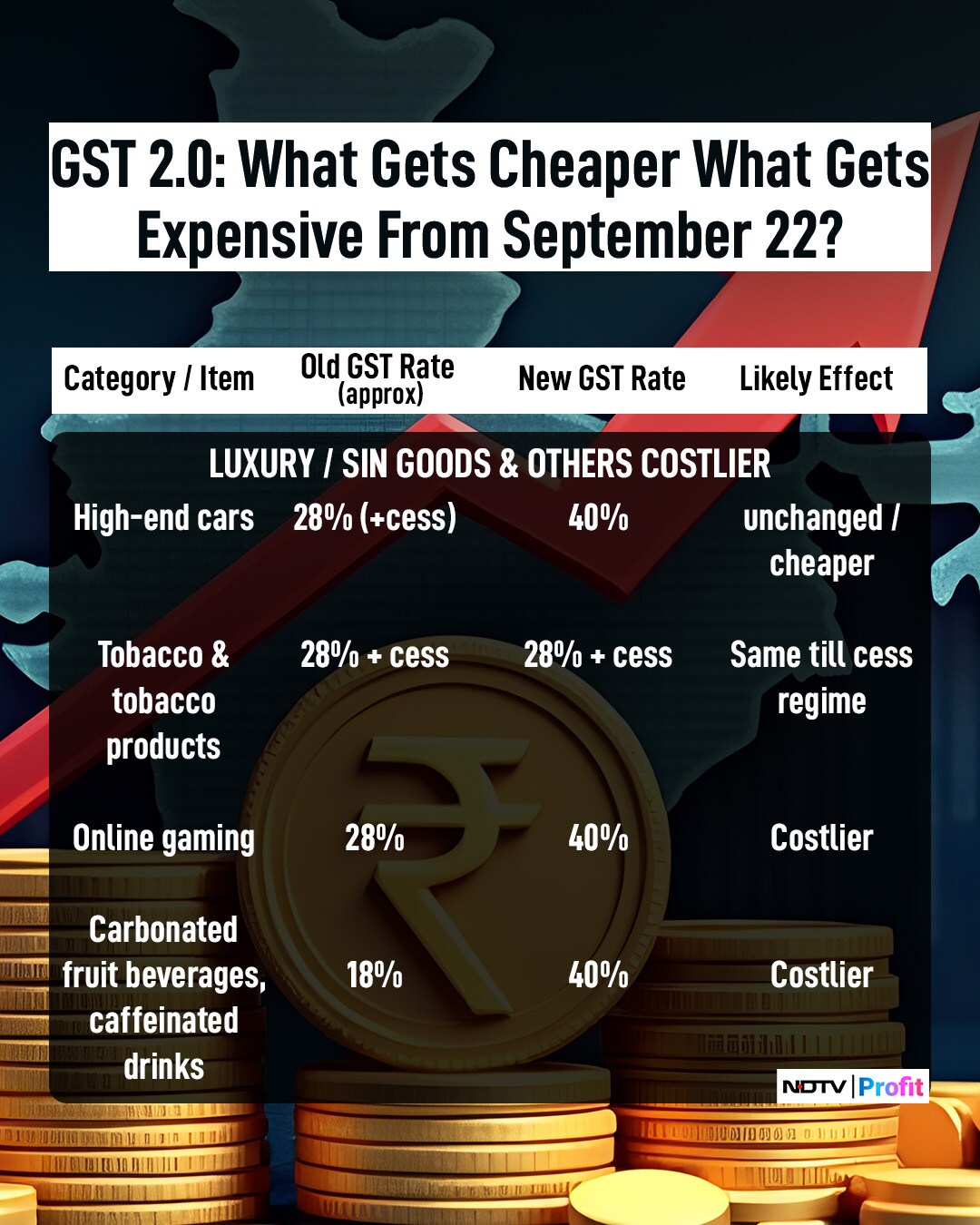

Sin Goods And Others

Online gaming now attracts 40%, up from 28%. Carbonated fruit beverages and caffeinated drinks jump from 18% to 40%.

Tobacco products continue under 28% GST along with cess.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.