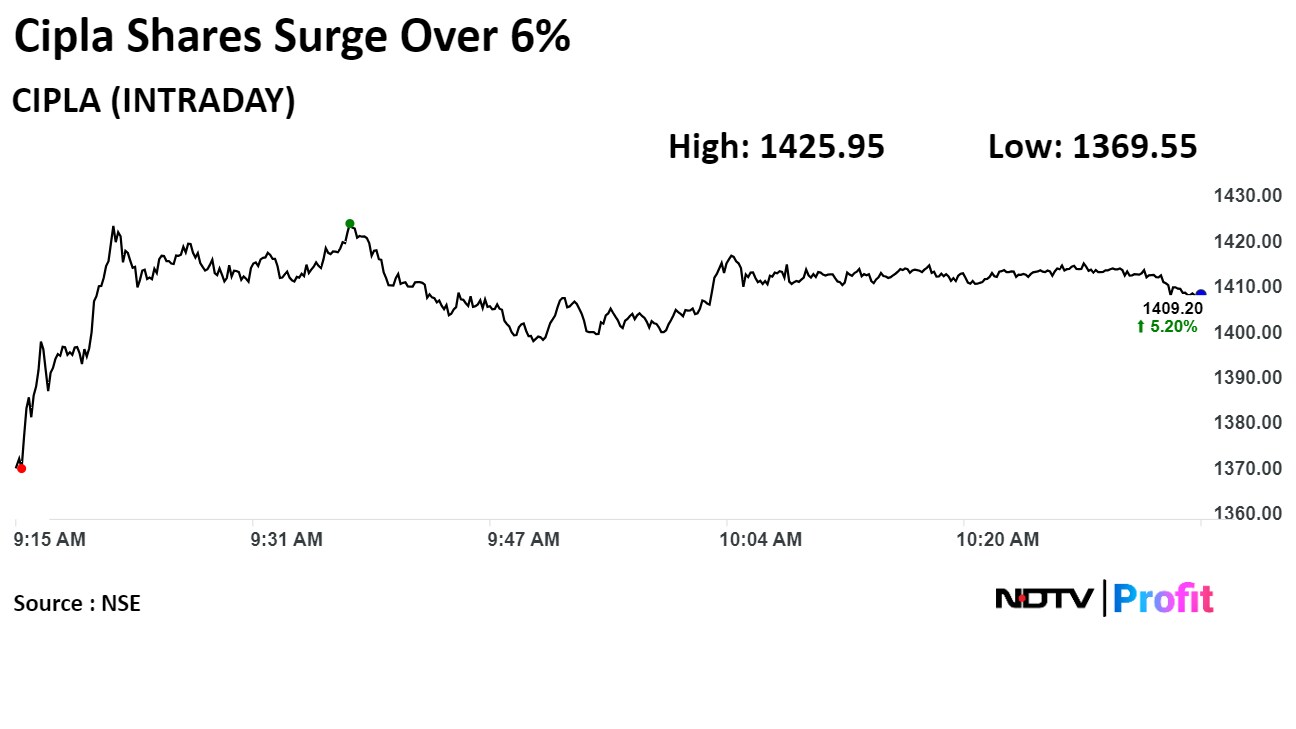

Shares of Cipla Ltd. surged over 6% on Monday after the drugmaker's consolidated net profit in the fourth quarter of financial year 2024 beat analysts' estimates.

The pharmaceutical company's profit rose 79% to Rs 931.9 crore in the quarter ended March, according to an exchange filing on Friday. Analysts tracked by Bloomberg had a consensus estimate of Rs 868 crore.

Revenue of Cipla's South Africa business rose by 26% in local currency terms, while that in North America and India markets grew by 11% and 7%, respectively.

The company's R&D investments stand at Rs 444 crore or 7.2 % of sales, higher by 19% YoY, driven by product filings and developmental efforts.

"As we enter into FY25, our focus will be on our priorities of market leading growth in our key markets, growing big brands bigger, investing in future pipeline as well as focusing on resolutions on the regulatory front," said Umang Vohra, MD and Global CEO, Cipla.

The drugmaker also declared a final dividend of Rs 13 per equity share for financial year 2024.

Cipla Q4 FY24 Earnings Highlights (Consolidated, YoY)

Revenue up 7.4% at Rs 6,163.2 crore (Bloomberg estimate: Rs 6,234 crore).

Ebitda up 12% at Rs 1,315.9 crore (Bloomberg estimate: Rs 1,370 crore).

Margin at 21.35% vs 2.45% (Bloomberg estimate: 22%).

Net profit up 79% at Rs 931.9 crore (Bloomberg estimate: Rs 868 crore).

Cipla's stock rose as much as 6.45% during the day to Rs 1,425.95 apiece on the NSE. It was trading 5.53% higher at Rs 1,413.6 per share, compared to a 0.89% decline in the benchmark Nifty at 10:34 a.m.

The share price has risen 53.2% in the last 12 months and 10% on a year-to-date basis. The total traded volume so far in the day stood at 15 times its 30-day average. The relative strength index was at 51.

Twenty-six out of the 38 analysts tracking the company have a 'buy' rating on the stock, six recommend 'hold' and as many suggest 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 4.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.