Life Insurance Corp.'s market capitalisation breached the Rs 7-lakh-crore mark briefly, making it the fifth most valued firm after Infosys Ltd.

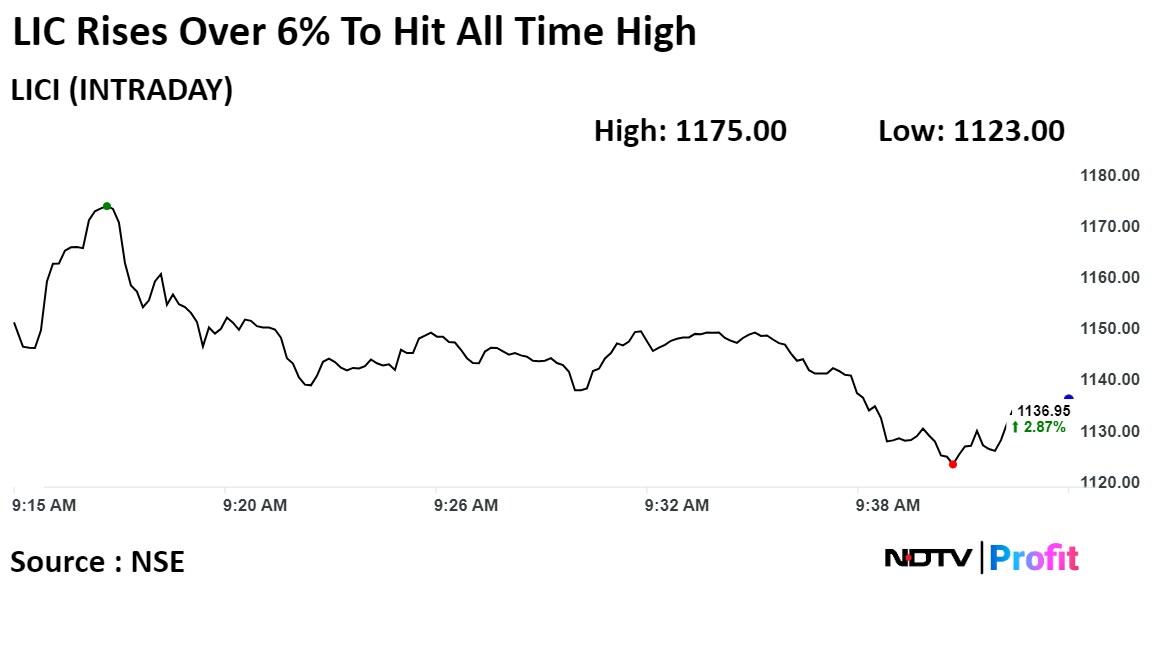

Shares of India's largest life insurer surged as much as 6% on Friday after its third-quarter profit jumped in results released post market hours on Thursday.

The state-owned insurer's standalone profit after tax rose 49% year-on-year to Rs 9,444 crore, according to an exchange filing on Thursday. The net premium of the company rose 5% year-on-year to Rs 1,17,017 crore

LIC Q3 Results Highlights (Standalone, YoY)

The value of new business, on a net basis, rose 46% to Rs 2,634 crore vs Rs 1,801 crore.

Net VNB margin stood at 20% versus 14.6%.

Revenue rose 8% to Rs 2.1 lakh crore.

On an annualised premium equivalent basis, total APE rose 7% to Rs 13,163 crore.

The 13th month persistency ratio—or customer retention— on premium basis improved to 78% from 77.61%.

For the 61st month, it fell to 62.40% from 62.73%.

The solvency ratio, which measures the extent to which assets cover commitments for future liabilities, rose to 193% from 185%.

It's above the minimum requirement of 150%.

Shares of the state-owned insurers has been rising since Monday, pushing its market capitalisation across Rs 6-lakh-crore mark earlier this week. Share prices also breached the Rs 1,000 mark for the first time on Monday.

LIC crossed ICICI Bank Ltd. to become the fifth most valued firm. Reliance Industries Ltd., Tata Consultancy Services Ltd., HDFC Bank Ltd and Infosys are the top four most valued firm.

Shares of the company rose as much as 6.31% to 1,175 apiece to touch fresh life high. The stock pared gains to trade 3.57% higher at Rs 1,144.70 apiece as of 9:36 a.m. This compares to a 0.13% advance in the NSE Nifty 50 Index.

LIC stock has risen 86.26% in the past 12 months. The total traded volume so far in the day stood at 9.4 times its 30-day average. The relative strength index was at 84 indicating it was overbought.

Out of 19 analysts tracking the company, 13 maintain a 'buy' rating, five recommend a 'hold', and one suggests a 'sell', according to Bloomberg data. The average of 12-month analyst price target implies an upside of 87.2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.