A car is more than the sum of its parts and the company that makes it. At least that's what Tata Motors Ltd. believes now.

India's biggest carmaker by market value is seeking a demerger of its trucking and car-making businesses into two listed entities in an attempt to unlock value and turn net debt-free.

The commercial-vehicle business and its related investments will be housed in one entity, while the other will include passenger cars, electric vehicles and luxury cars under the Jaguar Land Rover brand, according to an exchange filing on Monday. The demerger—a proposal for which will be presented before the board of directors in the coming months—is likely to be completed in 12–15 months, subject to statutory approvals.

Shareholders of Tata Motors will continue to have identical shareholding in both the listed entities, the filing stated, and it'll be business as usual after the demerger.

The stock, in response to the demerger plan, surged to an all-time high on Tuesday, even as most brokerages indicated that the spinoff is unlikely to boost valuations in the short term.

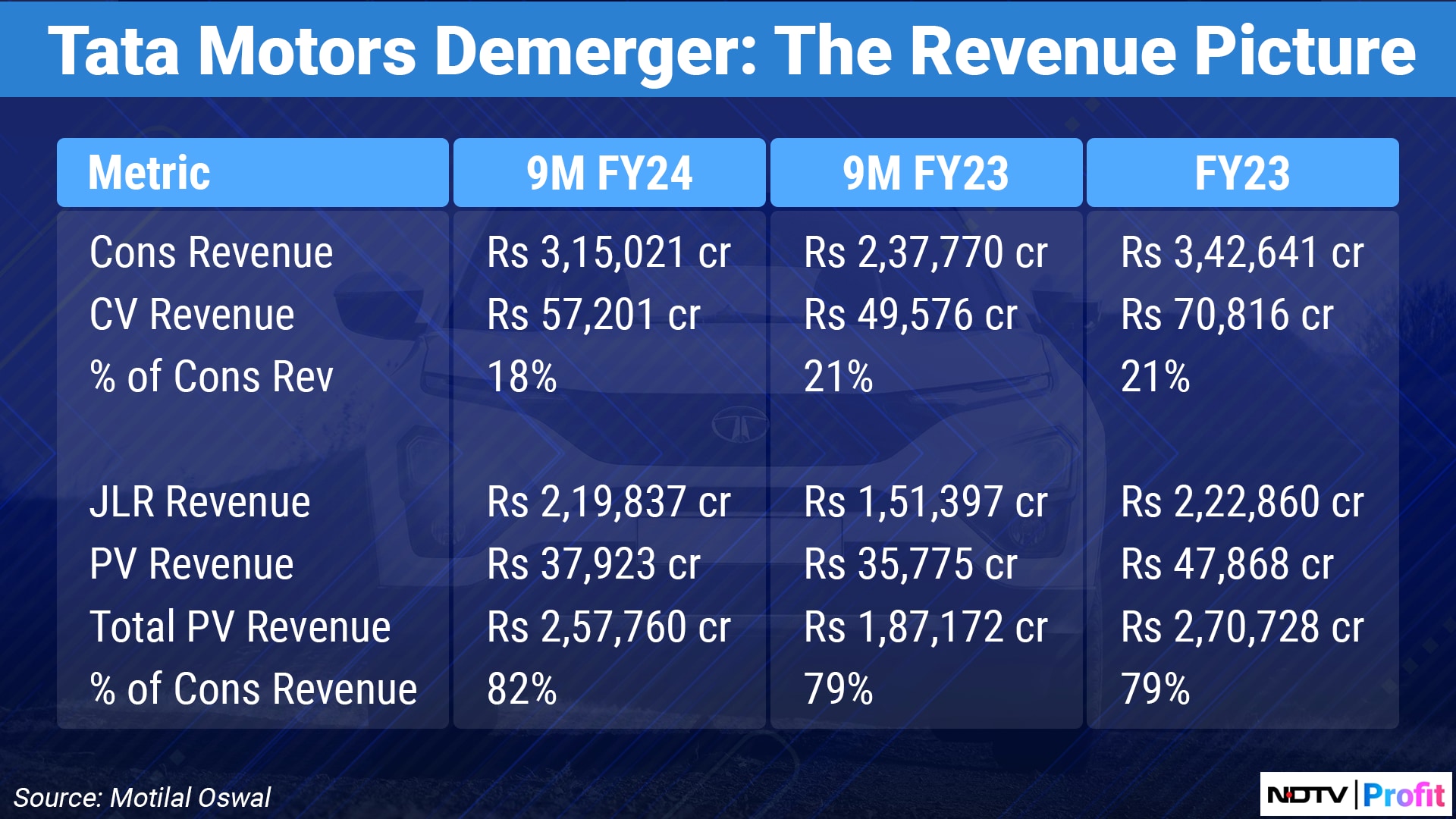

“While the demerger seems to be a step in the right direction, we don't foresee any need to revisit our target price, which is already based on SoTP (sum-of-the-parts) valuation,” Aniket Mhatre, Amber Shukla and Aniket Desai, research analysts at Motilal Oswal Financial Services Ltd., said in a March 5 note. “Moreover, despite factoring in most of the positive triggers, we get limited upside given the sharp run-up in the stock.”

But that's about the stock in the near term. In the long run, there's money to be made.

The demerger comes at an inflection point of sorts. The global automobile industry is in the midst of a seismic shift in mobility—from fossil-fueled and mechanically propelled to battery-powered and software-driven. Tata Motors, which already has a leg up in the EV space, at least in its home market, wants to make the most of the change that's afoot.

The CV Business

Historically for Tata Motors, it's the truck business that cushions the revenue impact with its cash flows when the car division falters—more often than not due to Jaguar Land Rover. As a standalone entity, that overhang gets removed.

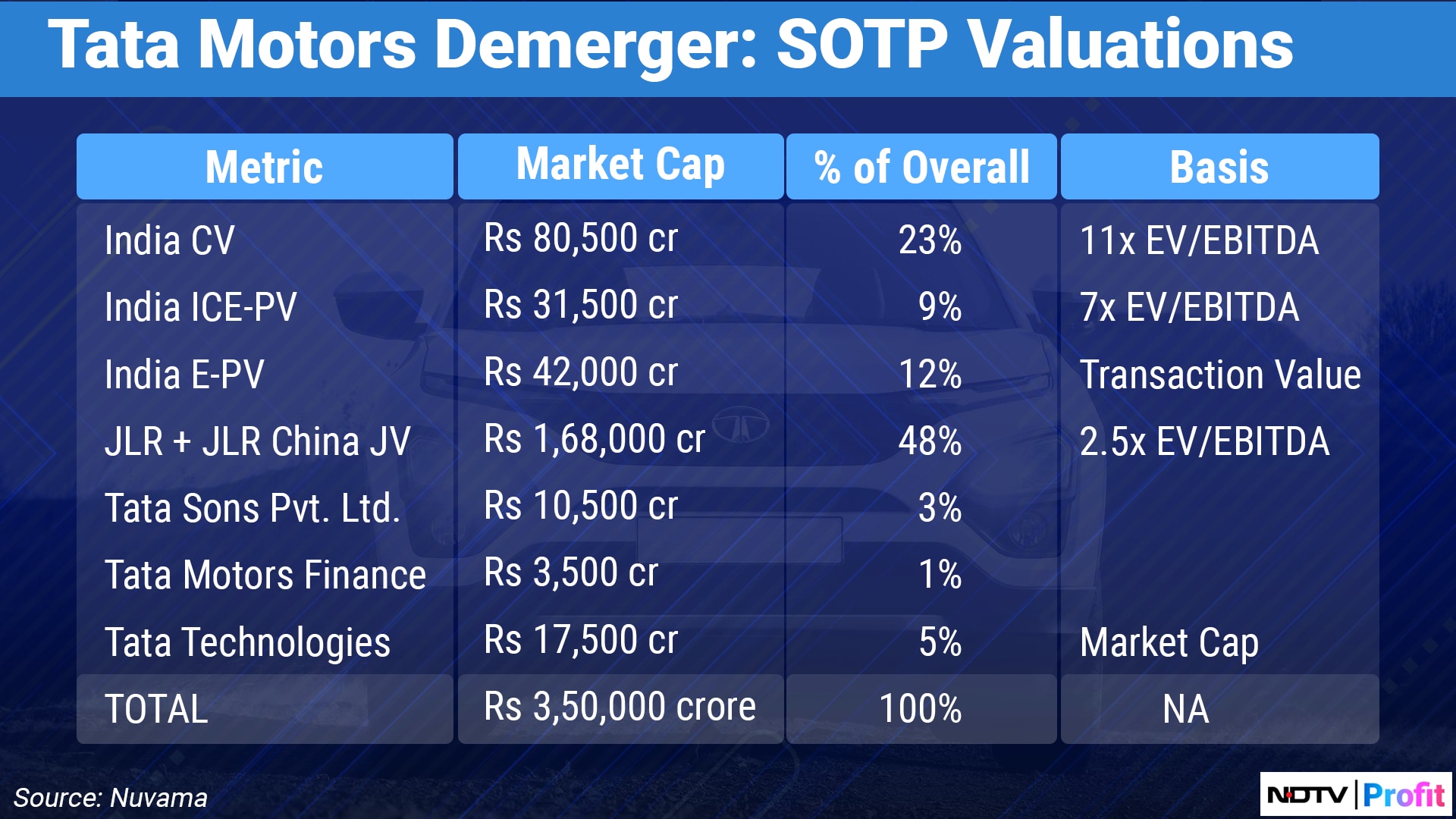

According to Investec, the CV business is valued at 12X EV/EBITDA over the next three years, suggesting a 20% premium to direct rival Ashok Leyland Ltd. This implies that nearly 35% of the sum-of-the-parts is from the truck portfolio, or Rs 330 per share of Tata Motors.

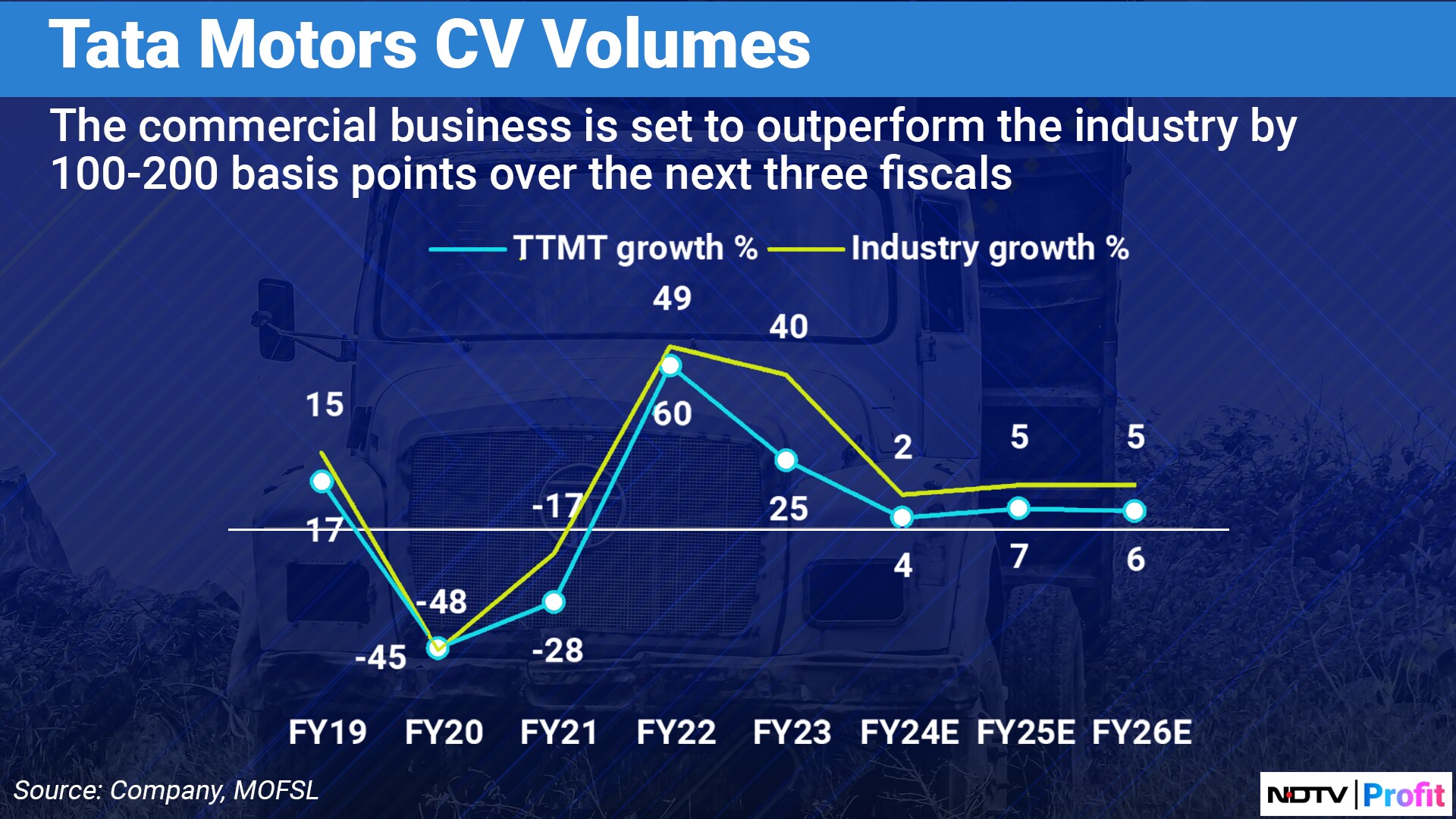

“We don't expect a significant re-rating of the CV business here on, especially as there is fear of CV growth slowdown on the back of a downcycle,” Investec analysts Aditya Jhawar and Aakash Gopani said in a March 4 note.

In the quarter ended December 2023, Tata Motors' CV sales grew 1% year-on-year to 95,914 units, indicating that cyclicality is at play. Still, nearly one in every two trucks sold in the country sports Tata badging.

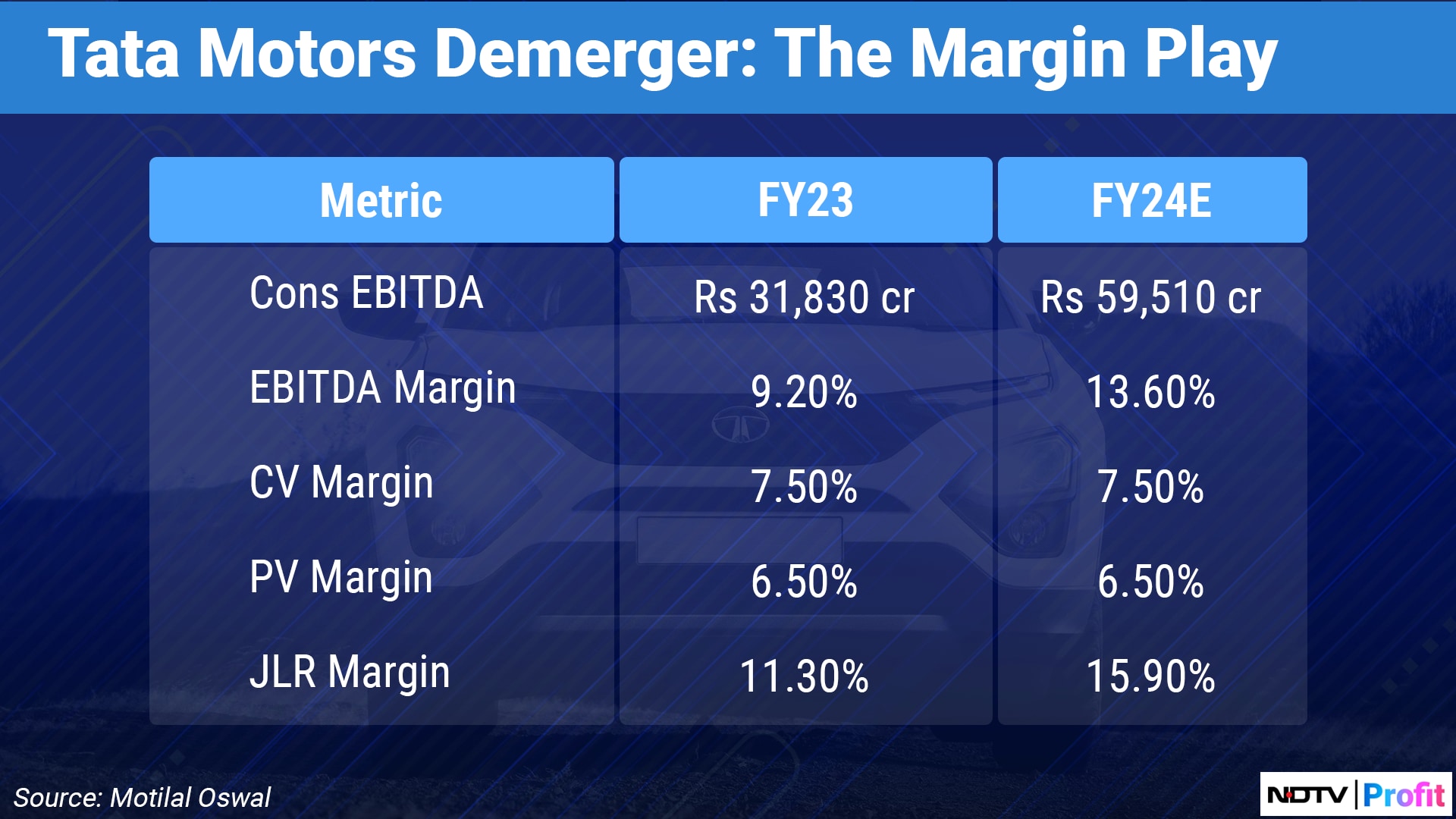

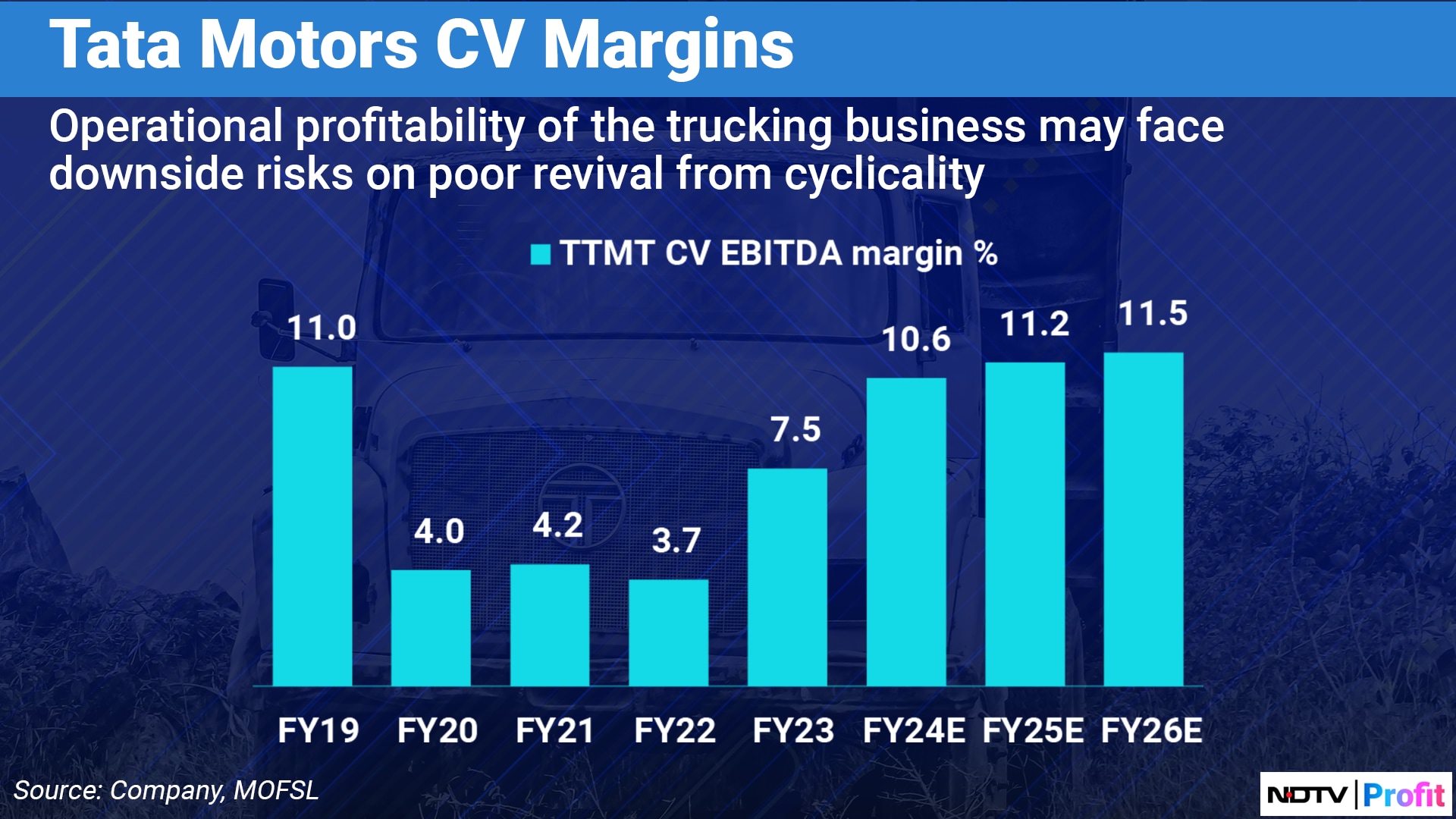

According to Motilal Oswal, the truck business can grow at 6% year-over-year in fiscal years 2025 and 2026 after a 1% decline in the ongoing financial year. That compares with the near-term weakness seen in the sector in FY25. The broker also expects the CV business to grow its operational profitability by 100 basis points over the next two years.

One basis point is one-hundredth of a percentage point.

The PV Business

The Tata Motors stock has been on a tear over the past couple of months, so much so that the Nexon maker has emerged as India's most valuable carmaker ahead of Maruti Suzuki India Ltd.—the nation's largest four-wheeler maker by volume.

The stock, in fact, has been on an upswing since 2020, moving in tandem with the surging domestic sales of passenger cars. Over the same time, the EV subsidiary—Tata Passenger Electric Mobility—has cornered three-fourths of the Indian EV market with the best-selling Nexon.ev compact SUV and the Tiago.ev hatchback.

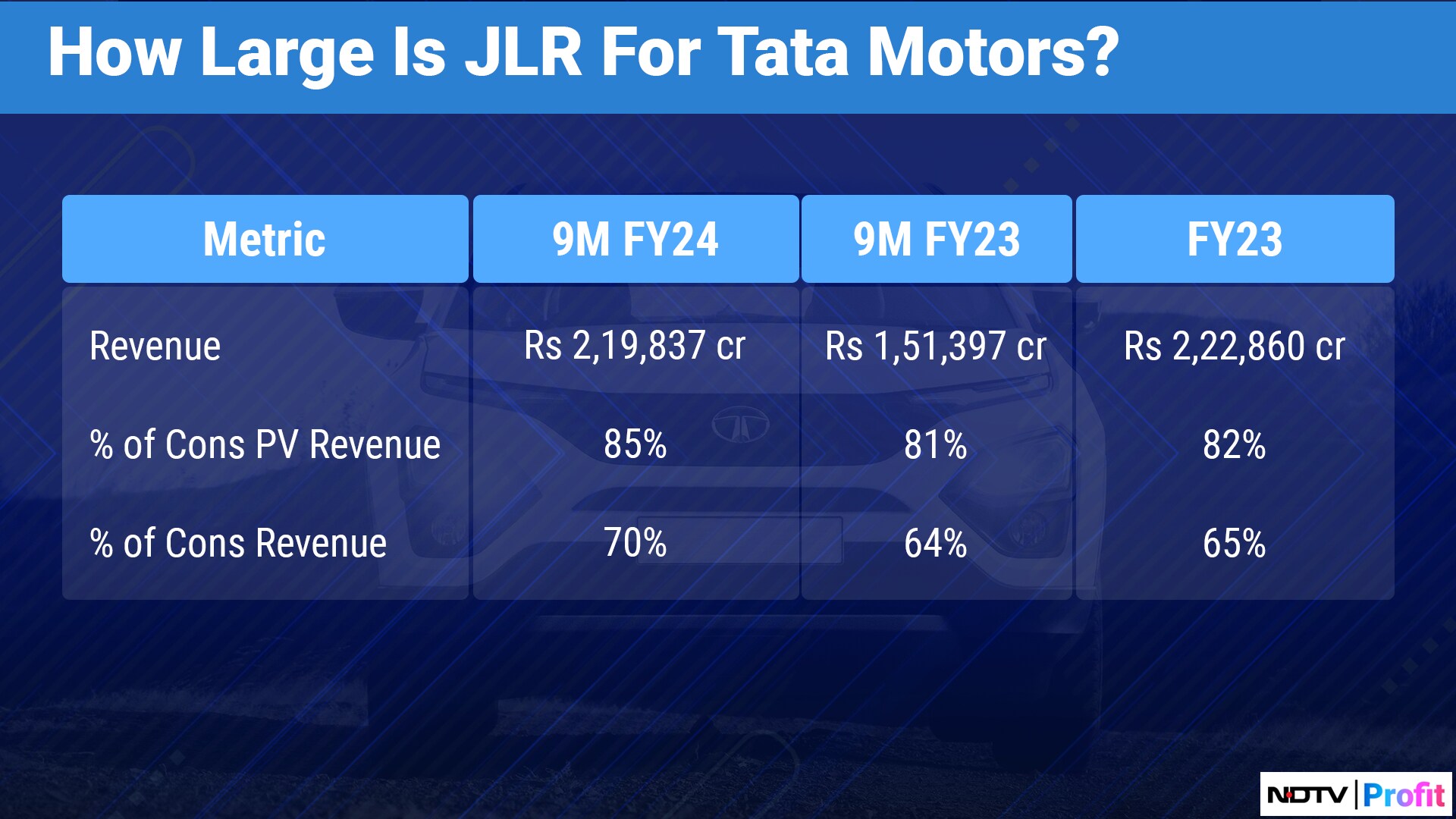

Additionally, JLR achieved its highest wholesales in eleven quarters during October–December 2023. The British marquee shipped 101,043 units—a 27% jump over the year-ago period. An electric Range Rover, which is due later this year, has already received 16,000 bookings since opening the waiting list in December last year, Bloomberg reported.

Essentially, the car business—passenger, electric and luxury—is firing on all cylinders. It only made sense to bring them under one umbrella to tap synergies between electric mobility and vehicle software and unlock value.

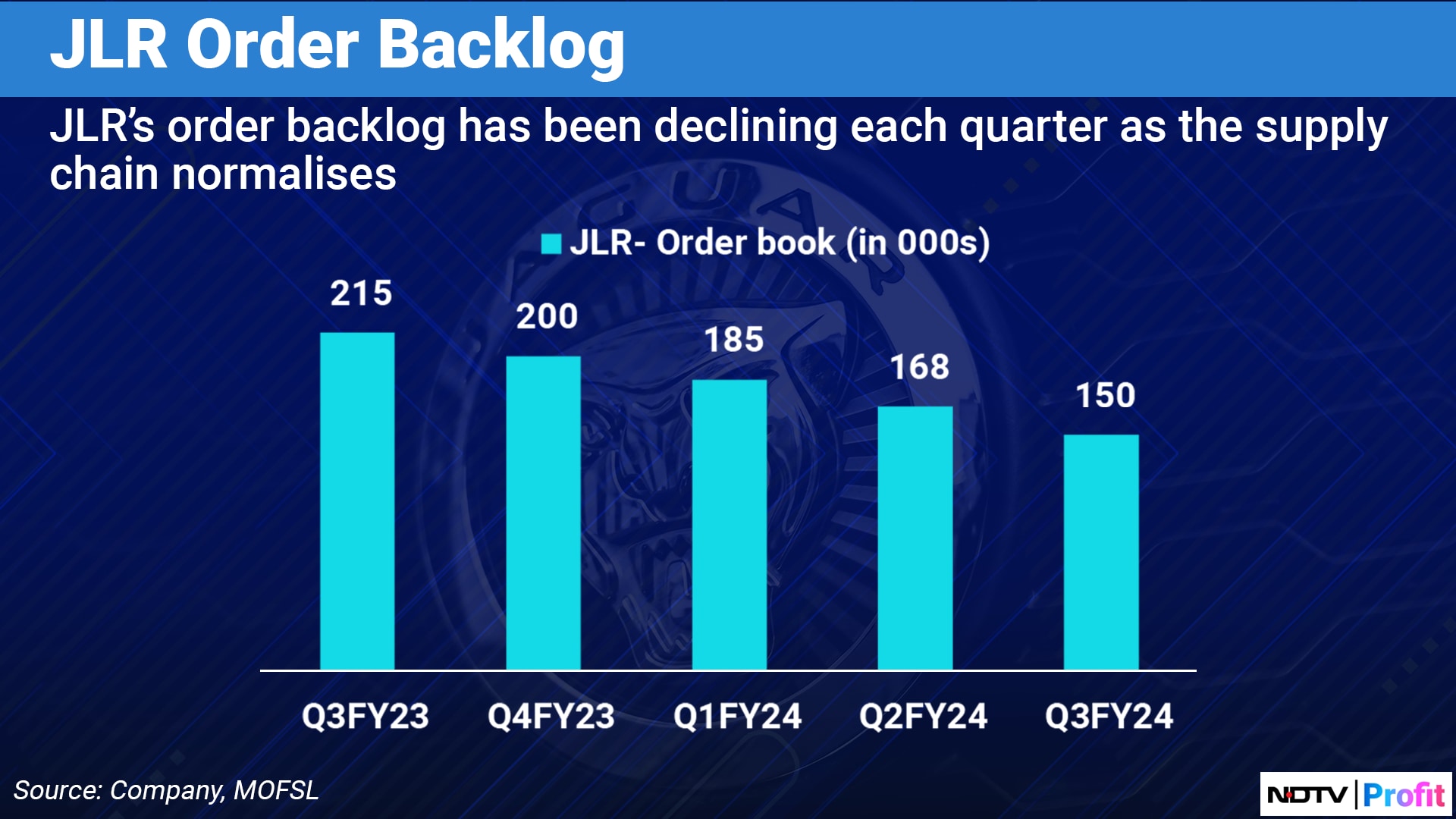

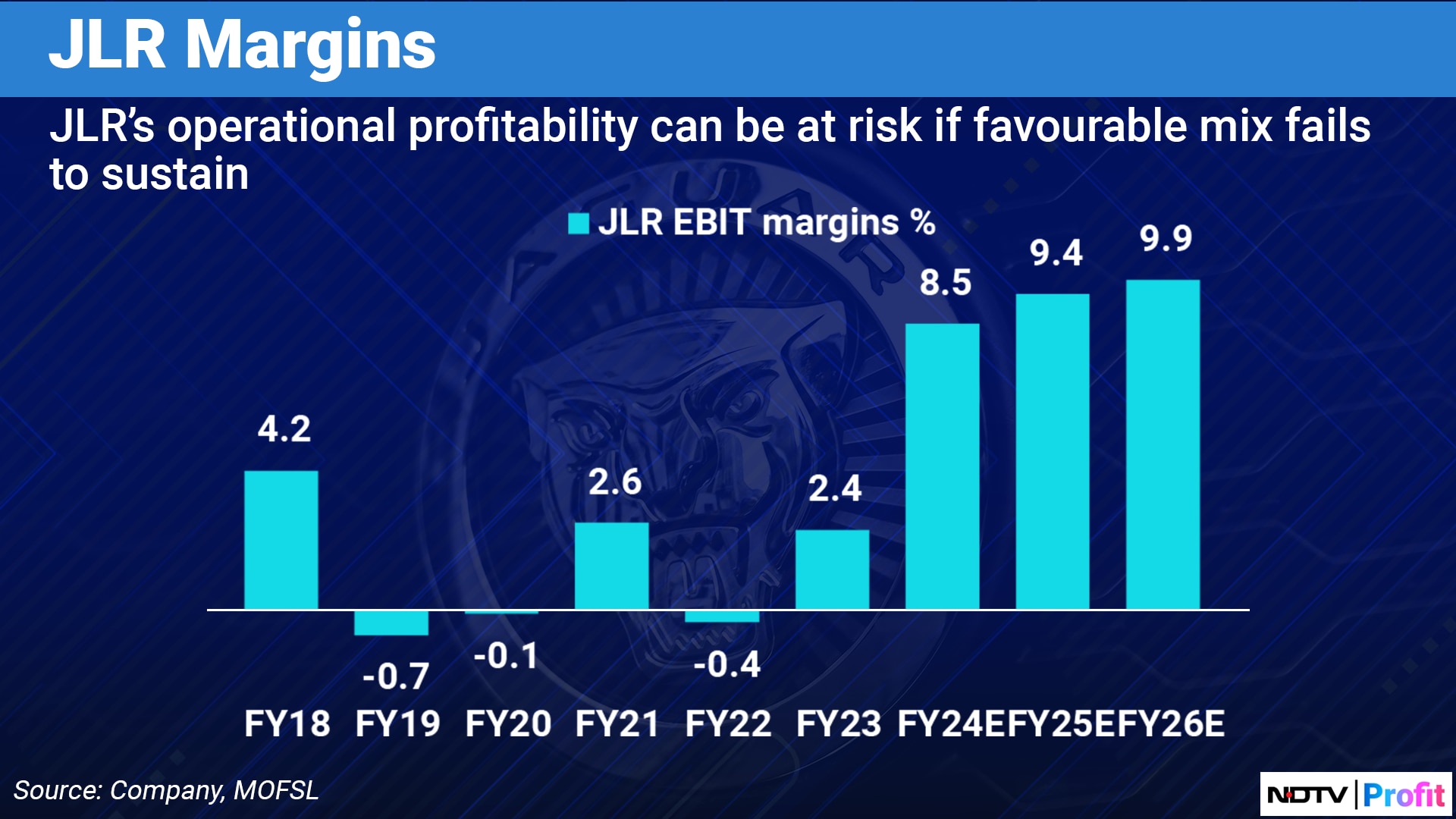

According to Invesco, Tata Motors' PV business is valued at 15 times EV/EBITDA—a 25% discount to Maruti Suzuki Ltd. The electric mobility business, valued at $3.6 billion at the time of the latest fund infusion by TPG Rise, accounts for 9% of SOTP, or Rs 80 of the stock price. The brokerage has a “hazy” outlook on JLR—30% of the SOTP—due to a declining order book.

That, however, doesn't discount the outsized potential the PV business has to create value through this decade, Nomura said in its March 4 note.

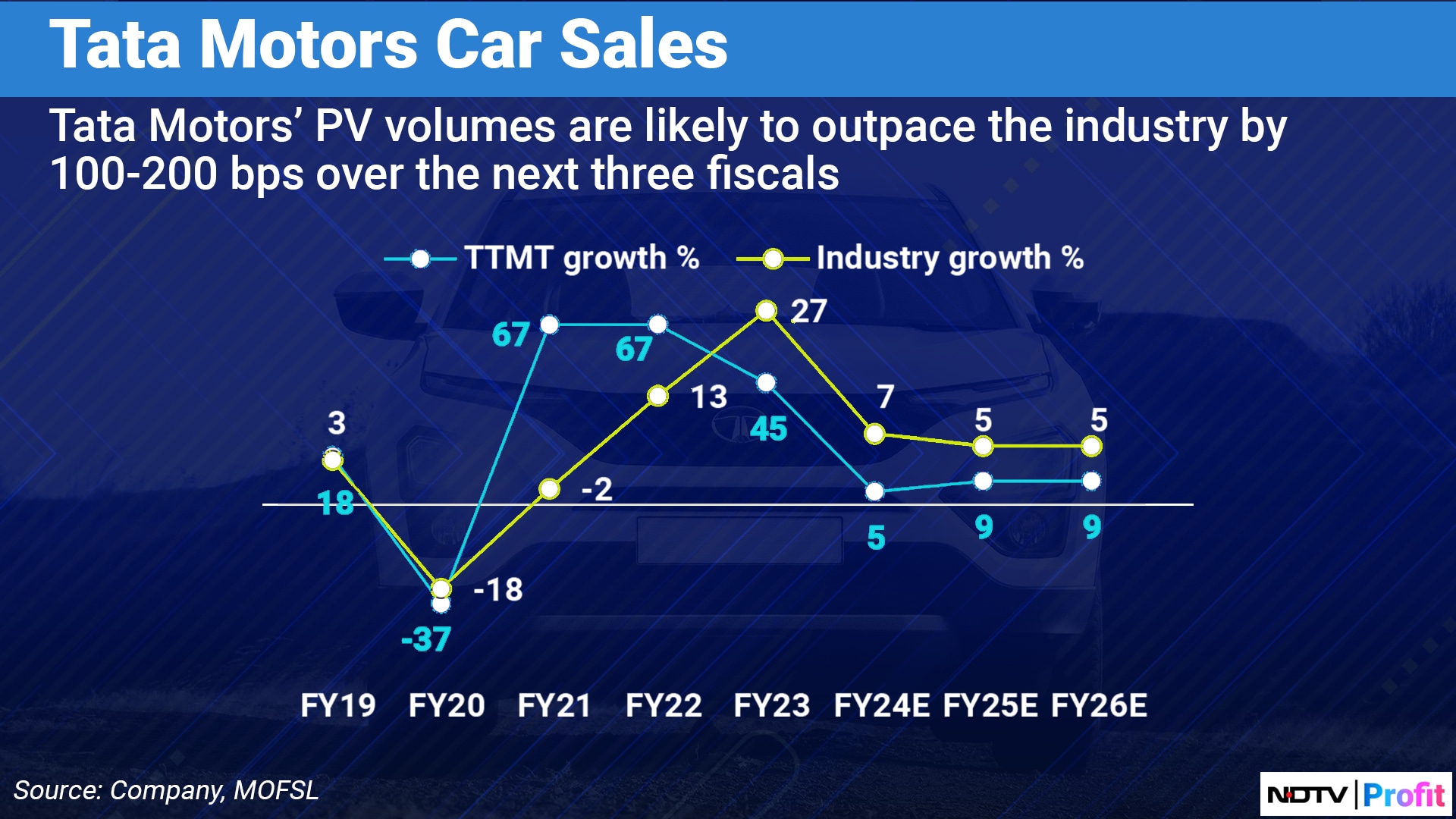

“The PV business has seen a turnaround after 2020, with market share ramping up from mid-single digits to 13.5% as of 9M FY24,” the brokerage said. “We believe Tata Motors may be aiming to become the No. 2 PV player in India by FY25–26.”

Motilal Oswal expects the spun-off PV business to grow at 8.5% every year through FY26, against 4.5% growth seen in FY24. That compares with industry guidance of low single-digit growth.

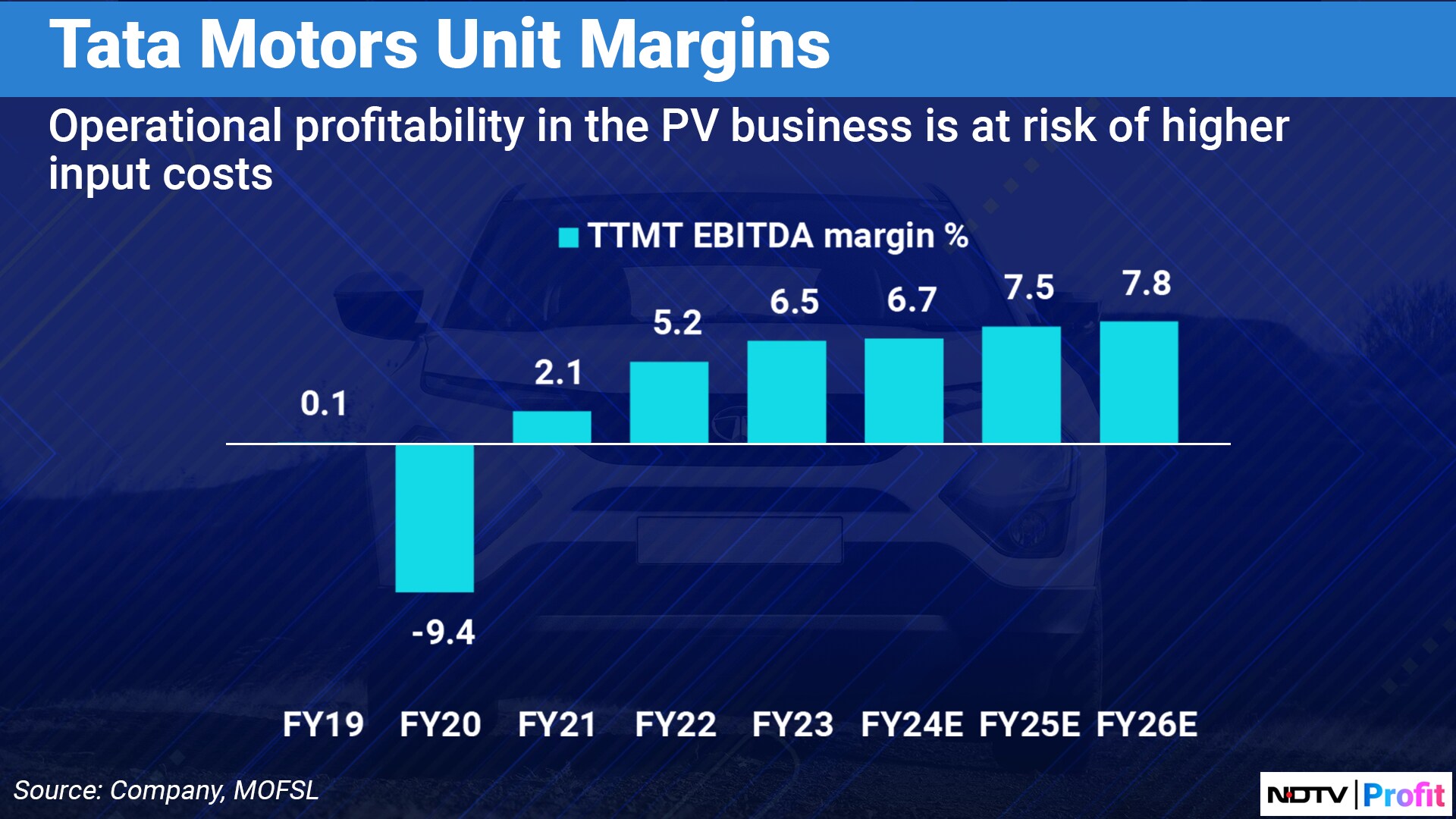

JLR is seen growing at 7% over the same time period, as against a muted industry outlook, with operational profitability expanding by 150 bps. The brokerage is also factoring in a margin expansion of 100 bps for the PV business over the next two years.

The EV piece is the joker in the pack.

The PV business enjoys an operating margin of 6.5%, and ICE margins have improved to 9.4% in Q3 FY24, but EV margins at -8.2% pull them down, Nomura said. That should improve over time, as most of the losses come from product development costs.

By FY26, Tata Motors aims to have 10 electric cars in its portfolio and 50% of its volumes from EVs by 2030. If it's successful, then there can be substantial value creation, Nomura said.

Debt & Free Cash Flow

The demerger ties into the subsidisation drive Tata Motors embarked on in 2022 as part of Tata Sons Chairman Natarajan Chandrasekaran's endeavour to simplify the structure at the group level.

“The three automotive business units are now operating independently and are delivering consistent performance,” Chandrasekaran said in the statement released on Monday.

“This demerger will help them better capitalise on the opportunities provided by the market by enhancing their focus and agility. This will lead to a superior experience for our customers, better growth prospects for our employees, and enhanced value for our shareholders.”

The demerger also plays into Tata Motors' debt picture.

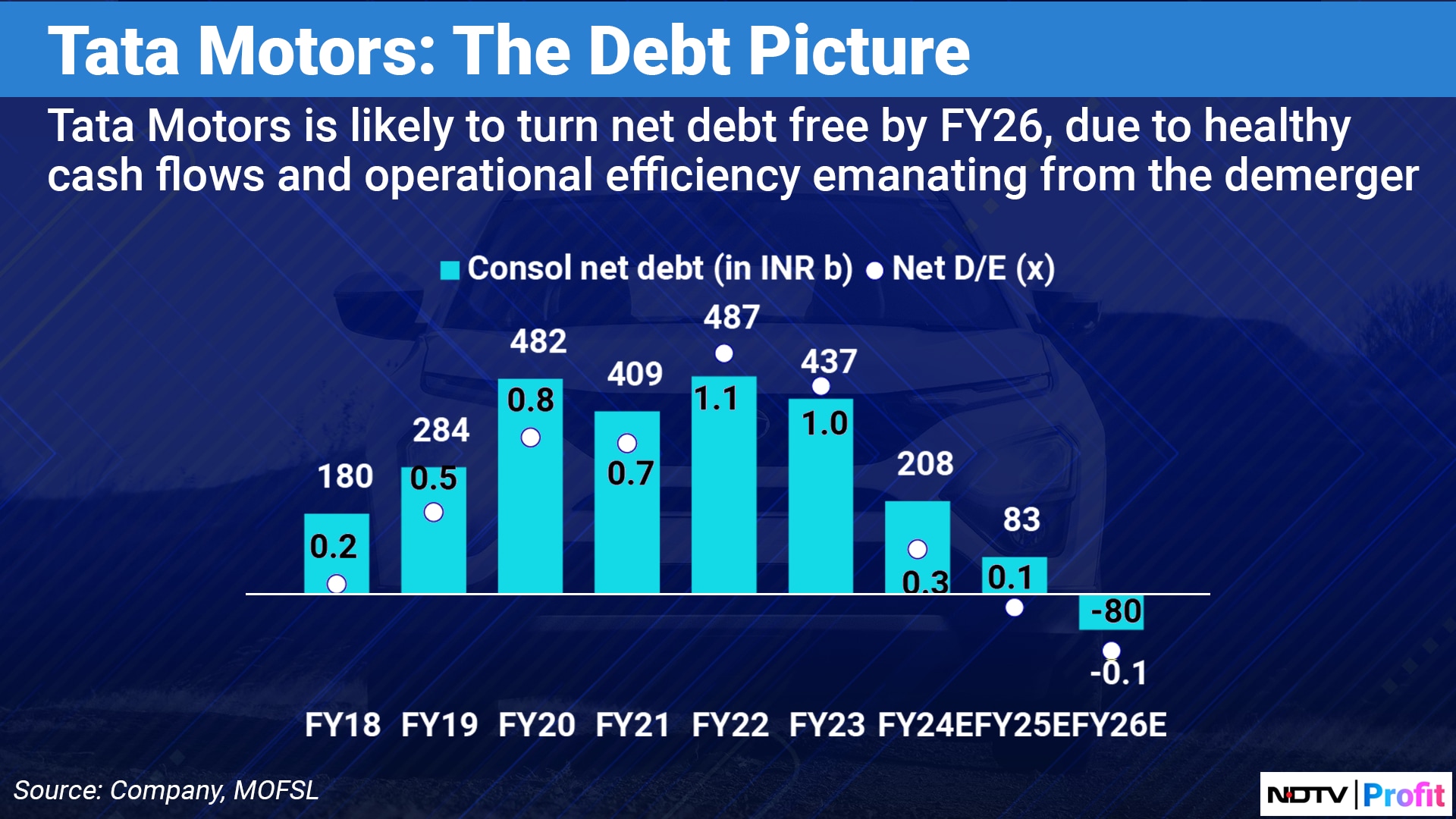

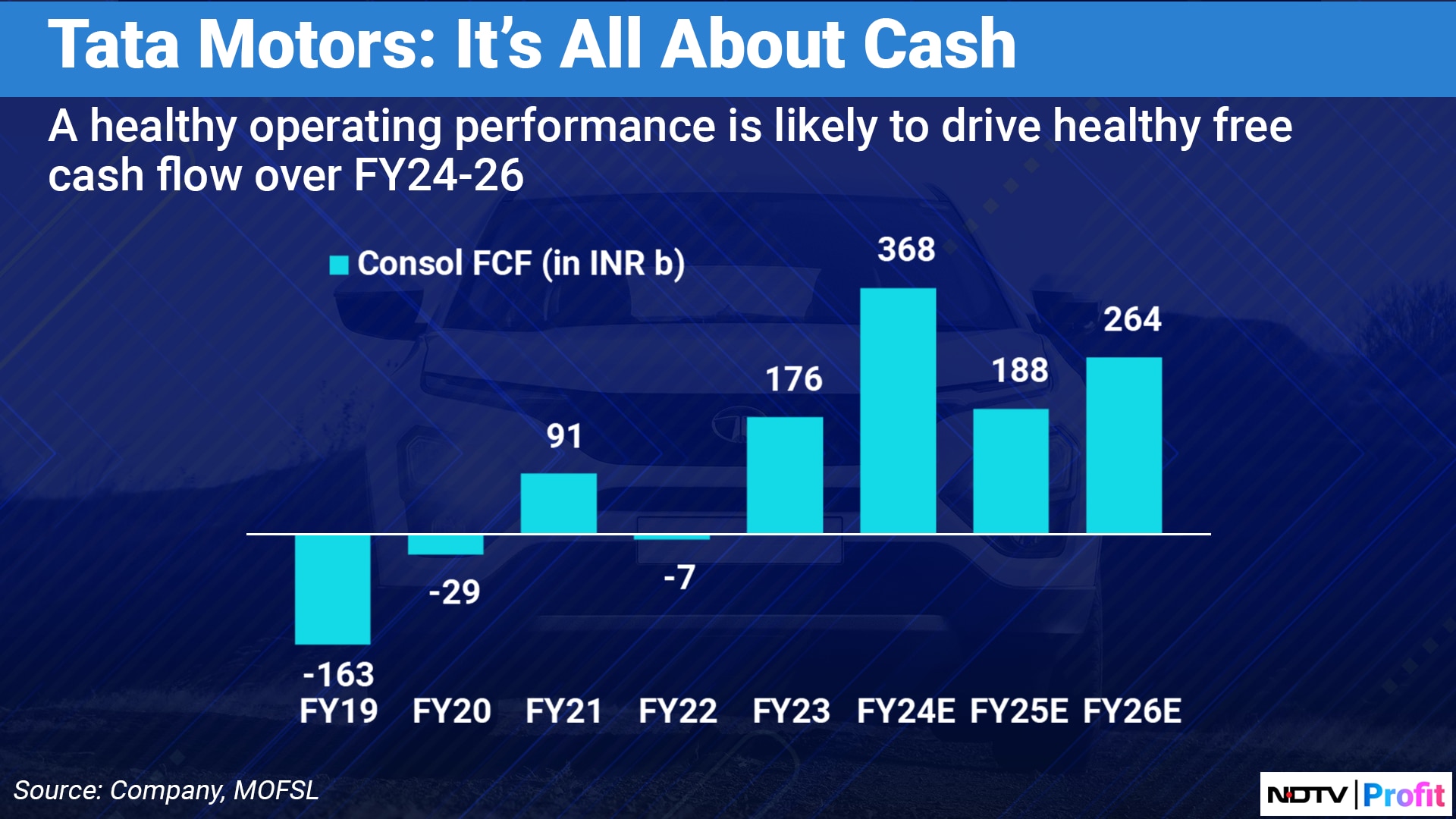

As of Dec. 31, 2023, Tata Motors had a net automotive debt of Rs 29,200 crore even as the free cash flow has improved—Rs 6,400 crore in Q3 FY24 from Rs 5,300 crore a year ago.

At JLR, free cash flow stood at £626 million in Q3 FY24 and £1.4 billion in the nine months to Dec. 31, even as debt almost halved year-on-year to £1.6 billion, according to the firm's third-quarter financials. As of Dec. 31, Tata Motors had a debt-to-equity ratio of 1.58, down from 3.68 a year earlier.

“On our net debt journey, I expect Tata Motors' domestic business to become near net debt zero in FY24 and JLR the following year,” Chandrasekaran had said at the car company's annual general meeting in August last year.

Motilal Oswal expects the consolidated entity to turn in net cash by FY26.

The three companies within the Tata Motors Group—CV, PV and JLR—have reached a critical stage of maturity, and Tata Motors believes it's an opportune time to unlock value.

What remains to be seen is how the CV business weathers economic challenges on its own and whether the PV business can make the most of the synergies.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.