SBI Cards and Payment Services Ltd.'s spending market share in November saw a decline from the impact of the Reserve Bank of India's notification on corporate card spending, according to Morgan Stanley.

The spending market share in November fell to 14.9% versus 19.6% year-on-year and 15.8% month-on-month, the brokerage said in a note.

The market share in number of cards in force stood at 18.7% in November, down 33 basis points year-on-year and up 15 basis points sequentially. The spending fell 20% in November compared to the same period last year against the 5% growth for industry, Morgan Stanley said.

The aggregate daily spending was up 8% year-on-year so far in December versus 4% in November, according to the note. The brokerage maintained 'equal-weight' with a target price of Rs 650 per share, a downside of 6% from the previous close.

Notably, the RBI had tightened rules for cards used for business accounts through a notification issued on Mar. 7 this year. The business card-issuers are mandated to monitor the end-use of funds through an effective mechanism, as per the notification.

Last month, the directors of SBI Cards approved the appointment of Challa Sreenivasulu Setty as the nominee director and chairman of the company.

SBI Cards recorded a 33% year-on-year slide in its net profit for the quarter ended September 2024. It reported a bottomline of Rs 404 crore during the period, as compared to Rs 603 crore in the same quarter last year.

The company's total income, however, jumped by 8% to Rs 4,556 crore in the July- September period as against Rs 4,221 crore in the year-ago quarter.

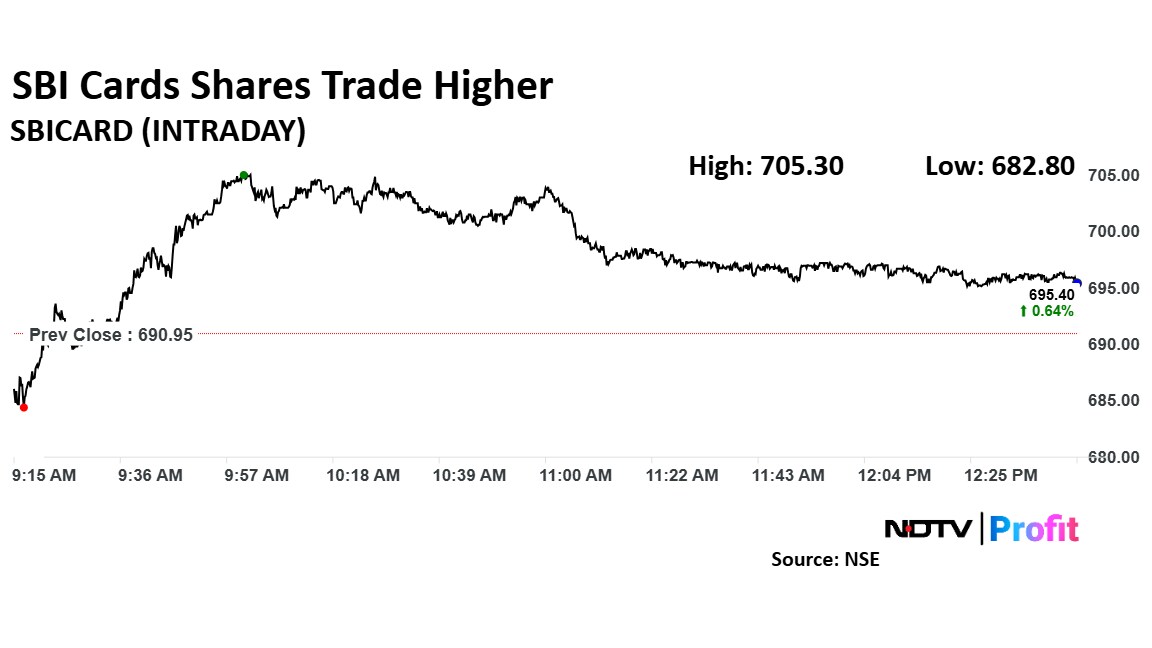

SBI Cards' stock fell as much as 1.23% during the early minutes of trade, but soon recovered to edge higher. The scrip was up 0.71% at Rs 696.2 apiece, compared to a 0.19% advance in the benchmark Nifty 50 as of 12:45 p.m.

The company's stock has fallen 9% during the last 12 months and has declined by 8.3% on a year-to-date basis. The total traded volume so far in the day stood at 2.4 times its 30-day average. The relative strength index was at 43.

Five out of the 27 analysts tracking the company have a 'buy' rating on the stock, nine suggest a 'hold' and 13 recommend a 'sell', according to Bloomberg data. The average of 12-month analysts' price targets implies a potential downside of 0.8%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.