In the aftermath of the default of IL&FS in September 2018, non-banking finance companies have been facing a significant amount of financial stress. In popular discourse, attention has been paid to understanding the market risk faced by the NBFCs. NBFCs are in the business of lending where credit risk is also important. In this article, we take a look at how the NBFCs have been pricing credit risk.

Background: A Decade Of Rapid Growth

NBFCs have had a good run over the last few years. During the period 2009-2018, the loan book of the NBFC sector grew at a compound annual growth rate of 17 percent. The highest growth was recorded during the 2009-2014 period, of over 24 percent. Several factors contributed to this good run. Public sector banks reduced their lending in response to the burgeoning pile of non-performing assets and capital shortfall. Private sector banks' lending remained concentrated in select segments. This created a credit supply shortage that presented the NBFCs with an expansion opportunity.

While banks reduced their exposure to the corporate sector, they continued to lend to NBFCs.

At the same time, increased investment of household financial savings in mutual funds meant that the NBFCs could raise funds from the debt mutual funds. During the period 2009-2018, NBFCs' average share of bond market borrowing in total borrowing was 51 percent whereas the share of bank borrowing was 26 percent.

Events in September 2018 effectively put a stop to the good run. Over the span of a few months, the NBFC's sector growth declined rapidly and margins came under pressure. This has resulted in some fundamental questions being raised about the NFBC business model.

NBFC Business Model and Risk

At the heart of any lending business is a rating arbitrage – the lender has to have, on average, a better rating than the borrower so that its own borrowing cost is lower than what it charges the customer. The lender can also create a margin by running a maturity mismatch – borrowing short and lending long when the yield curve is upward sloping. Both these actions, credit arbitrage, and maturity mismatch create risk and profits for the NBFCs.

NBFCs thus take two types of risks– market risk, conventionally called asset-liability management risk and credit risk that arises from lending to higher risk customers.

Following the IL&FS episode, there has been considerable discussion on the market risk embedded in NBFC balance sheets arising from the ALM mismatch problem. Regulatory actions have also focused on the market risk in terms of the reporting requirements for NBFCs with instructions to rating agencies to consider market risk while rating NBFCs. In our study, we take a closer look at the credit risk in the NBFC model.

NBFCs And Credit Risk

To understand the pricing of credit risk in an NBFC we have to look at two components – the pricing of credit risk when lenders such as banks and bond markets lend to an NBFC and the pricing of credit risk when the NBFC lends money to its customers. We call the former component ‘NBFC/ HFC premium' while the latter ‘loan premium'. We define the NBFC premium as the difference between the average cost of borrowing for NBFCs and the 10-year government security yield. We define the loan premium as the difference between the average yield on loans given out by the NBFCs and the 10-year g-sec yield. The relative levels of these two premiums over time give a sense of the evolution of credit risk pricing in the overall NBFC sector.

For our analysis, we study the period 2009-2018. We focus on the post-global financial crisis period during which the NBFC sector grew steadily. We split our sample between NBFCs (non-deposit taking) and housing finance companies. We consider 11 largest NBFCs (excluding the government-owned ones) and 10 largest HFCs. We look at them separately because the nature of their businesses and hence the credit risk profiles are different. Together they represent about 80 percent of the entire NBFC sector.

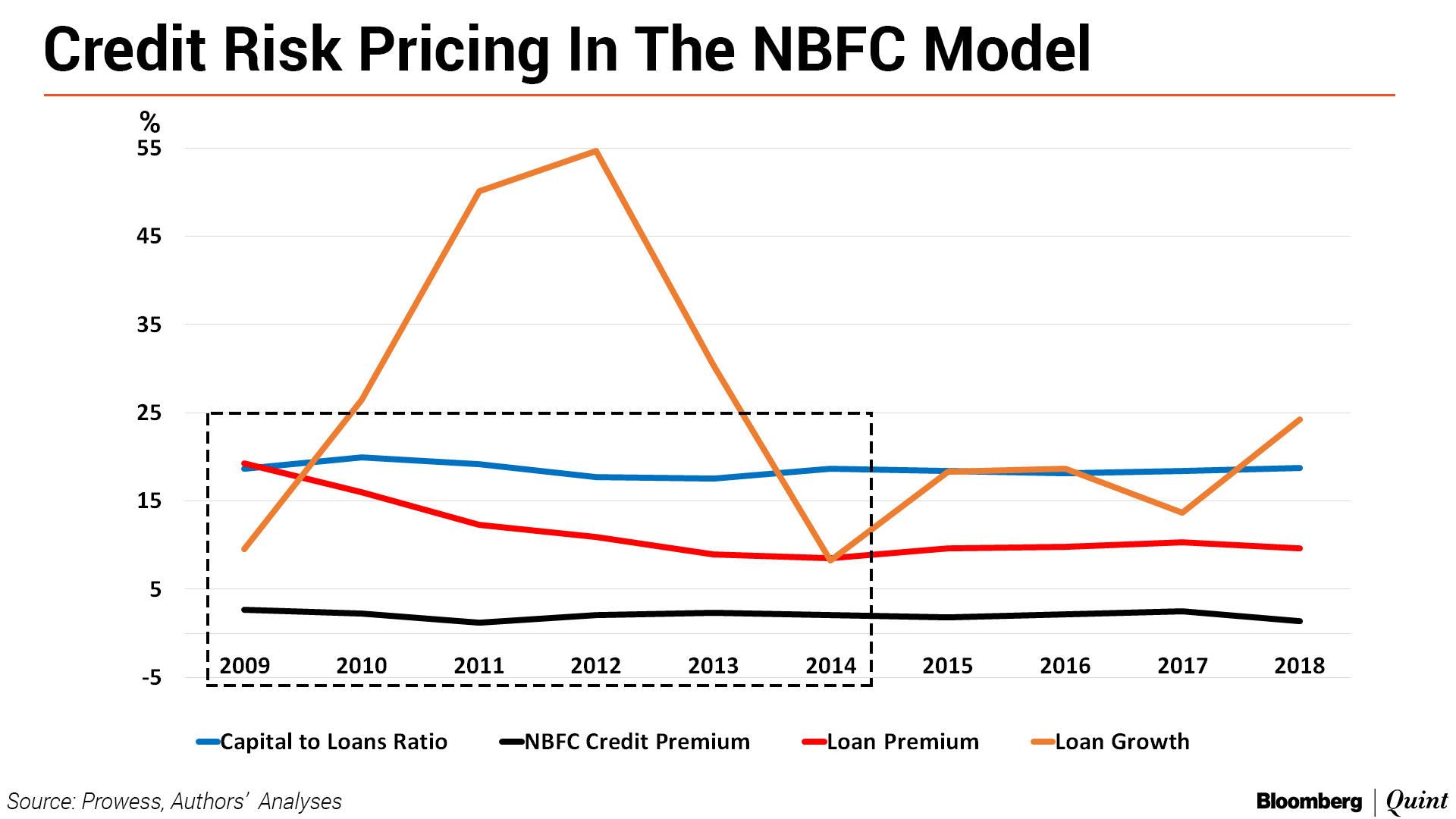

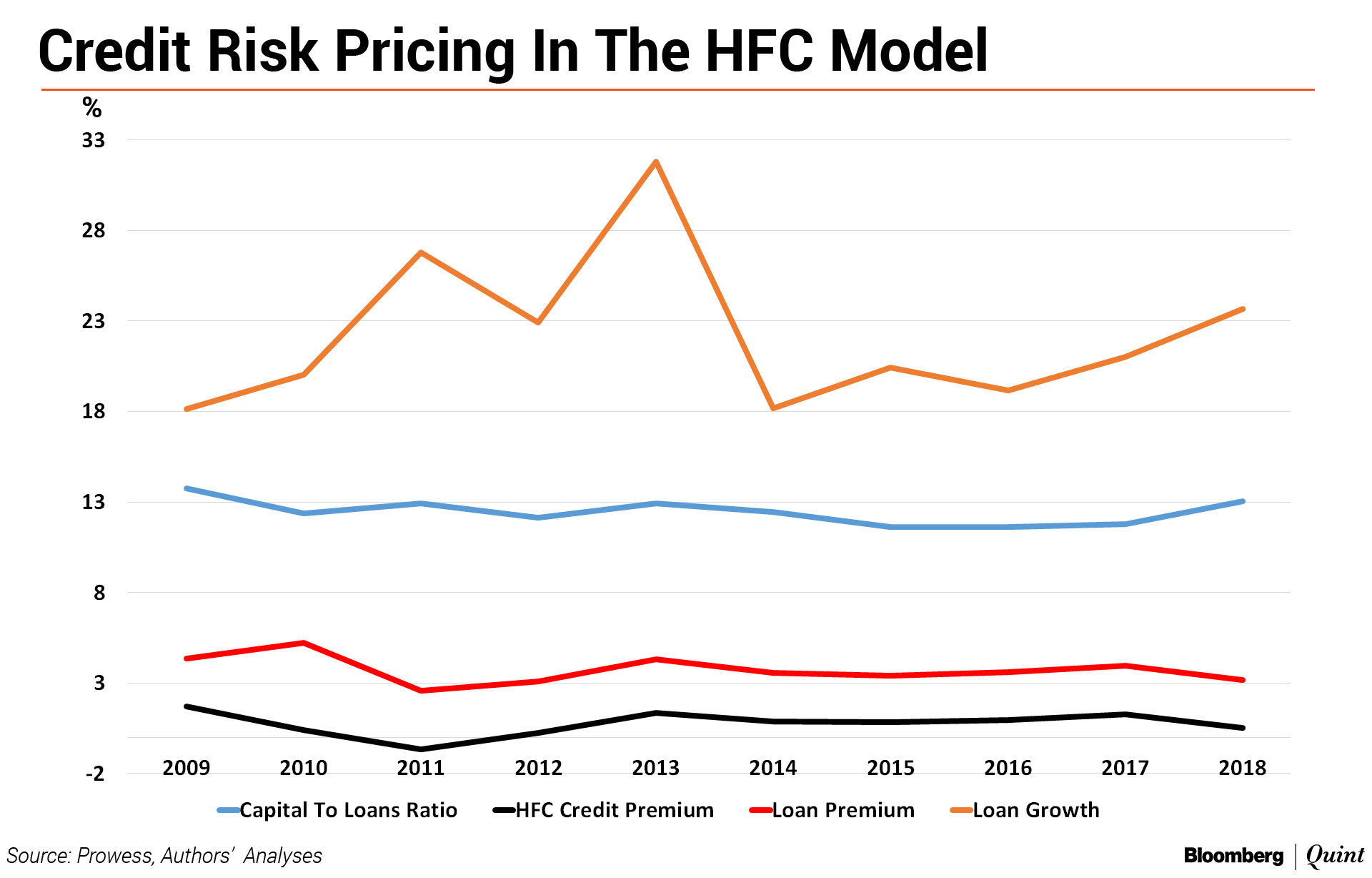

We also look at the capital to loans ratio of the NBFCs/HFCs as a broad indicator of capital adequacy and the overall loan growth registered by the NBFCs/HFCs to get a sense of expansion of the sector. The chart below plot these variables for our sample of NBFCs/HFCs over the 10 year period.

Our observations from the charts can be summarised as follows:

- The HFC premium, the HFC loan premium, and the HFC capital to loan ratio remain fairly stable over the period under study. The spread between the credit premium and loan premium also remained stable. This suggests that for the HFCs, the credit risk, in general, has been stable.

- For our sample of NBFCs, during the period 2009-2014, while the NBFC premium was stable, the loan premium declined steeply from roughly 20 percent to 10 percent. The capital to loans ratio of NBFCs remained stable throughout the period.

- During the period from 2009 to 2014, NBFC loans grew rapidly at a CAGR of 27 percent. The period average of loan growth for 2009-2018 was 23 percent. In other words, during the time when the loan premium charged by the NBFCs was falling, their loan books were expanding rapidly.

This implies that while the lenders to NBFCs kept their credit premium stable, the NBFCs themselves started reducing the credit premium they were charging their own customers. We do not find this trend for the HFCs.

The lowering of loan premium by the NBFCs could happen for two reasons. It could be that NBFCs started lending to more creditworthy, lower-risk customers. There is however no evidence to suggest the same. On the contrary anecdotal evidence suggests that in search of growth opportunities, NBFCs started lending to riskier customers.

The alternate explanation for reducing loan premium is that NBFCs started systematically underpricing credit risk at a time of rapid growth. There was also no commensurate improvement in the capital levels to support this underpricing.

The underpricing of credit may have been a result of intensifying competition in the sector which would drive down the lending rates, or a correction of previous overpricing of credit or based on a perception that the overall risk in the economy was declining. Notwithstanding the reasons for underpricing, it would have made the NBFC business model riskier. Arguably, the underpricing of credit helped the expansion of the NBFC sector during their high growth period.

Another way of interpreting the data is that despite NBFCs relatively under-pricing credit risk on their loans and their capital levels not going up, lenders did not penalise them by increasing the credit risk premium they charged. This could be because the bond market became a dominating source of financing for NBFCs presumably due to increased inflows into debt funds, and the bond market was relatively less discriminating in pricing credit risk.

If it is indeed the case that the NBFCs have been systematically underpricing credit risk as is apparent from our analysis, then this could be a plausible reason behind heightened risk perceptions about the sector in recent times.

This would imply that ALM mismatches in the balance sheets are not the only problem in the NBFC business model which has some fundamental challenges that need to be addressed.

Systematic mispricing of risk could result in solvency issues for the NBFC sector as a whole.

Recent events have thrown the spotlight on NBFCs. Our analysis suggests that deeper examination of risk management – both market and credit risk in NBFCs, could lead to better understanding and hence better supervision.

Harsh Vardhan is Executive-In-Residence at the Centre of Financial Services, SP Jain Institute of Management & Research. Rajeswari Sengupta is an Assistant Professor of Economics at the Indira Gandhi Institute of Development Research. The authors thank Mansi Sharma of IGIDR for help with the data work.

The views expressed here are those of the authors and do not necessarily represent the views of Bloomberg Quint or its editorial team.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.