MakeMyTrip, the Nasdaq-listed travel booking platform, logged a nearly twofold rise in its net profit sans exceptional gains in the quarter ended March 2025.

The platform posted a bottom line of $29.2 million during the fourth quarter. In comparison, the net profit excluding exceptional items stood at $15.2 million in the year-ago quarter.

However, the exceptional gains in the March 2024 quarter had pushed the overall net profit during that period to $171.9 million. This included a one-time net credit of $126.1 million from deferred tax asset recognition and a $30.6 million gain due to changes in the carrying value of its convertible notes due in 2028.

Meanwhile, in the January-March period of fiscal 2025, MakeMyTrip's gross bookings grew 30.4% year-on-year in constant currency, reaching $2,553.1 million from $2,039.0 million.

Revenue under IFRS, or International Financial Reporting Standards, increased 25.6% in constant currency terms, rising to $245.5 million from $202.9 million.

Besides, adjusted operating profit registered a growth of 37.9% and reached $44.7 million during the quarter under review compared to $32.4 million a year ago.

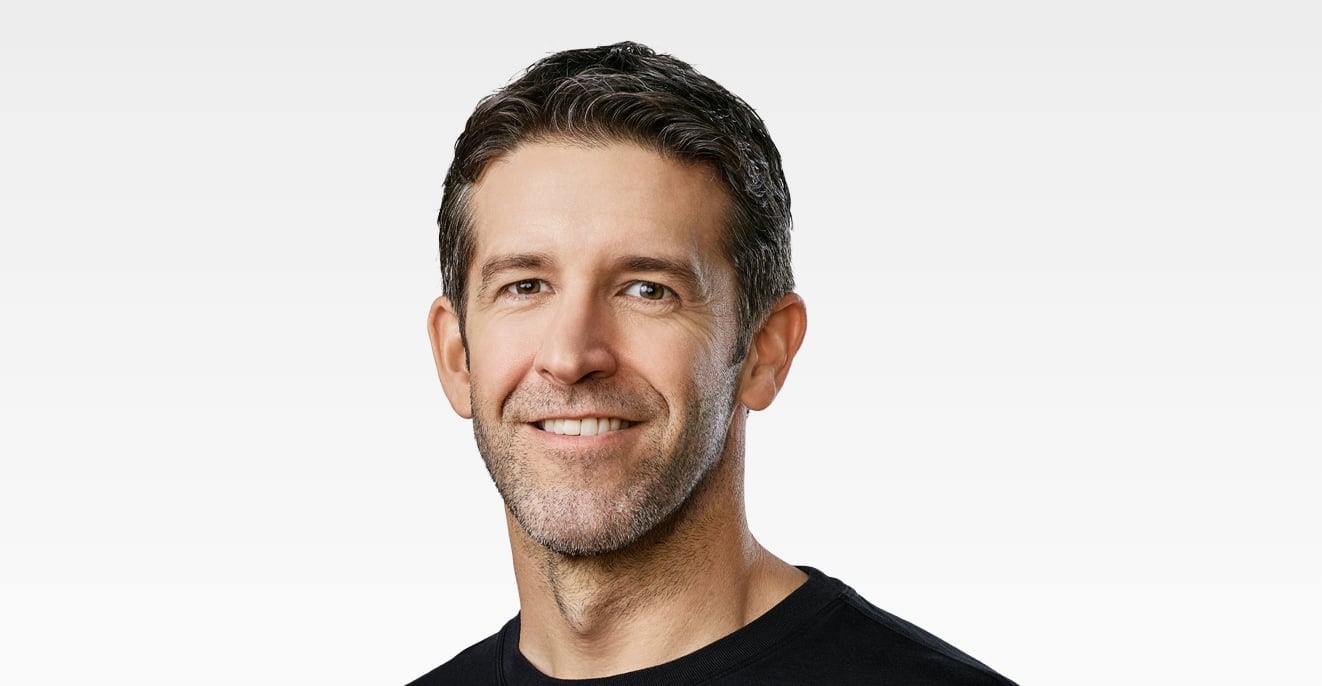

MakeMyTrip Group Chief Executive Officer Rajesh Magow said, "We delivered record gross bookings and revenue this fiscal year with robust growth and expanding margins underscoring the strength of our platform, the popularity of our brands, and the sustained momentum in both domestic and international travel demand."

"Our investments in new demand segments and personalized customer experiences across our platform have helped us grow our customer base as well as drive high repeat bookings."

(With PTI inputs)

RECOMMENDED FOR YOU

RECOMMENDED FOR YOU

MakeMyTrip Partners With Zomato For On-Train Food Delivery

Sep 17, 2025

Sep 17, 2025

SpiceJet Shares Tumble Following Q1 Loss Of Rs 234 Crore

Sep 08, 2025

Sep 08, 2025

.jpg?rect=0%2C0%2C3500%2C1969&w=320)

JSW Cement Q1 Results: Net Loss Widens To Rs 1,356 Crore On Exceptional Expense

Sep 02, 2025

Sep 02, 2025

ReNew Q1 Results: Net Profit Rises Multifold To Rs 513 Crore

Aug 14, 2025

Aug 14, 2025