SpiceJet Ltd. shares came under pressure on Monday after the company slipped to a loss in the first quarter of financial year 2026.

The airline registered a net loss of Rs 234 crore in the June quarter compared to a profit of Rs 150 crore in the year-ago period.

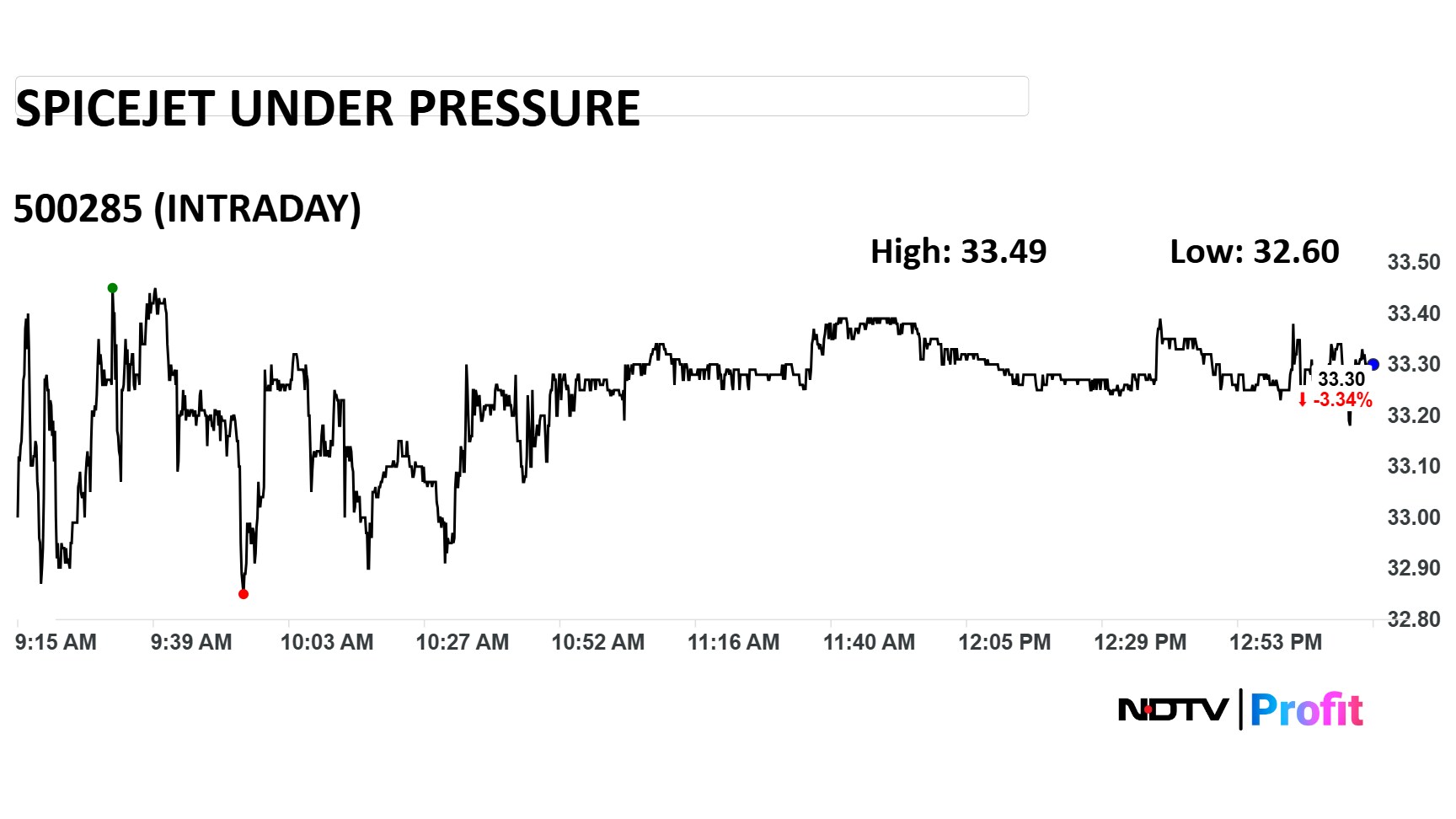

The stock fell more than 3%, reaching an intraday low of Rs 32.6.

(Photo: NDTV Profit)

The budget airline carrier saw its revenue dip significantly as well, from Rs 1,708 crore in the June quarter last year to Rs 1,120 crore this fiscal.

In an official statement, SpiceJet management confirmed that performance in the quarter was impacted by several headwinds, including geopolitical turbulence.

All of this has put immense pressure on the SpiceJet stock, which has been under fire for quite some time. SpiceJet shares have tanked 33% in the past six months and over a one-year period, the stock has fallen almost 50%.

A Relative Strength Index of 57 suggests neutral market sentiment around the SpiceJet stock.

A total of four analysts are tracking the company, with one having a 'buy' rating. two have recommended 'hold,' while one suggest 'sell,' as per data compiled by Bloomberg.

SpiceJet Q1FY26 Result Highlights (Consolidated, YoY)

Net loss of Rs 234 crore versus profit of Rs 158 crore

Revenue down 34.4% at Rs 1,120 crore versus Rs 1,708 crore

Ebitda loss of Rs 86.7 crore versus Ebitda of Rs 43.2 crore

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.