Lack of earnings growth is turning into an Achilles' heel for the Indian markets. The benchmark Nifty 50 is facing stiff resistance at the 25,000 level. Every time the index attempts to rise above this psychological mark, there is very little support for a sustained rally. The answer perhaps lies in the profitability growth of the Nifty 50 companies. According to the Bloomberg consensus EPS estimate for Nifty 50 companies, the consolidated net profit calculated for the index basket is expected to grow by around 5% in fiscal 2026.

Lack of earnings growth is turning into an Achilles' heel for the Indian markets. The benchmark Nifty 50 is facing stiff resistance at the 25,000 level. Every time the index attempts to rise above this psychological mark, there is very little support for a sustained rally. The answer perhaps lies in the profitability growth of the Nifty 50 companies. According to the Bloomberg consensus EPS estimate for Nifty 50 companies, the consolidated net profit calculated for the index basket is expected to grow by around 5% in fiscal 2026.

This is lower than what has been the trend in the past few years, when the street usually penciled in a profit growth of 10-12% in earnings at the beginning of the year.

According to the available consensus forward EPS, only around 10 or 20% of Nifty companies are expected to post a profit growth of more than 10% in fiscal 2026. The rest of the companies are expected to post low-to-mid single-digit growth in profits.

And even though topline growth has been high-single to double-digit for most Nifty 50 companies—owing to lack of volume growth—raw material inflation has started to dent the operating profits of the companies, that is, the Ebitda margin.

In the absence of a significant jump in profitability expected, the Nifty EPS is expected to be around Rs 1,180 for the financial year ending March 2026. Interestingly, consensus targets for the Nifty companies also do not have enough headroom for a stock price run-up. Only 16 companies, or a little over 30% of the Nifty 50 companies, have stock run-up potential of over 10-20%, with around seven companies having stock correction potential; that is, the consensus target price for the stock is lower than the current market price.

With FY26 EPS estimated for Nifty 50 at Rs 1,180, and assuming all stocks hit their consensus target price, the Nifty 50 can hit a level of 27,372. That is around a little over 10% at the current market level. At this level, the index will be trading at 23 times—a significant premium to other emerging markets and a premium to the last average forward price to earnings for the Nifty 50.

Foreign investors have invested close to Rs 46,000 crore in the last month. This follows fund ETF redemptions in China ETFs and US ETFs and flow into emerging markets, including India.

The lack of a trigger in the form of significant earnings growth for Nifty 50 companies is perhaps one of the key reasons why Nifty 50 is reluctant to run ahead.

In the last few days, broader markets have performed better than benchmark indices like Nifty 50. Investors have used these opportunities to invest in companies that are part of the Nifty Midcap 150 and have shown high growth in the fourth quarter and significantly high guidance for the forthcoming financial year.

RECOMMENDED FOR YOU

RECOMMENDED FOR YOU

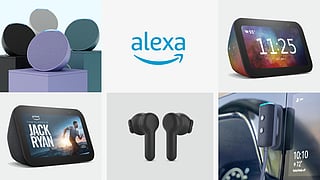

Amazon’s Sept. 30 Event: What To Expect From Echo, Kindle And Fire TV

Sep 30, 2025

Sep 30, 2025

OnePlus 15 5G: What To Expect, India Price Rumours, And Global Launch Dates

Sep 29, 2025

Sep 29, 2025

Bond Market Watchers Expect RBI To Step In As Yields Spike

Sep 01, 2025

Sep 01, 2025

Kaun Banega Crorepati: Earn Rs 35,000 A Month? Here's How You Can Make Rs 1 Crore

Aug 27, 2025

Aug 27, 2025

Sign Up with Google

Sign Up with Google