Union Bank of India's board of directors approved on Wednesday a fundraising plan worth up to Rs 6,000 through share sale and debt issue in the current financial year.

The public sector bank will raise up to Rs 3,000 crore through any of the means like further public offer, rights issue, private placements, qualified institutions placements or preferential allotment or a combination, according to a stock exchange filing.

Union Bank of India will float Basel III-compliant Additional Tier 1 bonds not exceeding Rs 2,000 crore and Tier 2 bonds not exceeding Rs 1,000 crore, including foreign currency-denominated bonds.

The capital-raise plan requires government approval.

Banks raise capital to strengthen their financial position, fund growth and meet regulatory requirements. These funds provide a buffer against losses, allowing them to lend more and expand their operations.

On Tuesday, Executive Director Pankaj Dwivedi was removed from his position by the Union government. Dwivedi was appointed as the ED at the state-owned lender in 2024.

Dwivedi will return as the general manager at Punjab & Sind Bank, according to a government notice exclusively seen by NDTV Profit. This is likely one of the first instances where an ED-level official has been demoted back to a GM position.

Shares of Union Bank of India settled 1.8% lower at Rs 144.4 apiece on the BSE ahead of the capital-raise announcement, compared to a 0.85% advance in the benchmark Sensex.

RECOMMENDED FOR YOU

RECOMMENDED FOR YOU

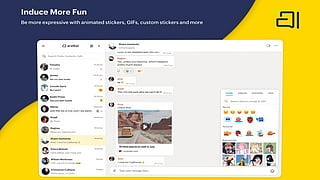

All You Need To Know About Arattai: The Indian-Made WhatsApp Alternative Endorsed By Union Ministers

Sep 28, 2025

Sep 28, 2025

SEBI Proposes Easier Tech-Glitch Norms In Brokers' Trading Systems

Sep 22, 2025

Sep 22, 2025

SEBI Says 100 FPIs Register In India Every Month, Higher Than Last Year

Sep 12, 2025

Sep 12, 2025

Trump Tariffs: Exporters Urge RBI For Relief Measures To Cushion Blow

Sep 11, 2025

Sep 11, 2025